Report: Despite red flags and knowing he lied about his net worth, Deutsche Bank kept giving Trump loans

President Trump has a long history with Deutsche Bank — one that the bank didn't want scrutinized after he was elected in 2016, The New York Times reports.

More than 20 current and former executives and board members told the Times that despite Deutsche Bank saying Trump was not a top priority, it's just not true. Beginning in the late 1990s, Deutsche Bank gave Trump loans despite his business bankruptcies and knowing he overinflated his net worth and the worth of his real estate assets. At the time, the German bank wanted to make a name for itself on Wall Street, so it worked with clients deemed risky by other entities, a former employee told the Times.

In 2008, Trump defaulted on a loan and then sued Deutsche Bank, claiming the financial crisis was a "tsunami" and thus an act of God, preventing him from paying the loan back, the Times reports. In 2010, the bank concluded that he was inflating some of his assets by up to 70 percent, yet still gave him a $100 million loan to buy the Doral Golf Resort and Spa in Miami.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

One managing director, Rosemary Vrablic — who'd helped get Trump more than $300 million in loans — tried to get Trump a loan in early 2016 for his golf course in Turnberry, Scotland, the Times reports. An executive, Jacques Brand, opposed the loan because of Trump's divisive rhetoric, Vrablic appealed, and top executives were aghast that the bank was considering lending him money during the campaign, ending the transaction in March.

After Trump's election, Deutsche Bank commissioned reports to figure out how the bank became so entwined with him, and employees were told they couldn't even say "Trump" in public, the Times reports. All told, Trump is believed to have received more than $2 billion from the investment banking and private banking arms. The New York state attorney general and congressional committees are now investigating the relationship between Trump and Deutsche Bank. You can read more about the various loans Trump managed to secure at The New York Times.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Catherine Garcia has worked as a senior writer at The Week since 2014. Her writing and reporting have appeared in Entertainment Weekly, The New York Times, Wirecutter, NBC News and "The Book of Jezebel," among others. She's a graduate of the University of Redlands and the Columbia University Graduate School of Journalism.

-

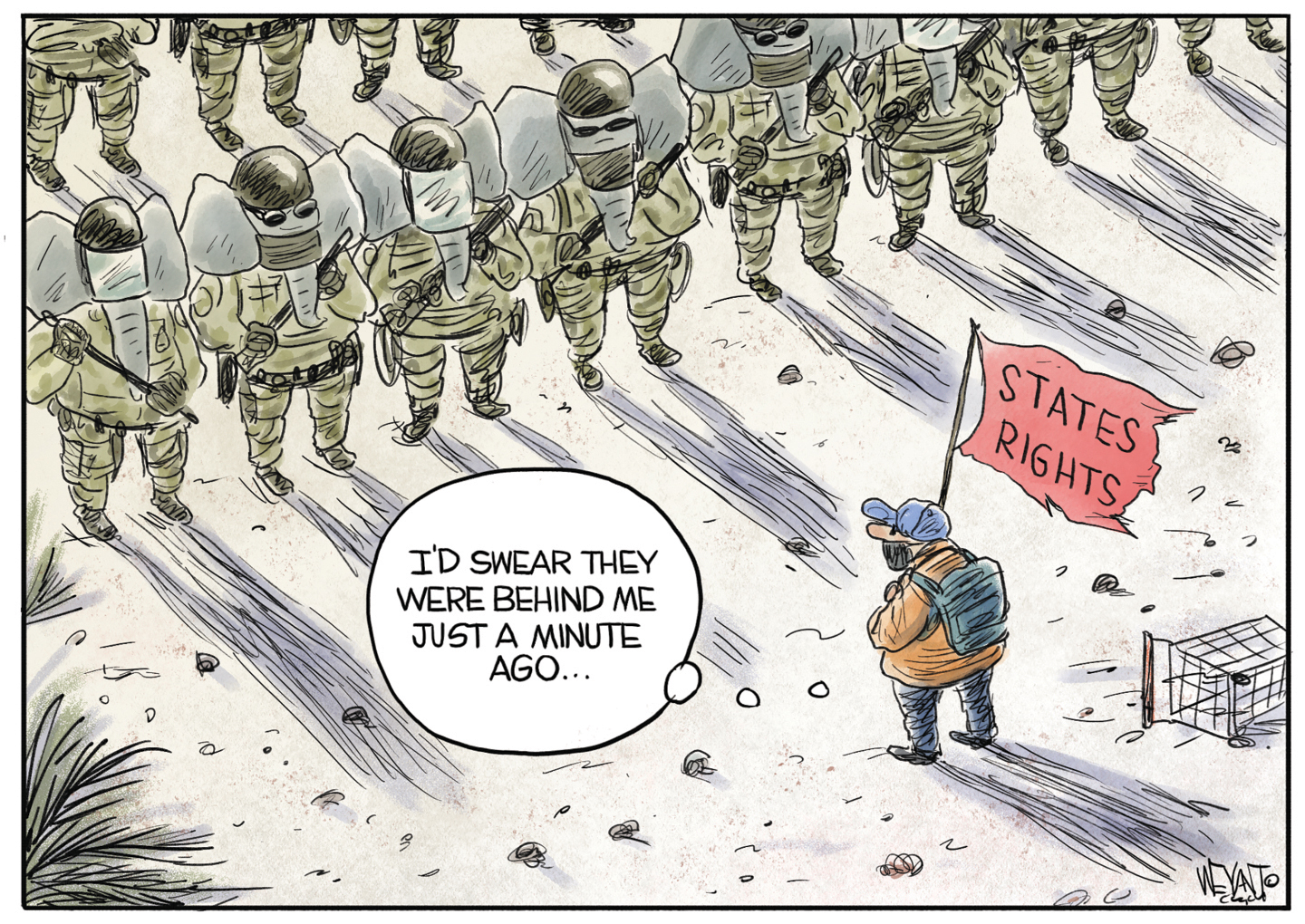

5 jackbooted cartoons about L.A.'s anti-ICE protests

5 jackbooted cartoons about L.A.'s anti-ICE protestsCartoons Artists take on National Guard deployment, the failure of due process, and more

-

Some of the best music and singing holidays in 2025

Some of the best music and singing holidays in 2025The Week Recommends From singing lessons in the Peak District to two-week courses at Chetham's Piano Summer School

-

Sudoku medium: June 14, 2025

Sudoku medium: June 14, 2025The Week's daily medium sudoku puzzle

-

Mortgages: The future of Fannie and Freddie

Mortgages: The future of Fannie and FreddieFeature Donald Trump wants to privatize two major mortgage companies, which could make mortgages more expensive

-

Economists fear US inflation data less reliable

Economists fear US inflation data less reliablespeed read The Labor Department is collecting less data for its consumer price index due to staffing shortages

-

Pocket change: The demise of the penny

Pocket change: The demise of the pennyFeature The penny is being phased out as the Treasury plans to halt production by 2026

-

The UK-US trade deal: what was agreed?

The UK-US trade deal: what was agreed?In Depth Keir Starmer's calm handling of Donald Trump paid off, but deal remains more of a 'damage limitation exercise' than 'an unbridled triumph'

-

Crypto firm Coinbase hacked, faces SEC scrutiny

Crypto firm Coinbase hacked, faces SEC scrutinySpeed Read The Securities and Exchange Commission has also been investigating whether Coinbase misstated its user numbers in past disclosures

-

Starbucks baristas strike over dress code

Starbucks baristas strike over dress codespeed read The new uniform 'puts the burden on baristas' to buy new clothes, said a Starbucks Workers United union delegate

-

Trump vs. China: another tariff U-turn?

Trump vs. China: another tariff U-turn?Today's Big Question Washington and Beijing make huge tariff cuts, as both sides seek 'exit ramp' from escalating trade war

-

Warren Buffet announces surprise retirement

Warren Buffet announces surprise retirementspeed read At the annual meeting of Berkshire Hathaway, the billionaire investor named Vice Chairman Greg Abel his replacement