Bitcoin price: is the cryptocurrency bull run over?

Forecasters clash as digital coin’s value drops again

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Bitcoin investors are bracing for another rocky ride as the volatile cryptocurrency takes a dip following weeks of gradual gains.

The digital coin reached its highest value in 15 months last week after breaking through the $10,000 mark (£7,970) - a psychological barrier that once surpassed, spurred investors on to grow their stash of digital coins.

But after peaking at $13,780 (£10,980) on 26 June, bitcoin plunged by around $3,000 within the space of 24 hours, before tumbling further to $9,810 (£7,820) on 2 July, according to ranking site CoinMarketCap.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Although values had climbed back to $11,230 (£8,950) as of midday today, prices are still well below their recent highs.

Is the bull run over?

Bitcoin certainly seems to have lost the momentum that sent values slowly climbing in recent weeks, but it’s not yet known whether the recent price fluctuations are a sign of imminent declines or just the latest swing in the virtual coin’s ever-changing fortunes.

According to cryptocurrency news site FXStreet, the near-future outlook for bitcoin values is “mostly bearish”, suggesting that more declines may be on the horizon.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

But Forbes argues that bitcoin’s recent swings are merely signs of the digital coin’s “loony-tunes volatility”, and predicts that prices could surpass $20,000 (£15,940) before the year is out.

That said, the news site admits that its predictions are “just a crude sketch” based on similarities between bitcoin’s price fluctuations in 2017, when prices came within touching distance of the $20,000 mark, and the virtual coin’s patterns in 2019.

Some experts argue that the volatility could ignite interest among investors, who may use the period of uncertainty to build their stash of bitcoin.

Arthur Hayes, head of cryptocurrency exchange BitMEX, told attendees at the Asia Blockchain Summit in Taiwanese capital Taipei this week that “bitcoin is fun, but it’s a hell of a lot more fun at 100 times leverage”, Bloomberg reports.

“That’s what people want to see in crypto, they want that high volatility,” he said. “At the end of the day, we’re all in the entertainment business of traders.”

That view is shared by Charlie Lee, creator of bitcoin rival litecoin, who says that the cryptocurrency market’s current volatility will “definitely bring more people into the space”.

Have bitcoin’s rivals faced similar declines?

Yes. In the cryptocurrency world, rival coins often lose momentum when bitcoin values start sliding.

Ethereum, the market’s second largest cryptocurrency behind bitcoin, has slipped from a high of $353 (£280) last Wednesday to around $293 (£230) today, according to CoinMarketCap.

Banking-focused coin Ripple has suffered similar declines. The digital currency, which sits in third place, has plunged from $0.49 (£0.39) on Wednesday to $0.39 (£0.31), figures on the ranking site show.

-

Bad Bunny’s Super Bowl: A win for unity

Bad Bunny’s Super Bowl: A win for unityFeature The global superstar's halftime show was a celebration for everyone to enjoy

-

Book reviews: ‘Bonfire of the Murdochs’ and ‘The Typewriter and the Guillotine’

Book reviews: ‘Bonfire of the Murdochs’ and ‘The Typewriter and the Guillotine’Feature New insights into the Murdoch family’s turmoil and a renowned journalist’s time in pre-World War II Paris

-

Witkoff and Kushner tackle Ukraine, Iran in Geneva

Witkoff and Kushner tackle Ukraine, Iran in GenevaSpeed Read Steve Witkoff and Jared Kushner held negotiations aimed at securing a nuclear deal with Iran and an end to Russia’s war in Ukraine

-

Why Trump pardoned crypto criminal Changpeng Zhao

Why Trump pardoned crypto criminal Changpeng ZhaoIn the Spotlight Binance founder’s tactical pardon shows recklessness is rewarded by the Trump White House

-

Bitcoin braces for a quantum computing onslaught

Bitcoin braces for a quantum computing onslaughtIN THE SPOTLIGHT The cryptocurrency community is starting to worry over a new generation of super-powered computers that could turn the digital monetary world on its head.

-

The noise of Bitcoin mining is driving Americans crazy

The noise of Bitcoin mining is driving Americans crazyUnder the Radar Constant hum of fans that cool data-centre computers is turning residents against Trump's pro-cryptocurrency agenda

-

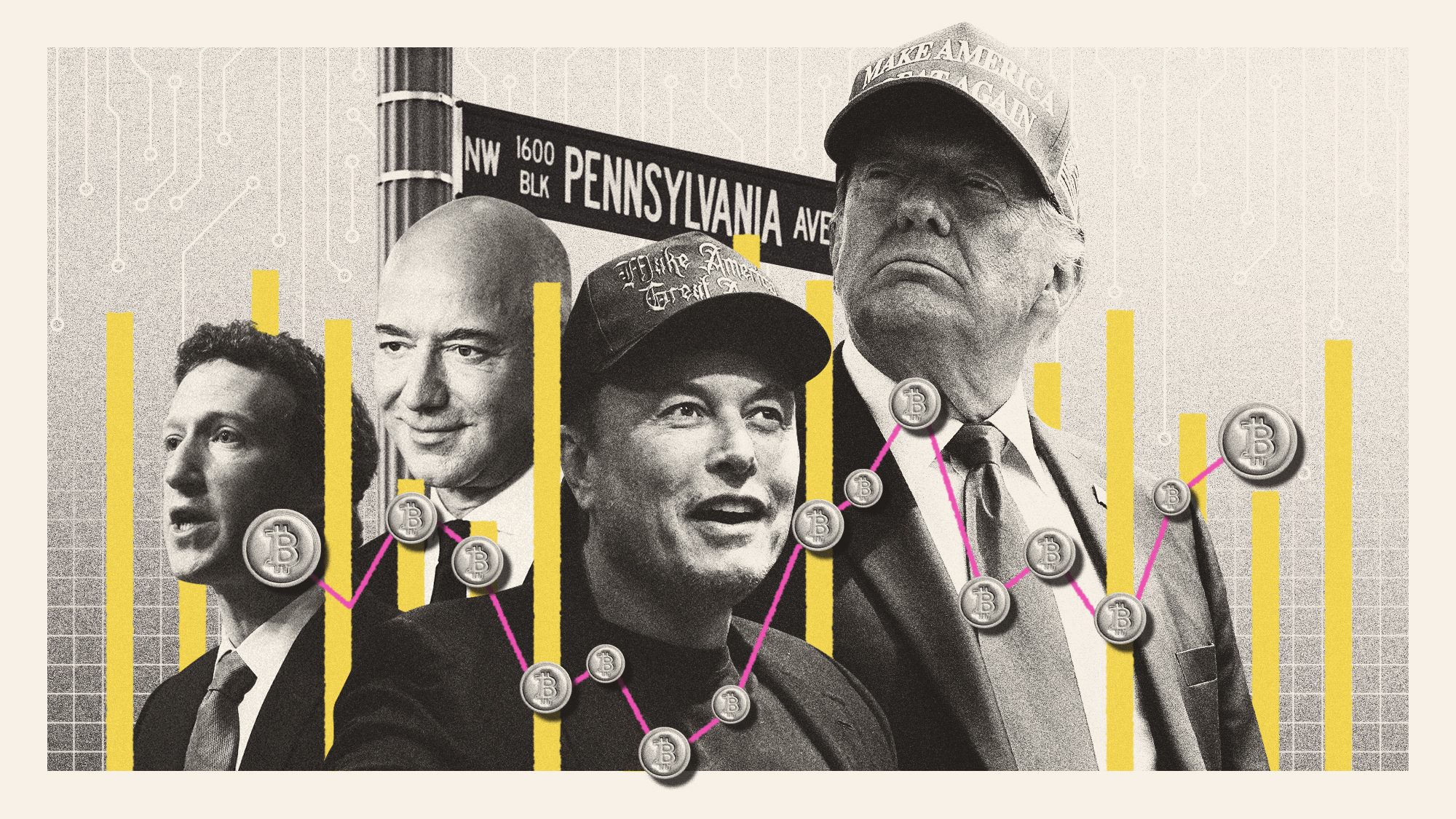

What Trump's win could mean for Big Tech

What Trump's win could mean for Big TechTalking Points The tech industry is bracing itself for Trump's second administration

-

Network states: the tech broligarchy who want to create new countries

Network states: the tech broligarchy who want to create new countriesUnder The Radar Communities would form online around a shared set of 'values' and acquire physical territory, becoming nations with their own laws

-

Paraguay's dangerous dalliance with cryptocurrency

Paraguay's dangerous dalliance with cryptocurrencyUnder The Radar Overheating Paraguayans are pushing back over power outages caused by illegal miners

-

2023: the year of crypto instability

2023: the year of crypto instabilityThe Explainer Crypto reached peaks — and valleys — throughout 2023

-

Sam Bankman-Fried found guilty: where does crypto go from here?

Sam Bankman-Fried found guilty: where does crypto go from here?Today's Big Question Conviction of the 'tousle-haired mogul' confirms sector's 'Wild West' and 'rogue' image, say experts