Do Republicans actually believe that cutting taxes will bring prosperity to all?

Because the trouble is — and I'll say this slowly — It. Isn't. True.

The Trump administration announced the outline of a tax overhaul this Wednesday, and to no one's surprise, it entailed dramatic tax cuts for corporations and the wealthy. In order to understand it and our larger debate about taxes, we have to take a moment to consider some epistemological and philosophical issues. It won't hurt, I promise.

If you want to be thoughtful in your understanding of political debates, it's important to address what your opponents say on their own terms as often as you can. It's easy to fall back on the stance that the other side doesn't really believe anything they say, that they're just pulling a scam to fool people and the justifications they offer for their own positions are all lies. Taken to a rancid extreme, that belief gets you to what much of the Republican Party thought about Barack Obama for eight years: that he didn't actually want a thriving economy, a good health-care system, or a wise foreign policy, but instead he was literally trying to destroy America. It's the difference between responding to your opponents with "You're wrong about this" or with "You don't believe what you're saying because you have a secret, nefarious agenda."

It's a dangerous position to take not because it can't be politically effective (sadly, it can) but because it makes it impossible to persuade anyone who doesn't already agree with you. The truth is that most of the time, even when they're wrong, your opponents are being sincere about what they believe. It's not true 100 percent of the time, but more often than not it's better to assume that they aren't hiding the real reason they want to pursue their favored course of action.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Which brings us to taxes, and a question I have been struggling with lately, and not for the first time: Do Republicans actually believe that cutting taxes on the wealthy and corporations will create an explosion of economic growth that will trickle down to everyone? I'd like to give them the benefit of the doubt, I really would. But they make it so hard.

I say that for a couple of reasons. The first is that the position Republicans take — that we absolutely must cut taxes on corporations and the wealthy — is profoundly unpopular with the public, yet they never give it up. It consistently hurts them politically, allowing Democrats to charge that they're only looking out for the rich, yet they never abandon it. Year after year, they say we must cut those taxes, and when they get power, as they have now, it's one of the first items on their agenda.

So they aren't doing it just because it's popular — they want it with all their hearts, even if it causes them political danger. The main argument they use to persuade otherwise skeptical people is that cutting taxes will cause a spectacular transformation in the economy, a supernova of growth that will bring prosperity to all. In the old days we called this "trickle-down economics," the idea that if you shower benefits on those at the top, in the end they'll trickle down to everyone else.

We often talk about this question in terms of the federal budget deficit, which is something Republicans say they care deeply about (especially when there's a Democrat in the White House). The theory goes that if you cut taxes, the ensuing explosion in economic growth will be so enormous that more revenue will come in, meaning the tax cuts will have paid for themselves. We can have our cake and eat it too, or as Treasury Secretary Steven Mnuchin recently said about the administration's coming tax cuts, "The plan will pay for itself with growth."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

The trouble is — and I'll say this slowly — It. Isn't. True. It has never been true. Any reputable economist, even Republican ones, will tell you so. Tax cuts can boost growth somewhat, but never enough to pay for themselves; the most optimistic analyses say that at most you might make up about a third of what the cut cost.

We have this argument over and over again: Republicans say the tax cuts will be a miracle cure for everything that ails us, Democrats ridicule them for it, and Republicans are unable to provide even an iota of empirical evidence that their justification is actually true.

So do they believe it? I'm not really sure. I don't know how they account in their own minds for the failure of the Bush tax cuts of 2001 and 2003, which were substantially similar to what the Trump administration is proposing now, yet were an utter failure: Not only didn't they produce the promised express ride to prosperity, Bush's presidency saw an anemic economy that culminated in the worst financial crisis in 80 years.

Nor do I know how they account for Bill Clinton's presidency. When Clinton raised taxes on the wealthy in 1993, Republicans insisted it would cause a "job-killing recession," yet what ensued was the creation of 23 million jobs. Or how they account for Obama's presidency, in which 16 million jobs were created after the Great Recession bottomed out, and unemployment went below 5 percent, despite the fact that Obama raised some taxes, especially on the wealthy.

The point isn't that raising taxes on the wealthy will boost the economy. But perhaps fiddling with the tax code just doesn't make that much of a difference, and other economic forces are far more important. That's what Democratic economists tend to believe. If you ask them, they'll suggest progressive changes to the tax code we could make, but they don't harbor any illusions that tweaking rates, changing deductions, or even making more fundamental changes will have some kind of transformative effect on the economy. That's the biggest reason why tax reform isn't very high on the Democrats' agenda when they take power: They just don't think it makes that much of a difference to the country's fortunes.

But Republicans do — or say they do. But the weight of that history suggests that unless they're impossibly dumb, they can't possibly believe that the next tax cut will do what the last one didn't.

Which leads one to the conclusion that Republican beliefs about taxes are at root moral judgments and not practical ones. It isn't that they wouldn't be perfectly happy if cutting taxes on the wealthy actually improved the lives of ordinary people — that'd be great. But more fundamentally, they think that cutting those taxes is just the right thing to do, even if it never trickles down.

We can have an entirely separate debate on that moral question — what everyone owes society, what the fairest tax system might look like — but it does seem to be what's actually motivating the Republican position on taxes, and not a practical conclusion they've come to based on the evidence.

Paul Waldman is a senior writer with The American Prospect magazine and a blogger for The Washington Post. His writing has appeared in dozens of newspapers, magazines, and web sites, and he is the author or co-author of four books on media and politics.

-

‘No Other Choice,’ ‘Dead Man’s Wire,’ and ‘Father Mother Sister Brother’

‘No Other Choice,’ ‘Dead Man’s Wire,’ and ‘Father Mother Sister Brother’Feature A victim of downsizing turns murderous, an angry Indiana man takes a lender hostage, and a portrait of family by way of three awkward gatherings

-

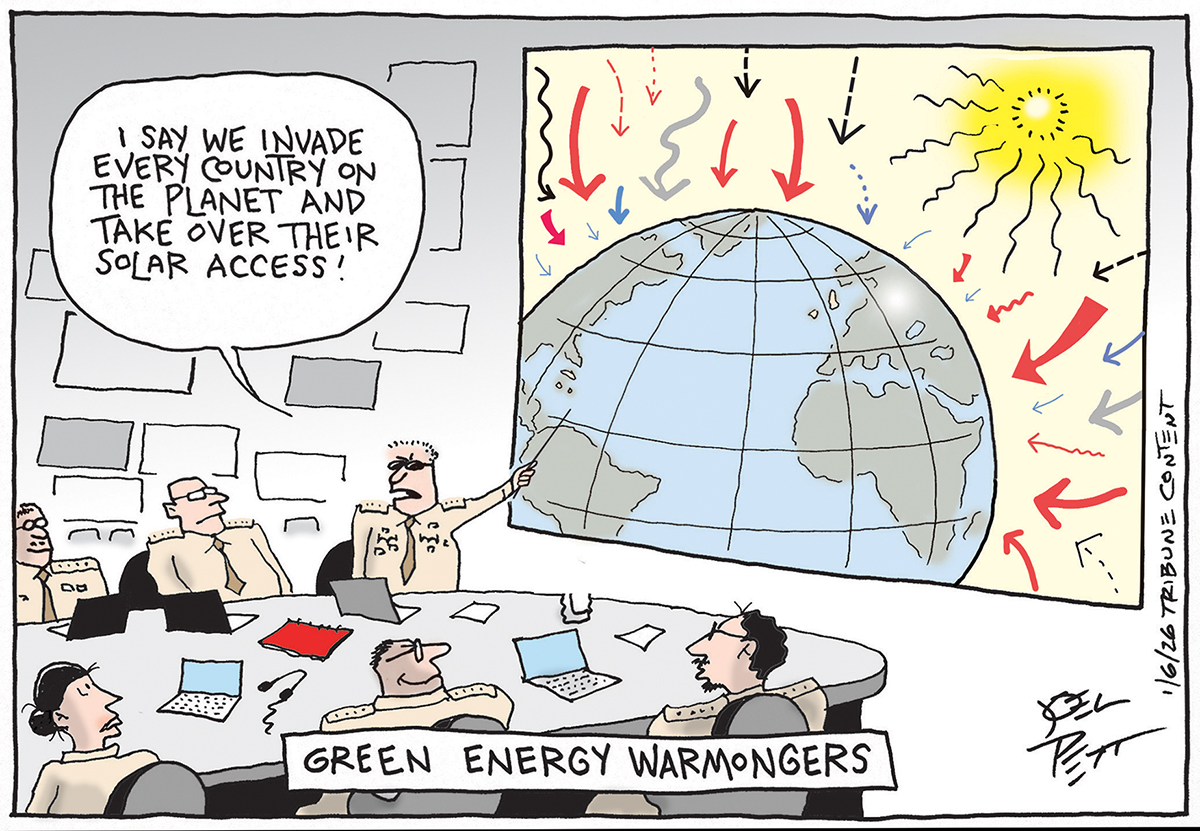

Political cartoons for January 11

Political cartoons for January 11Cartoons Sunday’s political cartoons include green energy, a simple plan, and more

-

The launch of the world’s first weight-loss pill

The launch of the world’s first weight-loss pillSpeed Read Novo Nordisk and Eli Lilly have been racing to release the first GLP-1 pill

-

The billionaires’ wealth tax: a catastrophe for California?

The billionaires’ wealth tax: a catastrophe for California?Talking Point Peter Thiel and Larry Page preparing to change state residency

-

Bari Weiss’ ‘60 Minutes’ scandal is about more than one report

Bari Weiss’ ‘60 Minutes’ scandal is about more than one reportIN THE SPOTLIGHT By blocking an approved segment on a controversial prison holding US deportees in El Salvador, the editor-in-chief of CBS News has become the main story

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred