Democrats need to unabashedly support raising taxes

Let's spread the wealth around

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

For the past several decades, there has been a fairly wide bipartisan consensus that tax reform in which closed loopholes are exchanged for lower rates would be broadly beneficial and desirable. The evidence for this proposition was thin even in the 1960s, when taxes were dramatically higher than they are now. Today, it's frankly not credible, but it has been very hard to convince most Democrats of this.

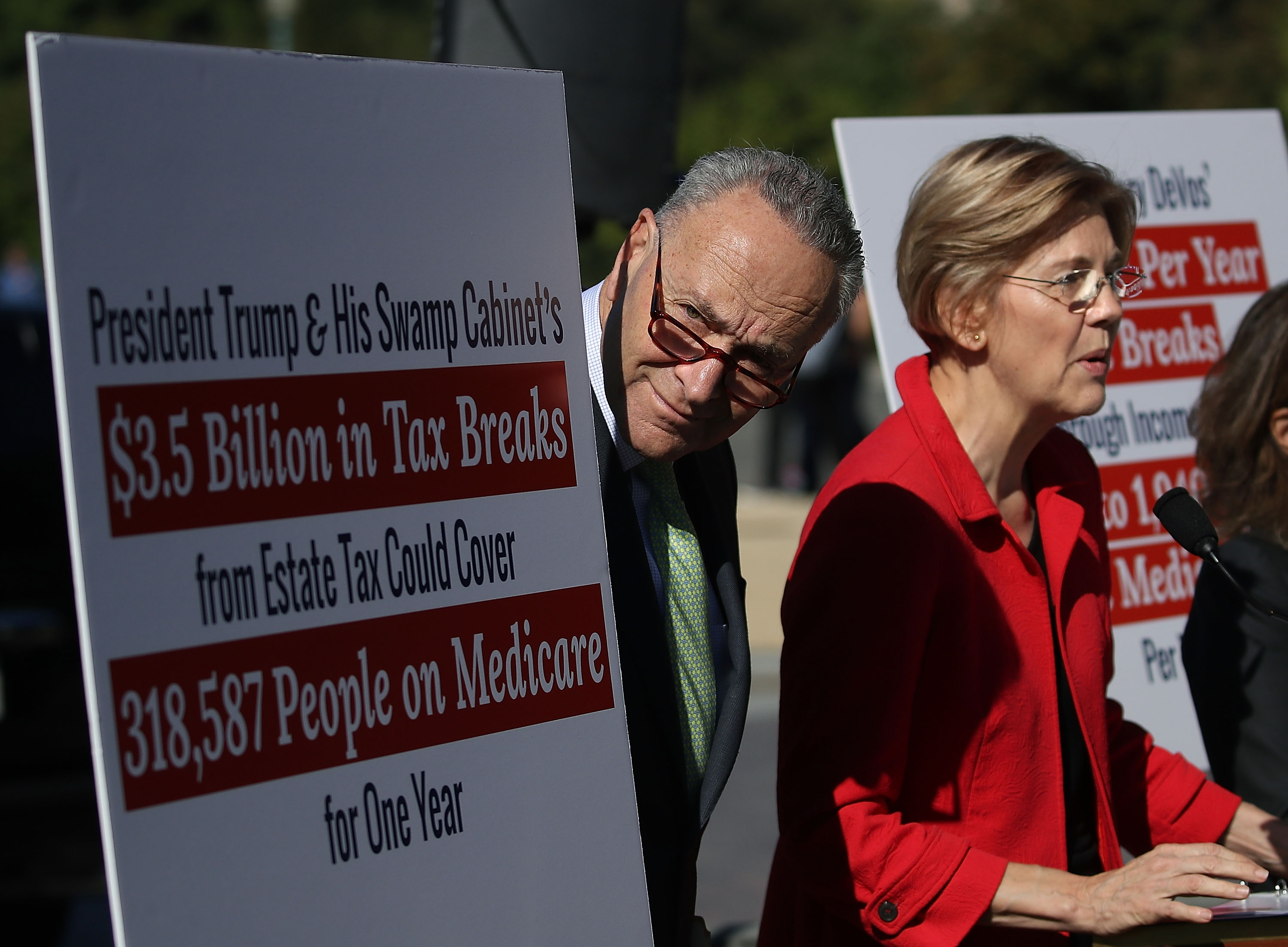

But of late, some Democrats are beginning to question this conventional wisdom. On Wednesday, the Congressional Progressive Caucus released its set of principles for tax reform. Its main contention is that the big problem with taxes is that corporations and rich people are not paying enough, and it is undeniably true. But they could go even farther.

The CPC statement is focused mainly on fairness. It notes that whereas back in the 1950s, about one out of three tax dollars came from corporations, now it is only about one in nine. It notes that U.S. corporations have some $2.6 trillion stashed offshore — much of the money made inside the U.S. and protected from taxation with a lot of legal chicanery. It further notes that the 2004 tax repatriation holiday did not lead to any significant investment, just a quick cash grab.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

For a better vision, the CPC points to their "People's Budget," which calls for sharply increasing taxes on the rich and closing corporate tax loopholes — as well as spending $2 trillion on infrastructure, bumping funding for housing subsidies, raising the minimum wage, and expanding tax credits to the working class, plus a slew of other goodies.

And, of course, the statement demands that no tax reform of any kind be done until President Trump releases his tax returns. Given that Trump is almost certain to personally benefit hugely from any Republican tax plan, this is a completely fair request.

However, there is a good case that progressives could turn the logic of supply-side economics on its head. Conservatives constantly argue that cutting taxes will increase growth. For example, the Trump administration recently released an absolutely preposterous prediction that a big cut in the corporate tax rate will result in gigantic increases in wages — indeed, much larger than the size of the cut, up to fivefold so in some cases!

As economists Jared Bernstein and Larry Summers argue, there is no reason to think this will actually happen. The utopian predictions of conservative supply-side economics have been repeatedly tested over the past three decades, and come up wildly short again and again.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

However, American output and productivity growth really have been abysmally bad over the last decade. It suggests that there is some sort of structural problem with the economy. But if it's not too-high taxes on corporations, investment, and the rich, what might it be?

Many economists have been building a case that it's the opposite: Taxes are too low at the top of the income ladder. The argument is threefold: First, as economists Marshall Steinbaum and Eric Bernstein argue, low tax rates on the top income bracket and capital gains encourage the rich to restructure American corporations away from research and investment in productive enterprise and towards payouts to stockholders and executives. As economist J.W. Mason demonstrates, this transformation has indeed happened over the last three decades — despite corporate profits which have been bumping up against postwar highs for eight straight years as a share of the economy, corporate investment has stayed near historic lows.

Second, that process works with low rates to also increase income inequality, which all else equal is almost certainly a structural drag on growth. Rich people spend a smaller fraction of their money, so greater inequality means it is harder and harder to sustain an economy based on mass consumption — and also to justify the new investment and businesses that would sell to a large customer base. It also means lower interest rates, as the rich tend to save more of their income and increase the supply of loanable funds — and therefore greater vulnerability to the zero lower bound, which sharply constrains the effectiveness of monetary policy.

Finally, lower taxes on investment and dividends enables greater financialization of the economy, which is associated with financial crises — made even worse by the above factors. The economic crash of 2008 was a huge one-time hit to output — and afterwards, as another Mason paper shows, instead of recovering, per-capita output growth has actually slowed by about 50 percent from its postwar average. This has meant literally trillions in output going unproduced every year, with no end in sight.

The American economy has become extremely top-heavy, with mass consumption fueled to an alarming degree by increasing consumer borrowing. While one can never know for sure what any economic policy will do, there is a very strong case that this sort of left-wing supply-side policy (that is, increased taxes on corporations, capital gains, and the rich) might not just be more fair and "spread the wealth around," but also strengthen output and productivity growth. At any rate, it's at the least worth trying, given the abysmal failure of the last round of rich-tilted tax cuts. It would also, amusingly, allow the left to seize the rhetorical ground of being the most concerned about economic performance, against the naive, unserious business wing of the party.

Let's make tax hikes happen.

Ryan Cooper is a national correspondent at TheWeek.com. His work has appeared in the Washington Monthly, The New Republic, and the Washington Post.