Marco Rubio's proposal to fight income inequality is pretty good — but it could be better

Reform-minded conservatives want to strengthen the Earned Income Tax Credit. We should be reforming the Child Tax Credit on similar lines.

Whenever the topic of poverty comes up, conservatives have a go-to policy: the Earned Income Tax Credit, which subsidizes work for low-income families and has become one of our most important anti-poverty programs. Amidst ongoing debates over income inequality, more policy-minded conservatives have proposed strengthening the EITC by turning it into a wage supplement program.

It's a great idea, and could provide a model for broadening the Child Tax Credit as well, essentially establishing a European-style allowance system.

Many conservatives (though by no means all) prefer expanding the EITC over raising the minimum wage, because the tax credit boosts low-earning workers' incomes without making them more expensive for businesses to employ.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Workers, however, don't feel the benefits of the tax credit in the same way as an actual pay raise. This is because the EITC only comes once a year, lowering or refunding some of a worker's tax liability. It does not come every two weeks like a paycheck.

The solution to this is to spread payment of the EITC out over the full year. Republican Sen. Marco Rubio (Fla.) has proposed that we turn the tax credit into a wage supplement so that it would "arrive in sync with a monthly paycheck rather than a year-end lump-sum credit."

This idea makes a lot of sense. The subsidy would have greater effect on low-income workers' budgets and establish a stronger connection to work if it arrived throughout the year. This practical reality led Rubio to break with Republican dogma that has traditionally favored tax credit subsidies over direct government spending.

But there's no reason to stop at the EITC. We could likewise convert the Child Tax Credit into a series of periodic direct cash payments to families. This would ensure that the childcare subsidy syncs with family expenses throughout the year, rather than arriving as a lump sum.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

The Child Tax Credit is a partially refundable $1,000 tax credit for families with children. It is the most significant childcare subsidy in the United States, keeping 1.6 million children out of poverty in 2012.

If we turned the Child Tax Credit into a series of direct cash transfers, it would functionally become a child allowance system like those prevalent throughout Europe. Since 2005, the Netherlands has provided quarterly automatic payments to families to subsidize child-rearing expenses. American journalist Russell Shorto discovered the refreshing simplicity of the Dutch system after moving to Amsterdam. "Every quarter," he explained, "the [Dutch Social Insurance Bank] quietly drops $665 into my account with the one-word explanation kinderbijslag, or child benefit."

If we followed the Dutch model, we could make our $1,000 tax credit fully refundable, and turn it into $250 payments that appear in families' checking accounts (or as debit cards for unbanked families) every three months.

Not only would this smooth out payment, but it would also detach the subsidy from our complex and costly tax system. Structuring our principal childcare subsidy as a tax credit favors families with the means to navigate the tax code. It also leaves the families who need the subsidy most as the least likely to claim it.

Tying our childcare subsidy to the tax code is also inefficient, as a portion of the subsidy is eaten up by the costs of using a tax preparer. All of these problems could be avoided through a system of direct payments.

In the Netherlands, the child allowance is a universal benefit "meant for all parents, regardless of income." In the United States, however, the full Child Tax Credit is only universally available for families earning between $16,333 and $110,000. Those earning below or above these amounts receive only a partial tax credit or none at all.

Having a universal child subsidy secures broad political support for the benefit, but it also limits the generosity of the subsidy for the neediest families. The alternative to a flat subsidy for all is a means-tested one. Instead of providing four $250 payments to all families, we might make higher payments to low-income families and partial payments to comfortably middle-class families.

Better yet, we could simply increase payments for everyone. This is what President George W. Bush did when he both doubled the value of the Child Tax Credit from $500 to $1,000, and made it partially refundable in his 2001 and 2003 tax cuts. Republican Sen. Mike Lee (Utah) has proposed further increasing the tax credit to $3,500 per family and making it more refundable.

While we should certainly raise the value of our childcare subsidy, moving toward a child allowance alone would be a vast improvement over a subsidy dependent on the tax system. Rubio's insight is an important one for our public policy: government subsidies ought to be tied to the things that they are subsidizing. Our work subsidies should track the work that we're doing, just as our child subsidies should track our child expenses. And our policy should support the work of family life year-round — not just during tax season.

Joel Dodge writes about politics, law, and domestic policy for The Week and at his blog. He is a member of the Boston University School of Law's class of 2014.

-

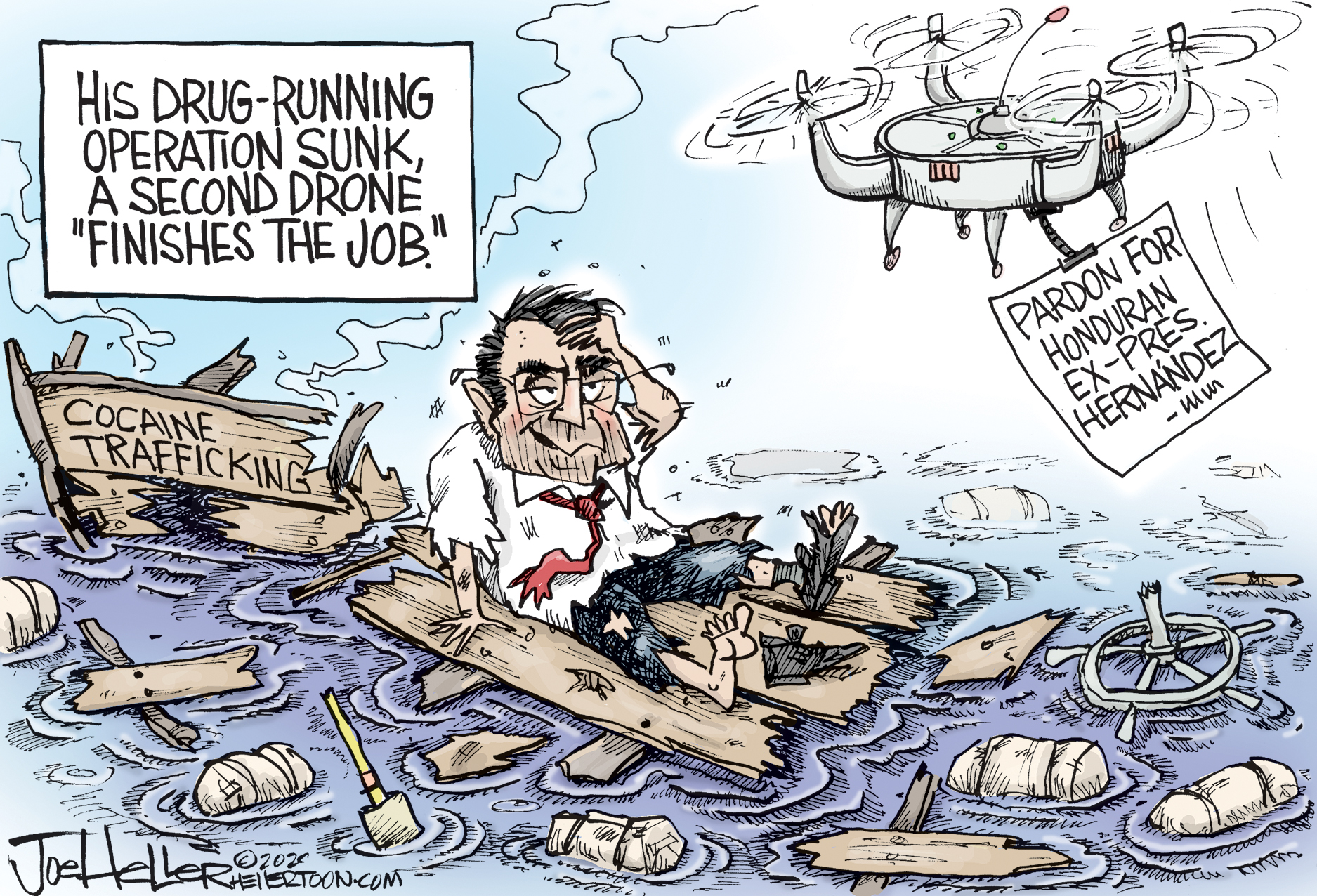

Political cartoons for December 6

Political cartoons for December 6Cartoons Saturday’s political cartoons include a pardon for Hernandez, word of the year, and more

-

Pakistan: Trump’s ‘favourite field marshal’ takes charge

Pakistan: Trump’s ‘favourite field marshal’ takes chargeIn the Spotlight Asim Munir’s control over all three branches of Pakistan’s military gives him ‘sweeping powers’ – and almost unlimited freedom to use them

-

Codeword: December 6, 2025

Codeword: December 6, 2025The daily codeword puzzle from The Week

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred

-

Will Trump's 'madman' strategy pay off?

Will Trump's 'madman' strategy pay off?Today's Big Question Incoming US president likes to seem unpredictable but, this time round, world leaders could be wise to his playbook

-

Democrats vs. Republicans: who are US billionaires backing?

Democrats vs. Republicans: who are US billionaires backing?The Explainer Younger tech titans join 'boys' club throwing money and support' behind President Trump, while older plutocrats quietly rebuke new administration