Bitcoin booming again on 'safe haven' demand

Virtual currency surges 13 per cent as political uncertainty hits trading

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Bitcoin has broken through the $2,000 mark yesterday, boosted by growing interest in Asia and global political uncertainty.

It surged by 13 per cent to a record of more than $2,200 per coin to trade around 70 per cent above the price of an ounce of gold.

"It has more than doubled its value since the beginning of the year," says Bloomberg.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The surge in demand has largely been driven by a move towards "safe haven" trading.

"In the past, bitcoin has acted as a safe haven for investors worried about political instability and the performance of other asset classes," says CNBC.

This is also one of the main drivers of demand for gold, which has bounced back in the past week in the wake of the crisis that has engulfed the administration of US President Donald Trump.

In addition, bitcoin received a major boost in Asian trading when Japan passed legislation allowing retailers to accept the cryptocurrency.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

It has also been helped by fluctuations in the Chinese yuan, the French elections and, to a lesser extent, this month's ransomware attack which required payment in bitcoin, says The Economist.

Bitcoin worth more than gold for first time

3 March

Bitcoin was worth more than gold for the first time yesterday, with the virtual currency worth $1,268 a coin to the metal's $1,233 an ounce at the close.

The price was helped by soaring demand in China, with the effects of a crackdown by the authorities earlier this year lifting, says the BBC.

Beijing believes Bitcoin is used to take money out of China illegally and started spot checks on its trading in January, pushing the value down, adds the broadcaster. However, the dip lasted only briefly and the currency soared to record highs later that month. Yesterday's trading saw it go even higher.

Since the beginning of the year, Bitcoin has risen 25 per cent, says CNet, while gold is up seven per cent. It's an extraordinary price for what the site calls a "volatile digital currency that most people have never actually used".

Yesterday's surge marks a definite reversal in fortunes for the currency. After being founded in 2009, it fell drastically in 2014, when a major exchange collapsed, and then last year, a hacker stole millions of dollars' worth of the currency, reducing its value.

Despite the rise, critics are still not convinced the virtual currency is here to stay.

The Financial Times says it is "arbitrary" to compare its value to gold because the metal is measured in weight while the "virtual currency beloved of technologists is entirely ephemeral and abstract".

Nevertheless, adds the newspaper, the news today is symbolic of Bitcoin's "unexpected staying power and influence in certain circles".

The BBC hints that those circles tend towards the shady side, saying the currency is attractive to "some users" because of its anonymity and freedom from government control.

Bitcoin largely powered the Silk Road website, which was closed by the FBI and other agencies in 2013 after the open sale of drugs and weapons.

However, the cryptocurrency is increasingly becoming respectable. "The Securities and Exchange Commission is currently considering a proposal for an exchange-traded fund backed by bitcoin," says the FT. A decision is due by 9 March.

Bitcoin 'creator' U-turns on promise to prove his story

6 May

An Australian who said he was the inventor of digital currency Bitcoin has made an abrupt U-turn on his promise to prove his claim.

Craig Wright approached the BBC and other media outlets on Monday to say he was "Satoshi Nakamoto", the pseudonym used by the mysterious Bitcoin creator.

When questioned further, the businessman promised to provide incontrovertible proof to counter sceptics.

However, he has now deleted the blog in which he outlined his claim and replaced it with a single post, headlined: "I'm Sorry."

"I believed that I could do this. I believed that I could put the years of anonymity and hiding behind me," he writes.

"But, as the events of this week unfolded and I prepared to publish the proof of access to the earliest keys, I broke. I do not have the courage. I cannot."

Rory Cellan-Jones, the technology correspondent for the BBC, says he was convinced Wright's claim was true not so much because of the proof he offered, but because he was backed by two senior figures in the Bitcoin Foundation, Jon Matonis and Gavin Andresen.

Andresen said Wright had privately shown him undeniable proof and later wrote: "I am very happy to be able to say I shook his hand and thanked him for giving Bitcoin to the world." He now says he was mistaken.

Matonis, however, yesterday implied he still has faith, writing on Twitter that while Wright will not now offer his proof of identity, there "won't be another Satoshi".

Wright refers to the two men in his apology, saying: "I can only hope that their honour and credibility is not irreparably tainted by my actions. They were not deceived, but I know that the world will never believe that now."

Cellan-Jones says only that the U-turn is "bound to create fresh doubts". The journalist does not say he no longer believes Wright, but could be forgiven for washing his hands of the businessman, given the damage to his own professional reputation.

There's no doubt that Wright's climb-down does "provide ammunition to those who speculated his claims were not true", says Wired.

UK tech magazine The Register remains entirely convinced Wright is not Nakamoto. Dubbing him "Yeah Wright" and "the creator of Craig Wright", not Bitcoin, it suggests the Australian is just seeking the "oxygen of publicity".

His claim is "transparently false", adds the site: "Craig Wright is not Satoshi Nakamoto. Why he wants people to believe he is, well, that's something for him and his therapist to figure out."

What is a Bitcoin?

A full explanation of Bitcoin and how it works "would take several thousand words", says the Daily Telegraph, but a more concise description is that it is a "currency that only exists in cyberspace, with holders storing their stash in a virtual 'wallet' and making transfers over the internet". ABC News offers an even briefer description: "If hard currency is like a record, then Bitcoin is like an MP3."

Bitcoin: Coinbase in talks to open first UK exchange

07 April

Online currency Bitcoin is set to take another step into the mainstream as it was revealed that one of the world’s biggest digital currency markets, Coinbase, is in talks with UK financial regulators about setting up a Bitcoin exchange in the UK.

Coinbase opened the first regulated Bitcoin exchange in the United States this year, after receiving $106 million in backing from the New York stock exchange, The Times reported.

Now Brian Armstrong, CEO of Coinbase, hopes to set up in the UK as well.

In an interview with The Times, Armstrong said he had been in conversation with UK regulators for six months and that discussions were "positive and all moving in the right direction", but added that he was "hesitant to avoid putting any measure" on a potential launch date.

Coinbase is a company "entirely focused" on making it easier for businesses and individuals to buy and sell Bitcoins, Medium said.

The company also intends to help Bitcoin shake off its image as the currency of choice for drug dealers and criminals on the so-called "dark web".

Armstrong is hopeful that with increased regulation, the currency will become more stable. The price of one Bitcoin is currently hovering around $250, having crashed from highs of more than $1,200 at the end of 2013.

"[Bitcoin] is getting less volatile every year and I think that trend will continue,” Armstrong said. “There was a bubble period and the end of 2013 and the beginning of 2014. We saw this massive run-up in the price that didn't match the actual price of Bitcoin underneath."

Juniper Research suggests the value of all crypto-currencies is likely to drop by more than half this year, from $71 billion to $30 billion, The Times noted. But Coinbase stressed that, for the time being, it does not intend to deal in any currency other than Bitcoin.

"Our mission is to enable consumers from around the world to access a cheap, fast, global payment network. It's pretty clear right now that Bitcoin is the dominant payment network, and we feel that adding another digital currency would slow us down in our mission by confusing people who are just being introduced to the concept of digital currencies."

How much is a Bitcoin worth?

In 2011, one Bitcoin unit was priced at $1. Today it is worth $305. While this seems like a massive increase, Bitcoin's price has actually been falling since its peak of $1,147 in December 2013, with its drop in value partly blamed on a clampdown on the currency by Chinese authorities.

Who invented Bitcoin?

The identity of the mastermind behind Bitcoin has been shrouded in secrecy. The concept entered the public domain in 2008 and was credited to a "pseudonymous developer" known as Satoshi Nakamoto. It has been suggested – by Ted Nelson, one of the web's founding fathers – that Nakamoto is the Japanese mathematician Shinichi Mochizuki. That claim has not been verified, but you can read a detailed explanation of Nelson's argument here.

In March, Newsweek claimed the founder was Dorian Prentice Satoshi Nakamoto, a 64-year-old father-of-six living near Los Angeles – although a brief interview with Nakamoto himself offered no concrete evidence that it was him.

Where do you get Bitcoins?

The world's first Bitcoin ATM opened in Vancouver on 1 November 2013. The machine allows "users to exchange their credits of the digital currency for cash and vice-versa", says the BBC. In May last year, a new bank called Circle also opened its virtual doors to users of the currency. The Boston-based financial services company allows users to deposit currency and see it converted instantly to Bitcoin without any fees. Users are then able to use their account to make transactions. Circle says that it aims to make Bitcoin easier to use for real-world purchases; at present, the cryptocurrency tends to be used primarily as an investment.

If you don't want to trade hard cash for Bitcoins, you can also "mine" new ones.

How do you mine Bitcoins?

You won't need a shovel. Bitcoins are "hidden amid a complex encrypted computer program", explains ABC News. Users have their computers "working round the clock to solve a complicated mathematical problem in order to release new coins". Of the 21 million possible Bitcoins, about 11 million have already been unearthed. You can also mine coins using your smartphone, says Know Your Mobile – but don't expect quick returns. Eight hours of running a Bitcoin-mining app, unearthed just 0.0005 coins. That's because finding new coins requires enormous amounts of computing power which has led some hackers to take over unsuspecting users' machines to harness more power.

The Bitcoin system is designed so that the work required to find new Bitcoins rises steadily as each coin is uncovered. "That makes the currency's growth rate, also known as inflation, steady and predictable," says ABC News.

How do you spend Bitcoins?

If you want to buy something using Bitcoins you need to make sure the seller accepts the cryptocurrency. If they do, you acquire the anonymous identification number attached to the seller's "wallet" then move coins from your virtual wallet to theirs. The "anonymity" of these transactions has made the currency particularly popular with drug dealers, says ABC News.

Will Bitcoin replace existing currencies?

That's the big question. the Telegraph suggests Bitcoin does present a serious challenge, saying: "Unless the issues that Bitcoin raises are addressed in a thoughtful and proactive manner by existing authorities, the disintermediating power of technology is likely to have a disruptive impact on currency systems and those that regulate and rely on them".

Simon Johnson, a professor of entrepreneurship at MIT's Sloan School of Management, told Mashable that a Bitcoin "backlash" is likely as "governments and established financial institutions" fight to retain their supremacy. Bitcoin will "face political pressure and aggressive lobbying from big banks because of its disruptive nature," says Johnson.

Bitcoin: is Circle the world's first crypto-currency bank?

16 May

BITCOIN took a tentative step towards the mainstream today as a new bank called Circle opened its virtual doors to users of the currency, but analysts say it may have a hard time attracting users.

The Boston-based financial services company will allow users to deposit currency and see it converted instantly to Bitcoin without any fees. Users will then be able to use their account to make transactions. Circle says that it aims to make Bitcoin easier to use for real-world purchases; at present, the cryptocurrency tends to be used primarily as an investment.

"The focus is on making this easier for people to adopt," says the company's CEO, Jeremy Allaire.

"There have been a lot of barriers and friction and complexity to digital money formats over the past year or so. What we've tried to do with the service is remove a great deal of the complexity."

According to TheNextWeb's Josh Ong, Circle is hoping to do for virtual currency what Skype did for video phone calls. "Circle is utilising the benefits of Bitcoin – instant, secure, global and free – to help customers store money and make payments", Ong says.

To use the service, customers will need to link their bank account, credit card or debit card and add money into their Circle account. They can then make transactions using Circle in any currency without conversion fees. In an effort to assuage people's concerns about storing their money in a virtual currency, Circle displays finances in US dollars rather than Bitcoin.

Still, The Verge's Casey Newton says that Circle may have a hard time convincing people to use the service, because "it remains unclear why the average person would conduct a transaction in Bitcoin instead of cash". But, he says, in the long run there may be some advantages: "Advocates for the cryptocurrency say that merchants may eventually offer discounts to Bitcoin users that take advantage of lower transaction fees".

Yet in spite of the fact that the service offers no immediate advantages, Circle already a sizable waiting list of people hoping to sign up.

The service has raised $26m from investors and has a credible collection of financiers on its board of directors. Its future remains far from clear, but as Newton says, the technology and the philosophy behind it seem inevitable. "Whether it is Circle, or another startup that comes along, we're on the verge of free, instant access to our funds from any device and anywhere in the world".

-

Local elections 2026: where are they and who is expected to win?

Local elections 2026: where are they and who is expected to win?The Explainer Labour is braced for heavy losses and U-turn on postponing some council elections hasn’t helped the party’s prospects

-

6 of the world’s most accessible destinations

6 of the world’s most accessible destinationsThe Week Recommends Experience all of Berlin, Singapore and Sydney

-

How the FCC’s ‘equal time’ rule works

How the FCC’s ‘equal time’ rule worksIn the Spotlight The law is at the heart of the Colbert-CBS conflict

-

Why 2025 was a pivotal year for AI

Why 2025 was a pivotal year for AITalking Point The ‘hype’ and ‘hopes’ around artificial intelligence are ‘like nothing the world has seen before’

-

Microsoft pursues digital intelligence ‘aligned to human values’ in shift from OpenAI

Microsoft pursues digital intelligence ‘aligned to human values’ in shift from OpenAIUNDER THE RADAR The iconic tech giant is jumping into the AI game with a bold new initiative designed to place people first in the search for digital intelligence

-

How the online world relies on AWS cloud servers

How the online world relies on AWS cloud serversThe Explainer Chaos caused by Monday’s online outage shows that ‘when AWS sneezes, half the internet catches the flu’

-

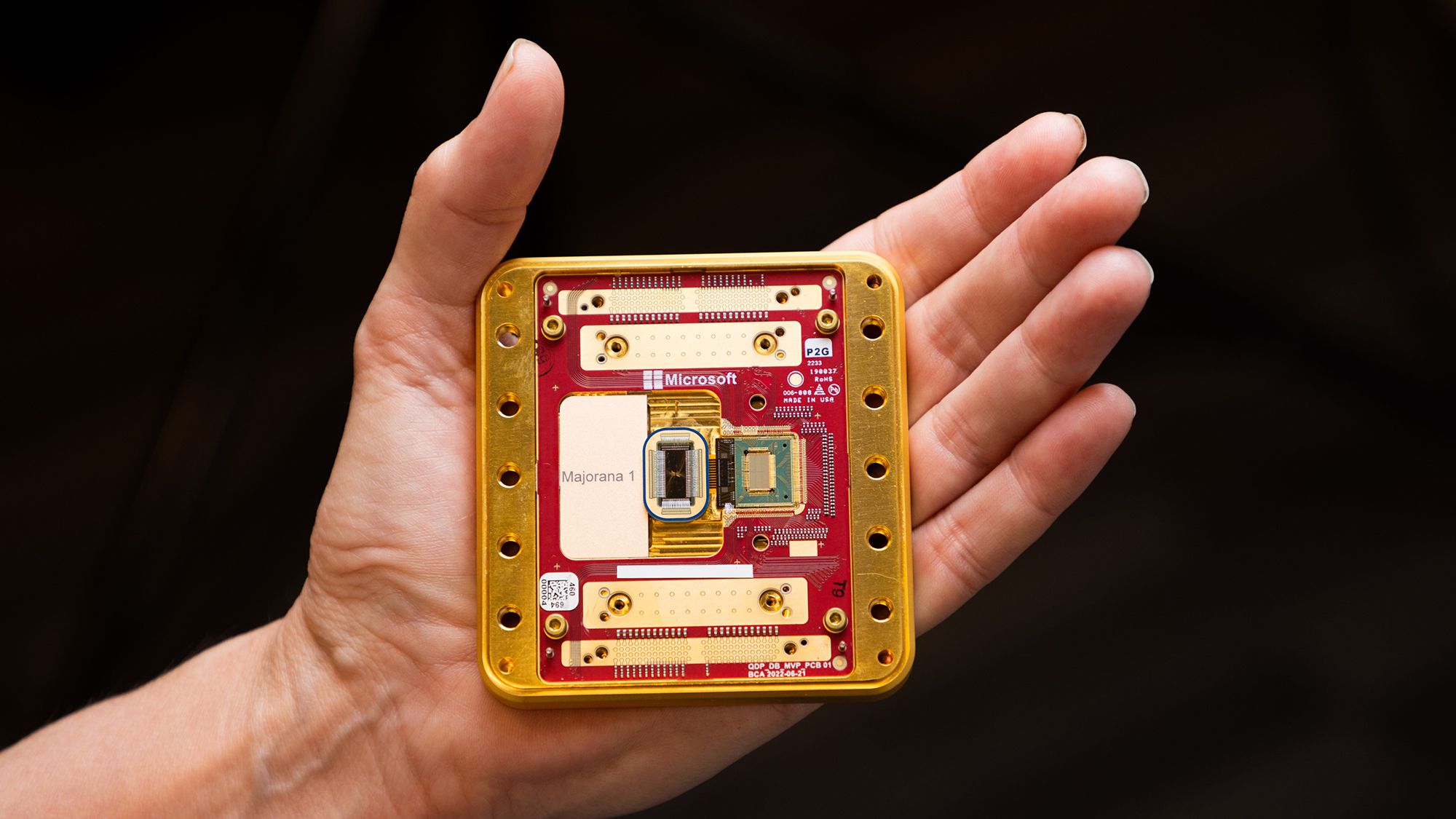

Microsoft unveils quantum computing breakthrough

Microsoft unveils quantum computing breakthroughSpeed Read Researchers say this advance could lead to faster and more powerful computers

-

Microsoft's Three Mile Island deal: How Big Tech is snatching up nuclear power

Microsoft's Three Mile Island deal: How Big Tech is snatching up nuclear powerIn the Spotlight The company paid for access to all the power made by the previously defunct nuclear plant

-

Video games to play this fall, from 'Call of Duty: Black Ops 6' to 'Assassin's Creed Shadows'

Video games to play this fall, from 'Call of Duty: Black Ops 6' to 'Assassin's Creed Shadows'The Week Recommends 'Assassin's Creed' goes to feudal Japan, and a remaster of horror classic 'Silent Hill 2' drops

-

CrowdStrike: the IT update that wrought global chaos

CrowdStrike: the IT update that wrought global chaosTalking Point 'Catastrophic' consequences of software outages made apparent by last week's events

-

Why is Microsoft breaking up Teams and Office?

Why is Microsoft breaking up Teams and Office?Today's Big Question The company had previously divided the software in Europe, but will now make this change globally