Is there about to be a recession?

Investors are losing confidence in the global economy amid the ongoing US-China trade war and the stuttering performance of key economies

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Markets shuddered yesterday as dire economic data emerged from Germany and China, and bond markets flashed an ominous warning.

Fears of a global economic slowdown are proliferating. Yesterday in UK and US bond markets, for the first time since the prelude to the devastating 2008 global financial crash, it became cheaper for governments to hold long-term rather than short-term debt.

Interest rates for short-term bonds are generally lower than those for long-term, and when they flip this is known as an ‘inverted yield curve’, an event that regularly foreshadows severe economic downturn, even recession.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

A yield curve inversion has preceded the last seven US recessions, and has occurred without a recession just once in the last 50 years.

After hearing the news, this morning Asian stock markets saw shares drop. CNBC reports the numbers: “In mainland China, the Shanghai composite shed 1.08%, while the Shenzhen component declined 1.27% and Shenzhen composite fell 1.363%. Hong Kong’s Hang Seng index also shed 0.73%. In Japan, the Nikkei 225 fell 1.47% in morning trade, while the Topix index dropped 1.4%. Australia’s S&P/ASX 200 also tumbled 2.29%. The MSCI Asia ex-Japan index shed 0.89% overall.”

Yesterday, data released by the German government confirmed the country’s economy had shrunk 0.1% between April and June. “Deutsche Bank analysts predicted that the economy would continue to shrink in the current quarter,” the New York Times reports. If they are correct, the German economy will have shrunk in two consecutive quarters, a slump that meets “the technical definition of a recession.”

Data also showed that the UK economy contracted 0.2%.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Likewise in China, government data showed weak economic performance, including the revelation that factory output is at its lowest flow for 17 years.

“This yield curve inversion in the States really tells us more about the global economy than the US economy,” said Marc Ostwald, chief economist at ADM Investor Services International, quoted by the Independent. “We are looking at Germany, we are looking at, above all, China and we are going, ‘This isn’t good, these are meant to be motors of global trade’.”

The bad news from China and Germany, and in the UK and US stock markets are all intimately linked, and the investment manager BlackRock is clear about what they think is driving the troubles. “The recent escalation in US -China tensions reinforces our view that trade and geopolitical frictions have become the key driver of the global economy and markets,” they said in a statement released on Monday.

In further signs of trouble, Reuters reports that “oil prices sank more than 4% on Wednesday after global demand fears were revived by weak economic data from China and Europe and an unexpected build in US crude inventories.”

Is a recession due?

An interest rate inversion signals that investors have concerns about the economic outlook in the next few years, but it also helps to cause economic downturn.

As Reuters explains, “When short-term yields climb above longer-dated ones, it signals short-term borrowing costs are more expensive than longer-term loan costs. Under these circumstances, companies often find it more expensive to fund their operations, and executives tend to temper or shelve investments. Consumer borrowing costs also rise and consumer spending, which accounts for more than two-thirds of U.S. economic activity, slows. The economy eventually contracts and unemployment rises.”

Former Federal Reserve Chair Janet Yellen counselled caution on those predicting a recession in the US: “I think the answer is most likely no. I think that the U.S. economy has enough strength to avoid (a recession). But the odds have clearly risen and they are higher than I’m frankly comfortable with,” said Yellen in an interview with FOX Business Network, set to air on Friday.

According to Mike Riddell, a bond portfolio manager at Allianz Global Investors, the UK yield curve inversion is less significant than that of the US. “The UK curve spent almost half the 1990s inverted and things were fine,” the Financial Times quotes him as saying. He added, though, that there was “no question that a curve that is flattening or inverting is increasing the chances of recession”.

What can be done to arrest the economic slump?

Generally, in times of weak economic growth, central banks lower interest rates. The major problem now is that most countries have rates hovering not far above zero. There is little ammunition left for action.

In the US, Donald Trump has renewed his attacks on Federal Bank chair Jerome Powell, who has dropped interest rates, but not aggressively enough, according to Trump.

Germany has long preached and adhered strictly to a policy of ‘Schwarze Null’ - or ‘black zero’ - in which they spend and borrow conservatively. The government has operated a budget surplus since 2014. However, their recent troubles are leading some to call for an end to this policy.

“This is an embarrassment for Germany, which has long lectured other countries on how to manage their economies,” argues Jack Ewing in The New York Times. “The slumping growth will probably increase calls for Chancellor Angela Merkel’s government to increase spending to stimulate the economy.”

Anja Hajduk, the deputy leader of Germany’s Green parliamentary group, agrees: “What is even more disappointing than the economic data are that the government is still not doing anything to counter this long-expected economic downturn,” the Financial Times quotes her as saying. “If the government wants to pursue an economic policy that looks to the long term, it cannot give priority to the Schwarze Null over indispensable investments in our future.”

William Gritten is a London-born, New York-based strategist and writer focusing on politics and international affairs.

-

Corruption: The spy sheikh and the president

Corruption: The spy sheikh and the presidentFeature Trump is at the center of another scandal

-

Putin’s shadow war

Putin’s shadow warFeature The Kremlin is waging a campaign of sabotage and subversion against Ukraine’s allies in the West

-

Media: Why did Bezos gut ‘The Washington Post’?

Media: Why did Bezos gut ‘The Washington Post’?Feature Possibilities include to curry favor with Trump or to try to end financial losses

-

Is the US in a hiring recession?

Is the US in a hiring recession?Today's Big Question The economy is growing. Job openings are not.

-

Is the UK headed for recession?

Is the UK headed for recession?Today’s Big Question Sluggish growth and rising unemployment are ringing alarm bells for economists

-

Why has America’s economy gone K-shaped?

Why has America’s economy gone K-shaped?Today's Big Question The rich are doing well. Everybody else is scrimping.

-

Is the US in recession?

Is the US in recession?Today's Big Question ‘Unofficial signals’ are flashing red

-

Doing the hustle: Are side gigs a sign of impending recession?

Doing the hustle: Are side gigs a sign of impending recession?In the Spotlight More workers are 'padding their finances while they can'

-

Frozen pizza sales could be a key indicator of a recession

Frozen pizza sales could be a key indicator of a recessionThe Explainer Sales of the item have been increasing since the pandemic

-

Trump tariffs: five scenarios for the world's economy

Trump tariffs: five scenarios for the world's economyThe Explainer A US recession? A trade war with China? How 'Liberation Day' could realign the globe

-

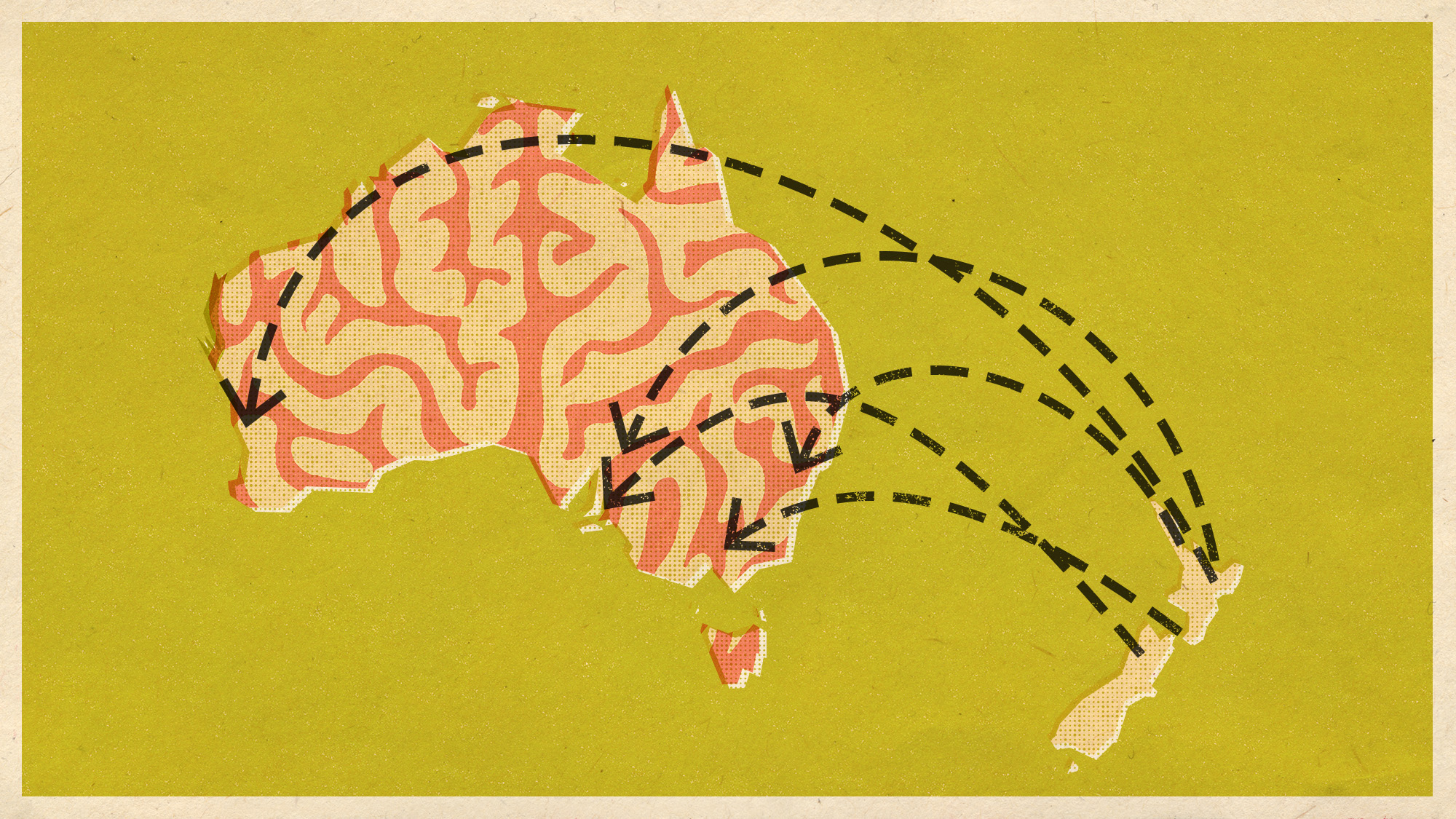

'Brain drain' fear as record numbers leave New Zealand

'Brain drain' fear as record numbers leave New ZealandUnder The Radar Neighbouring Australia is luring young workers with prospect of better jobs