Conservatives' new child tax credit has nothing to do with reducing child poverty

"We're trying to allow people to have the number of kids they would without government intervention," says one conservative economist

The new hotness in conservative policy circles is a beefed-up child tax credit.

The policy is a major plank in "Room to Grow," the new reform conservative manifesto, and Sen. Mike Lee (R-Utah) has put such a proposal before Congress. It would leave intact the current $1,000 child tax credit, adding another one of $2,500 on top. This additional credit could be used to reduce payroll tax liability and would not phase out at higher income levels (unlike the current one).

As part of the justification for this policy, reformers have proposed that people should be compensated for their children's future tax payments. Basically, the idea here is that people used to have kids out of a fear of starving in old age; now that retirement is socialized through Social Security and Medicare, that connection has been lost. This has been dubbed the "parental tax penalty," and reformers seek to rectify it by incentivizing having kids.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Matt Bruenig has repeatedly attacked the logic of this, pointing out that because of the design features I mentioned above — chiefly, the fact that as a tax "credit" it disproportionately helps those whose owe more in taxes — the bottom income quintile will receive almost none of the policy's benefits. Furthermore, up to quite a high level, the more money people make, the more benefits they will receive.

If we take the "future child tax payments" logic on its face, Bruenig says, it would seem to militate towards a much more equal disbursement of benefits. He cites a per-head child allowance, a $300 version of which could reduce child poverty by 42 percent at a stroke, as a far better way to accomplish the same goal.

However, to understand the conservative view, I don't think we can consider the "future tax payments" argument as anything more than a vague gesture. The major motivation is the belief that the middle class and upper class are disproportionately being disincentivized from having kids.

I spoke with economist Robert Stein, who originally proposed the policy in National Affairs and wrote the manifesto chapter in question. "I look at it in terms of economic efficiency," he said. Social Security and Medicare have created a "subtle bias against raising children," but somebody is still going to have to produce the next generation. Our old-age system is "suppressing" fertility.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

However, this doesn't hold for the poor, according to Stein, because the "pre-existing generosity" of the Earned Income Credit has already given them quite a large incentive to have kids. The proposed child tax credit is designed to "hold harmless the bottom 20 percent," but "not designed to encourage fertility in the poor over and above what we already do," he said. The idea is "trying to allow people to have the number of kids they would without government intervention."

Thus, when I brought up the child poverty angle, Stein demurred. The policy "is not addressed toward child poverty," he said. "I have no idea what to do [about that]." When I asked specifically about Bruenig's child allowance proposal, he said that perhaps it could be a good idea, but similar to how Ross Douthat reacted, he suggested we "might want to hinge it on something," like a work requirement.

Positive notices aside, I suspect Bruenig is wrong to hope that he might get conservatives on board with his child allowance proposal. Nearly a quarter of all children live in poverty and fertility rates are strongly inversely correlated with income — the birth rate among families making less than $10,000 is nearly twice that of families making more than $75,000. Therefore, any straightforward allowance disbursed on a per-child basis would heavily favor the very poor, and would run headlong into conservatives' desire to not encourage fertility there.

Update: Turns out this final argument isn't quite complete. To get a correct view of poverty and fertility rates, one has to control for age, because people get richer as they get older as Bruenig explains here. This wouldn't close the fertility gap between rich and poor, but it would narrow it somewhat.

Ryan Cooper is a national correspondent at TheWeek.com. His work has appeared in the Washington Monthly, The New Republic, and the Washington Post.

-

6 exquisite homes for skiers

6 exquisite homes for skiersFeature Featuring a Scandinavian-style retreat in Southern California and a Utah abode with a designated ski room

-

Film reviews: ‘The Testament of Ann Lee,’ ’28 Years Later: The Bone Temple,’ and ‘Young Mothers’

Film reviews: ‘The Testament of Ann Lee,’ ’28 Years Later: The Bone Temple,’ and ‘Young Mothers’Feature A full-immersion portrait of the Shakers’ founder, a zombie virus brings out the best and worst in the human survivors, and pregnancy tests the resolve of four Belgian teenagers

-

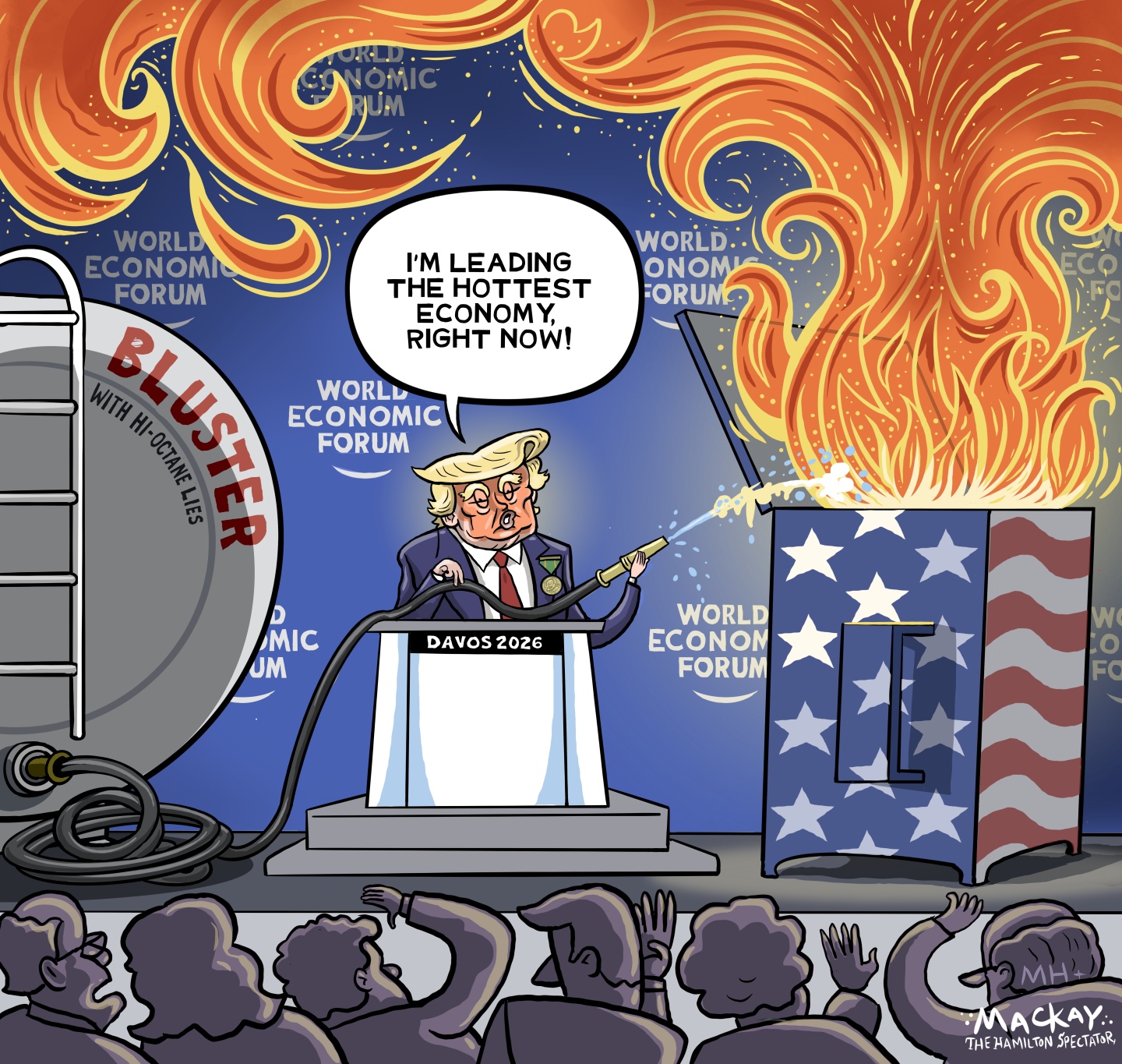

Political cartoons for January 25

Political cartoons for January 25Cartoons Sunday's political cartoons include a hot economy, A.I. wisdom, and more

-

The billionaires’ wealth tax: a catastrophe for California?

The billionaires’ wealth tax: a catastrophe for California?Talking Point Peter Thiel and Larry Page preparing to change state residency

-

Bari Weiss’ ‘60 Minutes’ scandal is about more than one report

Bari Weiss’ ‘60 Minutes’ scandal is about more than one reportIN THE SPOTLIGHT By blocking an approved segment on a controversial prison holding US deportees in El Salvador, the editor-in-chief of CBS News has become the main story

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred