Will buy-to-let crackdown actually harm renters?

Many landlords plan to sell up when tough new legislation takes effect, but who gains?

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The number of landlords planning to sell up has surged to a ten-year high, as tax changes cracking down on buy-to-let take effect.

Research conducted for the National Landlords Association (NLA) shows that 20% of members plan to reduce the number of properties in their portfolio in the next year – the highest level of intended property sales since the financial crisis a decade ago.

“It follows a series of policies to curb buy-to-let activity in the private rental sector,” says The Independent. These include the withdrawal of mortgage interest relief for higher and additional rate tax payers, a 3% surcharge on purchases of an additional property, and the introduction of a ban on upfront letting fees for tenants.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Under further changes announced by the Chancellor in last year’s budget, landlords will also have to foot the bill for tenancy agreements, referencing and credit checks.

Tough new legislation combined with “a weakening housing market and increased difficulty in obtaining mortgages have all made buy-to-let a less attractive investment”, says The Daily Telegraph.

The chief executive of the NLA, Richard Lambert, said that with “more and more people relying on this sector for a home, it is vital that landlords not only provide a high standard of accommodation, but are incentivised to do so by the prospects of a reasonable return on investment”.

He said current government policies, while politically popular, “are undermining the viability of many landlords’ businesses and removing the incentives to invest in residential property for business purposes”.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

The changes could actually harm renters says Property118, “with tenants ending up paying high rents and having fewer rental properties to choose from”.

Last August, a survey by Britain’s biggest landlord organisation, the Residential Landlord Association, found almost half of private sector landlords plan to increase rents over the next year.

-

How the FCC’s ‘equal time’ rule works

How the FCC’s ‘equal time’ rule worksIn the Spotlight The law is at the heart of the Colbert-CBS conflict

-

What is the endgame in the DHS shutdown?

What is the endgame in the DHS shutdown?Today’s Big Question Democrats want to rein in ICE’s immigration crackdown

-

‘Poor time management isn’t just an inconvenience’

‘Poor time management isn’t just an inconvenience’Instant Opinion Opinion, comment and editorials of the day

-

Can Trump make single-family homes affordable by banning big investors?

Can Trump make single-family homes affordable by banning big investors?Talking Points Wall Street takes the blame

-

AI is creating a luxury housing renaissance in San Francisco

AI is creating a luxury housing renaissance in San FranciscoUnder the Radar Luxury homes in the city can range from $7 million to above $20 million

-

Exurbs: America's biggest housing trend you haven't heard of

Exurbs: America's biggest housing trend you haven't heard ofUnder the Radar Northeastern exurbs were the nation's biggest housing markets in 2024

-

Foreigners in Spain facing a 100% tax on homes as the country battles a housing crisis

Foreigners in Spain facing a 100% tax on homes as the country battles a housing crisisUnder the Radar The goal is to provide 'more housing, better regulation and greater aid,' said Spain's prime minister

-

Why are home insurance prices going up?

Why are home insurance prices going up?Today's Big Question Climate-driven weather events are raising insurers' costs

-

Homebuyers are older than ever

Homebuyers are older than everThe Explainer Rising prices and high mortgages have boxed millennials out of the market

-

Could 'adult dorms' save city downtowns?

Could 'adult dorms' save city downtowns?Today's Big Question 'Micro-apartments' could relieve office vacancies and the housing crisis

-

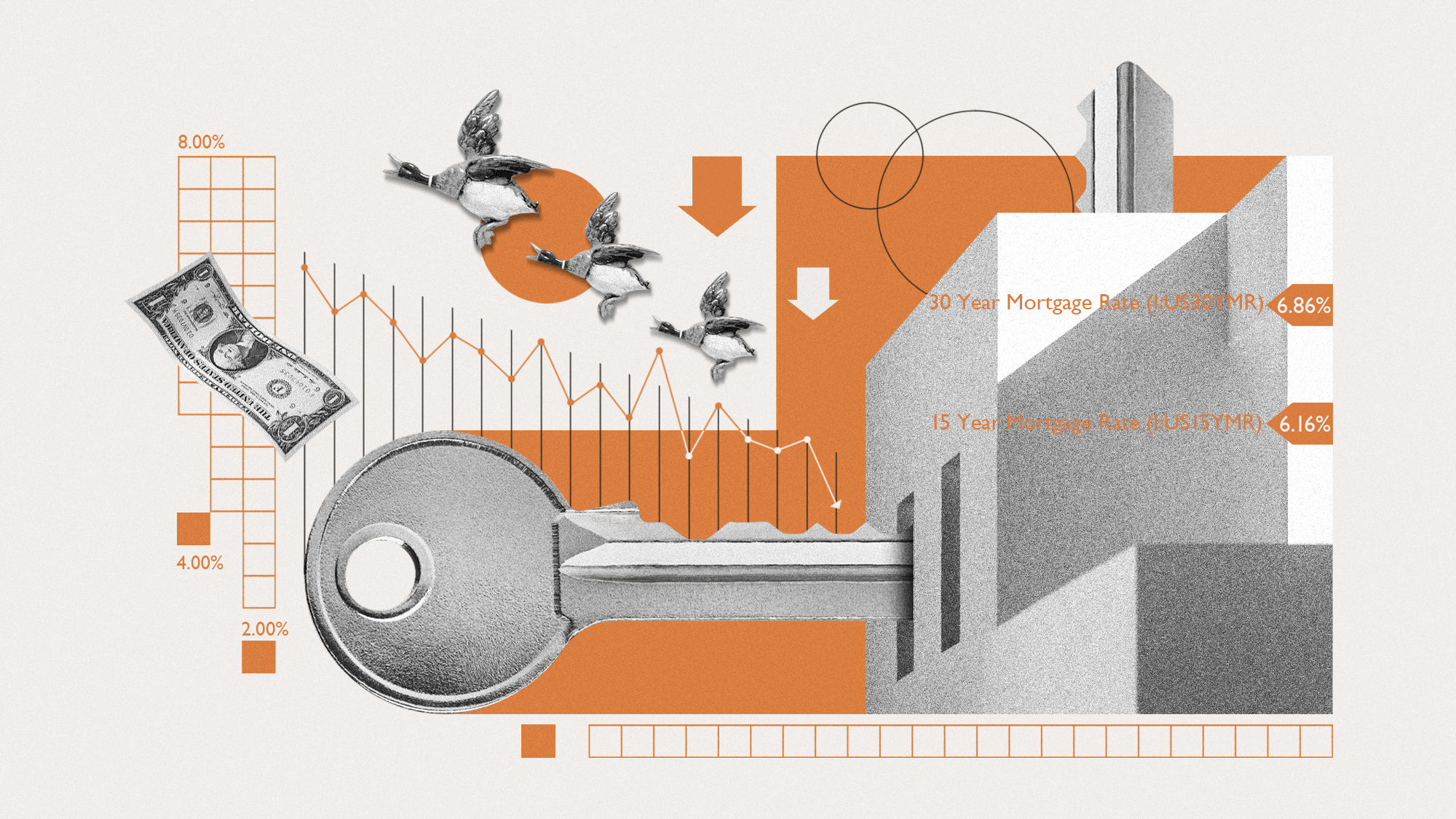

Will the housing slump ever end?

Will the housing slump ever end?Today's Big Question Probably not until mortgage rates come down