Kamala Harris' plan to raise taxes on corporations and the wealthy

Tweaks, rather than sweeping overhauls, characterize the Democratic nominee's proposals

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Tax policy is an area that tends to invite highly specific ideas during U.S. presidential campaigns, as virtually all Americans are forced to reckon with the tax regime every April. To that end, Vice President Kamala Harris and former President Donald Trump have starkly different tax proposals. Harris, the Democratic Party nominee, has released additional details about her proposed economic agenda in recent weeks that have helped paint a more complete picture of what her administration's approach to taxes would be if she were to win the election.

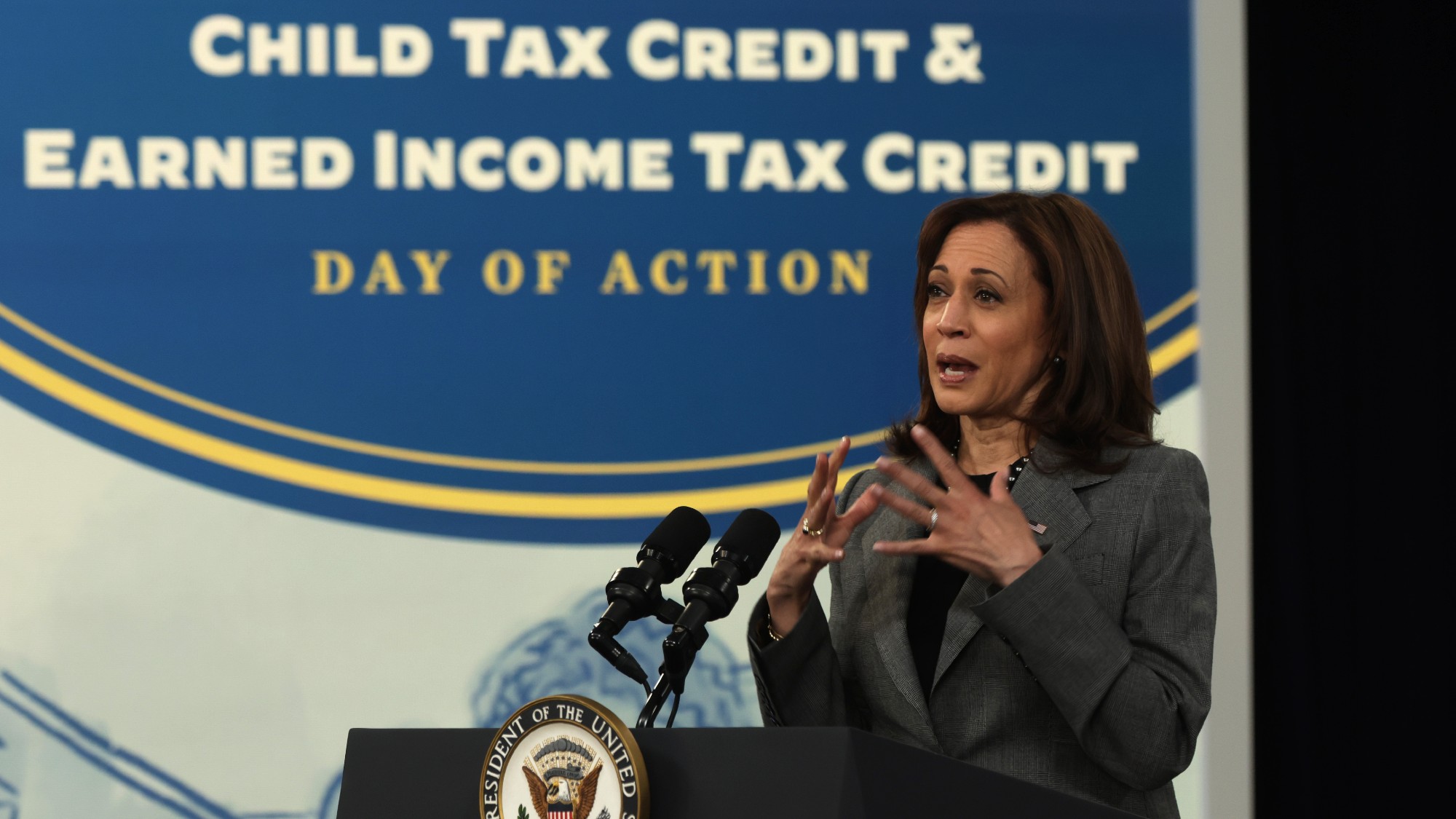

Tax credits dominate

One of the key points that Harris has tried to reinforce is that her administration would not raise taxes on anyone making less than $400,000 a year. Rather than proposing any kind of sweeping overhaul of the tax system like the so-called flat tax that Republicans once campaigned on, Harris' plans mostly rely on tweaks on the margins to deliver relief to families and businesses.

The Harris campaign wants to make the structure of the pandemic-era Child Tax Credit, which was briefly distributed as a monthly direct cash payment in 2021, permanent. Researchers credited that expanded tax credit with a dramatic drop in child poverty, but it was allowed to expire at the end of 2021 when Democrats were unable to secure the votes to renew it. Harris has also proposed a new $6,000 tax credit for new parents, to help with the blizzard of costs associated with bringing a new child into the world. Finally, Harris has suggested an unspecified increase in the Earned Income Tax Credit (EITC), which benefits lower income individuals and families.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Raising taxes on corporations and the wealthy

Harris wants to raise the tax rate on corporations from its current 21% to 28%. Republicans, under President Donald Trump, had dropped that rate from 35% to 21% with their 2017 Tax Cuts and Jobs Act. Harris also supports raising taxes on wealthy Americans through a variety of schemes, including raising the capital gains tax, levying a tax on unrealized capital gains, increasing taxes on the sale of things like stocks, bonds and real estate, increasing the Corporate Alternative Minimum Tax and putting a 25% tax on individuals with assets of over $100 million. She also wants to raise the tax on stock buybacks from 1% to 4%.

The Harris tax plan seeks to make housing more affordable. It would offer incentives to developers to build new low-income housing through an expansion of the Low-Income Housing Tax Credit (LIHTC) and the creation of a new tax credit, what the campaign calls the Neighborhood Homes Tax Credit, which would support building new homes or rehabbing existing housing stock in lower-income communities. Harris has also proposed a $10,000 tax credit and up to $25,000 in down payment support for "first-generation home buyers" — i.e. first-time home buyers whose parents did not own their own homes.

Harris has advocated for a significant increase in the size of the tax credit for new businesses, from $5,000 to $50,000. Following Trump's promise to abolish taxes on tips, Harris has also discussed eliminating some taxes on tips for service and hospitality workers making less than $75,000.

The response

"We find the tax policies would raise top tax rates on corporate and individual income to among the highest in the developed world, slowing economic growth and reducing competitiveness," said the conservative Tax Foundation. A Penn Wharton School of Business analysis of Harris' overall economic plan predicted a GDP decrease of 1.3% over the next decade. Lower and middle-income Americans would do better under the Harris plan than wealthier Americans, according to Penn Wharton.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

A Reuters analysis found that Harris' plans will have a less adverse impact on the federal budget deficit than Trump's. Some budget analysts, though, have not yet been able to fully model the impact of Harris' new plans and revisions to existing proposals. "The campaign talking points are moving faster than the budget models," said Shai Akabas of the Bipartisan Policy Center to Reuters.

David Faris is a professor of political science at Roosevelt University and the author of "It's Time to Fight Dirty: How Democrats Can Build a Lasting Majority in American Politics." He's a frequent contributor to Newsweek and Slate, and his work has appeared in The Washington Post, The New Republic and The Nation, among others.

-

Big-time money squabbles: the conflict over California’s proposed billionaire tax

Big-time money squabbles: the conflict over California’s proposed billionaire taxTalking Points Californians worth more than $1.1 billion would pay a one-time 5% tax

-

Trump sues IRS for $10B over tax record leaks

Trump sues IRS for $10B over tax record leaksSpeed Read The president is claiming ‘reputational and financial harm’ from leaks of his tax information between 2018 and 2020

-

How ‘Manchesterism’ could change the UK

How ‘Manchesterism’ could change the UKThe Explainer The idea involves shifting a centralized government to more local powers

-

‘Dark woke’: what it means and how it might help Democrats

‘Dark woke’: what it means and how it might help DemocratsThe Explainer Some Democrats are embracing crasser rhetoric, respectability be damned

-

San Francisco tackles affordability problems with free child care

San Francisco tackles affordability problems with free child careThe Explainer The free child care will be offered to thousands of families in the city

-

The Mint’s 250th anniversary coins face a whitewashing controversy

The Mint’s 250th anniversary coins face a whitewashing controversyThe Explainer The designs omitted several notable moments for civil rights and women’s rights

-

US citizens are carrying passports amid ICE fears

US citizens are carrying passports amid ICE fearsThe Explainer ‘You do what you have to do to avoid problems,’ one person told The Guardian

-

Inside Minnesota’s extensive fraud schemes

Inside Minnesota’s extensive fraud schemesThe Explainer The fraud allegedly goes back to the Covid-19 pandemic