How Hillary Clinton can beef up her child poverty plan

Liberals must stop predicating their benefits on work

Hillary Clinton finally has a poverty policy that has something to do with poverty! After previous attempts that bundled a bunch of largely unrelated policy into a sort of poverty-adjacent program, Clinton announced Tuesday something that will actually help the poor: making the child tax credit more refundable.

I'll explain in more detail below, but the basic idea is to give more money to poor parents of children, especially ones under 5 years old. It's an encouraging idea, but still a limited one. Until Clintonite liberals can admit that the basic problem of poverty is people being unable to work, they will never be able to attack poverty in a serious way.

So, how does this work? Recall that a "refundable" tax credit is one that will pay money if you owe no taxes. Currently, the Child Tax Credit (CTC) is only partially refundable. Starting after the first $3,000 in income, 15 percent of further income can be paid to you as a credit even if your tax liability is zeroed out, up to the maximum $1,000 credit per child. So for example, if you are a single mother with one 2-year-old child making $8,000 in income, and you owe no federal income tax, you can get a credit of $750 (15 percent of $5,000).

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Clinton would change this in two ways. First, she would get rid of the $3,000 minimum to claim the credit. Second, for children under 5 years old, she would make the credit phase in at 45 percent of income (instead of 15 percent), and increase the credit to $2,000 per child. That same single mother making $8,000 would instead get a full $2,000 credit (since 45 percent of $8,000 is well over the limit), a dramatic increase.

As my colleague Jeff Spross argues, this is probably the best policy Clinton has produced so far. Most importantly, it tacitly admits the error of Bill Clinton's welfare reform. Poor people do not need a coercive surveillance apparatus attempting to bludgeon them into the labor market, and poverty programs should not be block-granted to the states (so conservative ones can bogart the money to spend on dubious anti-abortion programs). Instead, what poor people need is more income.

On the other hand, Clinton's approach is still dogged by an insistence that poverty benefits must be tied to work. This is a fundamental error in thinking about poverty, and a capitulation to conservative agitprop. (Conservative versions of the CTC are always totally nonrefundable, because conservatives think that irresponsible poor people will have kids simply to claim the extra money — they don't want "to encourage fertility in the poor," as a conservative analyst told me once.)

That's surely why Clinton's CTC is quite narrowly targeted — to parents who work, and especially those with young children. Giving money to the parents of children 4 years old and under does make sense, since daycare is more expensive for younger kids, and they can't go to school yet. However, that also means the overall expansion is rather small, because there aren't that many families with children who are that young. (If our imaginary mother above had a 6-year-old instead, for example, she would get a measly $250 extra.)

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

The Center on Budget and Policy Priorities estimates that in 2014, this change would have benefited 14 million families, lifting 1.5 million of them out of poverty. That's a decline in the poverty rate of about 3.1 percent — not nothing, but not a huge reduction either.

What's more, per Dylan Matthews' assertion that this is about attacking deep poverty, the poorest of the poor are quite deliberately left out of this program. Parents with no income get nothing whatsoever — and parents who suffer a collapse of income will see their benefits vanish as well. Phasing the tax credit in means that, for parents of children under 5 who make less than $4,444 (the point at which the maximum credit can be claimed), the tax credit will pay out more the more you make — in other words, inverse to need. This benefit is supposed to be about helping children. Why must a child suffer because of the characteristics of their parents?

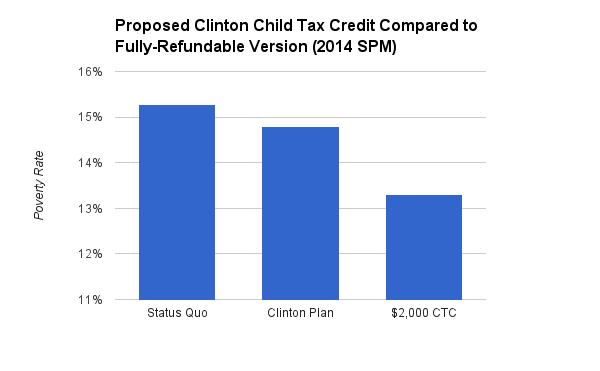

A better approach, just for starters, would be to make the CTC fully refundable, no matter how much money you make. Using 2014 Census Supplemental Poverty Measure microdata together with the Annual Social and Economic Supplement, I estimated the effects of such a program. With a fully-refundable CTC of $2,000, 6.3 million people would be pulled out of poverty, and about 23 million people would benefit. Better still, the very poorest families would be included, who would undoubtedly appreciate the extra income the most. Here's how the poverty rate drop compares to Clinton's policy:

However, funneling a child benefit through the tax system is problematic as well. Poor people are often very budget-constrained, do not have a bank account, and are not well-educated; and thus have trouble smoothing their spending. Giving them a big lump sum on tax day is better than nothing, but many will struggle to sock away the benefit so as to spread it out evenly over the year. Worse, the tax prep vultures are sure to be all over this new benefit like flies on manure, reducing the amount that actually makes it to poor people.

Far and away the best way to deliver a child benefit is to take it out of the tax system, and run it through the Social Security Administration as a monthly check to every parent. But until liberals can get over their queasiness about giving money to poor people, no strings attached, we won't get there.

Ryan Cooper is a national correspondent at TheWeek.com. His work has appeared in the Washington Monthly, The New Republic, and the Washington Post.

-

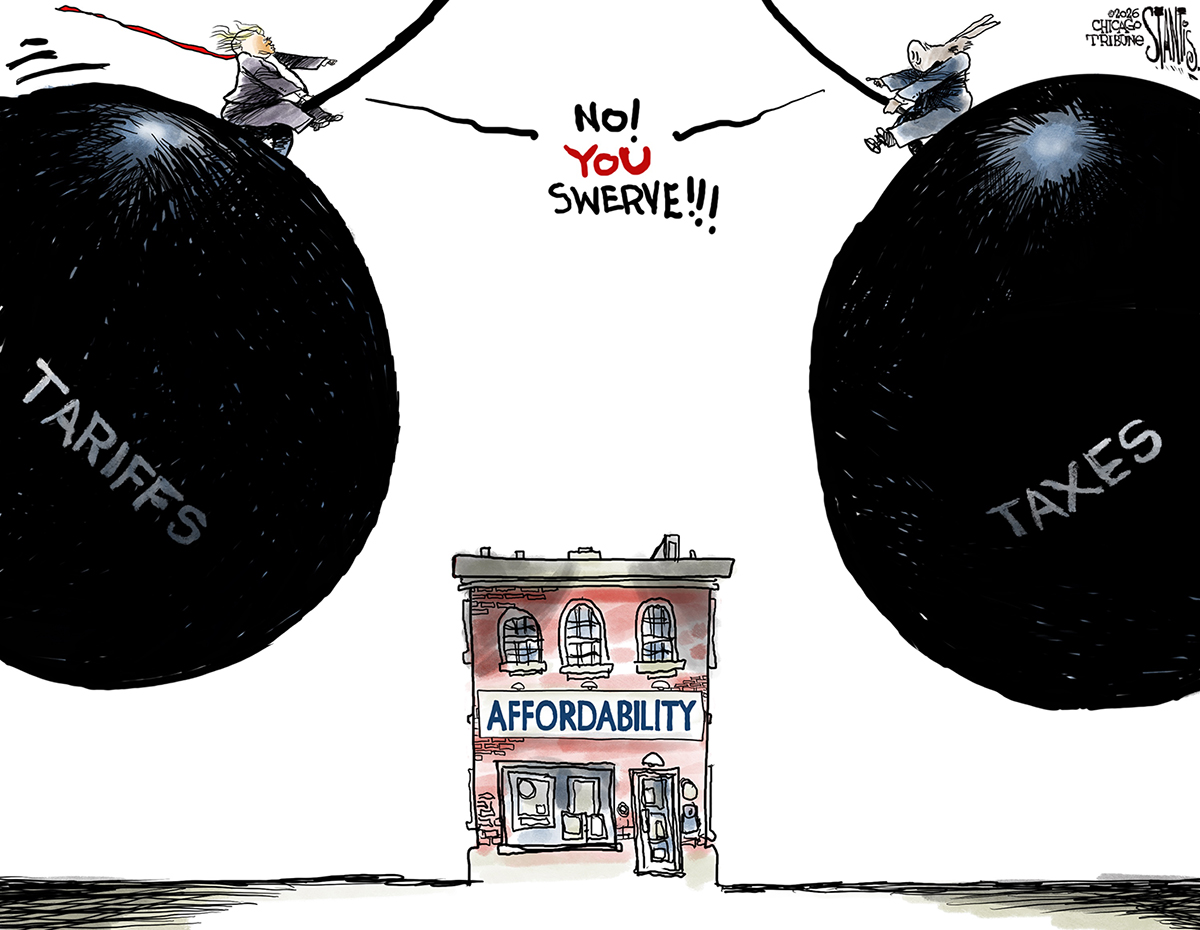

Political cartoons for January 18

Political cartoons for January 18Cartoons Sunday’s political cartoons include cost of living, endless supply of greed, and more

-

Exploring ancient forests on three continents

Exploring ancient forests on three continentsThe Week Recommends Reconnecting with historic nature across the world

-

The rise of the spymaster: a ‘tectonic shift’ in Ukraine’s politics

The rise of the spymaster: a ‘tectonic shift’ in Ukraine’s politicsIn the Spotlight President Zelenskyy’s new chief of staff, former head of military intelligence Kyrylo Budanov, is widely viewed as a potential successor

-

The billionaires’ wealth tax: a catastrophe for California?

The billionaires’ wealth tax: a catastrophe for California?Talking Point Peter Thiel and Larry Page preparing to change state residency

-

Bari Weiss’ ‘60 Minutes’ scandal is about more than one report

Bari Weiss’ ‘60 Minutes’ scandal is about more than one reportIN THE SPOTLIGHT By blocking an approved segment on a controversial prison holding US deportees in El Salvador, the editor-in-chief of CBS News has become the main story

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred