What Rand Paul's bonkers tax plan tells us about conservative economics

It's vivid proof that Republicans believe in magic — at least when it comes to taxes

Rand Paul debuted his flat tax plan Thursday in a Wall Street Journal op-ed, and we shouldn't mince words: This plan is utterly bonkers. But it may yet have an impact on the presidential race, not because anything like it will ever be enacted, but because it's so radical that the other candidates will have to confront it. They might decide that it makes their own plans seem reasonable and practical by comparison. Or they might feel pressure to make their own ideas more sweeping to try to keep up. Either way, Paul's plan is vivid proof of the magical thinking that grips Republicans on the subject of taxes.

When you get to this line early in Paul's op-ed, you know you've entered an economic Bizarro World, where the most fantastical claims are sure to follow: "In consultation with some of the top tax experts in the country, including the Heritage Foundation’s Stephen Moore, former presidential candidate Steve Forbes, and Reagan economist Arthur Laffer, I devised a 21st-century tax code..." Those three are "some of the top tax experts in the country" in the same sense that Jenny McCarthy, Guy Fieri, and that lady down the street who ate her baby's placenta are "some of the top medical experts in the country." So what did Paul and his kitchen cabinet of cranks come up with?

First, he'd tax all individuals and businesses at 14.5 percent, regardless of the type of income. In there is the sole good idea Paul has — there's no logical reason why wage income should be taxed at a higher rate than income from investments — but that represents a gigantic tax cut for those with high incomes. He'd completely eliminate inheritance taxes, which is good news for future Paris Hiltons. He'd also eliminate payroll taxes, "which are seized by the IRS from a worker’s paychecks before a family ever sees the money." Paul doesn't mention the fact that payroll taxes fund the Social Security and Medicare systems, of which Americans are rather fond. Is he going to just shut them down? Who knows.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Speaking of things Americans are fond of, Paul shows the limits of his courage by noting that while he'd eliminate most tax deductions, he'd keep the deduction for charitable contributions and the hallowed mortgage interest deduction. If you own a home, you love the mortgage interest deduction — who wouldn't want the government to pay part of their mortgage? But it costs around $70 billion a year, and three-quarters of the benefits go to those earning over $100,000. In other words, the mortgage interest deduction is a middle- and upper-class entitlement program, a gigantic big-government giveaway of the type a quasi-libertarian like Rand Paul ought to despise. But don't worry — he'll let you keep it.

And what about the economic benefits of Paul's plan? I'll let him explain:

Because the Fair and Flat Tax rewards work, saving, investment, and small business creation, the Tax Foundation estimates that in 10 years it will increase gross domestic product by about 10 percent, and create at least 1.4 million new jobs.

So he's claiming that his plan will increase GDP by 1 percent a year, which is substantial, but for some reason it produces a whopping 140,000 jobs per year, or 11,667 jobs per month. Last month the U.S. economy added 280,000 new jobs, so it's a little hard to see that 11,667 as the "economic steroid injection" Paul says it would be.

The plan would deprive the federal government of huge amounts of tax revenue, meaning either an enormous deficit or truly spectacular spending cuts. How does Paul handle this? Get ready for the pixie dust:

And because the best way to balance the budget and pay down government debt is to put Americans back to work, my plan would actually reduce the national debt by trillions of dollars over time when combined with my package of spending cuts.

Unless Paul's "package of spending cuts" includes shutting down the Department of Defense, eliminating Medicaid, and no longer doing a whole lot of other things the federal government currently does, there's just no way this is possible. And while it's true that the best way to balance the budget is with strong economic growth that brings in more tax revenue, Paul's plan rests on a theory that has been tested again and again, and has failed again and again.

Republicans are still gripped by a religious belief that tax rates are the primary determinant of whether the economy is good or bad at a particular moment, which leads to two inevitable corollaries: If you cut taxes, the economy will explode with a glitter bomb of prosperity for all, and if you raise taxes, the economy will descend into a pit of misery and despair. But we know that's false. The actual truth is that changing tax rates can have an impact on economic growth, all other things being equal, but that impact is quite small.

You don't have to be an economic historian to know that the predictions Republicans have made based on their economic theory have proven wrong again and again. When Bill Clinton raised taxes in 1993, they said the result would be a "job-killing recession." Over the course of Clinton's administration, the American economy created 22 million new jobs. When George W. Bush cut taxes, they said it would supercharge the economy. What followed was seven years of anemic job creation culminating in the worst economic crisis since the Great Depression. They said Barack Obama's policies, including some tax increases, would destroy any hope of job creation. But the economy has added 12 million jobs since the beginning of 2010, and 2014 was the best year for job growth since 1999.

That's not to mention the fact that some of the strongest growth in both the overall economy and in incomes in American history happened during the 1950s and 1960s, when the top income tax rate was as high as 91 percent (and labor unions were at their strongest, by they way). The point is that while cutting taxes can, in the right circumstances, provide a boost to the economy by giving people some more money to spend, it isn't anything like the panacea Republicans believe it to be. And tax cuts don't ever pay for themselves by creating so much growth, as Republicans always hope.

Yet that remains the foundation of every Republican candidate's tax plan: All we need to do is cut taxes, particularly for the wealthy, and we'll all sashay into economic nirvana. Rand Paul's may be the most extreme in the bunch (so far anyway), but you can bet the other candidates are going to look at the marker he has laid down and fall all over themselves to assure primary voters that they too believe that tax cuts have magical powers.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Paul Waldman is a senior writer with The American Prospect magazine and a blogger for The Washington Post. His writing has appeared in dozens of newspapers, magazines, and web sites, and he is the author or co-author of four books on media and politics.

-

Critics' choice: 2025 James Beard Award winners

Critics' choice: 2025 James Beard Award winnersFeature Featuring a casually elegant restaurant, recipes nearly lost to war, and more

-

How will Trump's spending bill impact student loans?

How will Trump's spending bill impact student loans?the explainer Here's what the Republicans' domestic policy bill means for current and former students

-

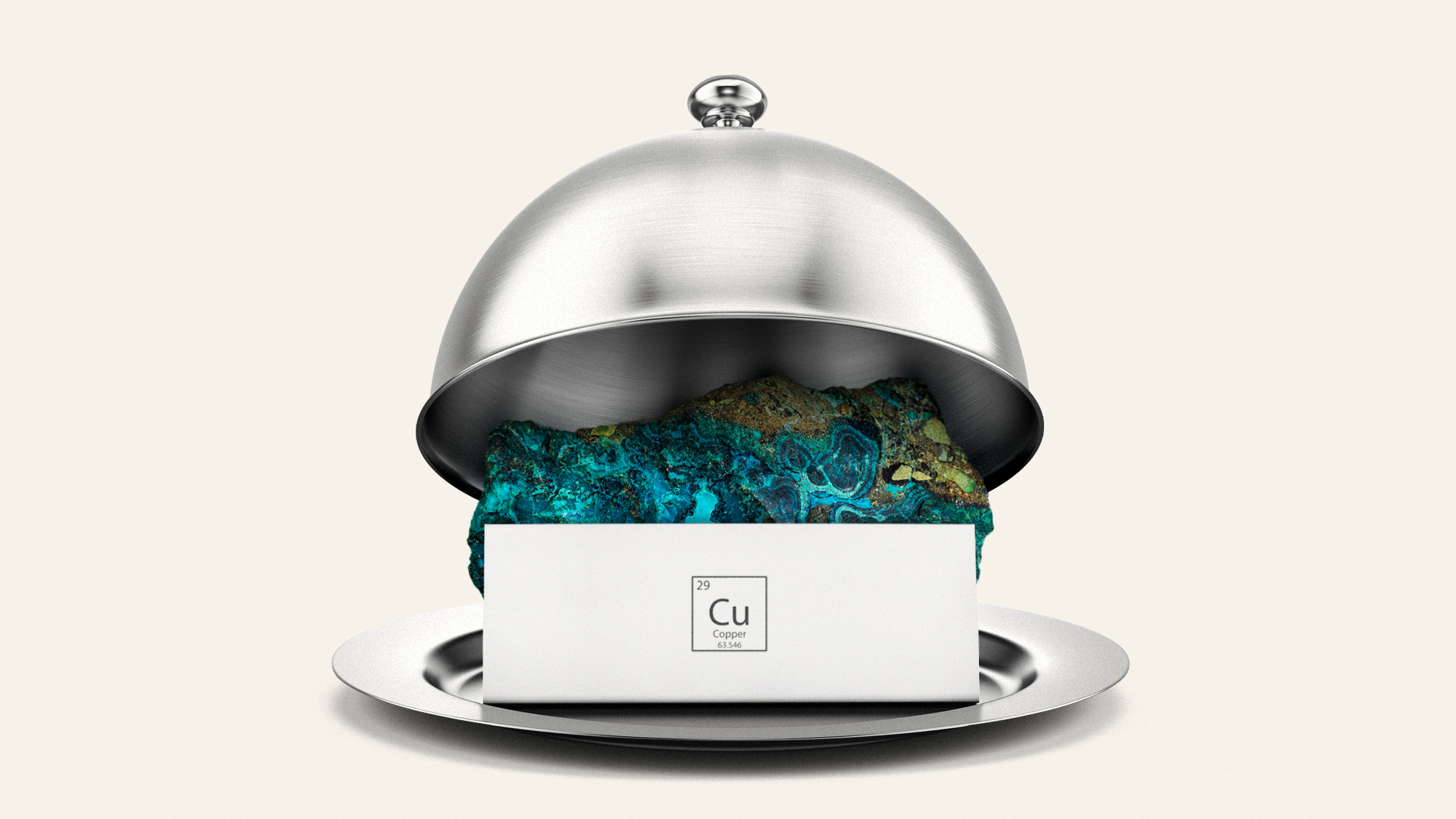

Can the US economy survive Trump's copper tariffs?

Can the US economy survive Trump's copper tariffs?Today's Big Question The price hike 'could upend' the costs of cars, houses and appliances

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred

-

Will Trump's 'madman' strategy pay off?

Will Trump's 'madman' strategy pay off?Today's Big Question Incoming US president likes to seem unpredictable but, this time round, world leaders could be wise to his playbook

-

Democrats vs. Republicans: which party are the billionaires backing?

Democrats vs. Republicans: which party are the billionaires backing?The Explainer Younger tech titans join 'boys' club throwing money and support' behind President Trump, while older plutocrats quietly rebuke new administration

-

US election: where things stand with one week to go

US election: where things stand with one week to goThe Explainer Harris' lead in the polls has been narrowing in Trump's favour, but her campaign remains 'cautiously optimistic'

-

Is Trump okay?

Is Trump okay?Today's Big Question Former president's mental fitness and alleged cognitive decline firmly back in the spotlight after 'bizarre' town hall event

-

The life and times of Kamala Harris

The life and times of Kamala HarrisThe Explainer The vice-president is narrowly leading the race to become the next US president. How did she get to where she is now?