Senate Republicans clear bill nullifying a pending consumer right to sue banks

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

On Tuesday night, the Senate voted, 51-50, to overturn a banking rule that would have allowed consumers to band together in class action lawsuits against banks and other financial institutions. Sens. Lindsey Graham (R-S.C.) and John Kennedy (R-La.) joined every Democrat in opposing the bill, and Vice President Mike Pence broke the tie. The rule, finalized in July by the Consumer Financial Protection Bureau (CFPB) after five years of work, would have banned most forms of mandatory arbitration included in the fine print of almost all bank account and credit card agreements.

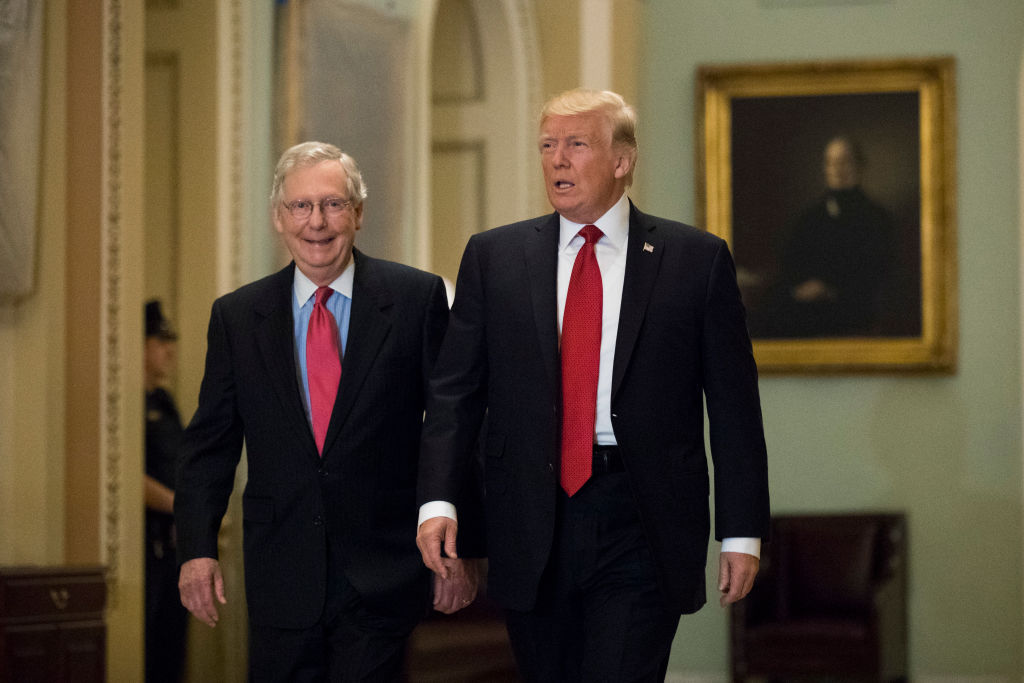

The banking industry had been lobbying hard for Congress to overturn the rule, using the Congressional Review Act, a previously obscure law that Republicans have used repeatedly this year to nullify regulations enacted under former President Barack Obama. The House passed its own bill overturning the arbitration rule in July, and President Trump is expected to sign it into law. "Tonight's vote is a giant setback for every consumer in this country," CFPB director Richard Cordray said in a statement. "As a result, companies like Wells Fargo and Equifax remain free to break the law without fear of legal blowback from their customers."

The American Bankers Association applauded the vote, and Republicans defended enforced arbitration as having worked "wonderfully" for consumers. "We have a very fair system that has been working for over 100 years in this country," said Sen. Mike Crapo (R-Idaho). Forced arbitration clauses, which circumvent courts and preclude class-action suits, have become ubiquitous since a pair of Supreme Court cases in 2011 and 2013, The New York Times notes. The CFPB was charged with studying the effects of such clauses, and its findings, detailed in a 728-page report issued in 2015, were that once consumers were blocked from suing, most declined arbitration; those consumers who did pursue arbitration usually lost, and the 78 successful arbitration claims over the two years the CFPB studied the issue resulted in $400,000 total awards.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Peter has worked as a news and culture writer and editor at The Week since the site's launch in 2008. He covers politics, world affairs, religion and cultural currents. His journalism career began as a copy editor at a financial newswire and has included editorial positions at The New York Times Magazine, Facts on File, and Oregon State University.