New analysis says Rubio's tax plan is still overwhelmingly tilted towards the wealthy

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

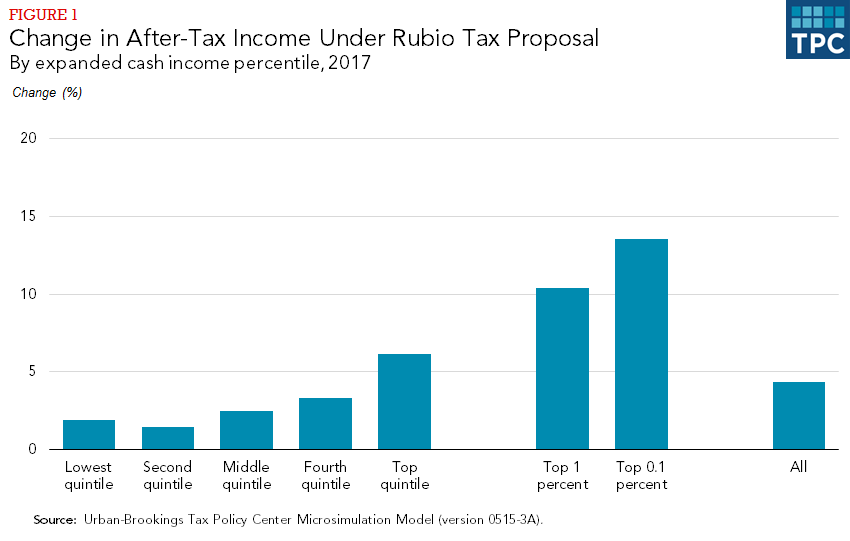

The Tax Policy Center (TPC) released its take on Marco Rubio's tax plan on Thursday. They concluded it would overwhelmingly benefits top earners the most, largely because it greatly reduces taxes on wealth income. And maybe eliminates them entirely — it's unclear.

Which brings up another point the analysis highlights: details matter.

For instance, Rubio's plan makes heavy use of tax credits, which allow filers to eliminate a set amount of their final tax liability. But what if the tax credit eliminates all of their tax liability, and there's still some of the credit left over? If the credit is refundable, the filer gets the remainder back from the government. If it's not, they don't.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

How refundability would work has massive implications for who Rubio's tax plan would help the most. The TPC said Rubio's people didn't provide them the necessary details, so they went with assumptions based on the Rubio campaign's assertion that "our reforms would not create payments for new, non-working filers." Here are their results, in terms of the percent change in people's after tax income. ("Lowest quintile" means the bottom fifth of workers, "second quintile" means the second-lowest fight, and so on.)

TPC found the plan would also massively reduce government revenue. Since Rubio has promised both a balanced budget and an increase in military spending, this implies enormous reductions in spending elsewhere.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.

-

The Olympic timekeepers keeping the Games on track

The Olympic timekeepers keeping the Games on trackUnder the Radar Swiss watchmaking giant Omega has been at the finish line of every Olympic Games for nearly 100 years

-

Will increasing tensions with Iran boil over into war?

Will increasing tensions with Iran boil over into war?Today’s Big Question President Donald Trump has recently been threatening the country

-

Corruption: The spy sheikh and the president

Corruption: The spy sheikh and the presidentFeature Trump is at the center of another scandal

-

TikTok secures deal to remain in US

TikTok secures deal to remain in USSpeed Read ByteDance will form a US version of the popular video-sharing platform

-

Unemployment rate ticks up amid fall job losses

Unemployment rate ticks up amid fall job lossesSpeed Read Data released by the Commerce Department indicates ‘one of the weakest American labor markets in years’

-

US mints final penny after 232-year run

US mints final penny after 232-year runSpeed Read Production of the one-cent coin has ended

-

Warner Bros. explores sale amid Paramount bids

Warner Bros. explores sale amid Paramount bidsSpeed Read The media giant, home to HBO and DC Studios, has received interest from multiple buying parties

-

Gold tops $4K per ounce, signaling financial unease

Gold tops $4K per ounce, signaling financial uneaseSpeed Read Investors are worried about President Donald Trump’s trade war

-

Electronic Arts to go private in record $55B deal

Electronic Arts to go private in record $55B dealspeed read The video game giant is behind ‘The Sims’ and ‘Madden NFL’

-

New York court tosses Trump's $500M fraud fine

New York court tosses Trump's $500M fraud fineSpeed Read A divided appeals court threw out a hefty penalty against President Trump for fraudulently inflating his wealth

-

Trump said to seek government stake in Intel

Trump said to seek government stake in IntelSpeed Read The president and Intel CEO Lip-Bu Tan reportedly discussed the proposal at a recent meeting