The arguments for and against Bloomberg's stance on the origins of the 2008 financial crisis

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

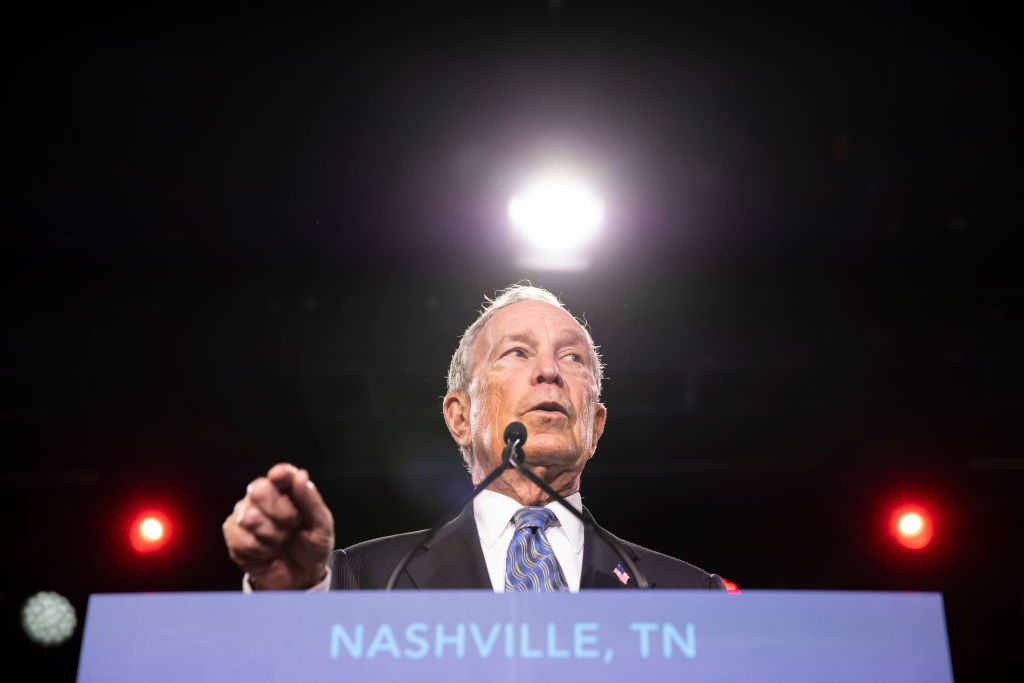

Billionaire and former New York City Mayor Michael Bloomberg has come under fire after The Associated Press rediscovered a 2008 interview he gave at Georgetown University. During the discussion, Bloomberg blamed the 2008 financial crisis on congressional legislation that pressured banks "to make loans to everyone," while defending the practice known as redlining (denying services to entire neighborhoods). But not everyone thinks Bloomberg's opinion was off-base.

Writing for The New York Times, Christopher Caldwell backed up Bloomberg's claim, arguing Congress put borrowers in an unenviable position by forcing banks to lower their underwriting standards. Caldwell's criticism is bipartisan — he blames the Democrats for coming up with the legislation and Republicans for ignoring it because it didn't affect the federal budget. "That brought an astonishing deterioration in the quality of housing assets," Caldwell wrote. "By 2007, high-risk mortgages made up 22 percent of the (government-sponsered enterprises') portfolio, up tenfold from a decade before."

Caldwell doesn't believe any "well-informed accountant" would think those loans could have survived. "The politicization of poor people’s mortgages in a single country — the promise to make loans to everyone, as Mr. Bloomberg put it — brought the world to the brink of economic disaster," he wrote.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Not so fast, wrote Robert Kuttner in The Washington Post. Kuttner wrote the Community Reinvestment Act of 1977, which created an obligation not to redline and provide credit without regard to location. Kuttner believes everything Bloomberg said about 2008 was wrong because Congress made sure to include language in the legislation which made it clear banks were not under pressure to give out bad loans. The law, he said, was designed to make sure lenders did not ignore entire communities, not to water down underwriting standards.

Later on, another law was even more explicit in prohibiting unsavory lending, but Kuttner says it was never enforced. "The problem was not Congress imposing unsound mandates on bankers," he wrote. "It was bank regulators ignoring legislated requirements intended to protect consumers from banker practices." Read Caldwell at The New York Times and Kuttner at The Washington Post.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Tim is a staff writer at The Week and has contributed to Bedford and Bowery and The New York Transatlantic. He is a graduate of Occidental College and NYU's journalism school. Tim enjoys writing about baseball, Europe, and extinct megafauna. He lives in New York City.

-

Political cartoons for February 15

Political cartoons for February 15Cartoons Sunday's political cartoons include political ventriloquism, Europe in the middle, and more

-

The broken water companies failing England and Wales

The broken water companies failing England and WalesExplainer With rising bills, deteriorating river health and a lack of investment, regulators face an uphill battle to stabilise the industry

-

A thrilling foodie city in northern Japan

A thrilling foodie city in northern JapanThe Week Recommends The food scene here is ‘unspoilt’ and ‘fun’

-

TikTok secures deal to remain in US

TikTok secures deal to remain in USSpeed Read ByteDance will form a US version of the popular video-sharing platform

-

Unemployment rate ticks up amid fall job losses

Unemployment rate ticks up amid fall job lossesSpeed Read Data released by the Commerce Department indicates ‘one of the weakest American labor markets in years’

-

US mints final penny after 232-year run

US mints final penny after 232-year runSpeed Read Production of the one-cent coin has ended

-

Warner Bros. explores sale amid Paramount bids

Warner Bros. explores sale amid Paramount bidsSpeed Read The media giant, home to HBO and DC Studios, has received interest from multiple buying parties

-

Gold tops $4K per ounce, signaling financial unease

Gold tops $4K per ounce, signaling financial uneaseSpeed Read Investors are worried about President Donald Trump’s trade war

-

Electronic Arts to go private in record $55B deal

Electronic Arts to go private in record $55B dealspeed read The video game giant is behind ‘The Sims’ and ‘Madden NFL’

-

New York court tosses Trump's $500M fraud fine

New York court tosses Trump's $500M fraud fineSpeed Read A divided appeals court threw out a hefty penalty against President Trump for fraudulently inflating his wealth

-

Trump said to seek government stake in Intel

Trump said to seek government stake in IntelSpeed Read The president and Intel CEO Lip-Bu Tan reportedly discussed the proposal at a recent meeting