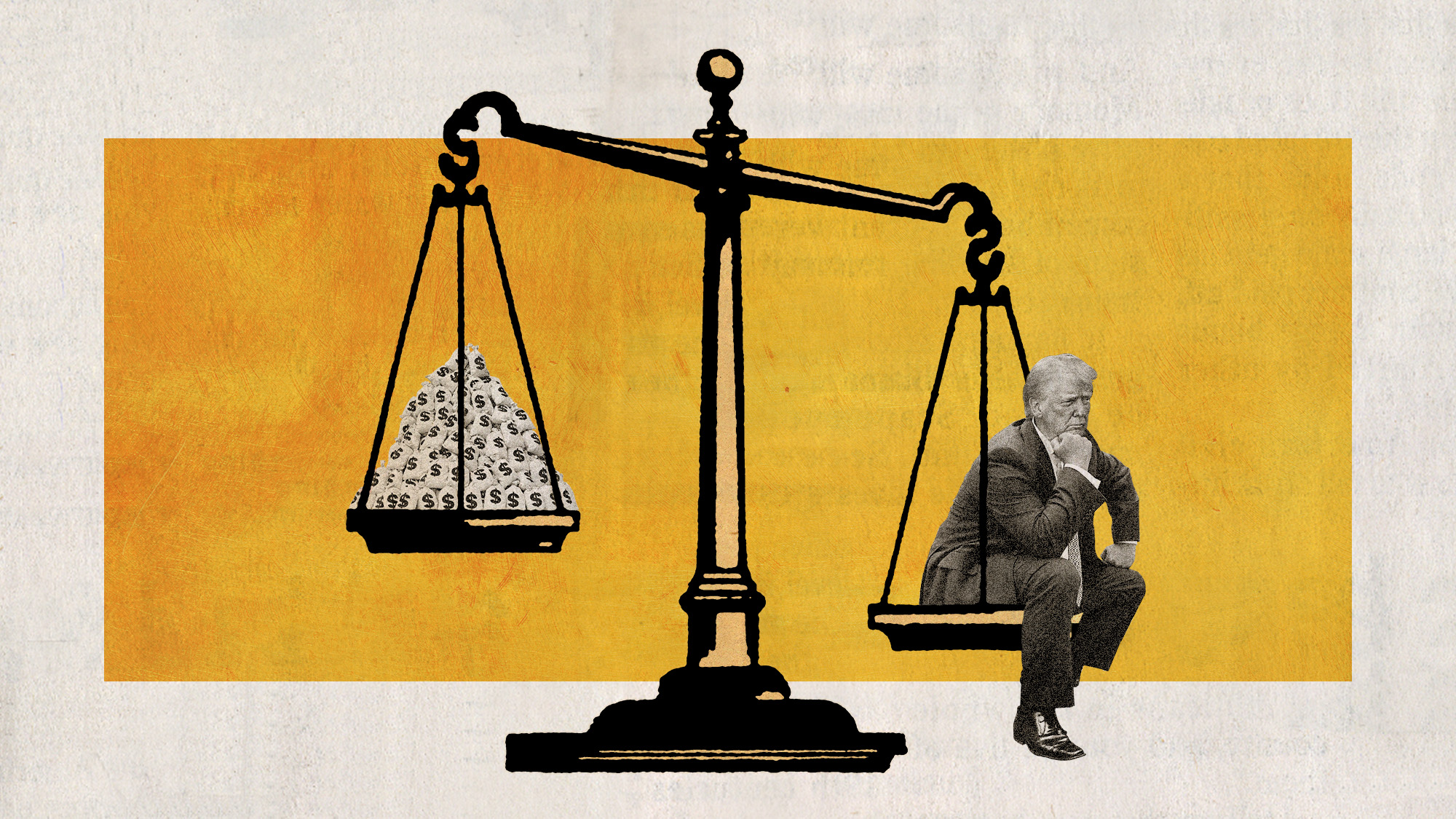

What is Donald Trump's net worth?

The president has nearly doubled his fortune since taking office, using the vast regulatory powers of the American government to enrich himself and his family

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

It is perhaps no surprise that the most well-off Americans have benefited tremendously from the AI-driven stock market expansion over the last year, continuing the trend of the planet's wealthiest individuals capturing a greater share of riches. But the degree to which President Donald Trump has personally enriched himself during his second term in office is shocking. By aggressively wielding the regulatory and national security powers of the U.S. government and leveraging his family's name and business reputation, Trump and his family have added billions to their bottom line since January 2025, often through quid pro quo arrangements conducted in broad daylight.

Many of Trump's most lucrative deals have involved the AI and crypto industries, both of which he substantially deregulated since taking office, despite concerns about conflicts of interest and the creation of speculative bubbles that could harm ordinary investors. The president remains completely unapologetic about using his office in this fashion and boosting his family's overseas business dealings with American policy and power. "I found out that nobody cared, and I'm allowed to," said President Trump in a January 8, 2026 interview with The New York Times. "I prohibited them from doing business in my first term, and I got absolutely no credit for it." This self-dealing, reminiscent of how developing world dictators like Nigeria's Sani Abacha use their positions in government, has yet to generate a substantial public backlash — especially given the current focus on the administration's other controversies, like mass deportations and the cost of living crisis.

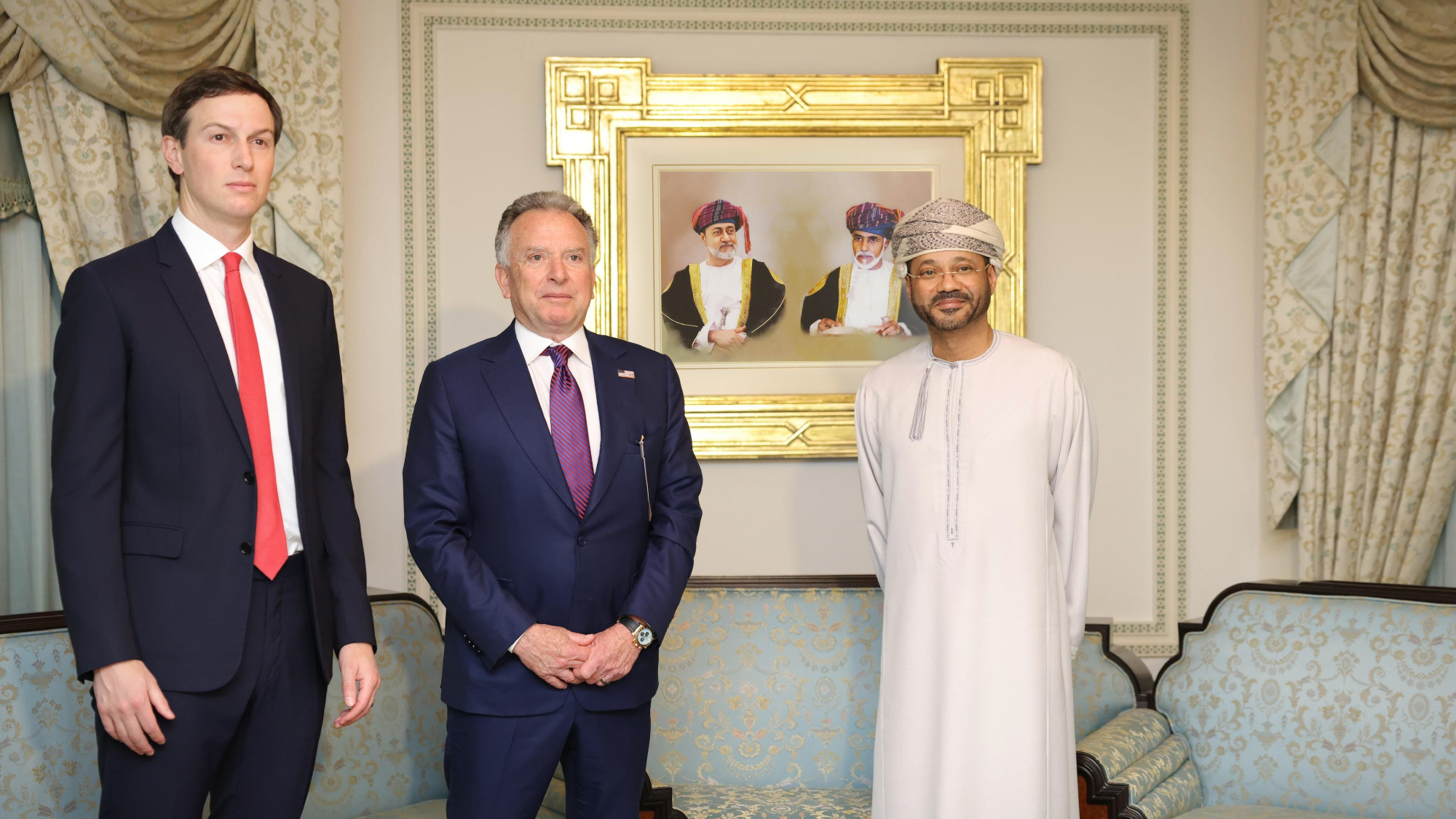

In May 2025, the Trump administration lifted a national security restriction on the sale of advanced AI chips to the UAE, months after the UAE and Qatar invested more than $1.5 billion in an investment fund operated by Trump's son-in-law Jared Kushner. These deals "blurred the lines between personal and government business and raised questions about whether U.S. interests were served," said The New York Times. In January 2026, Saudi developer Dar Al Arkan announced that it would "launch two Trump-branded luxury projects in Riyadh and Jeddah with a combined value of $10 billion," said Reuters. The announcement followed Saudi ruler Crown Prince Mohammed bin Salman's November 2025 visit to the White House, during which President Trump announced the U.S. would sell advanced F-35 fighters to the Kingdom, as well as promising to lift restrictions on AI chip sales. Another representative example was Trump's October 2025 pardon of former Binance CEO Changpeng Zhao, who was convicted of money laundering in 2023. Binance was the recipient of a $2 billion investment by Emirati investment firm MGX, which was conveniently conducted in the brand-new USD1 stablecoin, operated by World Liberty Financial, in which the Trump family has a controlling interest. It was the largest crypto transaction in history. In December 2025, "Binance began paying users of its platform to hold USD1: Binance announced that, for the next month, it would give users a bonus equal to about 1.7% on up to fifty thousand dollars’ worth of USD1 holdings," said The New Yorker. The total volume of USD1 in circulation has subsequently more than doubled, to "roughly five billion, and most of that expansion appears to have taken place on the Binance platform." World Liberty also began selling "digital governance tokens," which have no fixed value and "do not entitle a buyer to any equity in World Liberty; nor to any share of its profits, raising many questions about why an investor might want to own them — other than for World Liberty's connection to the Trumps," said The New Yorker.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Also in December 2025, the Trump Media & Technology Group, which owns the microblogging site Truth Social, announced that it had merged with a speculative nuclear fusion company, TAE Technologies. Nuclear fusion is a technology that, even in best case scenarios, is many years away from commercial viability. That day, Trump "saw the value of his stake jump by about $400 million to about $1.6 billion with the 35% rally in the stock by midday," said Politico. When that deal was signed, the president had "recently signed an executive order to launch" the Department of Energy's Genesis Mission, "which seeks to accelerate fusion development with help from AI, advanced computing and the department's sprawling national labs." Overall, The New Yorker estimated in February 2026 that Trump and his family have made $4.05 billion just since his second inauguration on ventures that fundamentally depend on his role as the U.S. president.

Trump's net worth, according to Forbes, had soared $7.3 billion as of February 18, 2026, after falling as low as $2.3 billion prior to his reelection in 2024. Despite this flurry of wealth-building activity, Trump still falls short of inclusion on Bloomberg's list of the 500 richest people in the world. And figuring out the trajectory of the president's wealth is a significant challenge made all the more difficult by his refusal to release his tax returns or share the kinds of financial disclosures that were once routine in American politics.

How did Trump originally amass his fortune?

In Trump's telling, he is a self-made man who built his fortune with a small loan from his father. But in "every era of Mr. Trump's life, his finances were deeply intertwined with, and dependent on, his father's wealth," said The New York Times; the outlet claims that his parents ultimately transferred nearly $1 billion to their children while paying almost nothing in taxes. "Fred Trump was relentless and creative in finding ways to channel this wealth to his children," and much of his maneuvering was "structured to sidestep gift and inheritance taxes using methods tax experts described to The Times as improper or possibly illegal."

Trump's father, Fred, was a real estate tycoon who operated mostly in and around New York City, and Donald Trump "served his own apprenticeship in the less glamorous family business of renting apartments," said the Los Angeles Times. One of his earliest duties was "booting poor, nonpaying tenants" out of a Cincinnati apartment complex purchased by his father. After graduating from the University of Pennsylvania's Wharton School of Business in 1968, Trump returned to New York City and took on a larger role in the family business. He "took control of the company — which he renamed the Trump Organization — in 1971," said BBC. His "first big move" was "to negotiate an unusual arrangement with the government of New York City," including a 40-year tax abatement, in order to purchase the Commodore Hotel in New York City, said the Miller Center. The hotel was relaunched in 1980 and rebranded as the Grand Hyatt Hotel.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

As his portfolio expanded, "the one that made him" was Trump Tower, said Curbed. In 1979, he bought the department store Bonwit Teller for $10 million and demolished it to make way for the mixed-use high-rise that would eventually bear his name. When it opened on October 1, 1983, Trump Tower "offered an unprecedented mix of high-end retail space and luxury condominiums," said The Hollywood Reporter. "Celebrity was a big ingredient" in its success, added Curbed, and Trump sold residential units to Hollywood stars including Steven Spielberg and Fay Wray. With his real estate empire expanding, Trump also embarked on a media blitz that "helped the real estate developer transition from a figure of note in New York City to a national celebrity and household name," said The Atlantic. In 1987, he published a ghostwritten book, "The Art of the Deal," that was a "phenomenal success, spending forty-eight weeks on the Times best-seller list," said The New Yorker. By 1990, his holdings included not just Manhattan high-rises and other real estate developments but also casinos, golf courses and the Eastern Airlines shuttle service he had purchased in 1989 and renamed Trump Shuttle.

Overcoming bankruptcy with a little help from family and reality TV

The Trump Organization fell on hard times in the 1990s. Hit hard by the 1990-1991 recession, "the amount of cash that Mr. Trump had available to him had fallen below $1.7 million and was expected to fall below $800,000 within months" in 1991, said The New York Times. The basic problem was that "Trump's empire could not keep pace with the enormous debt payments he owed," said NPR. Trump was forced to sell his airline to USAir in 1991. Those struggles pushed him into the "transaction that would eventually free him from his financial travails": taking his "struggling casinos public, selling stock to raise money and shifting his personal debt into the new company" in 1995.

In 1997, Fred Trump transferred his real estate holdings to his four children, which they sold off in 2004. Donald Trump received $177.3 million. Yet he filed an "individual tax return reporting $89.9 million in net losses from his core businesses for the prior year" in 2004, said The New York Times. It was also in 2004 that Trump began hosting NBC's reality show "The Apprentice," in which a group of contestants competes to win a contract from the Trump Organization. The show, which Trump hosted from 2004 to 2015, helped him make "some $197 million" over 16 years. In addition, "$230 million flowed from the fame" associated with the show.

Not everything that Trump touched during this time period turned to gold, however. Between 2005 and 2010, Trump operated Trump University, which ultimately had to pay out a $25 million settlement to "more than 6,000 Trump U students who paid thousands of dollars for courses they describe as worthless," said NPR. In 2006, he launched a self-branded vodka business that "stopped production in 2011, reportedly due to a lack of interest," said Time. Trump also operated an unsuccessful steak business, a failed travel search engine and a short-lived mortgage company between 2006 and 2012.

Assuming the presidency and pursuing social media

When Trump launched his bid for president in 2015, Forbes estimated his net worth at $4.5 billion. During his first term, he largely refrained from new ventures, while his "assortment of businesses brought in some $2.4 billion in revenue and some $550 million in income from 2017 to 2020," said Forbes. After leaving office in 2021, he founded the Trump Media and Technology group, which included his new far-right social media website, Truth Social. But legal troubles, including an $83.3 million judgment in a civil trial stemming from sexual assault allegations against him by journalist E. Jean Carroll and a $454 million fraud liability in New York, took their toll. By early 2024, his "political prospects were shaky, his financial future nightmarish," said Forbes.

However, over the following year, Trump "more than doubled his estimated fortune, from $2.3 billion to $5.1 billion, in large part by taking Truth Social public, delaying payment on his judgments and plunging himself into a third quest for the presidency. It was a bid he would ultimately win, setting the stage for an even more aggressive and norm-shattering plan to capitalize financially on his position as the country's chief executive.

New tariff regime sends markets into turmoil

If anything, the first eleven months of President Trump's second term have rendered it even harder to make a confident appraisal of his net worth. The "opaque ownership structure of the Trump businesses makes it difficult to assess changes in his net worth," said The New Yorker, and it is "hard to isolate his presidential profits, in part because estimating how much his businesses might have made if he weren't president would require detailed comparisons with similar enterprises that have non-presidential owners." Another significant contributor to that uncertainty was his decision to implement sweeping tariffs on nearly every country in the world on April 2, 2025, which he pledged to do during his campaign and for weeks preceding the announcement. He dubbed it "Liberation Day" and argued that the new tariffs "will free the U.S. from a reliance on foreign goods," said The Associated Press.

But the most immediate reaction was widespread fear that the levies "could push the U.S. economy into recession if they aren't quickly pulled back," said CNN. As many analysts expected, that maneuver sent stocks tumbling immediately and introduced almost unprecedented uncertainty into financial markets.

Reeling from that financial turmoil, President Trump announced a "pause" on April 9, 2025, saying that while his administration worked out individual trade deals with dozens of countries, he would impose a "universal tariff rate for the next 90 days" that would be "10% for virtually all countries, with the exception of China," said CBS News. That stabilized markets until the expiration date of the original "pause" approached in July, when he announced significant new tariffs on 14 countries that lacked new trade agreements, including South Korea and Japan, triggering another round of market mayhem.

Markets not only recovered, however, but thrived, driven by an ongoing AI investment boom that has many analysts worried about a massive bubble. By mid-February 2026, the Dow Jones Industrial Average was up nearly 6,000 points since his second inauguration. Those gains added hundreds of millions of dollars to the president's net worth, together with ongoing and aggressive maneuvers to boost the value of his various holdings. When Trump Media merged with the nuclear fusion company TAE Technologies, it sent shares of the former soaring and added another $500 million to his net worth. While his wealth is currently parked in an irrevocable trust managed by his son Donald Trump, Jr., President Trump "remains the sole donor and beneficiary, and is still able to earn income from his businesses," said Forbes. And the most important of those businesses, in terms of the spectacular growth of his net worth, are his crypto ventures.

Trump's crypto schemes boost his fortune

On January 17, 2025, days before being sworn in for his second term as president, Trump launched his own cryptocurrency, a meme coin, "sparking a feverish buying that apparently sent its market capitalization soaring to several billion dollars," said CBS News. His wife, Melania Trump, also launched a currency the same day. The decision to launch Trump-branded cryptocurrency on the eve of his presidency created a "mind-boggling number of potential conflicts of interest" and "aligns with the interests of rich crypto bros who want to seize the reins of government to make themselves even richer," said Rolling Stone. In addition, "President Donald Trump’s family took control of the crypto venture" World Liberty Financial in January 2025 and "grabbed the lion’s share" of funds the enterprise had raised," said The Associated Press. "It's as if a new bank had opened under the sitting President's name, and it was being sent large quantities of funds by various foreign businesses and political elites," said The New Yorker.

Very quickly, crypto came to constitute a substantial portion of Trump's financial portfolio. "A majority of his fortune, an estimated $3.3 billion of his total $5.5 billion, lies in the buzzy" crypto industry, said Forbes in an updated net worth appraisal in June 2025. That may help explain his administration's crypto-friendly policies, including appointing a "pro-crypto businessperson, Paul Atkins, to lead the Securities and Exchange Commission," and the creation of a federal Bitcoin reserve and the Emirati investment deal conducted in Trump's stablecoin. The Trump administration's determination to make the U.S. the "crypto capital of the world" has unleashed a wave of companies seeking to offer new products in the crypto marketplace. Many of them "have some connection to the Trump family's growing lineup of crypto companies, which have blurred the line between commerce and government," said The New York Times. Taken together, these developments suggest that even one of the world's richest men can, in fact, be bought — it just costs a lot.

David Faris is a professor of political science at Roosevelt University and the author of "It's Time to Fight Dirty: How Democrats Can Build a Lasting Majority in American Politics." He's a frequent contributor to Newsweek and Slate, and his work has appeared in The Washington Post, The New Republic and The Nation, among others.

-

Why are election experts taking Trump’s midterm threats seriously?

Why are election experts taking Trump’s midterm threats seriously?IN THE SPOTLIGHT As the president muses about polling place deployments and a centralized electoral system aimed at one-party control, lawmakers are taking this administration at its word

-

‘Restaurateurs have become millionaires’

‘Restaurateurs have become millionaires’Instant Opinion Opinion, comment and editorials of the day

-

Earth is rapidly approaching a ‘hothouse’ trajectory of warming

Earth is rapidly approaching a ‘hothouse’ trajectory of warmingThe explainer It may become impossible to fix

-

Why are election experts taking Trump’s midterm threats seriously?

Why are election experts taking Trump’s midterm threats seriously?IN THE SPOTLIGHT As the president muses about polling place deployments and a centralized electoral system aimed at one-party control, lawmakers are taking this administration at its word

-

‘Restaurateurs have become millionaires’

‘Restaurateurs have become millionaires’Instant Opinion Opinion, comment and editorials of the day

-

Should the EU and UK join Trump’s board of peace?

Should the EU and UK join Trump’s board of peace?Today's Big Question After rushing to praise the initiative European leaders are now alarmed

-

Witkoff and Kushner tackle Ukraine, Iran in Geneva

Witkoff and Kushner tackle Ukraine, Iran in GenevaSpeed Read Steve Witkoff and Jared Kushner held negotiations aimed at securing a nuclear deal with Iran and an end to Russia’s war in Ukraine

-

Kurt Olsen: Trump’s ‘Stop the Steal’ lawyer playing a major White House role

Kurt Olsen: Trump’s ‘Stop the Steal’ lawyer playing a major White House roleIn the Spotlight Olsen reportedly has access to significant US intelligence

-

Trump’s EPA kills legal basis for federal climate policy

Trump’s EPA kills legal basis for federal climate policySpeed Read The government’s authority to regulate several planet-warming pollutants has been repealed

-

House votes to end Trump’s Canada tariffs

House votes to end Trump’s Canada tariffsSpeed Read Six Republicans joined with Democrats to repeal the president’s tariffs

-

Bondi, Democrats clash over Epstein in hearing

Bondi, Democrats clash over Epstein in hearingSpeed Read Attorney General Pam Bondi ignored survivors of convicted sex offender Jeffrey Epstein and demanded that Democrats apologize to Trump