Stock market enters 'fastest' correction in history

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Coronavirus fears sent U.S. markets into correction territory on Thursday, down more than 10 percent from record highs after days of losses, reports CNBC.

The Dow Jones Industrial Average closed Thursday down almost 1,200 points, or over 4.4 percent, while the S&P 500 and Nasdaq Composite were each off 4.4 percent and 4.6 percent, respectively.

President Trump has sought to reassure investors that the coronavirus outbreak, which has affected countries around the world, is only a small worry for the stock market. He said Wednesday the market would recover, claiming the U.S. is "really prepared" for the virus and blaming Democratic presidential candidates for the dip. The Dow has lost more than 3,000 points this week.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The slip is the fastest the stock market has ever dipped into correction territory, per Deutsche Bank. The next-fastest decline occurred in 2018. The Dow and S&P 500 are on pace for their worst weekly performance since 2008, notes CNBC.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

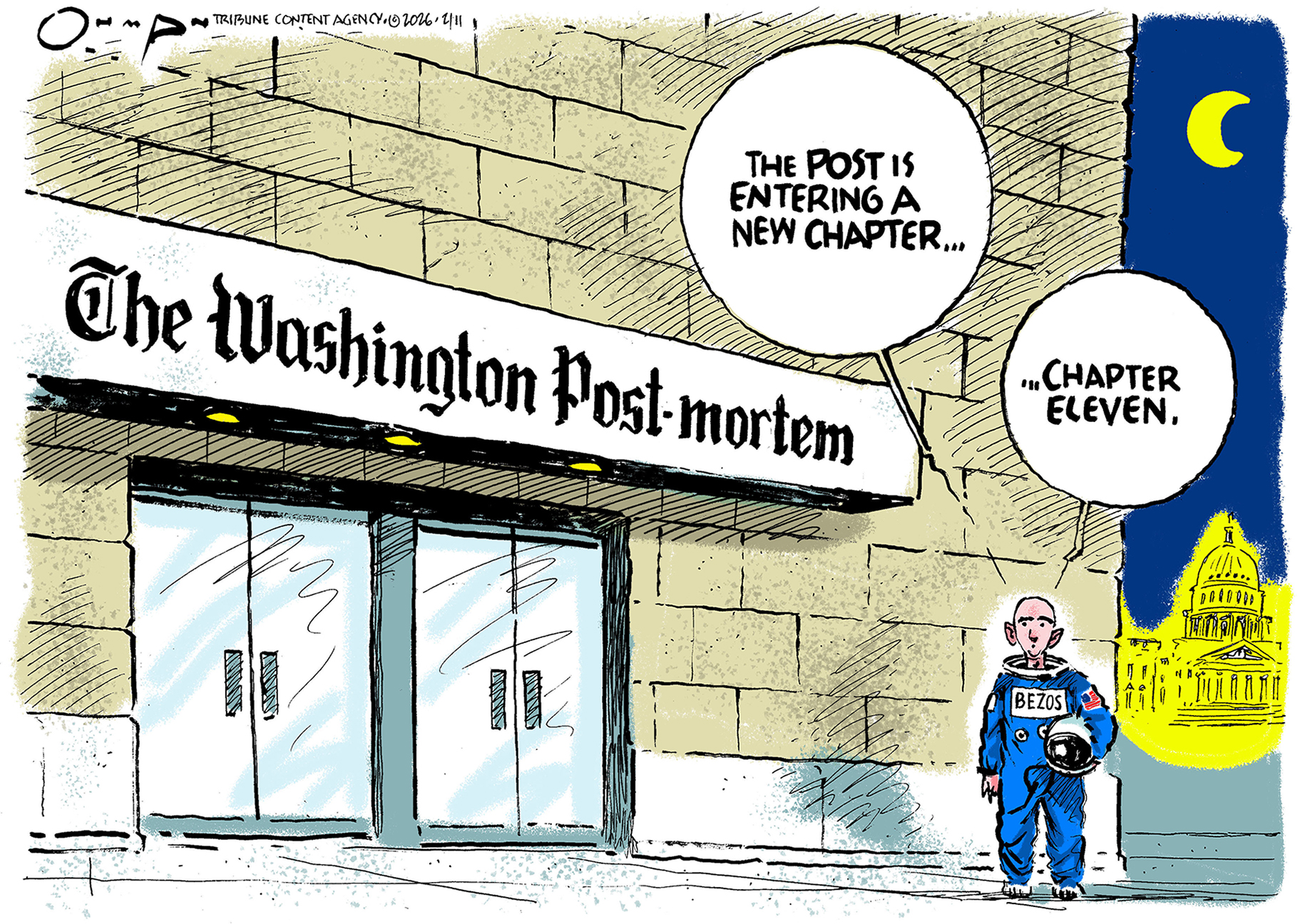

5 calamitous cartoons about the Washington Post layoffs

5 calamitous cartoons about the Washington Post layoffsCartoons Artists take on a new chapter in journalism, democracy in darkness, and more

-

Political cartoons for February 14

Political cartoons for February 14Cartoons Saturday's political cartoons include a Valentine's grift, Hillary on the hook, and more

-

Tourangelle-style pork with prunes recipe

Tourangelle-style pork with prunes recipeThe Week Recommends This traditional, rustic dish is a French classic

-

TikTok secures deal to remain in US

TikTok secures deal to remain in USSpeed Read ByteDance will form a US version of the popular video-sharing platform

-

Unemployment rate ticks up amid fall job losses

Unemployment rate ticks up amid fall job lossesSpeed Read Data released by the Commerce Department indicates ‘one of the weakest American labor markets in years’

-

US mints final penny after 232-year run

US mints final penny after 232-year runSpeed Read Production of the one-cent coin has ended

-

Warner Bros. explores sale amid Paramount bids

Warner Bros. explores sale amid Paramount bidsSpeed Read The media giant, home to HBO and DC Studios, has received interest from multiple buying parties

-

Gold tops $4K per ounce, signaling financial unease

Gold tops $4K per ounce, signaling financial uneaseSpeed Read Investors are worried about President Donald Trump’s trade war

-

Electronic Arts to go private in record $55B deal

Electronic Arts to go private in record $55B dealspeed read The video game giant is behind ‘The Sims’ and ‘Madden NFL’

-

New York court tosses Trump's $500M fraud fine

New York court tosses Trump's $500M fraud fineSpeed Read A divided appeals court threw out a hefty penalty against President Trump for fraudulently inflating his wealth

-

Trump said to seek government stake in Intel

Trump said to seek government stake in IntelSpeed Read The president and Intel CEO Lip-Bu Tan reportedly discussed the proposal at a recent meeting