How the Federal Reserve could affect the 2016 presidential election

If the central bank raises rates, the economy could become a headache for Democrats

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The Federal Reserve's monetary policy is ostensibly all about economic performance. However, there is a very important political context, given the looming 2016 election. If the Fed hikes its benchmark interest rate too soon, thus over-restricting access to credit and slowing economic growth, it could very well throw the election to the party out of the White House, which in this case happens to be the Republican Party.

On the economic fundamentals, the case for an imminent rate hike has crumbled to bits. The usual justification is that the Fed must move to keep ahead of inflation, but inflation has been too low and is trending down. Employment and growth, meanwhile, have not come anywhere close to recovering from the Great Recession. And any argument that the Fed should act to restrain excess euphoria in the markets was just rendered moot by serious jitters in markets across the globe.

Is it possible that the Fed could raise rates out of political preference? A great deal of research has demonstrated that economic health is one of the most important factors determining whether the incumbent party will hold power (the other being whether the country is losing a war). Run for re-election during a bad recession, as Jimmy Carter did, and you'll likely lose. Run during a boom, as Ronald Reagan did, and you'll likely win — even though on the merits Carter's economic record was arguably better.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Once a Federal Reserve chair is confirmed, there is vanishingly little the president, or anyone else, can do about the chair's policy decisions. So if the chair wanted to sandbag the economy for the next year or two, thus all but guaranteeing Republican victory in 2016, there would basically be no stopping her.

Janet Yellen is by all accounts a scrupulously honest bureaucrat, and I'm sure she would be stunned and outraged were someone to accuse her of taking political motivations into account when making monetary policy. Indeed, the whole point of central bank "independence" is to make sure that central bankers make policy free from the meddling hand of politicians seeking re-election, since political interference would supposedly lead to an immediate inflationary death spiral.

On its own, that's a dubious argument at best, since central bankers have their own ideologies and belief systems. But nobody seems to have thought of keeping nations free from the meddling hand of central bankers. And this isn't a theoretical concern — the European Central Bank helped execute what amounted to a coup d'etat in Italy when former Prime Minister Silvio Berlusconi floated the idea of leaving the eurozone.

The Fed has never done anything like that. However, the Supreme Court is also supposed to be a house of impartial judgment, and that didn't stop the court from handing the presidency to George W. Bush in 2000 in a blatantly partisan unsigned decision. When it comes to power, supposedly neutral technocrats have a long history of magically making their analysis line up with their political principles.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Again, I doubt Yellen or any of her colleagues on the Fed board would actively argue for slowing or strengthening the economy so as to install their favored political candidate in the White House. On the contrary, they seem concerned with preserving their image as boring, buttoned-down androids even at the expense of actually fulfilling their statutory obligations.

But it is simply impossible to avoid the fact that the decisions the Fed makes over the next year or so will have a dramatic effect on the election. If the Fed wants to preserve its vaunted independence, it can start by keeping it simple, and doing all it can to fulfill its mandate of creating jobs and actually hitting its inflation target.

Ryan Cooper is a national correspondent at TheWeek.com. His work has appeared in the Washington Monthly, The New Republic, and the Washington Post.

-

6 gorgeous homes in warm climes

6 gorgeous homes in warm climesFeature Featuring a Spanish Revival in Tucson and Richard Neutra-designed modernist home in Los Angeles

-

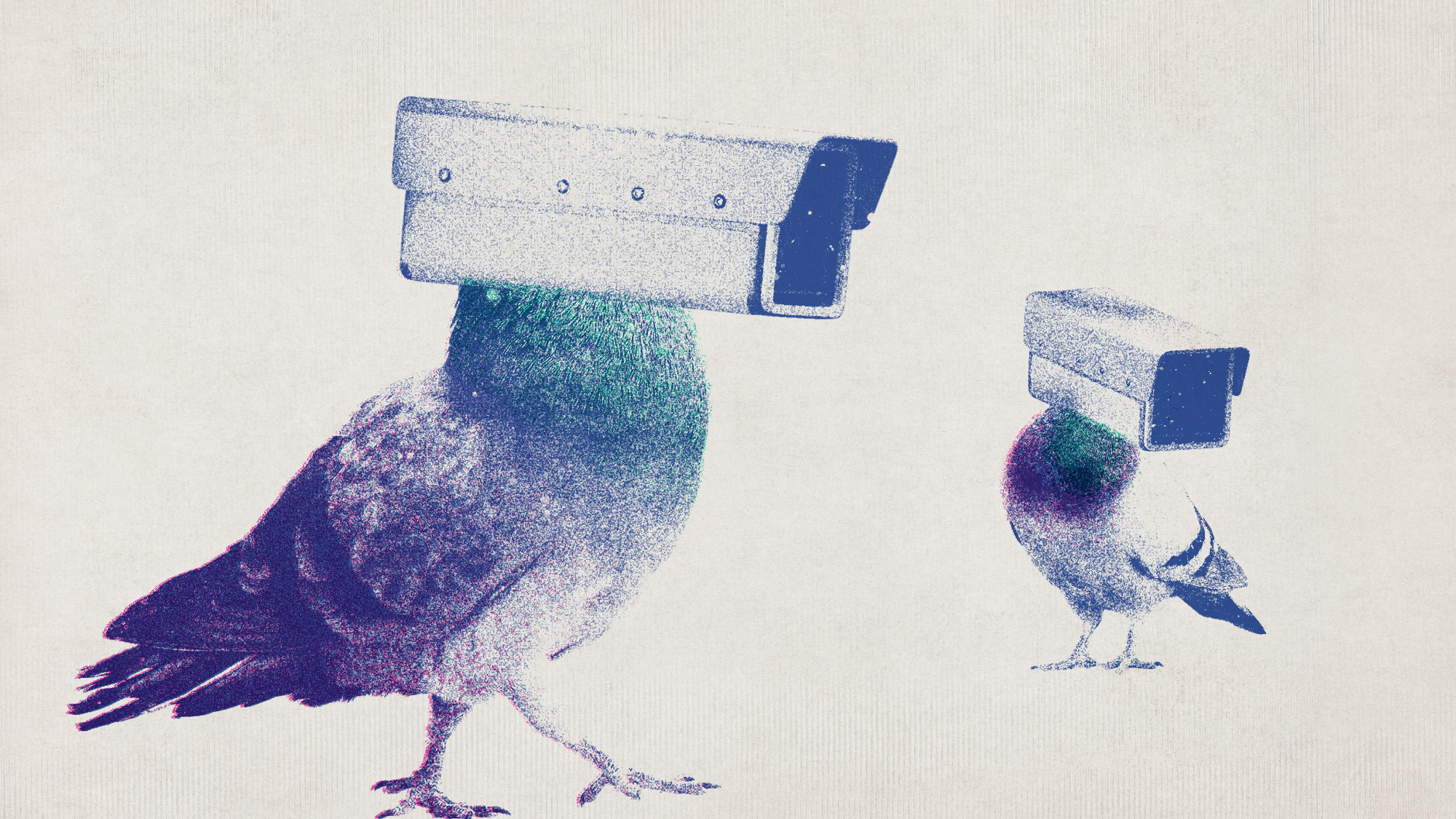

Russia’s ‘cyborg’ spy pigeons

Russia’s ‘cyborg’ spy pigeonsUnder the Radar Moscow neurotech company with Kremlin-linked funding claims to implant neural chips in birds’ brains to control their flight, and create ‘bio-drones’

-

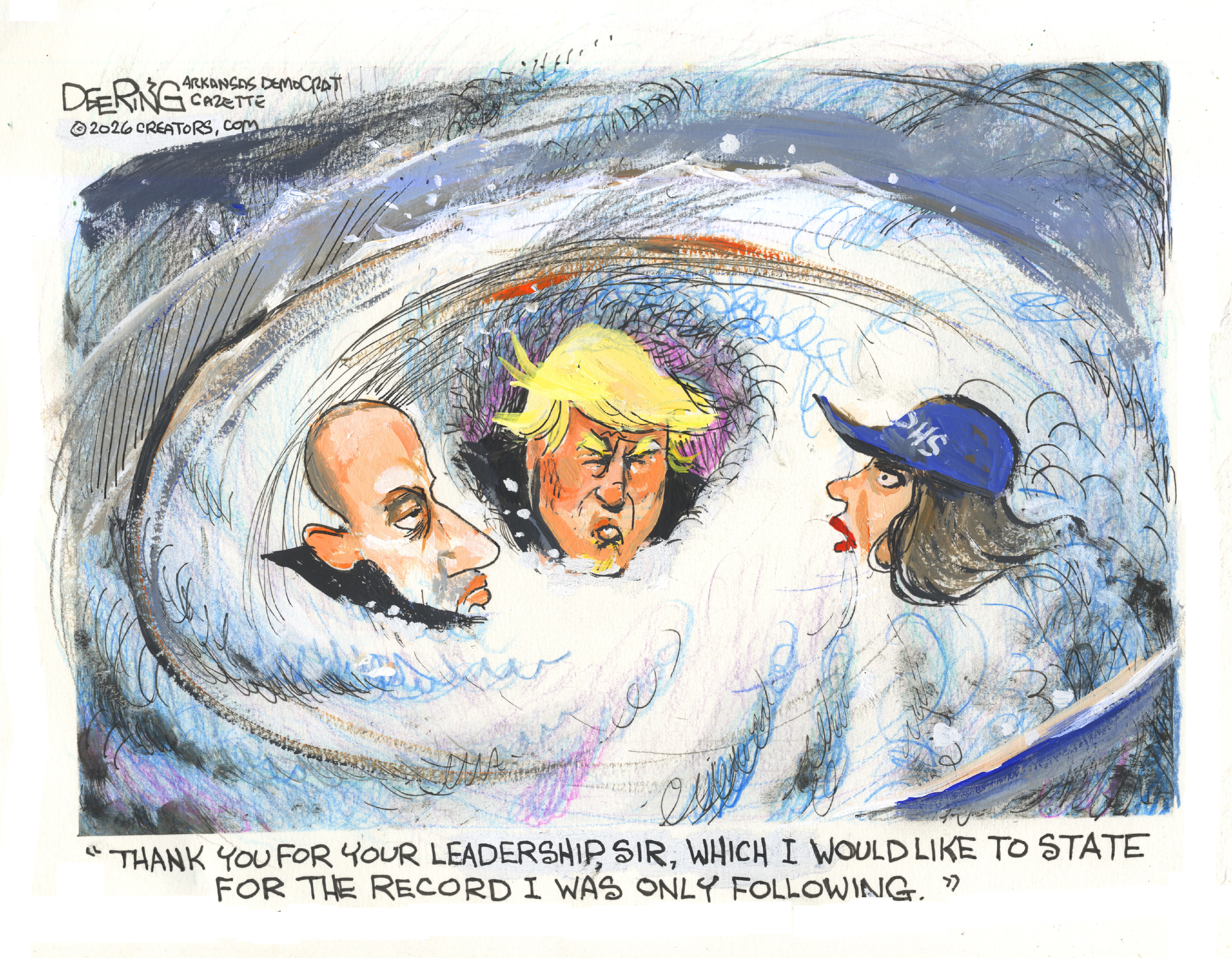

Political cartoons for February 8

Political cartoons for February 8Cartoons Sunday’s political cartoons include going down the drain, American history, and more

-

The billionaires’ wealth tax: a catastrophe for California?

The billionaires’ wealth tax: a catastrophe for California?Talking Point Peter Thiel and Larry Page preparing to change state residency

-

Bari Weiss’ ‘60 Minutes’ scandal is about more than one report

Bari Weiss’ ‘60 Minutes’ scandal is about more than one reportIN THE SPOTLIGHT By blocking an approved segment on a controversial prison holding US deportees in El Salvador, the editor-in-chief of CBS News has become the main story

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred