Issue of the week: Bracing for a recession

Now even President Bush has dropped his sunny economic outlook, said Sheryl Gay Stolberg and David M. Herszenhorn in The New York Times. Just days after the government reported that the jobless rate last month jumped sharply to 5 percent from 4.7 percent,

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Now even President Bush has dropped his sunny economic outlook, said Sheryl Gay Stolberg and David M. Herszenhorn in The New York Times. Just days after the government reported that the jobless rate last month jumped sharply to 5 percent from 4.7 percent, Bush acknowledged in a speech to business leaders this week that the U.S. faces “economic challenges” and that “we cannot take growth for granted.” Other administration officials sounded even less upbeat. Treasury Secretary Henry Paulson said that home

prices had yet to hit bottom, a point bolstered by a new report indicating that pending home sales fell 2.6 percent in November. Although Bush stopped short of warning that a recession looms, outside economists were less cautious, said Greg Robb in Marketwatch.com. At the annual meeting of American Economics Association in New Orleans, many economists “spoke of a recession almost as a given.”

What economy are these guys looking at? said Larry Kudlow in National Review Online. Disposable income is rising strongly, the latest auto sales report is encouraging, and “even holiday sales have surprised on the upside.” At the same time, though, the corporate sector is sending some worrisome signals. Prices for raw materials and energy are rising, and “that

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

spells weakening profits.” To help companies weather this rough patch, the Fed should lower interest rates by a half-point at its Jan. 30 meeting. “A big-bang rate cut would help businesses, consumers, and mortgage owners.” At the same time, policymakers should cool the talk of recession, which can become a self-fulfilling prophecy. This economy isn’t running aground. It just needs “a bit of help.”

That’s what I thought six weeks ago, said former Treasury Secretary Lawrence Summers in the Financial Times. But as evidence of a slowdown mounts, the debate now isn’t really over whether a recession will occur but how severe it will be. So it’s time to consider a different question: Can interest rate cuts alone restore the economy to health, or should Congress and the White House seek other remedies? I would argue for measures aimed at stimulating the economy, such as a one-time tax rebate, along with emergency steps to help the worst off, such as an extension of unemployment benefits. But whatever the stimulus measures, the key is to implement them quickly—before “the necessity of even greater ones has been unambiguously established by further pain.”

Whatever policymakers do, election-year politics will loom large, said John McKinnon and Damian Paletta in The Wall Street Journal. Congressional Democrats are already working on a stimulus plan, “putting pressure on the White House as it mulls a plan of its own.” New York Democratic Sen. Charles Schumer, for instance, favors “steps that will give lower- and middle-income consumers more confidence and more money to spend,” possibly including tax relief. The White House seems to be leaning toward tax cuts for business and the well-off. But both sides risk going overboard to score political points. “Once you start the discussion over taxes,” warns former Federal Reserve economist Vincent Reinhart, “you’re not sure how it ends.”

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

6 gorgeous homes in warm climes

6 gorgeous homes in warm climesFeature Featuring a Spanish Revival in Tucson and Richard Neutra-designed modernist home in Los Angeles

-

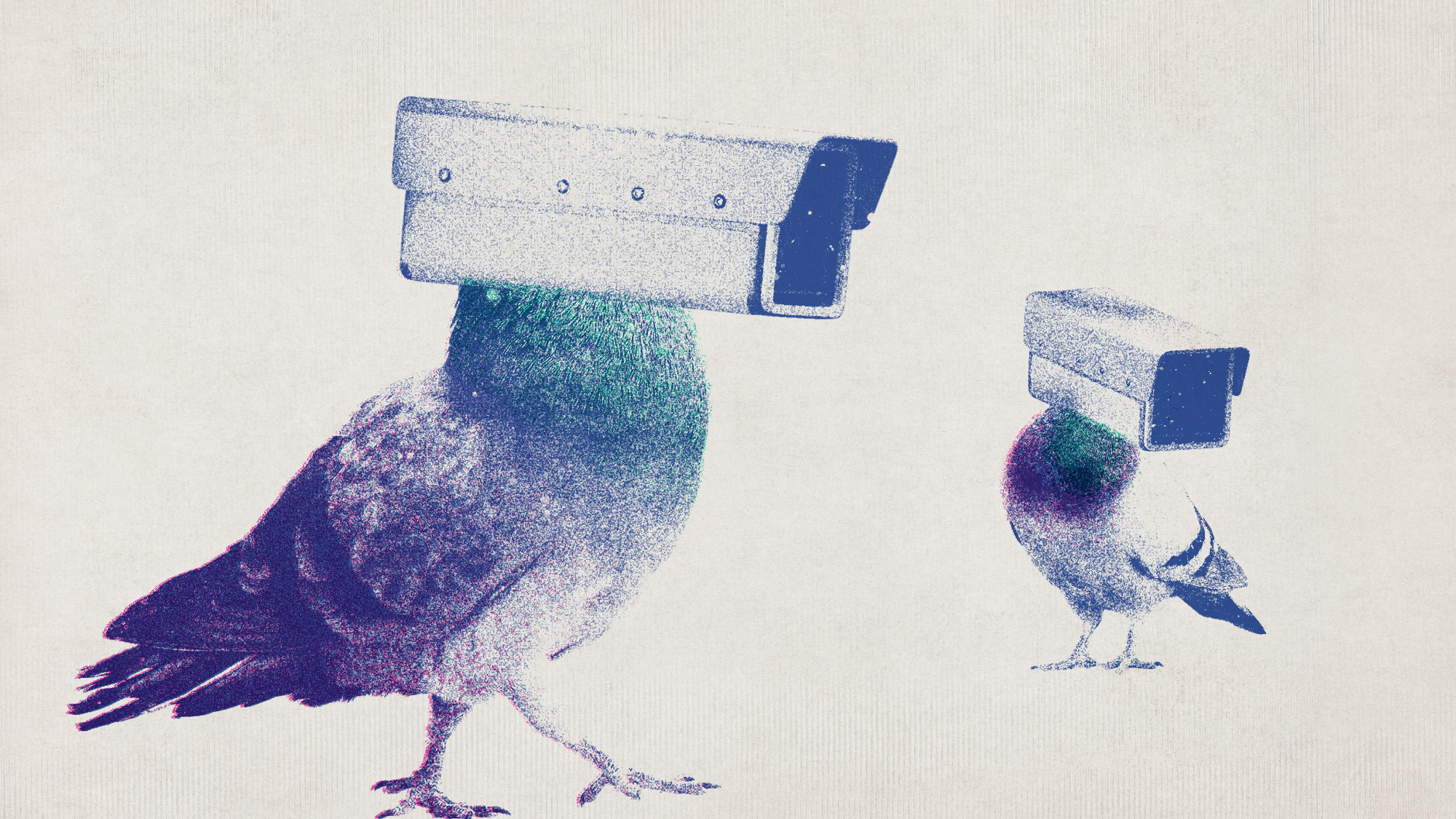

Russia’s ‘cyborg’ spy pigeons

Russia’s ‘cyborg’ spy pigeonsUnder the Radar Moscow neurotech company with Kremlin-linked funding claims to implant neural chips in birds’ brains to control their flight, and create ‘bio-drones’

-

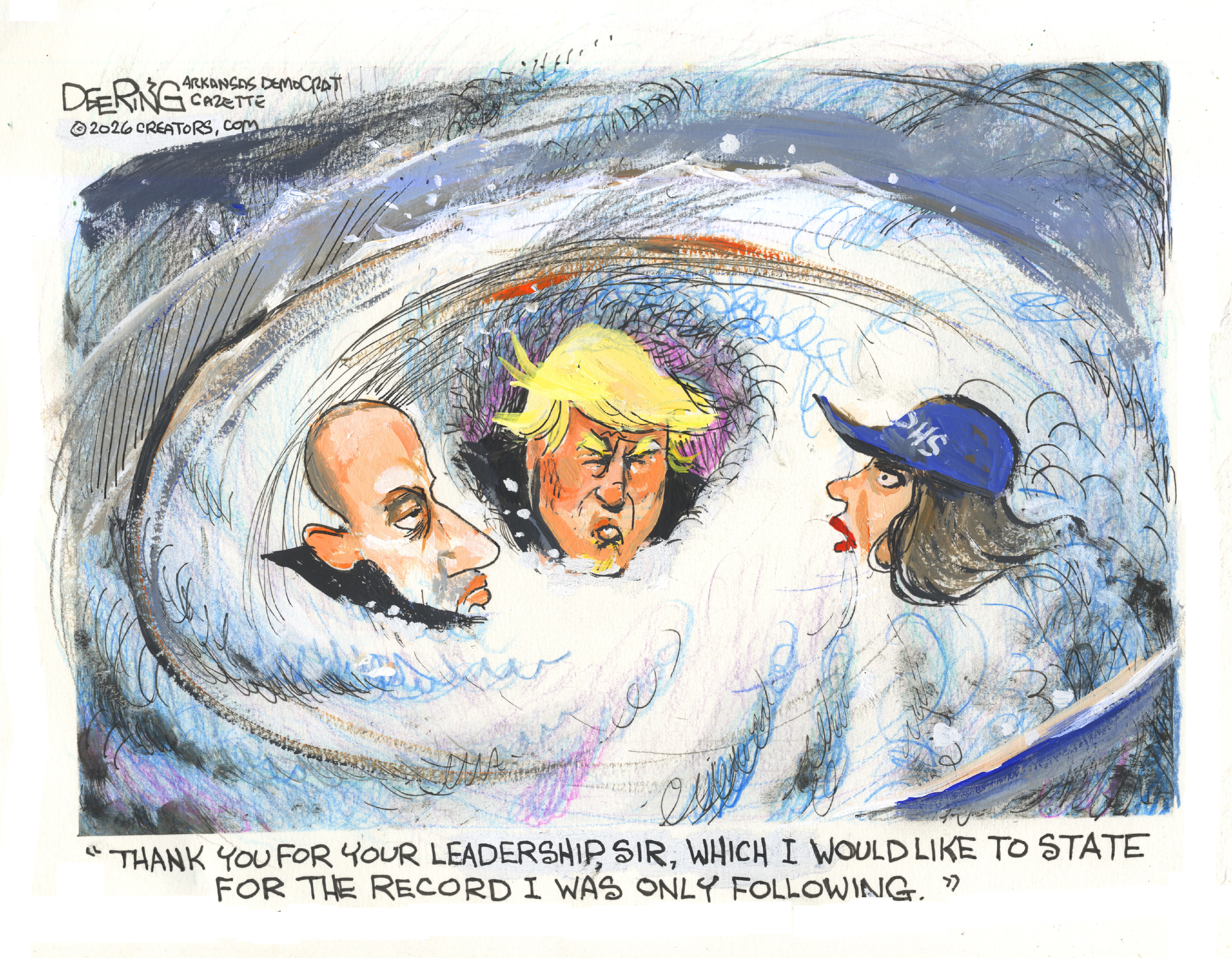

Political cartoons for February 8

Political cartoons for February 8Cartoons Sunday’s political cartoons include going down the drain, American history, and more

-

The billionaires’ wealth tax: a catastrophe for California?

The billionaires’ wealth tax: a catastrophe for California?Talking Point Peter Thiel and Larry Page preparing to change state residency

-

Bari Weiss’ ‘60 Minutes’ scandal is about more than one report

Bari Weiss’ ‘60 Minutes’ scandal is about more than one reportIN THE SPOTLIGHT By blocking an approved segment on a controversial prison holding US deportees in El Salvador, the editor-in-chief of CBS News has become the main story

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred