The Federal Reserve has failed to control inflation for three straight years

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The Fed, America's central bank, has two jobs. It's supposed to maintain full employment, and keep inflation from getting out of hand. Most people interpret the latter objective as simply stopping inflation from getting too high, but the responsibility actually goes two ways. Inflation also must be kept from getting too low, because it represents a shortfall of aggregate demand, prevents quick price adjustment, and makes a liquidity trap harder to avoid. Price stability, neither too low nor too high, is the mandate. That's defined by the Fed itself as an inflation rate of 2 percent.

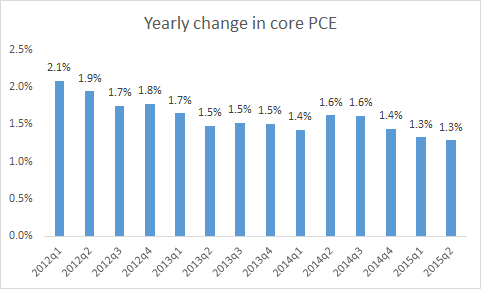

Economist Jared Bernstein, in a letter to Fed Chair Janet Yellen, points out that the Fed hasn't hit its inflation target for over three consecutive years — and it's actually getting worse over time:

The Fed is reportedly likely to raise interest rates — so it can get ahead of increasing inflation, supposedly — in September. It is hard to explain why.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Ryan Cooper is a national correspondent at TheWeek.com. His work has appeared in the Washington Monthly, The New Republic, and the Washington Post.

-

Why is the Trump administration talking about ‘Western civilization’?

Why is the Trump administration talking about ‘Western civilization’?Talking Points Rubio says Europe, US bonded by religion and ancestry

-

Quentin Deranque: a student’s death energizes the French far right

Quentin Deranque: a student’s death energizes the French far rightIN THE SPOTLIGHT Reactions to the violent killing of an ultraconservative activist offer a glimpse at the culture wars roiling France ahead of next year’s elections

-

Secured vs. unsecured loans: how do they differ and which is better?

Secured vs. unsecured loans: how do they differ and which is better?the explainer They are distinguished by the level of risk and the inclusion of collateral

-

TikTok secures deal to remain in US

TikTok secures deal to remain in USSpeed Read ByteDance will form a US version of the popular video-sharing platform

-

Unemployment rate ticks up amid fall job losses

Unemployment rate ticks up amid fall job lossesSpeed Read Data released by the Commerce Department indicates ‘one of the weakest American labor markets in years’

-

US mints final penny after 232-year run

US mints final penny after 232-year runSpeed Read Production of the one-cent coin has ended

-

Warner Bros. explores sale amid Paramount bids

Warner Bros. explores sale amid Paramount bidsSpeed Read The media giant, home to HBO and DC Studios, has received interest from multiple buying parties

-

Gold tops $4K per ounce, signaling financial unease

Gold tops $4K per ounce, signaling financial uneaseSpeed Read Investors are worried about President Donald Trump’s trade war

-

Electronic Arts to go private in record $55B deal

Electronic Arts to go private in record $55B dealspeed read The video game giant is behind ‘The Sims’ and ‘Madden NFL’

-

New York court tosses Trump's $500M fraud fine

New York court tosses Trump's $500M fraud fineSpeed Read A divided appeals court threw out a hefty penalty against President Trump for fraudulently inflating his wealth

-

Trump said to seek government stake in Intel

Trump said to seek government stake in IntelSpeed Read The president and Intel CEO Lip-Bu Tan reportedly discussed the proposal at a recent meeting