The Musk meltdown

Enron Musk needs to be brought to heel

Elon Musk is in trouble.

After some ill-advised tweeting, the Tesla CEO is now under investigation by the Securities and Exchange Commission for possible securities fraud. The New York Times also published an interview last week in which Musk admitted to emotional disturbance over recent events, and Tesla stock promptly plunged 9 percent. Commentators are beginning to speculate about whether the company will survive.

It's a good window into the spectacular hubris of today's Big Tech barons.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

So what's going on at Tesla? In its early days, the company was primarily making a small number of luxury electric cars: the Model S, Model X, Roadster, and so on. These were quite popular and a business success. Over the last couple years, Tesla has moved into the mass market with the Model 3, a relatively modestly-priced sedan — still expensive at a $35,000 base price, but in line with a high-spec Toyota Camry.

The Model 3 rollout has been plagued with problems. A huge backlog of orders quickly piled up, and Tesla struggled to fulfill demand. The price turned out to be too low to make a profit at the base model — one analyst estimated $6,000 in losses per vehicle — and Tesla hemorrhaged money, losing over $715 million in the second quarter of this year alone. Speculators began placing bets against the company.

Most of the cars were delivered late, and many had glaring manufacturing defects. And because Tesla refuses to sell most replacement parts on the secondary market, it became difficult (and often very expensive) to get repairs done. Stories of shoddy workmanship and enraged customers filled the press. Even the price of wrecked Teslas shot to ludicrous heights, as amateurs doing custom rebuild or repair jobs scrounged desperately for spare parts.

Essentially, it appears Tesla bit off considerably more than it could chew in terms of rapidly expanding its industrial facilities. It's notable that more experienced car companies, familiar with the extreme difficulty of low-margin, high-quality mass manufacturing, have moved only gradually into the electric market.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

What Tesla very obviously needs to do is buckle down and sort out its engineering and logistical problems, perhaps by bringing on some experts from Toyota or Volkswagen. Instead — in keeping with the Silicon Valley ideology of "brazen indifference to domain expertise and a preference for reinventing the wheel" — Musk reacted with petulant defensiveness, obsessing about short sellers and getting into furious tweet battles with journalists.

He also continued his dilettante proposals for high-tech underground transit schemes and meddling in various international news stories. Years ago he proposed a "hyperloop" (basically a tiny maglev train in a near-vacuum tunnel) from San Francisco to Los Angeles that would supposedly be much cheaper and faster than conventional high-speed rail. The proposal was preposterously unworkable, and he later abandoned the idea and moved on to smaller-scale proposals for underground cars (also ridiculous) and now a mini-train to Dodgers Stadium (same).

Musk also idly promised to fix the ongoing water crisis in Flint, Michigan (which went nowhere), and promised to build a ludicrously impractical tiny submarine to rescue the boys trapped in the cave in Thailand. When one of the cave divers who actually did rescue the boys (one of whose colleagues died in the attempt) sneered contemptuously at the submarine idea, Musk accused him of being a pedophile. Musk is not exactly coming off as the most stable and committed business executive. He later apologized.

This brings me to the infamous tweet:

Musk is promising here that he has money lined up to buy every publicly-traded share at $420 each (about a 20 percent premium over the price at the time), which would require about $70 billion — an enormous sum. If true, that would naturally cause a sharp increase in the share price, as investors jostled to get a piece of the buyout.

But if Musk did not have the money in hand, that is straight-up securities fraud — an attempt to manipulate the share price by lying. And when he posted a note on the privatization proposal, only gesturing at some vague preliminary meetings he had with the Saudi sovereign wealth fund, and asserting without evidence that most shareholders would not want their shares purchased, it became obvious that he does not. It's such a clear legal violation that even President Trump's SEC is issuing subpoenas.

It is beyond obvious that Musk has been so coddled for so long that he simply cannot conceive of the idea that the rules might apply to him — a characteristic he shares with most of his fellow billionaire CEOs. Perhaps throwing the book at him — as happened to Martha Stewart for a far, far smaller crime — might make an instructive example for the capitalist class.

Ryan Cooper is a national correspondent at TheWeek.com. His work has appeared in the Washington Monthly, The New Republic, and the Washington Post.

-

The 8 best hospital dramas of all time

The 8 best hospital dramas of all timethe week recommends From wartime period pieces to of-the-moment procedurals, audiences never tire of watching doctors and nurses do their lifesaving thing

-

‘Implementing strengthened provisions help advance aviation safety’

‘Implementing strengthened provisions help advance aviation safety’Instant Opinion Opinion, comment and editorials of the day

-

How Manchesterism could change the UK

How Manchesterism could change the UKThe Explainer The idea involves shifting a centralized government to more local powers

-

Ryanair/SpaceX: could Musk really buy the airline?

Ryanair/SpaceX: could Musk really buy the airline?Talking Point Irish budget carrier has become embroiled in unlikely feud with the world’s wealthiest man

-

Musk wins $1 trillion Tesla pay package

Musk wins $1 trillion Tesla pay packageSpeed Read The package would expand his stake in the company to 25%

-

How Tesla can make Elon Musk the world’s first trillionaire

How Tesla can make Elon Musk the world’s first trillionaireIn The Spotlight The package agreed by the Tesla board outlines several key milestones over a 10-year period

-

Tesla reports plummeting profits

Tesla reports plummeting profitsSpeed Read The company may soon face more problems with the expiration of federal electric vehicle tax credits

-

How could Tesla replace Elon Musk?

How could Tesla replace Elon Musk?Today's Big Question The company's CEO is its 'greatest asset and gravest risk'

-

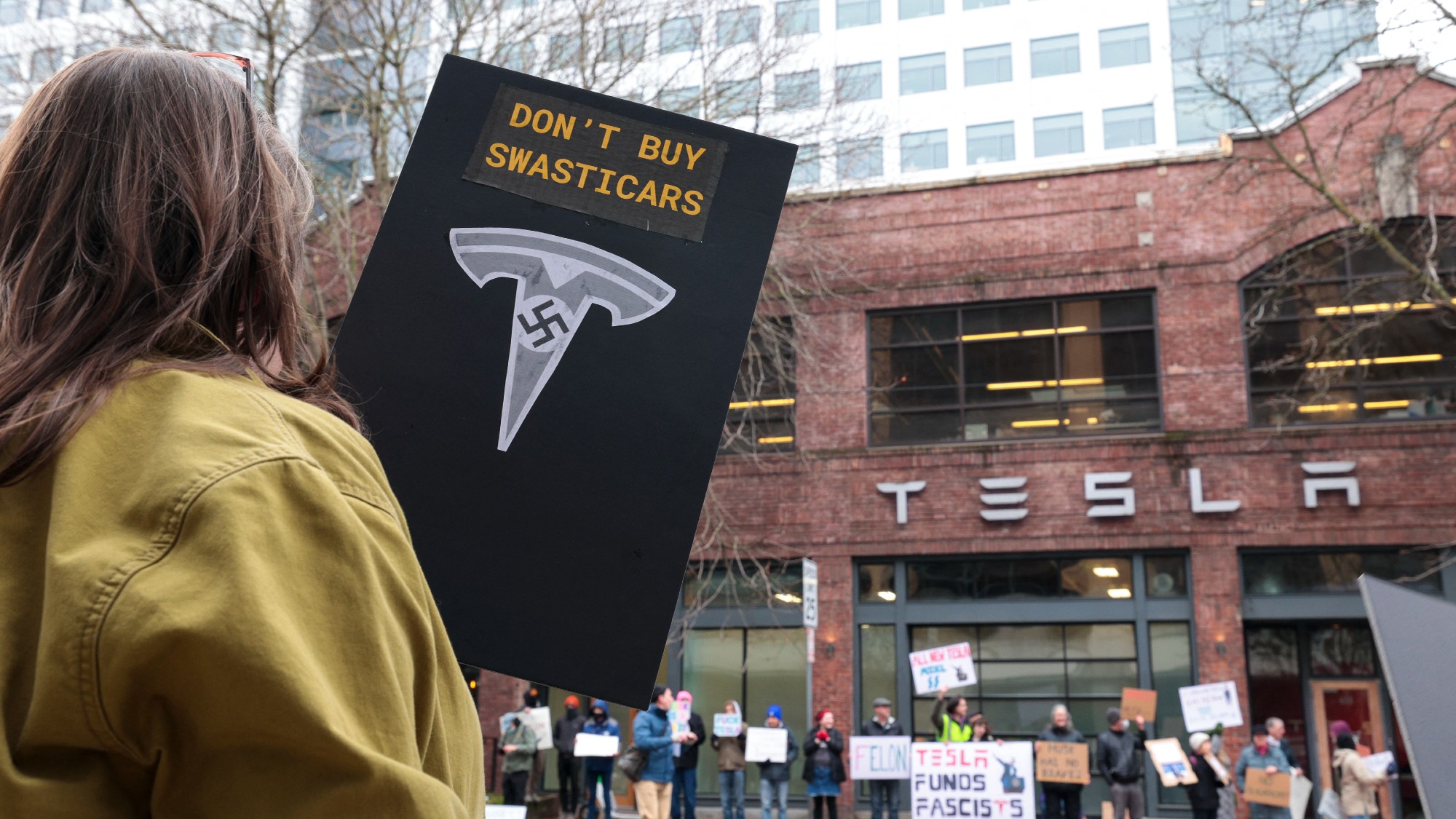

Elon Musk: has he made Tesla toxic?

Elon Musk: has he made Tesla toxic?Talking Point Musk's political antics have given him the 'reverse Midas touch' when it comes to his EV empire

-

What does Musk's 'Dexit' from Delaware mean for the future of US business?

What does Musk's 'Dexit' from Delaware mean for the future of US business?Talking Points A 'billionaires' bill' could limit shareholder lawsuits

-

Tesla Cybertrucks recalled over dislodging panels

Tesla Cybertrucks recalled over dislodging panelsSpeed Read Almost every Cybertruck in the US has been recalled over a stainless steel panel that could fall off