Unleash the IRS

Tax dodging leads to right-wing extremism and cozy relationships with authoritarian regimes

Saudi Arabia may have finally cracked its reputation among the American elite, at least in part. While wealthy Silicon Valley liberals and the D.C. foreign policy "blob" don't particularly care when that country casually blows up a school bus full of children, it turns out they care quite a lot when it allegedly assassinates a Washington Post columnist — that is, someone rather like themselves. Thus elite journalists and Big Tech tycoons are dropping out of the so-called "Davos in the Desert" investment conference in Saudi Arabia.

However, there is one large exception: the financial elite. So far most of the big bankers are staying in. BlackRock's Larry Fink and Blackstone's Steve Schwartzman are still going to speak there, as well as Treasury Secretary Steven Mnuchin.

This is shameful. It's also a good occasion to recall one quick and easy way to take the American plutocracy down a peg or three: by enforcing existing tax law. It's highly, highly likely that many of the financial vampires heading to Saudi Arabia aren't paying what they owe. Staffing up the IRS with aggressive analysts and auditors and siccing them specifically on the top 1 percent is likely to cut income inequality substantially and rake in a tidy sum for Uncle Sam.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

A good indicator of the level of tax-dodging in this county can be found in the gargantuan New York Times story about how Trump built his initial wealth. It's a spectacular piece of reporting, worth reading carefully and in full. But in essence, Trump reportedly received at least $413 million from his father through a huge number of questionably-legal acts and several "instances of outright fraud," as the Times writes.

This story got little attention, because fresh Trump scandals (and other disasters) are constantly flushing the old scandals off the front page, providing a sort of protective effect. Whether it's his constant flagrant violation of the Emoluments Clause, his alleged hush money payments for adulterous affairs, his grotesque failure to rebuild Puerto Rico, his staggeringly corrupt Cabinet, or any of a dozen others stories, another scandal has reliably come along to distract the public from the last one.

So it's worth taking a step back to really internalize the Trump tax scandal, because it goes to the heart of how American government has been gradually undermined by corruption. Starting in the mid-20th century, the president's father, Fred Trump, built up a gigantic real estate empire, and being such a skinflint, spent almost none of the proceeds on himself. Instead, from nearly the moment they were born, Fred reportedly transferred huge sums of money to his children, by fair means and foul. He established trusts for his children and hired them directly in some instances. Some taxes were reportedly just straight-up not paid at all. In one particularly egregious case outlined by the Times, he reportedly set up his kids with a fake independent contractor service, which did nothing but pad existing service prices by 20-50 percent.

But probably the key tactic was real estate appraisals that reportedly drastically undervalued Fred's properties. When he was near death, the Trumps reportedly got bunk value estimates that meant they only had to pay gift or estate taxes on a fraction of the properties' worth. Ownership transferred, the children could reportedly then sell the properties at their real value and rake in massive free profits. Overall, the Times reporters estimate that the Trump parents transferred well over $1 billion to their children, which by rights should have incurred a roughly $550 million estate tax bill. Instead, they reportedly paid $52.2 million.

The remarkable thing about this was that the IRS reportedly cottoned onto many of the various alleged scams and forced the Trumps to pay up — but only a tiny fraction of the actual amount owed. In the case of a $17.1 million property claimed at just $2.9 million, an IRS auditor reportedly made them increase the value by ... $100,000. Even back when America was dramatically less corrupt than it is today, entitled rich jerks were constantly skating on egregious tax scams.

Donald Trump made his own attempts at real estate investing, but he was lousy at it and went bankrupt repeatedly. But he was a savant at getting media attention and used his inherited riches to carefully cultivate an image as a self-made businessman. From then he became a national celebrity, a reality TV star, and then president of the United States.

Can there be any doubt that if a couple of battalions of tax inspectors took a very hard look into the books of the American plutocracy, they would find a veritable tax avoidance rat king? A Bloomberg report several years ago detailed the blizzard of legal loopholes Sheldon Adelson was reportedly using to protect his gargantuan fortune from taxes. But what people sometimes forget is that using legal trickery to avoid tax is itself illegal. And with the IRS increasingly gutted, plutocrats are getting increasingly lazy. Just look at Paul Manafort's hamfisted tax fraud schemes! I would wager quite a lot that a dedicated IRS audit could find more than a few nickels for the U.S. Treasury in the Adelson couch cushions.

Republicans have steadily strangled the budget and workforce of the IRS, more-or-less explicitly because that powerfully enables right-wing politics. The more tax that wealthy donors can dodge, the more that is available for campaign contributions and wingnut welfare "think tanks." But the converse of that reality is that simply forcing the rich to pay taxes is a powerful engine of egalitarian politics. (Given all the recent Republican tax cuts, today that would require increasing statutory tax rates as well.) It's a safe bet that would also take a sizable bite out of the Saudi lobbying industry, as laundering foreign bribes is one of the most common tax crimes committed nowadays (witness, again, Paul Manafort).

Ultimately, if Donald Trump had been forced to follow the letter of the tax law back in the 1980s and '90s, it's highly likely he would not have been able to boost himself into the media stratosphere and would not be president today.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Ryan Cooper is a national correspondent at TheWeek.com. His work has appeared in the Washington Monthly, The New Republic, and the Washington Post.

-

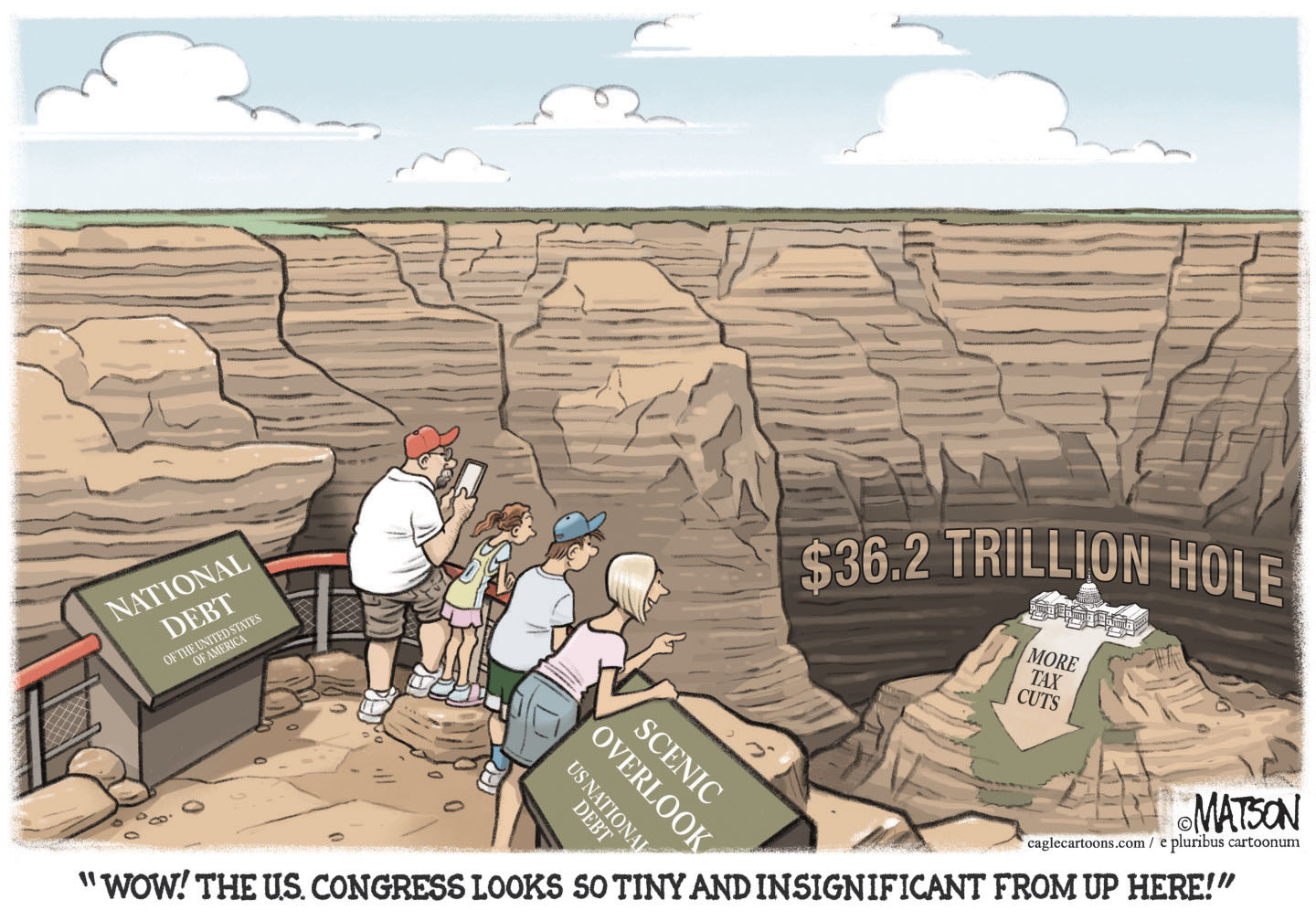

5 costly cartoons about the national debt

5 costly cartoons about the national debtCartoons Political cartoonists take on the USA's financial hole, rare bipartisan agreement, and Donald Trump and Mike Johnson.

-

Green goddess salad recipe

Green goddess salad recipeThe Week Recommends Avocado can be the creamy star of the show in this fresh, sharp salad

-

The Biden cover-up: a 'near-treasonous' conspiracy

The Biden cover-up: a 'near-treasonous' conspiracyTalking Point Using 'Trumpian' tactics, the former president's inner circle maintained a conspiracy of silence around his cognitive and physical decline

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred

-

Will Trump's 'madman' strategy pay off?

Will Trump's 'madman' strategy pay off?Today's Big Question Incoming US president likes to seem unpredictable but, this time round, world leaders could be wise to his playbook

-

Democrats vs. Republicans: who are the billionaires backing?

Democrats vs. Republicans: who are the billionaires backing?The Explainer Younger tech titans join 'boys' club throwing money and support' behind President Trump, while older plutocrats quietly rebuke new administration

-

US election: where things stand with one week to go

US election: where things stand with one week to goThe Explainer Harris' lead in the polls has been narrowing in Trump's favour, but her campaign remains 'cautiously optimistic'

-

Is Trump okay?

Is Trump okay?Today's Big Question Former president's mental fitness and alleged cognitive decline firmly back in the spotlight after 'bizarre' town hall event

-

The life and times of Kamala Harris

The life and times of Kamala HarrisThe Explainer The vice-president is narrowly leading the race to become the next US president. How did she get to where she is now?

-

Will 'weirdly civil' VP debate move dial in US election?

Will 'weirdly civil' VP debate move dial in US election?Today's Big Question 'Diametrically opposed' candidates showed 'a lot of commonality' on some issues, but offered competing visions for America's future and democracy