2 oil tankers reportedly attacked near Strait of Hormuz as Japan tries to defuse U.S.-Iran tensions

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

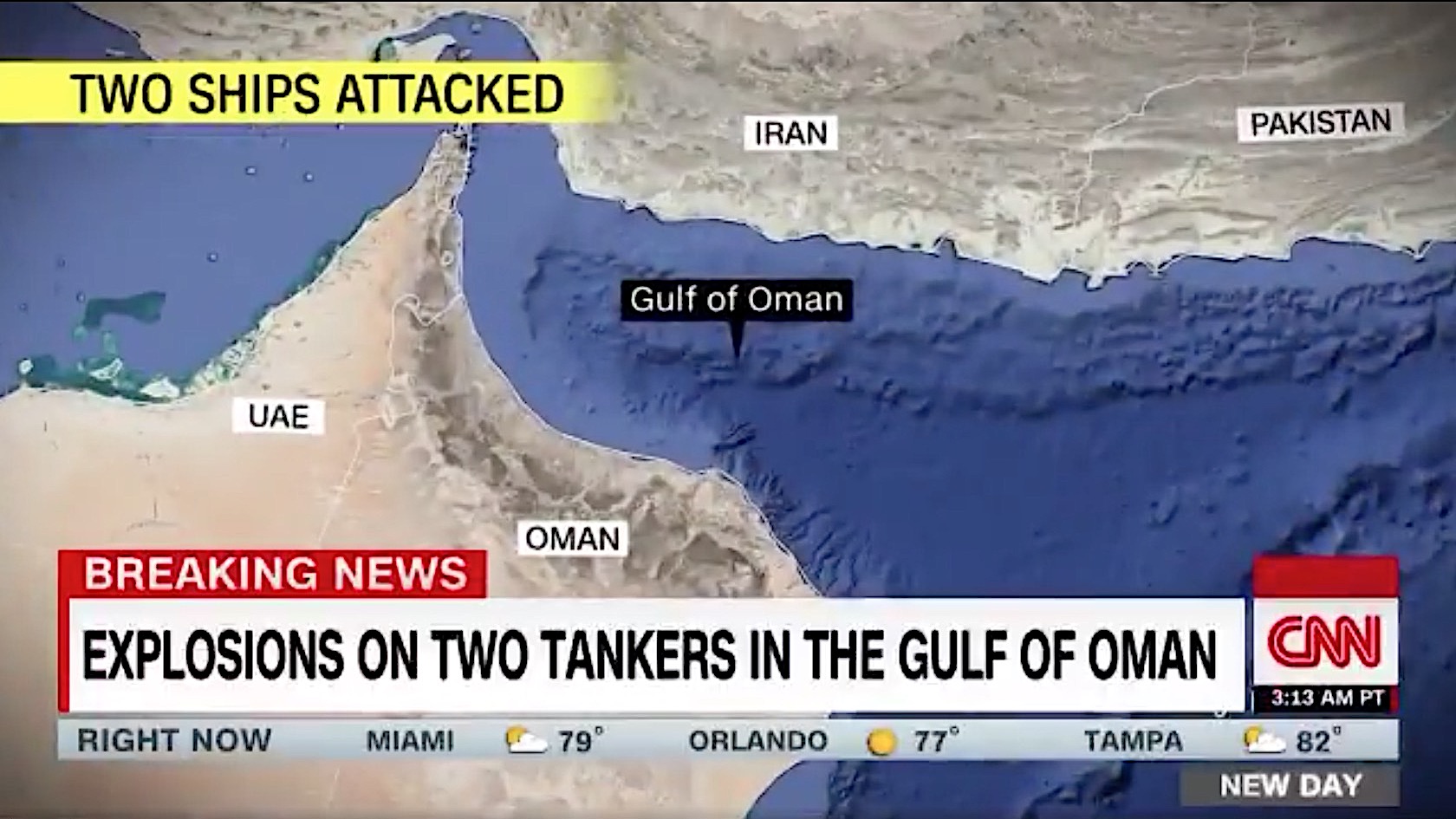

Two oil tankers were reportedly attacked early Thursday in the Gulf of Oman, on one end of the strategic Strait of Hormuz, and the U.S. Navy has rushed a ship to assist the vessels, one of which is "on fire and adrift," according to maritime intelligence firm Dryad Global. Iran said it has rescued all 44 sailors from the two ships — 21 from the Panama-flagged, Singapore-owned Kokuka Courageous and 23 from the MT Front Altair, a Marshal Islands-flagged tanker owned by a Norwegian firm and chartered by Taiwan state oil refiner CPC Corp. — and transported all crew members safely to the Iranian port of Jask.

The cause of the explosions has not been confirmed, but one of the ships reported being hit by a shell. The incident comes amid high tensions between Iran on one hand and the U.S. and Saudi Arabia on the other. Last month, four oil tankers were attacked off the nearby Emirati port of Fujairah; the United Arab Emirates blamed a "state actor" for the limpet mine attack, the U.S. said the state actor was Iran, and Iran denies involvement.

Thursday's apparent attack happened as Japanese Prime Minister Shinzo Abe is in Tehran trying to lower tensions between Iran and the U.S., apparently with little success. Japan's Trade Ministry said one of the ships hit Thursday morning is carrying "Japan-related cargo." The timing of the incident prompted Iranian Foreign Minister Mohammad Javad Zarif to tweet, "Suspicious doesn't begin to describe what likely transpired this morning."

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Two-thirds of the world's oil transported via ship passes through the Strait of Hormuz, and oil prices rose sharply Thursday morning.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Peter has worked as a news and culture writer and editor at The Week since the site's launch in 2008. He covers politics, world affairs, religion and cultural currents. His journalism career began as a copy editor at a financial newswire and has included editorial positions at The New York Times Magazine, Facts on File, and Oregon State University.