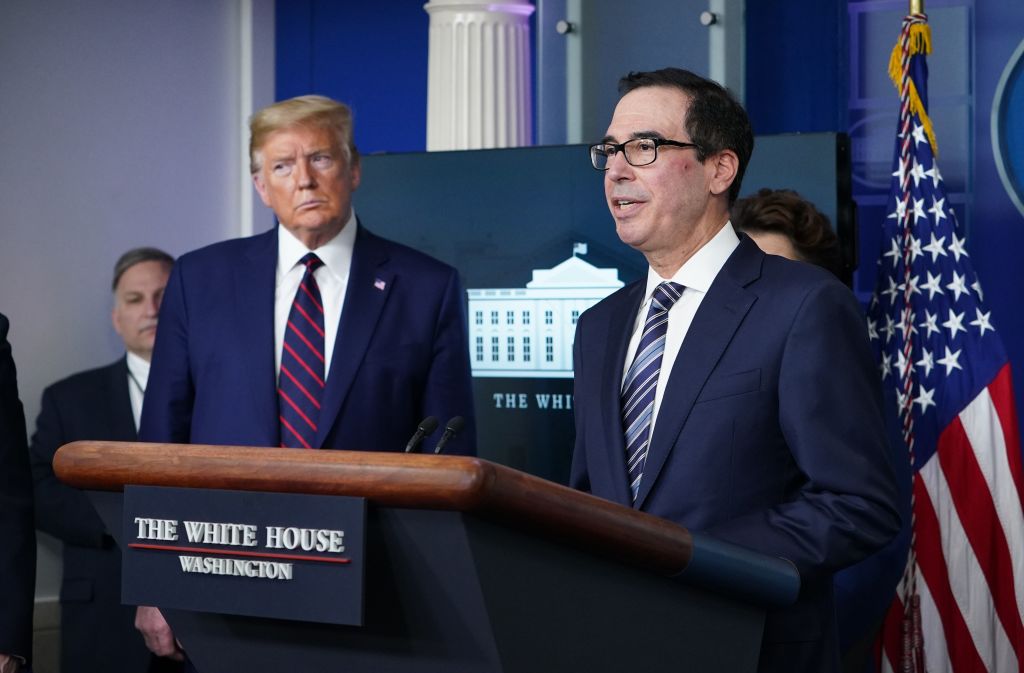

Mnuchin says stimulus loan program will be 'up and running' on Friday, despite lenders saying they aren't ready

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Treasury Secretary Steven Mnuchin on Thursday said a $349 billion coronavirus rescue loan program for small businesses will be "up and running" on Friday, even as lenders express confusion over how they will issue the loans.

The program aims to keep small businesses like salons and restaurants afloat during the coronavirus pandemic. Business owners can get loans of up to $10 million to make payroll for eight weeks or cover rent, utilities, and other expenses. Mnuchin admitted not all lenders will be able to issue loans on Friday, but still encouraged business owners to apply. "You get the money, you'll get it the same day, you use it to pay your workers," he said. "Please bring your workers back to work if you've let them go."

Tony Wilkinson, president of the National Association of Government Guaranteed Lenders, told Reuters "we anticipate more demand than supply. We've got to get our lenders comfortable with the rules so that we know that when we originate a loan, counting on a government guarantee, that we're doing the things necessary so we can actually have the government guarantee."

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Applications will be accepted on Friday, Wilkinson said, but it's anyone's guess how many will be approved. "They will process and close them after they know what the rules are," he said. JP Morgan Chase informed clients on Thursday night that they were "still awaiting guidance" from the Small Business Administration and Treasury, and "as a result, Chase will most likely not be able to start accepting applications on Friday, April 3rd, as we had hoped."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Catherine Garcia has worked as a senior writer at The Week since 2014. Her writing and reporting have appeared in Entertainment Weekly, The New York Times, Wirecutter, NBC News and "The Book of Jezebel," among others. She's a graduate of the University of Redlands and the Columbia University Graduate School of Journalism.

-

Nordic combined: the Winter Olympics sport that bars women

Nordic combined: the Winter Olympics sport that bars womenIn The Spotlight Female athletes excluded from participation in demanding double-discipline events at Milano-Cortina

-

Samurai: a ‘blockbuster’ display of Japanese heritage

Samurai: a ‘blockbuster’ display of Japanese heritageThe Week Recommends British Museum show offers a ‘scintillating journey’ through ‘a world of gore, power and artistic beauty’

-

BMW iX3: a ‘revolution’ for the German car brand

BMW iX3: a ‘revolution’ for the German car brandThe Week Recommends The electric SUV promises a ‘great balance between ride comfort and driving fun’

-

TikTok secures deal to remain in US

TikTok secures deal to remain in USSpeed Read ByteDance will form a US version of the popular video-sharing platform

-

Unemployment rate ticks up amid fall job losses

Unemployment rate ticks up amid fall job lossesSpeed Read Data released by the Commerce Department indicates ‘one of the weakest American labor markets in years’

-

US mints final penny after 232-year run

US mints final penny after 232-year runSpeed Read Production of the one-cent coin has ended

-

Warner Bros. explores sale amid Paramount bids

Warner Bros. explores sale amid Paramount bidsSpeed Read The media giant, home to HBO and DC Studios, has received interest from multiple buying parties

-

Gold tops $4K per ounce, signaling financial unease

Gold tops $4K per ounce, signaling financial uneaseSpeed Read Investors are worried about President Donald Trump’s trade war

-

Electronic Arts to go private in record $55B deal

Electronic Arts to go private in record $55B dealspeed read The video game giant is behind ‘The Sims’ and ‘Madden NFL’

-

New York court tosses Trump's $500M fraud fine

New York court tosses Trump's $500M fraud fineSpeed Read A divided appeals court threw out a hefty penalty against President Trump for fraudulently inflating his wealth

-

Trump said to seek government stake in Intel

Trump said to seek government stake in IntelSpeed Read The president and Intel CEO Lip-Bu Tan reportedly discussed the proposal at a recent meeting