New York overtakes London as world’s financial capital

Most financial services executives think Brexit chaos is to blame

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

New York has superseded London as the pre-eminent global financial capital because of turmoil caused by Brexit, leading financial services executives have said in a survey.

Consultancy firm Duff & Phelps released its 2019 Global Regulatory Outlook survey yesterday, having asked 183 leaders in private equity, hedge funds, asset management, brokerage, banking, and policy/government their opinion on the location of the world’s top financial centre.

As CNBC reports “London and New York switched places in the ranking from 2018, with 52% of respondents choosing New York as the globe’s financial hub, while 36% chose London. Last year, 42% chose New York and 53% chose London.”

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

“Last year, Brexit cast a shadow of uncertainty over the United Kingdom’s economy; it has now escalated to a full-blown crisis,” the report said.

“British government ministers said last week that the UK financial sector would emerge stronger from Brexit”, Reuters notes. However, it also adds that “Duff & Phelps said Dublin, Frankfurt and Luxembourg also fared better this year as the European Union’s financial industry searches for a new hub.”

Sky News quotes EY's UK financial services managing partner, Omar Ali, who said: "The subdued economic picture, Brexit uncertainty and the emergence of some longer-term trends such as the decline in car ownership and continued high house prices are all taking their toll."

Also mentioned in the report are other potential future contenders for the position. “Looking ahead… globalisation’s diffusion of influence begins to be apparent: 12 percent of respondents expect Hong Kong to be the world’sd preeminent financial centre five years from now, a stark contrast to the 3 percent who held this opinion just a year ago.”

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

The report goes on to address global anti-money laundering and financial terrorism countering efforts, concluding that weakness in that area is not an issue of resourcing but of inter-institutional coordination, as well as further issues pertaining to financial regulation.

This is not the first time Brexit has spelled bad news for the City. Last year, according to Sky News, a “Z/Yen Global Financial Centres Index showed New York overtaking the UK's capital.” The think tank’s index also found that "Zurich, Frankfurt, Amsterdam, Vienna, and Milan moved up the rankings significantly. These centres may be the main beneficiaries of the uncertainty caused by Brexit.”

William Gritten is a London-born, New York-based strategist and writer focusing on politics and international affairs.

-

Secured vs. unsecured loans: how do they differ and which is better?

Secured vs. unsecured loans: how do they differ and which is better?the explainer They are distinguished by the level of risk and the inclusion of collateral

-

‘States that set ambitious climate targets are already feeling the tension’

‘States that set ambitious climate targets are already feeling the tension’Instant Opinion Opinion, comment and editorials of the day

-

Mixing up mixology: The year ahead in cocktail and bar trends

Mixing up mixology: The year ahead in cocktail and bar trendsthe week recommends It’s hojicha vs. matcha, plus a whole lot more

-

Will SpaceX, OpenAI and Anthropic make 2026 the year of mega tech listings?

Will SpaceX, OpenAI and Anthropic make 2026 the year of mega tech listings?In Depth SpaceX float may come as soon as this year, and would be the largest IPO in history

-

Can Trump make single-family homes affordable by banning big investors?

Can Trump make single-family homes affordable by banning big investors?Talking Points Wall Street takes the blame

-

Why is crypto crashing?

Why is crypto crashing?Today's Big Question The sector has lost $1 trillion in value in a few weeks

-

Gopichand Hinduja and the rift at the heart of UK’s richest family

Gopichand Hinduja and the rift at the heart of UK’s richest familyIn The Spotlight Following the death of the patriarch, the family’s ‘Succession-like’ feuds are ‘likely to get worse’

-

Is a financial market crash around the corner?

Is a financial market crash around the corner?Talking Points Observers see echoes of 1929

-

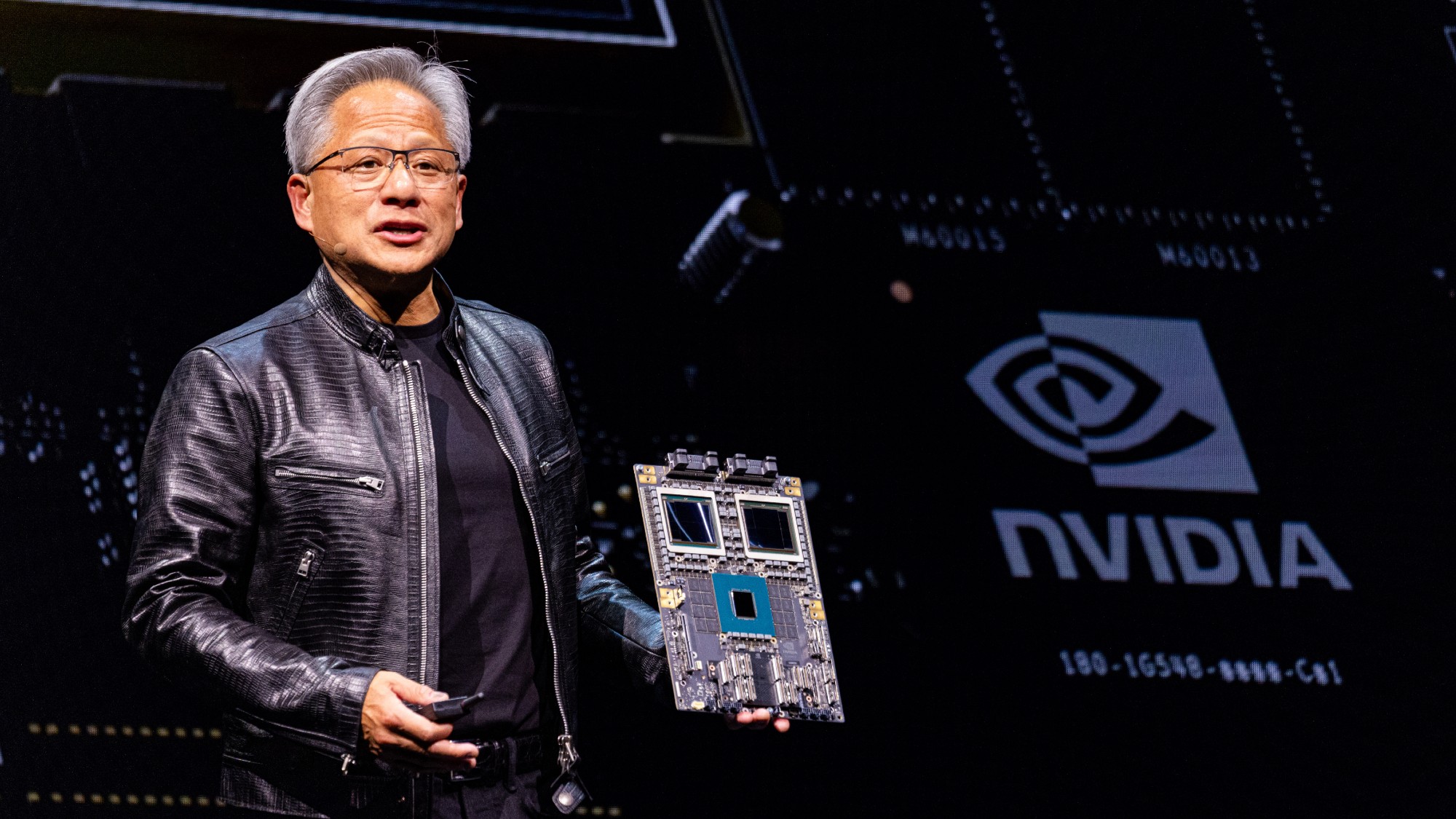

Nvidia: unstoppable force, or powering down?

Nvidia: unstoppable force, or powering down?Talking Point Sales of firm's AI-powering chips have surged above market expectations –but China is the elephant in the room

-

DORKs: The return of 'meme stock' mania

DORKs: The return of 'meme stock' maniaFeature Amateur investors are betting big on struggling brands in hopes of a revival

-

Tesla reports plummeting profits

Tesla reports plummeting profitsSpeed Read The company may soon face more problems with the expiration of federal electric vehicle tax credits