Tax rise needed for NHS: where does our money go?

Higher taxation is only way to keeping struggling health service afloat, warns think tank

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Taxes may have to rise to historically high levels in order to protect the future of the NHS, according to a new study from the Institute for Fiscal Studies (IFS).

The report warns that every British household will need to pay an extra £2,000 a year in tax, to help the healthcare service cope with unprecedented demand and an ageing population.

Both the IFS and The Health Foundation, which also worked on the study, believe high taxation is the only option to prevent a decline in the NHS, celebrating its 70th anniversary this year.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

“UK spending on healthcare will have to rise by an average 3.3% a year over the next 15 years just to maintain NHS provision at current levels, and by at least 4% a year if services are to be improved,” the report says.

Niall Dickson, chief executive of the NHS Confederation, which commissioned the report and represents 85% of NHS bodies, said: “This report is a wake-up call. And its message is simple - if we want good, effective and safe services, we will have to find the resources to pay for them.

“The scale of what we face is not widely understood. Over the next 15 years in the UK, there will be four million more people over 65, and the prospect of a 40% increase in hospital admissions and further large increases in the number of people with numerous long-term conditions.”

Meanwhile, The Spectator reports that Theresa May has decided to increase the NHS’s budget by 3% a year for each of the remaining four years of this Parliament.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

The news magazine claims that the prime minister has overridden Chancellor Philip Hammond’s concerns that such large sums would be difficult to afford.

But the IFS and Health Foundation study suggests that even this increase may not be enough, with the resources needed far outstripping any tax pledges, says The Guardian.

The joint report says that over the past 70 years, spending on the NHS “had been paid for by reduced spending on defence, housing and debt interest”, but warns that “none of those alternative sources of income would be available in the future”.

Instead, the money would have to be found from the three main sources of government revenue: income tax, VAT or national insurance.

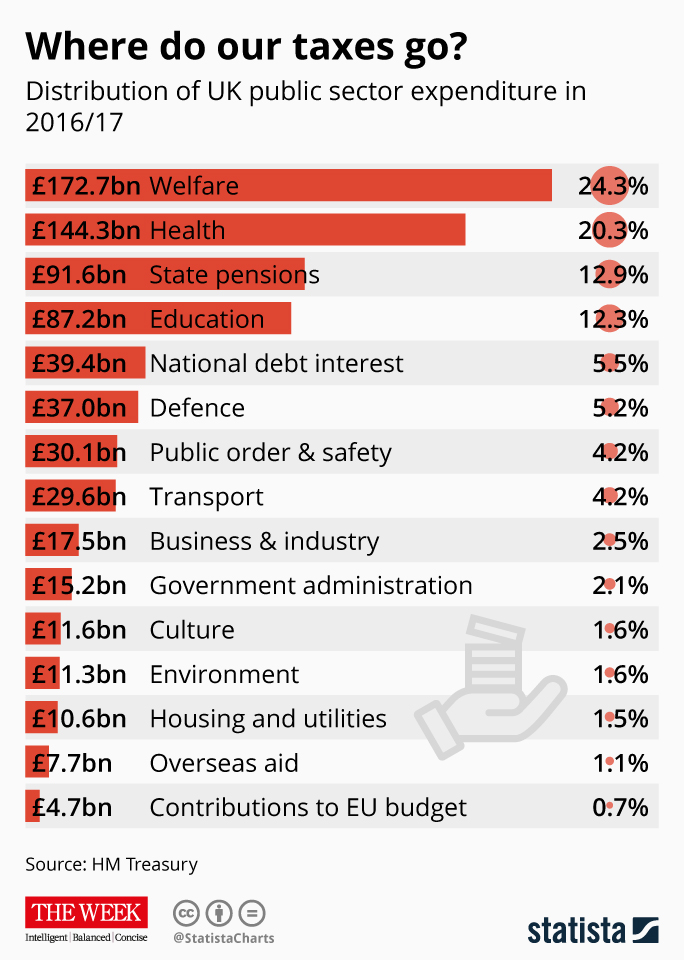

So, where do our taxes go?

For the past four years, the government has sent an annual summary to each household to show how their payments of income taxes and National Insurance have been spent.

According to the most recent figures, health spending is second only to welfare in terms of the distribution of public sector expenditure.

In 2016-17, the authorities spent £172.7bn on welfare, which amounts to 24.3% of public spending. Other areas of big spending include £91.6bn on state pensions and £39.4bn on servicing the national debt. Overseas aid, meanwhile, accounts for just 1.1% of public sector expenditure each year.

Infographic provided for The Week by Statista

-

The Olympic timekeepers keeping the Games on track

The Olympic timekeepers keeping the Games on trackUnder the Radar Swiss watchmaking giant Omega has been at the finish line of every Olympic Games for nearly 100 years

-

Will increasing tensions with Iran boil over into war?

Will increasing tensions with Iran boil over into war?Today’s Big Question President Donald Trump has recently been threatening the country

-

Corruption: The spy sheikh and the president

Corruption: The spy sheikh and the presidentFeature Trump is at the center of another scandal

-

How corrupt is the UK?

How corrupt is the UK?The Explainer Decline in standards ‘risks becoming a defining feature of our political culture’ as Britain falls to lowest ever score on global index

-

The Mandelson files: Labour Svengali’s parting gift to Starmer

The Mandelson files: Labour Svengali’s parting gift to StarmerThe Explainer Texts and emails about Mandelson’s appointment as US ambassador could fuel biggest political scandal ‘for a generation’

-

Three consequences from the Jenrick defection

Three consequences from the Jenrick defectionThe Explainer Both Kemi Badenoch and Nigel Farage may claim victory, but Jenrick’s move has ‘all-but ended the chances of any deal to unite the British right’

-

The high street: Britain’s next political battleground?

The high street: Britain’s next political battleground?In the Spotlight Mass closure of shops and influx of organised crime are fuelling voter anger, and offer an opening for Reform UK

-

The MAGA civil war takes center stage at the Turning Point USA conference

The MAGA civil war takes center stage at the Turning Point USA conferenceIN THE SPOTLIGHT ‘Americafest 2025’ was a who’s who of right-wing heavyweights eager to settle scores and lay claim to the future of MAGA

-

Is a Reform-Tory pact becoming more likely?

Is a Reform-Tory pact becoming more likely?Today’s Big Question Nigel Farage’s party is ahead in the polls but still falls well short of a Commons majority, while Conservatives are still losing MPs to Reform

-

What does the fall in net migration mean for the UK?

What does the fall in net migration mean for the UK?Today’s Big Question With Labour and the Tories trying to ‘claim credit’ for lower figures, the ‘underlying picture is far less clear-cut’

-

Will Rachel Reeves’ tax U-turn be disastrous?

Will Rachel Reeves’ tax U-turn be disastrous?Today’s Big Question The chancellor scraps income tax rises for a ‘smorgasbord’ of smaller revenue-raising options