How the GOP can blow the 2016 election: Promise tax cuts for the rich again

If Republicans want to cut taxes, they'll need to ensure the middle class directly benefits this time

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The midterms are over, meaning the 2016 White House race has begun. Here's my bold prediction: Almost all the GOP presidential contenders will offer a big tax-cut plan.

Of course they will.

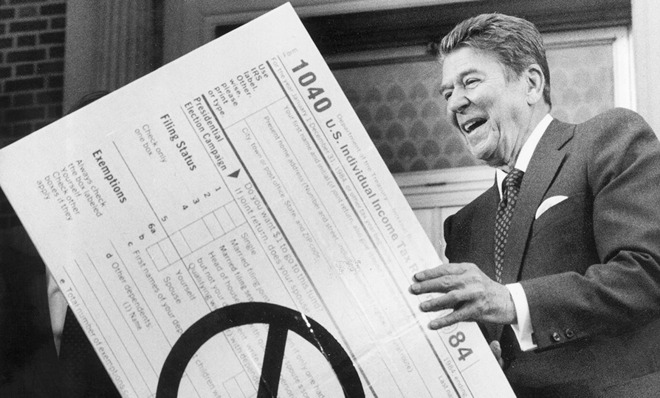

Income tax cuts have been the defining issue of the modern Republican Party since the 1980 election of Ronald Reagan. As conservative political reporter Robert Novak once declared, "God put the Republican Party on earth to cut taxes. If they don't do that, they have no useful function."

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

And if history is a reliable guide, most of those tax-cut plans will focus on cutting personal taxes so the richest Americans pay dramatically less to Uncle Sam. For instance: The 1 percent would have paid $150,000 a year less under Mitt Romney's plan in 2012, $238,000 less under Herman Cain's "9-9-9" plan, and $340,000 under New Gingrich's flat-tax plan. More recently, incoming House Ways and Means Chairman Paul Ryan has produced budgets lowering the top rate — currently 40 percent — to 25 percent, which would be its lowest level since the 1920s Coolidge administration. Americans might naturally conclude that the GOP's big, bold agenda for boosting economic growth, job creation, and middle-class incomes begins with letting the rich keep more of what they make.

And sometimes lowering top tax rates is pretty important, like back in 1980 when the top marginal rate was 70 percent. Even President Barack Obama has acknowledged, in his book The Audacity of Hope, that slashing the rate then was probably a good idea. But as an economic strategy today, such rate cuts are problematic.

First, there's little evidence they will supercharge the economy. Modeling of a recent plan put forward by Rep. Dave Camp (R-Mich.), the outgoing Ways and Means chairman, suggests it would increase the economy's size by less than 1 percent over a decade. Second, the income gains from modestly faster growth might not reach the middle class, where after-tax income has been stagnant for nearly a decade. The Congressional Budget Office recently found that top income growth has been five times faster than middle-income growth over the past 30 years.

Finally, sharply cutting top rates will lose the government trillions in revenue at a time the national debt is at historically high levels — unless, that is, lots of tax breaks are also eliminated. But many of those — such as the Earned Income Tax Credit — benefit middle- and working-class Americans, which is why more than 40 percent pay no federal income taxes, according to the Tax Policy Center.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Surely Republicans wouldn't raise taxes on the beleaguered middle to help pay for high-end tax cuts? Some might. Recently Stephen Moore, chief economist at the GOP-aligned Heritage Foundation, argued that tax reform should "ensure that everyone — except the very poor — pays at least some income tax." Keep in mind that according to the 2012 exit polls, Mitt Romney lost to Obama 86 percent to 16 percent among voters who most valued empathy in their presidential pick. Is the party shooting for 100-0 next time around? Hillary Clinton would like to know.

If Republicans want to cut income taxes, they should make sure the middle class directly benefits — even if some rich people pay more as an offset.

A plan put forward by Senators Mike Lee (R-Utah) and Marco Rubio (R-Fla.) would expand the child tax credit and apply it against both income and payroll taxes, the latter of which is what really hits most lower- and middle-income families. A more targeted plan from American Enterprise Institute economist John Makin would focus on cutting payroll taxes for households earning less than the median income, or about $52,000 per year. Such measures could be a key part of a pro-growth, pro-middle class agenda that also includes making a college education and health insurance coverage more affordable, and expanding income subsidies for low-skill workers. Oh, and cutting business taxes, too, since workers part at least part of that burden.

The GOP needs a new "useful function" — helping middle-class class and poor Americans climb the opportunity ladder.

James Pethokoukis is the DeWitt Wallace Fellow at the American Enterprise Institute where he runs the AEIdeas blog. He has also written for The New York Times, National Review, Commentary, The Weekly Standard, and other places.