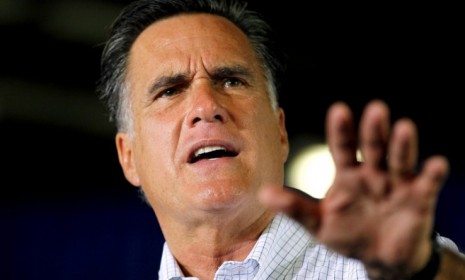

The ObamaCare ruling: Is Mitt Romney caught in a tax trap?

The GOP candidate is attacking the individual mandate outlined under President Obama's health care law, while defending the one he pushed through in Massachusetts

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Mitt Romney is under fire from the Left and the Right for his campaign's reaction to the Supreme Court decision upholding ObamaCare based on Congress' power to tax. Conservative critics went ballistic after Romney strategist Eric Fehrnstrom told MSNBC on Monday that the Republican presidential candidate agrees with President Obama, who says the fine for people who defy the individual mandate to buy health insurance is a penalty, not a tax. Then Romney, who imposed his own health insurance mandate in Massachusetts as governor, said that his state's fine isn't a tax, but Obama's is, prompting Democrats to call him a flip-flopper. How big of a problem is this "tax trap" for Romney?

Mitt will face a Tea Party revolt if he eases up on "ObamaTax": Mitt needs to get his act together, fast, says Joel B. Pollak at Breitbart. The Tea Party is willing to set aside its doubts about Romney's moderate record and rally to his side to defeat the health law, which the Supreme Court exposed as a massive "ObamaTax" on the middle class. But if Romney's not willing to fight for what the Right stands for, fiscal conservatives are going to demand that he "give up and let someone else do it."

"Conservatives to Mitt: Quit now if you won't fight ObamaTax!"

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Focusing on the tax penalty makes Romney look pathetic: Romney imposed an individual mandate with a tax penalty before Obama did, says Jed Lewison at Daily Kos. So "to call the mandate a middle-class tax hike is a ridiculous piece of spin by Romney" that makes him look like a flip-flopper. It's a huge "tactical error" to get sucked into this silly conservative hair-splitting. Anyone whose mind isn't made up on the Affordable Care Act is going to judge it on the benefits it delivers, not semantics.

"Mitt reflips, says the individual mandate is a tax after all"

Calling a truce might work... and it might not: Slamming ObamaCare as a tax could be a potent weapon for Romney, says Josh Kraushaar at National Journal, given how poorly ObamaCare polls, and how effectively it motivates conservatives. Yet Romney appears to be "calling a ceasefire" because of his own health-care record, and he doesn't want to divert attention from his focus on the economy. That play-it-safe approach might work if the economy "continues to sputter"; otherwise Romney could be guaranteeing his own defeat.

"Romney campaign declaring cease fire on health care"

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Read more political coverage at The Week's 2012 Election Center.

-

Corruption: The spy sheikh and the president

Corruption: The spy sheikh and the presidentFeature Trump is at the center of another scandal

-

Putin’s shadow war

Putin’s shadow warFeature The Kremlin is waging a campaign of sabotage and subversion against Ukraine’s allies in the West

-

Media: Why did Bezos gut ‘The Washington Post’?

Media: Why did Bezos gut ‘The Washington Post’?Feature Possibilities include to curry favor with Trump or to try to end financial losses

-

The billionaires’ wealth tax: a catastrophe for California?

The billionaires’ wealth tax: a catastrophe for California?Talking Point Peter Thiel and Larry Page preparing to change state residency

-

Bari Weiss’ ‘60 Minutes’ scandal is about more than one report

Bari Weiss’ ‘60 Minutes’ scandal is about more than one reportIN THE SPOTLIGHT By blocking an approved segment on a controversial prison holding US deportees in El Salvador, the editor-in-chief of CBS News has become the main story

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred