Student loan rates are doubling while Congress goes on vacation

Lawmakers are heading home for recess without reaching a deal to avert a hike in student loan interest rates

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Congressional inaction will result in the interest rate on future government-backed student loans doubling come Monday, costing the average borrower an additional $2,600 over the life of a 10-year loan.

Should Congress fail to reach a compromise deal before breaking Friday for a summer recess — a near certainty — the interest rate on new federal loans will jump from 3.4 percent to 6.8 percent. It's expected that some 7 million students will take out those loans before the next school year.

Though Congress has squabbled intensely over the issue this session, the flap actually dates back to 2007, when lawmakers struck a deal to keep the interest rates on Direct Stafford Loans at 3.4 percent. That rate was set to expire last summer, but Democrats, effectively leveraging the unusual dynamic of election year politics, pressured Republicans to join them in extending that rate for one more year.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

With the rate again slated to rise this summer, Democrats, Republicans, and President Obama all offered competing suggestions for how to avert a rate hike. Despite the looming deadline, though, no side would budge.

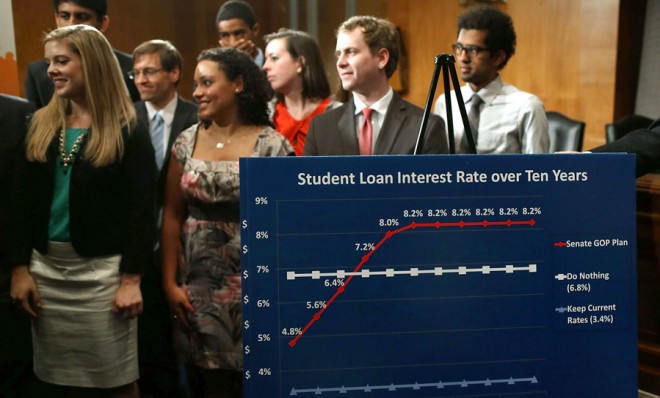

Congressional Democrats proposed a two-year extension of the existing rate, to be offset by closing loopholes in the tax code. President Obama suggested tying rates to the yield on 10-year Treasury notes, plus one percent, and locking those rates in place for the lifetime of loans. Republicans wanted to tie the rates to the same Treasury notes, plus 2.5 percent, and allow them to fluctuate with the whims of the market. The Republican plan also proposed capping the rates at 8.5 percent.

The GOP-backed plan passed the House back in May, but went nowhere in the Senate over Democratic objections that the variable rate could wind up hurting students down the road. Yet unlike last year, Republicans refused to back down this time, claiming the divide between Obama and his fellow Democrats in Congress was the real roadblock to a deal.

A last-minute attempt by Democrats to strike a compromise between the competing plans collapsed this week, and with Obama now touring Africa, no deal will be struck before the break.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

With the rates set to spike, Democrats and Republicans devolved into a game of finger-pointing on social media, with competing PR campaigns adopting the same Twitter hashtag #DontDoubleMyRate to blame the other side.

House Speaker John Boehner (R-Ohio), who has repeatedly pointed out that Republicans already passed a bill that, like Obama's suggested plan, tied interest rates to the Treasury, on Friday blamed Democratic "scorn and inaction" for the failure.

"Millions of American students and their families are about to pay the price for the stubbornness and partisanship of Senate Democratic leaders," he said in a press release. "It is stunning that Senate Democrats would leave town having done nothing to prevent interest rates on college loans from doubling."

Democrats leaders have said they are hopeful they can forge some deal — which would retroactively apply a lower rate — once Congress reconvenes in July, though there is no guarantee they'll be able to secure such a compromise.

Jon Terbush is an associate editor at TheWeek.com covering politics, sports, and other things he finds interesting. He has previously written for Talking Points Memo, Raw Story, and Business Insider.