Is formal office dress code dead?

Goldman Sachs becomes latest firm to issue new guidelines allowing more flexibility over work attire

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Goldman Sachs has become the latest corporate behemoth to relax its office dress code, part of a wider trend that could soon see the traditional suit and tie become extinct.

In a memo to staff, management issued new guidelines emphasising a “firmwide flexible dress code” to take into account a “changing nature of workplaces generally in favour of a more casual environment”.

“So does this mean it's the beginning of the end for the traditional suit and tie?” asks the BBC.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The company's move for “a more chill dress code” is fitting with other banks such as JP Morgan, Bustle says, “who are looking to address the needs and expectations of a younger work force”.

This makes sense, especially as the BBC reports a massive 75% of Goldman’ employees are born after 1981.

“This is a generational thing,” one senior Goldman banker told eFinancialCareers. “[CEO David Soloman’s] doing it to keep talent. Most of the GS bankers are now under the age of 30 anyway.”

The trend is even extending to the rarified heights of the City of London Corporation, which in January decreed that its formal City banquets needn’t be black tie but also encompass “lounge suits”.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

“The timing of Goldman Sachs’ announcement couldn’t be more in step with the current mood of men’s style” says Stephen Doig in the Daily Telegraph, noting there “has there been a tectonic shift over the last decade in what constitutes the idea of 'formal dress', with suiting taken apart at the seams and re-invigorated in a more dynamic way.”

“The shift has also come about as a reaction to the crash of a decade ago [when] bankers and their traditional pinstriped attire were toxic” he says.

This is not to say the high-flying world of Wall Street banking is ready to embrace the de rigeur T-shirts and jeans approach of their Silicon Valley counterparts, but it nevertheless represents a culture shift in what is still a conservative and male-dominated environment.

But while the recent shift at Goldman has been driven by changing workplace attitudes and, at least partly, attributed to new new chief executive David Solomon, who moonlights as a DJ, it could also be indicative of something more deep-rooted.

“Everything in the financial world moves in cycles. If you were to track an index of casualness in City and Wall Street dress codes it would almost certainly mirror the rise and fall of stock market booms and bust,” says Ben Wright in the Daily Telegraph.

He cites the 1986 Big Bang which deregulated the City of London, the Dot Com bubble of the late 1990s and the run-up to the 2008 financial crash as times when business dress trends foreshadowed an economic downturn.

“Financial crises tend to come round every ten years,” he concludes. “It’s been nearly ten-and-a-half since Lehman Brothers went bust. Stock markets have enjoyed a record bull run. And now Goldman Sachs is telling its staff to dress casually. If that’s not a sell signal, I don’t know what is.”

-

What to know before filing your own taxes for the first time

What to know before filing your own taxes for the first timethe explainer Tackle this financial milestone with confidence

-

The biggest box office flops of the 21st century

The biggest box office flops of the 21st centuryin depth Unnecessary remakes and turgid, expensive CGI-fests highlight this list of these most notorious box-office losers

-

The 10 most infamous abductions in modern history

The 10 most infamous abductions in modern historyin depth The taking of Savannah Guthrie’s mother, Nancy, is the latest in a long string of high-profile kidnappings

-

Will SpaceX, OpenAI and Anthropic make 2026 the year of mega tech listings?

Will SpaceX, OpenAI and Anthropic make 2026 the year of mega tech listings?In Depth SpaceX float may come as soon as this year, and would be the largest IPO in history

-

Can Trump make single-family homes affordable by banning big investors?

Can Trump make single-family homes affordable by banning big investors?Talking Points Wall Street takes the blame

-

Why is crypto crashing?

Why is crypto crashing?Today's Big Question The sector has lost $1 trillion in value in a few weeks

-

Is a financial market crash around the corner?

Is a financial market crash around the corner?Talking Points Observers see echoes of 1929

-

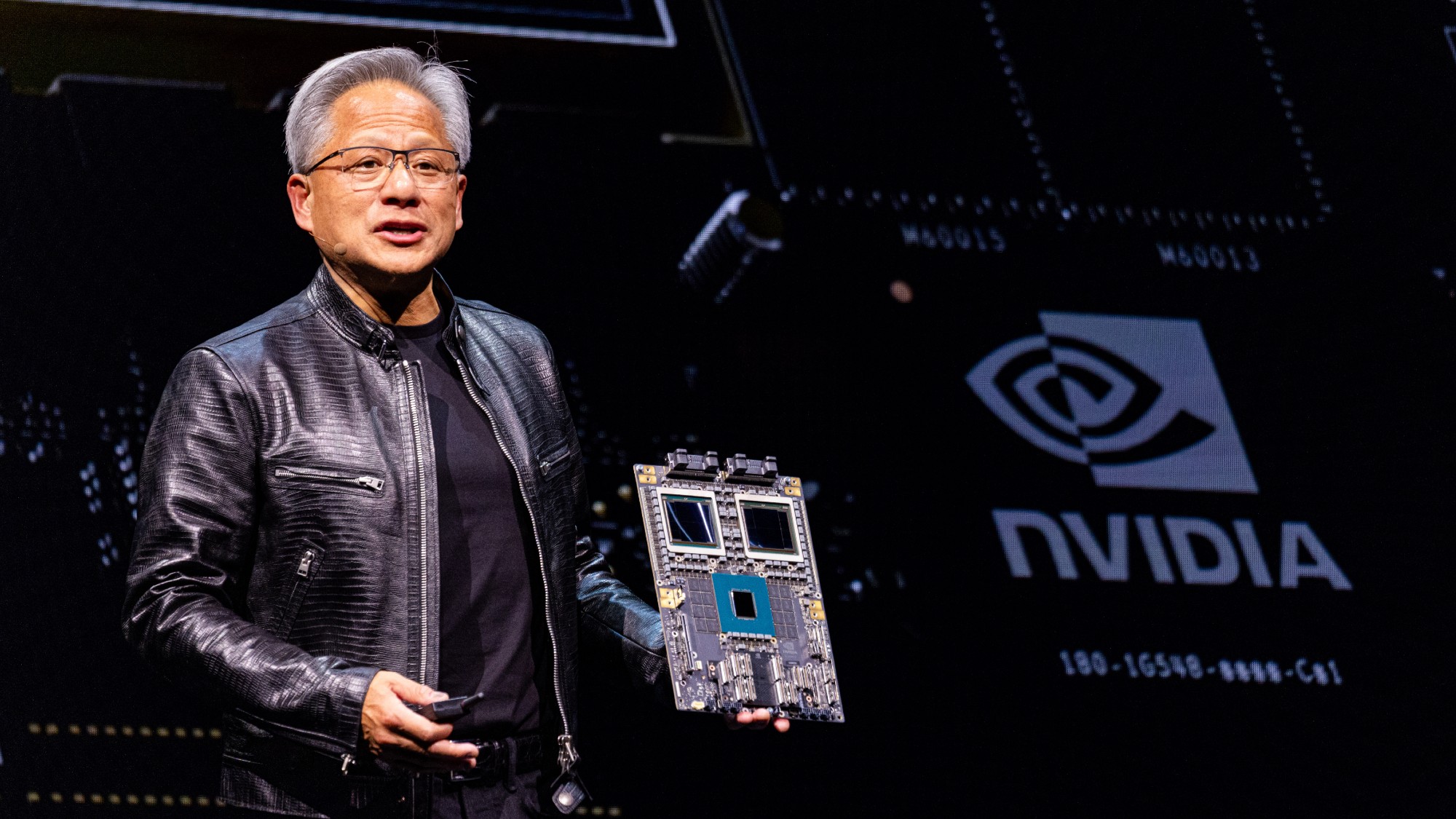

Nvidia: unstoppable force, or powering down?

Nvidia: unstoppable force, or powering down?Talking Point Sales of firm's AI-powering chips have surged above market expectations –but China is the elephant in the room

-

DORKs: The return of 'meme stock' mania

DORKs: The return of 'meme stock' maniaFeature Amateur investors are betting big on struggling brands in hopes of a revival

-

Tesla reports plummeting profits

Tesla reports plummeting profitsSpeed Read The company may soon face more problems with the expiration of federal electric vehicle tax credits

-

Trump's threats to fire Jerome Powell are unsettling the markets

Trump's threats to fire Jerome Powell are unsettling the marketsTalking Points Expect a 'period of volatility' if he follows through