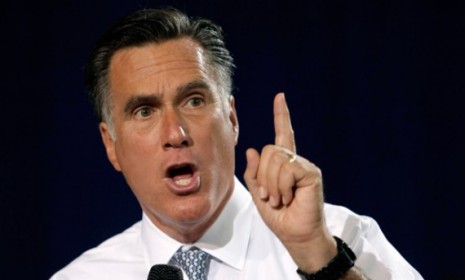

Would Mitt Romney actually raise taxes on 95 percent of Americans?

A nonpartisan think tank crunches the numbers, and they're not pretty: Under Romney, middle-class families could see their tax bills jump by hundreds of dollars

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

This week, the Tax Policy Center, a nonpartisan think tank run by the Brookings Institution and the Urban Institute, released a provocative report showing that Mitt Romney's tax plan would raise taxes on 95 percent of Americans. The Republican has promised a raft of specific tax cuts as well as a balanced budget, a feat that would be impossible to accomplish without drastically increasing tax revenue, severely cutting spending, or both. Romney has refused to explain in detail how he would avoid a massive deficit, only vaguely suggesting that he could make the numbers work by scrapping other tax benefits and loopholes. The Tax Policy Center crunched the numbers for all the loopholes that could possibly be closed, and came to a conclusion that many tax experts have long suspected: Romney's plan would result in a huge break for the rich, and burden the middle and lower tax brackets with a bigger bill. Here, a guide to the ins and outs of Romney's tax plan:

What is Romney's tax plan, exactly?

Romney has promised to cut taxes for all Americans by reducing individual income tax rates by 20 percent across the board. He favors eliminating taxes on capital gains and other income earned from investments, ending the estate tax, repealing the alternative minimum tax, and overturning ObamaCare, which includes tax increases on the wealthy.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

And what did the study find?

The Tax Policy Center calculated that Romney's proposals would result in a $360 billion shortfall by 2015. How would he make up for that lost cash? The think tank tried eliminating every single tax loophole for households earning more than $200,000 a year, and found that Romney would still come up short. So that means turning to other tax benefits — often related to health care, mortgages, and college tuition — that tend to be used by middle- and lower-income households. Eliminating those benefits would help Romney close the gap — but would also cost most Americans more money than they'd save under Romney's reduced tax rates. For example, a household earning between $50,000 and $75,000 would pay an extra $641 in taxes a year under President Romney. A household earning more than $1 million would get an $88,000 tax cut.

Hold on. Couldn't Romney just cut spending?

Yes. But government spending also "tends to benefit low- and middle-income households," says Derek Thompson at The Atlantic. Because a GOP president is unlikely to slash military spending, "the cuts would focus even more on programs that provide services or cash to the poor, sick, and elderly." That isn't hyperbole: "Poor, sick, and old is simply where the vast majority of non-combat government spending goes." So even if Romney cut spending instead of raising taxes, it would still hit the pocketbooks of middle- and low-income families.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

What does Team Romney say?

Unsurprisingly, the Romney campaign dismissed the study's findings as a liberal hatchet job, noting that one of the study's three authors had been on President Obama's Council of Economic Advisers. However, another author of the study had been an economic adviser to George W. Bush, and the Romney campaign has cited the Tax Policy Center as an "objective, third-party" think tank in the past. What's astonishing is "the complete and utter inability of the Romney campaign to respond to today's study with appropriate facts and figures revealing why, in their judgment, the study gets it wrong," says Rick Ungar at Forbes.

How has President Obama responded?

Obama is, of course, all over the study. Romney is "asking you to pay more so that people like him can get a tax cut," Obama said at a rally in Mansfield, Ohio. "And you don't have to take my word for it."

Sources: The Atlantic, Bloomberg, CBS, Forbes, The New York Times (2), Talking Points Memo

Read more political coverage at The Week's 2012 Election Center.