The death of Abenomics was greatly exaggerated

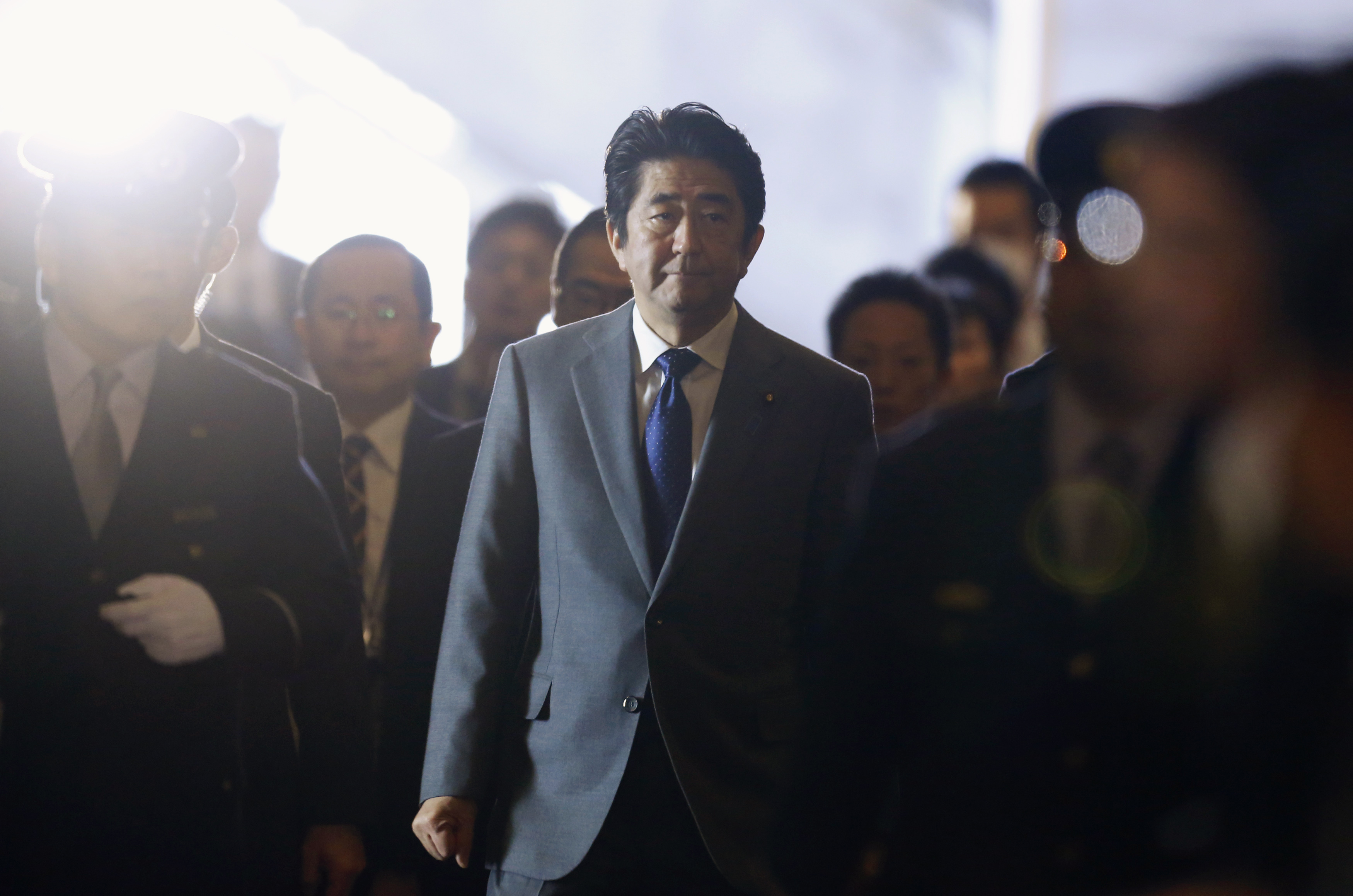

Just months ago, Shinzo Abe's signature economics policy was widely decried as an epic failure. Now it's proving the naysayers wrong — again.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The world seems to be slowly crawling its way out of its mini-depression, but it certainly doesn't feel like the global economy is firing on all cylinders. How do we get there?

A key country to watch is Japan.

Japan's economic policy, known as Abenomics, after Prime Minister Shinzo Abe, is a bet that monetary policy can reverse Japan's now multi-decade stagnation.

Article continues belowThe Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

This is important for two reasons: first, because central banks have not emerged from this last chapter of economic history looking very good. Yes, they almost certainly averted complete disaster, but they also have been seemingly unable to promote a strong recovery. If Japan can pull it off, that means central banks can too. Second, because while Japan — with its slowing demography, stagnating population, and zero-percent interest rate policy — looks like a global oddity, that is the direction in which much of the world seems to be headed. If we're going to end up in the same situation as Japan, then it becomes very important to see if it can revive its economy.

Well, what are the results?

One thing is for certain: Abenomics has boosted the stock market like nothing else. But nobody doubts that by buying up a bunch of assets, the central bank can lift asset prices. The question is: Can it boost monetary creation in the real economy so that the country is kicked out of its deflationary cycle and growth picks up?

The answer, increasingly, seems to be yes.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Japan spent the last couple quarters in a recession. A lot of people said Abenomics didn't work. That was wrong, firstly, because the recession was due to a VAT increase that certainly wasn't part of the original plan of Abenomics. But secondly, the recession was really only an accounting recession. Technically, GDP shrunk, but unemployment didn't go up and all other economic indicators pretty much stayed okay.

But this quarter, Japan's economic numbers look good.

Japan is officially out of recession. Its GDP numbers are up. More importantly, its nominal GDP — GDP without inflation — is up and steady. This is important, because it suggests that the central bank's actions are having the desired effect. Japan's problem is that it is stuck in a deflationary trap. If nominal GDP is growing, then it suggests that it might get out.

But the more important question is whether that growth can translate to wage growth, which would really be what would kick off a true recovery. Once Japanese workers make more money, they will spend more, helping Japan escape the deflationary trap for good and igniting a real recovery. On that front, unemployment keeps going down, and measured by the job openings-to-applicants ratio, Japan's labor market is tighter than it has been in a very, very long time.

All of these indicators suggest that Abenomics is proceeding nicely. Maybe Japan really will leave stagnation behind. If so, that's a prospect we should all cheer.

Pascal-Emmanuel Gobry is a writer and fellow at the Ethics and Public Policy Center. His writing has appeared at Forbes, The Atlantic, First Things, Commentary Magazine, The Daily Beast, The Federalist, Quartz, and other places. He lives in Paris with his beloved wife and daughter.