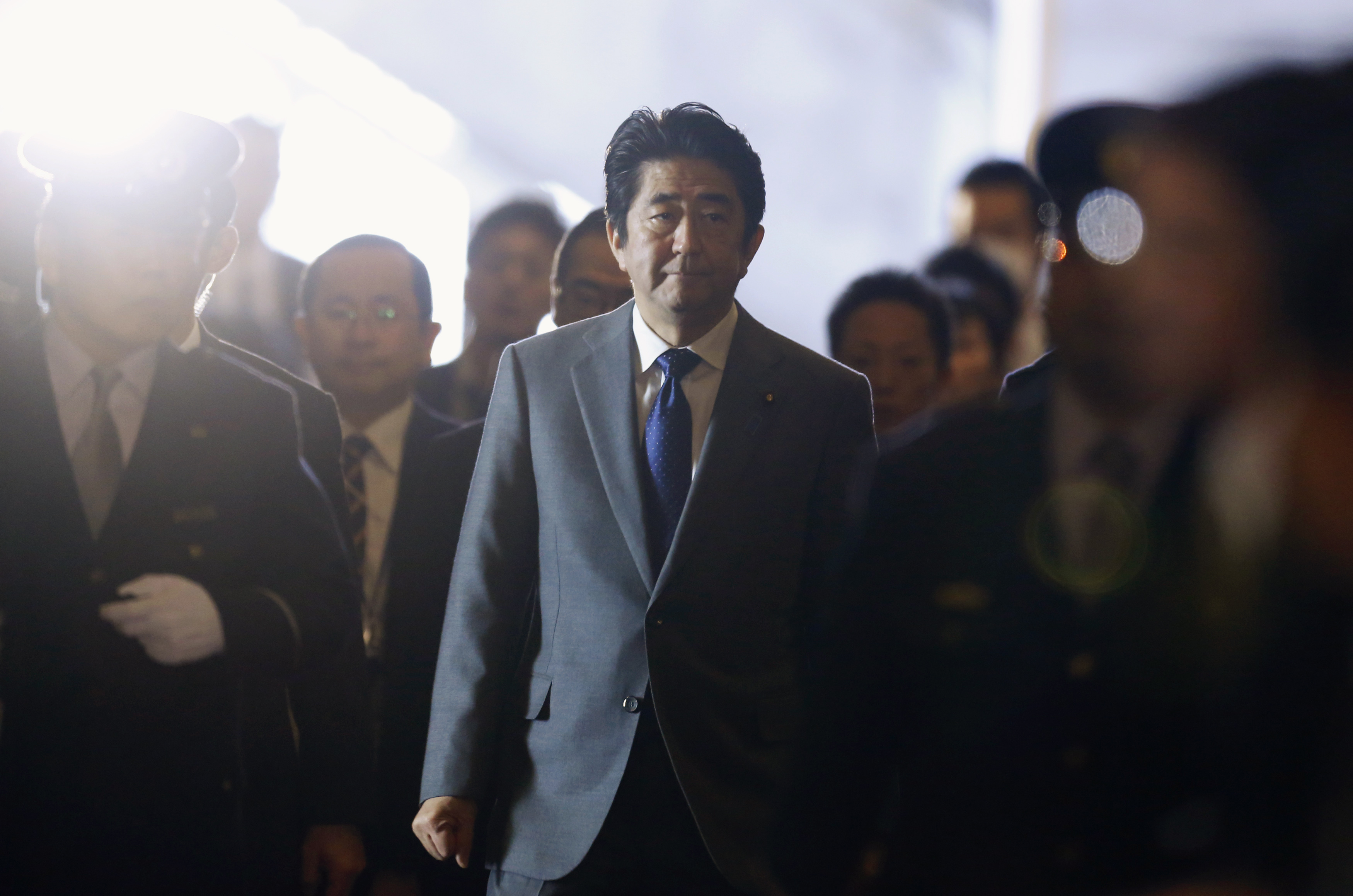

The death of Abenomics was greatly exaggerated

Just months ago, Shinzo Abe's signature economics policy was widely decried as an epic failure. Now it's proving the naysayers wrong — again.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The world seems to be slowly crawling its way out of its mini-depression, but it certainly doesn't feel like the global economy is firing on all cylinders. How do we get there?

A key country to watch is Japan.

Japan's economic policy, known as Abenomics, after Prime Minister Shinzo Abe, is a bet that monetary policy can reverse Japan's now multi-decade stagnation.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

This is important for two reasons: first, because central banks have not emerged from this last chapter of economic history looking very good. Yes, they almost certainly averted complete disaster, but they also have been seemingly unable to promote a strong recovery. If Japan can pull it off, that means central banks can too. Second, because while Japan — with its slowing demography, stagnating population, and zero-percent interest rate policy — looks like a global oddity, that is the direction in which much of the world seems to be headed. If we're going to end up in the same situation as Japan, then it becomes very important to see if it can revive its economy.

Well, what are the results?

One thing is for certain: Abenomics has boosted the stock market like nothing else. But nobody doubts that by buying up a bunch of assets, the central bank can lift asset prices. The question is: Can it boost monetary creation in the real economy so that the country is kicked out of its deflationary cycle and growth picks up?

The answer, increasingly, seems to be yes.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Japan spent the last couple quarters in a recession. A lot of people said Abenomics didn't work. That was wrong, firstly, because the recession was due to a VAT increase that certainly wasn't part of the original plan of Abenomics. But secondly, the recession was really only an accounting recession. Technically, GDP shrunk, but unemployment didn't go up and all other economic indicators pretty much stayed okay.

But this quarter, Japan's economic numbers look good.

Japan is officially out of recession. Its GDP numbers are up. More importantly, its nominal GDP — GDP without inflation — is up and steady. This is important, because it suggests that the central bank's actions are having the desired effect. Japan's problem is that it is stuck in a deflationary trap. If nominal GDP is growing, then it suggests that it might get out.

But the more important question is whether that growth can translate to wage growth, which would really be what would kick off a true recovery. Once Japanese workers make more money, they will spend more, helping Japan escape the deflationary trap for good and igniting a real recovery. On that front, unemployment keeps going down, and measured by the job openings-to-applicants ratio, Japan's labor market is tighter than it has been in a very, very long time.

All of these indicators suggest that Abenomics is proceeding nicely. Maybe Japan really will leave stagnation behind. If so, that's a prospect we should all cheer.

Pascal-Emmanuel Gobry is a writer and fellow at the Ethics and Public Policy Center. His writing has appeared at Forbes, The Atlantic, First Things, Commentary Magazine, The Daily Beast, The Federalist, Quartz, and other places. He lives in Paris with his beloved wife and daughter.

-

American universities are losing ground to their foreign counterparts

American universities are losing ground to their foreign counterpartsThe Explainer While Harvard is still near the top, other colleges have slipped

-

How to navigate dating apps to find ‘the one’

How to navigate dating apps to find ‘the one’The Week Recommends Put an end to endless swiping and make real romantic connections

-

Elon Musk’s pivot from Mars to the moon

Elon Musk’s pivot from Mars to the moonIn the Spotlight SpaceX shifts focus with IPO approaching

-

The pros and cons of noncompete agreements

The pros and cons of noncompete agreementsThe Explainer The FTC wants to ban companies from binding their employees with noncompete agreements. Who would this benefit, and who would it hurt?

-

What experts are saying about the economy's surprise contraction

What experts are saying about the economy's surprise contractionThe Explainer The sharpest opinions on the debate from around the web

-

The death of cities was greatly exaggerated

The death of cities was greatly exaggeratedThe Explainer Why the pandemic predictions about urban flight were wrong

-

The housing crisis is here

The housing crisis is hereThe Explainer As the pandemic takes its toll, renters face eviction even as buyers are bidding higher

-

How to be an ally to marginalized coworkers

How to be an ally to marginalized coworkersThe Explainer Show up for your colleagues by showing that you see them and their struggles

-

What the stock market knows

What the stock market knowsThe Explainer Publicly traded companies are going to wallop small businesses

-

Can the government save small businesses?

Can the government save small businesses?The Explainer Many are fighting for a fair share of the coronavirus rescue package

-

How the oil crash could turn into a much bigger economic shock

How the oil crash could turn into a much bigger economic shockThe Explainer This could be a huge problem for the entire economy