Mitt Romney releases his 2011 tax return: 4 takeaways

The long wait for Mitt Romney's latest filing with the IRS is over. So, what do the documents tell us about the candidate and his finances?

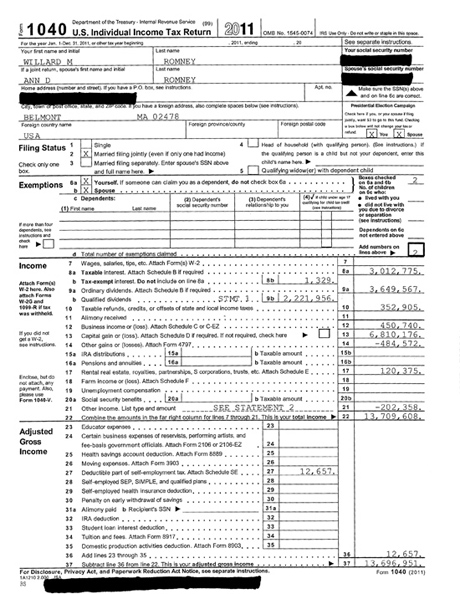

Mitt Romney released his 2011 tax return and posted it online Friday, triggering a mad media dash to see what was inside. (See the first page of the return below.) Romney and his wife, Ann, paid $1.95 million in taxes on investment income of $13.7 million last year (a significant dip from his 2010 haul of $20 million). The GOP presidential nominee made his fortune running private equity firm Bain Capital from 1984 to 1999 (or 2001, depending on whom you ask), so his earnings now come from money he has invested. That means he paid a lower tax rate — 14.1 percent — than workers pay on ordinary income from a paycheck. What do the revelations say about Romney and his run for the presidency? Here, four key takeaways:

1. Romney paid too much... busted!

The "gotcha moment" here, says Derek Thompson at The Atlantic, is the revelation that Romney only deducted $2.25 million of his $4 million in charitable donations, or less than he was entitled to. Why would he do that? Because he'd sworn up and down that he never paid less than 13 percent of his income in taxes over the last decade, and if he had deducted every penny he was entitled to last year, he would have had an effective tax rate under 10 percent. Pretty lame, as bombshells go, but liberals are chiding Mitt because he said he always pays what the law requires — no more, no less — and "if I had paid more [taxes] than are legally due I don't think I'd be qualified to become president." Ha! He paid too much but he said he didn't! "Yeah, yeah. Gotcha. Whatever."

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

2. This was as good a time as any to tear off the Band-Aid

Mitt has been promising to hand over his 2011 forms for some time, says Chris Cillizza at The Washington Post, so why now? For one thing, it's Friday, and it's a Washington tradition to dump news on topics you want hushed up when everyone's thinking about the coming weekend. More importantly, Romney's '47 percent' secret-video comments already made him the loser on "the big political scoreboard" this week, and "political strategy 101 dictates that when things are going badly is the best time to dump other bad." Besides, the first presidential debate is just two weeks away, and the longer he waited the more likely the returns were to become a big topic in his showdown with President Obama. Now he can move on, and work on turning everyone's attention back to the economy and Obama's handling of it.

3. Romney told the truth; Harry Reid didn't

Throughout the summer-long push to get Romney to release years and years of tax returns, says Michelle Malkin at her blog, Senate Majority Leader Harry Reid (D-Nev.) "claimed that a number of people had told him that Mitt Romney didn’t pay any taxes for a decade." Perhaps Harry and his imaginary friends would like to apologize now? Not only did Romney's trustee, Brad Malt, confirm that the former Massachusetts governor paid taxes every year for the past two decades, says Daniel Halper at The Weekly Standard, but his average tax rate was roughly 20 percent — which is what the Obamas paid last year. Sorry, folks, no scandal here.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

4. Congress and the IRS should be embarrassed, not Romney

The only thing the 200-page tax return proves about him is that he is "a very wealthy man," which is neither surprising nor shameful, says Peter Suderman at Reason. The people who should be red-faced here are the ones responsible for the "needlessly complex" tax code that forces people to construct documents as thick as a phone book every time Uncle Sam demands his pound — or, in Romney's case, ton — of flesh. Maybe instead of wasting time prying into Romney's personal tax history, which isn't really that important, we should be hounding him to release "the details of his plan to reform the U.S. tax code, which he has so far refused to specify."

Read more political coverage at The Week's 2012 Election Center.

-

Political cartoons for January 12

Political cartoons for January 12Cartoons Monday’s political cartoons include Mayflower colonisers, Lady Lawless, and more

-

Golden Globes affirm ‘One Battle,’ boost ‘Hamnet’

Golden Globes affirm ‘One Battle,’ boost ‘Hamnet’Speed Read Comedian Nikki Glaser hosted the ceremony

-

Trump, Iran trade threats as protest deaths rise

Trump, Iran trade threats as protest deaths riseSpeed Read The death toll in Iran has surpassed 500

-

The billionaires’ wealth tax: a catastrophe for California?

The billionaires’ wealth tax: a catastrophe for California?Talking Point Peter Thiel and Larry Page preparing to change state residency

-

Bari Weiss’ ‘60 Minutes’ scandal is about more than one report

Bari Weiss’ ‘60 Minutes’ scandal is about more than one reportIN THE SPOTLIGHT By blocking an approved segment on a controversial prison holding US deportees in El Salvador, the editor-in-chief of CBS News has become the main story

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred