Jeb Bush's big tax plan has something for everyone

Bush's plan would be a boon to corporations, while throwing in a few goodies for the 47 percent

Jeb Bush will not be offering American voters a fantasy tax plan. Unfortunately, this is a detail too often worth noting when examining Republican tax ideas. Bush's economic blueprint, announced this week, doesn't replace the current income tax with a flat tax, a national sales tax, or some other tax based on a close reading of the biblical Book of Deuteronomy.

Rather, if you assembled a random group of smart, GOP-leaning economists and told them to cook up a plan to boost long-term economic growth, their recipe would likely resemble Bush's "Reform and Growth Act of 2017." Which is why the Bush plan kind of also looks like the Mitt Romney plan from 2012. Like Romney, Bush would reduce the top tax rate to 28 percent while also reducing corporate and investment tax rates. The theory here is that more investment would increase productivity and economic growth. One of the especially disappointing features of the current recovery has been the lack of business spending and weak productivity gains — at least as officially measured.

The Bush plan has a populist streak, though. The focus isn't solely on heroic entrepreneurs and multinational firms locked in cutthroat global competition. Bush would double the standard deduction taken by most of us, expand the Earned Income Tax Credit for childless workers, move some 15 million low-income Americans off the income tax rolls, and close the "carried interest" tax break for hedge-fund managers. Hey, 47 percent, he cares! To be fair, most politically successful Republican tax plans contain a mix of changes to improve economic incentives while providing direct tax relief for the broad middle class. That was the Reagan model, the Bush II model, and now apparently the Bush III model, too.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

But would the plan turn America's sluggish Two Percent Economy into a red-hot Four Percent Economy, as we had for a few years in the 1990s? That's the national economic goal Bush has been pushing, after all. The answer: probably not, at least by itself. Bush's own group of outside economic advisers concede as much. They calculate the tax changes would add roughly 0.5 percentage points of higher economic growth per year over the next decade, with regulatory reform tacking on another 0.3 points. So the Two Percent Economy becomes a Three Percent Economy. Short of Bush's goal but a big improvement. And as an addendum, the advisers offer, "Federal spending restraint, immigration, trade policy, energy policy, health care reform, and improvements to education and training will prove to be significant contributors to increase the economy's potential." So, fingers crossed.

Yet even if every Bush policy gets enacted as written or dreamed, sustained 4 percent growth might remain merely an aspirational goal. As I wrote back in June: "[A]bout half of U.S. growth in the postwar era has come from higher productivity, and half from a growing labor force. But American society is getting older and working less. Given much slower labor force growth, much higher productivity is needed to make up the difference. If productivity growth just stays at its postwar average — and it's been much slower lately — the economy's growth potential is much lower than in the past."

Boosting productivity is key, then. Tax and regulatory reform of the sort Bush proposes can surely help, but might take a while to reach full effect. Even if you believe, for instance, that the 1980s Reagan economic reforms were effective, productivity growth didn't accelerate for a decade or more after their enactment. And for the Bush reforms to even boost growth to 3 percent, much less 4 percent, they can't generate big budget deficits.

The Bush advisers say the plan would lose $1.2 trillion over a decade, assuming "strong" but "conservative" economic effects. Without spending cuts — which are a lot harder to achieve than tax cuts — the growth impact will be less. Too bad, then, that Bush wastes so much money on reducing personal income tax rates on the labor income of wealthier Americans. Cutting the top rate from 40 percent to 28 percent probably won't do a whole lot for growth relative to other reforms while losing billions.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

If only Bush's populist streak were a bit wider.

James Pethokoukis is the DeWitt Wallace Fellow at the American Enterprise Institute where he runs the AEIdeas blog. He has also written for The New York Times, National Review, Commentary, The Weekly Standard, and other places.

-

Metal-based compounds may be the future of antibiotics

Metal-based compounds may be the future of antibioticsUnder the radar Robots can help develop them

-

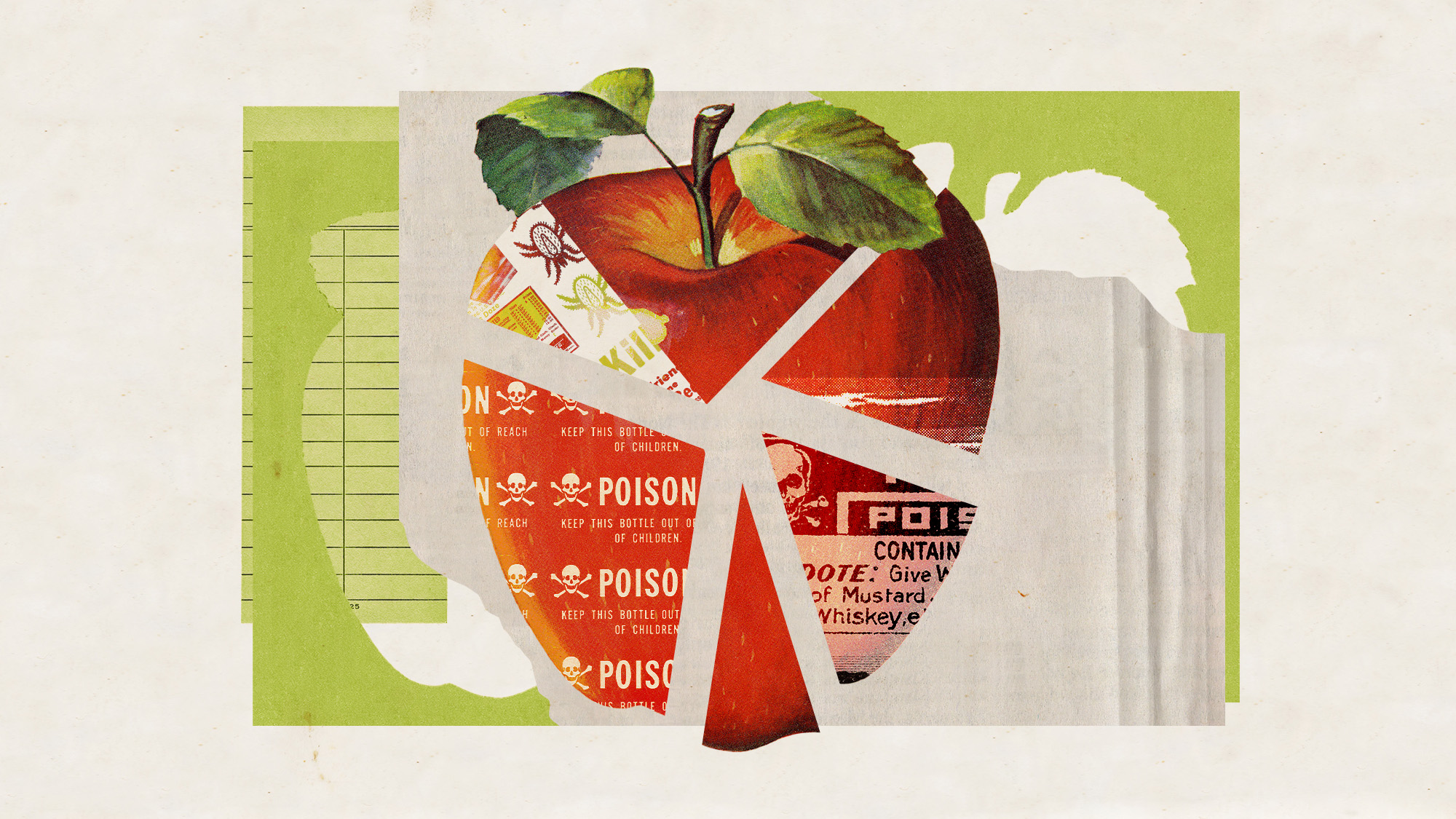

Europe’s apples are peppered with toxic pesticides

Europe’s apples are peppered with toxic pesticidesUnder the Radar Campaign groups say existing EU regulations don’t account for risk of ‘cocktail effect’

-

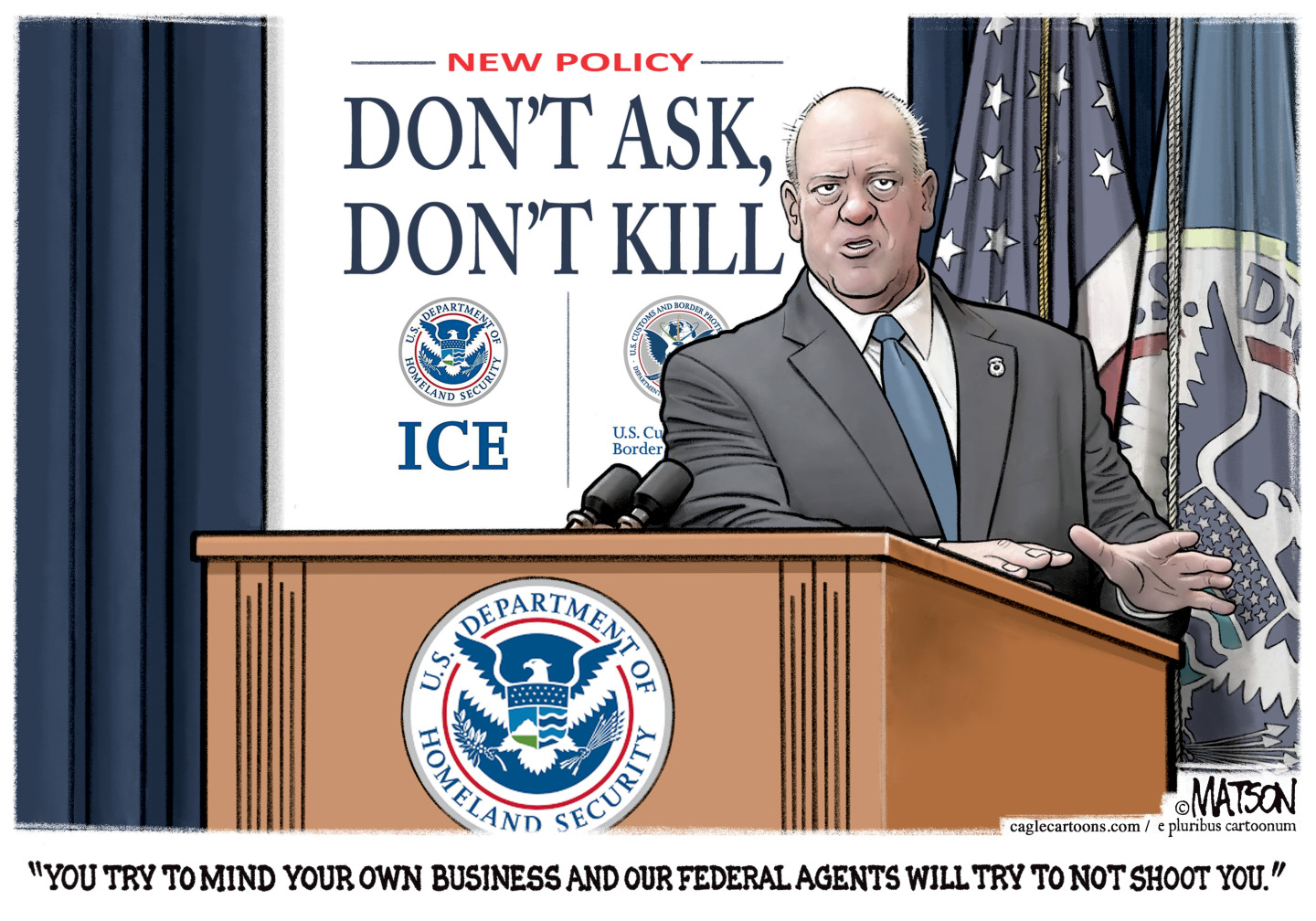

Political cartoons for February 1

Political cartoons for February 1Cartoons Sunday's political cartoons include Tom Homan's offer, the Fox News filter, and more

-

The billionaires’ wealth tax: a catastrophe for California?

The billionaires’ wealth tax: a catastrophe for California?Talking Point Peter Thiel and Larry Page preparing to change state residency

-

Bari Weiss’ ‘60 Minutes’ scandal is about more than one report

Bari Weiss’ ‘60 Minutes’ scandal is about more than one reportIN THE SPOTLIGHT By blocking an approved segment on a controversial prison holding US deportees in El Salvador, the editor-in-chief of CBS News has become the main story

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred