How John Maynard Keynes' most radical idea could save the world

"Bancor," explained

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

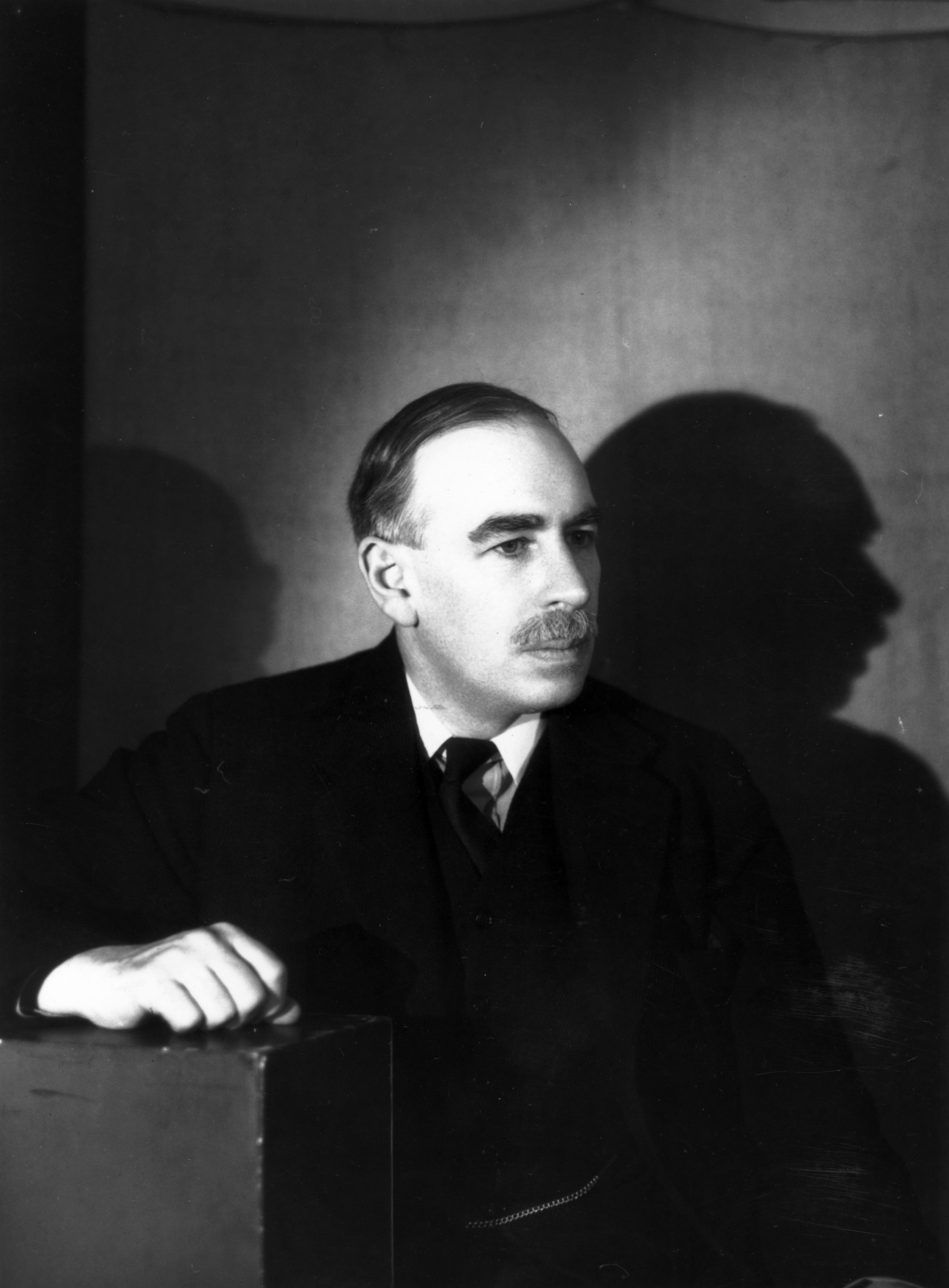

As the Second World War was drawing to a close, the economic experts of the Allies met in a New Hampshire resort to try to hammer out an international monetary system that would help prevent a recurrence of the Great Depression. The ensuing debate centered around two main proposals, one from the British delegation and one from the American. John Maynard Keynes, the greatest economist of the 20th century, presented the British case while Harry Dexter White, one of FDR's key economic advisers, presented the American one.

Keynes lost on many key points. The result was the Bretton Woods system, named after the small town in which the conference was held. As part of the agreement, it also created what would later become the International Monetary Fund and the World Bank. That served as the system of managing international trade and currencies for nearly three decades. Today the IMF and World Bank survive, but Bretton Woods was broken in 1971 when Nixon suspended the convertibility of the dollar into gold.

Yet most of the problems that spurred the creation of Bretton Woods have since returned in only somewhat less dire form. It's worth returning to Keynes' original, much more ambitious idea for an international institution to manage the flow of goods and money around the globe.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The basic problem with international trade is that imbalances can develop: Some countries get big export surpluses, while others necessarily develop big trade deficits (since the world cannot be in surplus or deficit with itself). And because countries typically must borrow to finance trade deficits, it's a quick and easy recipe for a crash in those countries when their ability to take on more debt reaches its limit. It's not as bad for surplus countries, since they will not have a debt crisis or a collapse in the value of their currency, but they too will be hurt by the loss of export markets. This problem has haunted nations since well before the Industrial Revolution.

Nations like Germany with a large export surplus often portray it as resulting from their superior virtue and technical skill. But the fundamental reality of such a surplus is that it requires someone to buy the exports. As Yanis Varoufakis points out in his new book, without some sort of permanent mechanism to recycle that surplus back into deficit countries, the result will be eventual disaster. It's precisely what caused the initial economic crisis in Greece that is still ongoing.

Bretton Woods addressed this problem with a set of rather ad hoc measures. The dollar would be pegged to a particular amount of gold, and semi-fixed exchange rates for other currencies were to be fixed around that. In keeping with White's more orthodox economic views, all trade imbalances were to be solved on the deficit side. There was no limit to the surplus nations could build up (importantly, at the time the U.S. was a huge exporter), and the IMF was tasked with shoring up countries having serious trade deficit problems by enforcing austerity and tight money. (This would lead to repeated disaster for developing countries.)

Keynes' idea, by contrast, was substantially more ambitious. He proposed an overarching "International Clearing Union" that potentially every country in the world could join. It would create a new reserve currency, the "bancor," that could only be used for settling international accounts, and member nations would pay a membership quota in proportion to their total trade. Countries in surplus would receive bancor credit, while those in deficit would have a negative account.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

The union was also explicitly aimed at facilitating increased trade overall (also unlike Bretton Woods). And critically, it would incentivize nations to keep their trade balanced on both sides — surplus and deficit. Run too far into deficit, and a country would be required to devalue to reduce imports. But run too far into surplus, and a country's currency would be required to appreciate so as to increase imports. A bancor tax would also be levied at an increasing rate on anyone with a large trade imbalance.

There's much more to the story, but the fundamental idea is fairly simple. As Keynes wrote in his original proposal, the basic "principle is the necessary equality of credits and debits, of assets and liabilities. If no credits can be removed outside the clearing system but only transferred within it, the Union itself can never be in difficulties."

For the postwar generation, Bretton Woods worked tolerably well — and it certainly was a vast improvement on the prewar gold standard. But its mechanisms were far less legible, and required constant good-faith efforts from various nations, particularly Germany and the U.S., to work properly. More importantly, it relied on large American surpluses to soak up the huge aid that was being sent to Europe under the Marshall Plan, a goodly portion of which was used to buy American-made exports. When the U.S. moved to deficit, the system broke down within only a few years.

Keynes' plan, by contrast, would likely have had the flexibility to adapt to a massive 180 degree shift in the balance of trade. It is also far more transparent and comprehensible to average people, perhaps disrupting the excessive pride of surplus countries to some extent. And if it were to be created in the future, it would be under effective supervision from the member states. The vast carnage inflicted by the unaccountable, supranational European Central Bank is too stark to ignore.

It would undoubtedly take years and years to build and update Keynes proposal to where it might be implemented. But the problems it is designed to address will always keep cropping up. Perhaps after the eurozone implodes, the world will get another chance to do it right.

Ryan Cooper is a national correspondent at TheWeek.com. His work has appeared in the Washington Monthly, The New Republic, and the Washington Post.

-

How the FCC’s ‘equal time’ rule works

How the FCC’s ‘equal time’ rule worksIn the Spotlight The law is at the heart of the Colbert-CBS conflict

-

What is the endgame in the DHS shutdown?

What is the endgame in the DHS shutdown?Today’s Big Question Democrats want to rein in ICE’s immigration crackdown

-

‘Poor time management isn’t just an inconvenience’

‘Poor time management isn’t just an inconvenience’Instant Opinion Opinion, comment and editorials of the day

-

Epstein files topple law CEO, roil UK government

Epstein files topple law CEO, roil UK governmentSpeed Read Peter Mandelson, Britain’s former ambassador to the US, is caught up in the scandal

-

Iran and US prepare to meet after skirmishes

Iran and US prepare to meet after skirmishesSpeed Read The incident comes amid heightened tensions in the Middle East

-

Israel retrieves final hostage’s body from Gaza

Israel retrieves final hostage’s body from GazaSpeed Read The 24-year-old police officer was killed during the initial Hamas attack

-

China’s Xi targets top general in growing purge

China’s Xi targets top general in growing purgeSpeed Read Zhang Youxia is being investigated over ‘grave violations’ of the law

-

Panama and Canada are negotiating over a crucial copper mine

Panama and Canada are negotiating over a crucial copper mineIn the Spotlight Panama is set to make a final decision on the mine this summer

-

Why Greenland’s natural resources are nearly impossible to mine

Why Greenland’s natural resources are nearly impossible to mineThe Explainer The country’s natural landscape makes the task extremely difficult

-

Iran cuts internet as protests escalate

Iran cuts internet as protests escalateSpeed Reada Government buildings across the country have been set on fire

-

US nabs ‘shadow’ tanker claimed by Russia

US nabs ‘shadow’ tanker claimed by RussiaSpeed Read The ship was one of two vessels seized by the US military