Oil prices hit four-year high

US withdrawal from Iran nuclear deal, deteriorating situation in Venezuela and Opec cuts drive up Brent Crude prices

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The price of oil hit a four-year high yesterday, rising above $70 a barrel for the first time since 2014.

Even after falls of almost 1% this morning, the price of a barrel of Brent crude now stands at $75.43 - up about 12% on the start of the year.

Much of the recent surge is down to expectations that Donald Trump could be about to withdraw the US from the Iran nuclear deal, with markets assuming that the return of US economic sanctions would disrupt output from the world’s third biggest oil exporter.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

CNN Money says this could affect as many as one million barrels per day of crude supply. Although some American allies, including India, Japan and South Korea, are expected to follow suit and cut off Iran, the effect could be tempered if the EU and China stick to the agreement and decide not to reimpose sanctions.

As well the short-term impact of the US withdrawing for the 2015 agreement, prices have been lifted by strong global demand and supply cuts agreed last year by Opec and other major oil producing countries such as Russia.

However, Fortune says Opec appears split on future cuts, with Iran wanting to see crude prices held at $60-$65 a barrel, while its great regional rival, Saudi Arabia, has said it is aiming for $80.

Another factor influencing oil prices is the deteriorating situation in Venezuela. According to Reuters, the country’s output has halved since the early 2000s to 1.5 million barrels per day, hit by a lack of investment in the oil industry.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

US output, meanwhile, has soared by more than a quarter over the past two years.

-

Mixing up mixology: The year ahead in cocktail and bar trends

Mixing up mixology: The year ahead in cocktail and bar trendsthe week recommends It’s hojicha vs. matcha, plus a whole lot more

-

Labor secretary’s husband barred amid assault probe

Labor secretary’s husband barred amid assault probeSpeed Read Shawn DeRemer, the husband of Labor Secretary Lori Chavez-DeRemer, has been accused of sexual assault

-

Trump touts pledges at 1st Board of Peace meeting

Trump touts pledges at 1st Board of Peace meetingSpeed Read At the inaugural meeting, the president announced nine countries have agreed to pledge a combined $7 billion for a Gaza relief package

-

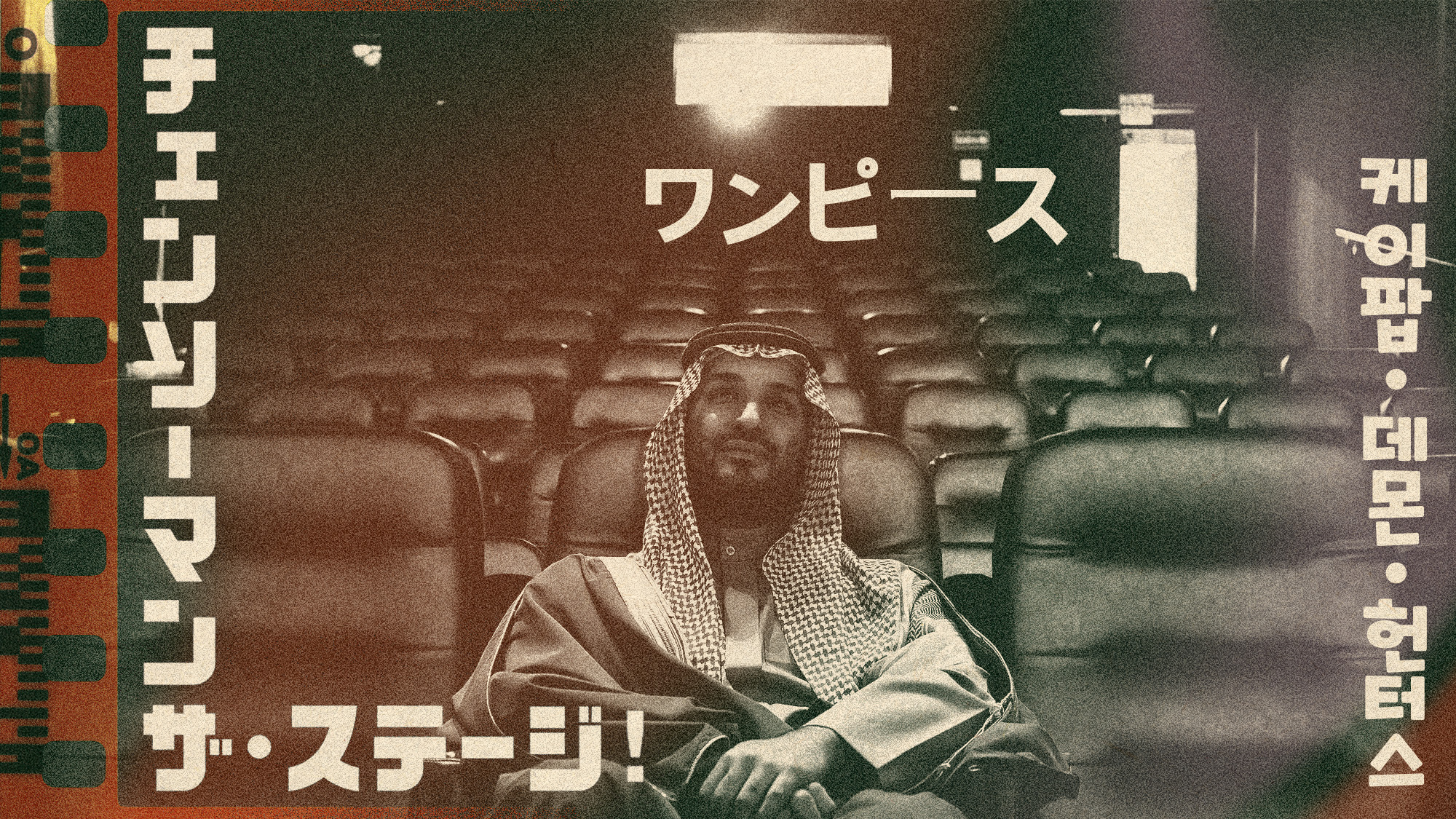

Why Saudi Arabia is muscling in on the world of anime

Why Saudi Arabia is muscling in on the world of animeUnder the Radar The anime industry is the latest focus of the kingdom’s ‘soft power’ portfolio

-

Electronic Arts to go private in record $55B deal

Electronic Arts to go private in record $55B dealspeed read The video game giant is behind ‘The Sims’ and ‘Madden NFL’

-

What Saudi Arabia wants with EA video games

What Saudi Arabia wants with EA video gamesIn the Spotlight The kingdom’s latest investment in gaming is another win for its ‘soft power’ portfolio

-

How might the Israel-Hamas war affect the global economy?

How might the Israel-Hamas war affect the global economy?Today's Big Question Regional escalation could send oil prices and inflation sky-high, sparking a worldwide recession

-

Recent mega-mergers could signal a turning point for the US oil industry

Recent mega-mergers could signal a turning point for the US oil industryTalking Point Both Chevron and Exxon have recently spent billions to acquire smaller oil companies

-

The PGA gets a Saudi makeover

The PGA gets a Saudi makeoverfeature Fans and players are reeling after the league announced a surprise merger with its Saudi-backed rival

-

Has Saudi Arabia lost control of oil prices?

Has Saudi Arabia lost control of oil prices?Today's Big Question Kingdom goes it alone to cut production, risking tension with US and reigniting cooling inflation in Europe

-

Why is Saudi Arabia going it alone on costly oil cuts?

Why is Saudi Arabia going it alone on costly oil cuts?Today's Big Question The unilateral production cuts could hurt its finances while raising gas prices for drivers and OPEC