Mick Mulvaney won't completely destroy the CFPB. He'll just rip its teeth out.

He will be an absolute disaster as director

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

On Monday morning, staff at the Consumer Financial Protection Bureau found themselves working under two warring directors. On one side was the agency's deputy director Leandra English, and on the other was President Trump's pick: his own budget director, Mick Mulvaney. Yesterday, a U.S. District Court judge ruled in favor of the Trump administration, all but solidifying Mulvaney's appointment.

Despite the confusion, on the economic policy merits, things are a lot more clear cut: Mulvaney will be an absolute disaster as director.

The CFPB was created by the 2010 Dodd-Frank financial reform law, and officially opened for business in July of 2011. The agency's job is right there in its name: It's tasked with going after all the ways financial services and products can prey upon, exploit, and defraud consumers.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

It's not a job Mick Mulvaney believes in. He called the CFPB a joke in a "sad, sick kind of way" back in 2014 when he was still in the House of Representatives. "I don't like the fact that CFPB exists," he said another time. Indeed, in his various statements, Mulvaney makes it plain that his concerns lie with protecting banks and financial firms from the agency's intrusions.

President Trump feels similarly, tweeting that the agency is "a total disaster as run by the previous administration's pick. Financial Institutions have been devastated and unable to properly serve the public."

A large part of the CFPB's value lies in how proactive it is. Before the agency's creation, the job of consumer protection still existed, but it was spread out among multiple agencies with lots of other responsibilities. So it always got short shrift. But since 2011, the CFPB has tackled over one million consumer complaints, returned almost $12 billion to Americans wronged by the financial industry, helped fight major frauds like the Wells Fargo scandal, issued new rules against payday lenders, and more. Congress bestowed unusual strength and independence on the CFPB, and the agency is able to bring lawsuits against exploitative financial schemes and to issue new rules to head such predation off.

As interim director, Mulvaney can't unilaterally destroy the CFPB. But he could scuttle the agency's proactive stance.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

For example, under the Obama administration, the CFPB was prepping a lawsuit against Santander Bank for overcharging consumers on auto loans. It's also enforcing a consent order from 2016, fining Santander $10 million for illegal overdrafts, deceptive marketing, and signing customers up for service without their consent. As interim director, Mulvaney could downscale the lawsuit or the enforcement efforts, direct resources away from both, or maybe even get the agency to back off the lawsuit completely. (In fact, the International Business Times reported that Mulvaney's former chief of staff left that job to become a lobbyist for Santander this year — helping the bank lobby against another CFPB regulatory effort in the process.)

"Under new leadership, the CFPB's rulemaking efforts will grind to a halt and its enforcement agenda will dramatically diminish," said Isaac Boltansky, the director of policy research at the D.C.-based investment firm Compass Point.

"The agency will be headed by someone who fundamentally doesn't believe in its mission," added Sen. Elizabeth Warren (D-Mass.), the lawmaker who originally came up with the idea for the CFPB. "This would change every calculation that every giant bank makes in the executive suite when deciding just how close to breaking the law they want to come. If the cop is pulled off the beat, then the profits from cheating people look far more attractive to the banking executives."

Now, both Trump and Mulvaney insist their opposition is ultimately about helping ordinary Americans. They and other conservatives argue the CFPB's rules hobble bank lending and hold back investment and job creation.

But in raw dollar amounts, consumer credit rose unabated after the creation of the CFPB, at the same rate (or faster) than it it did in the years preceding the 2008 financial crisis. The same goes for the supply of business loans. As for the banking industry's profits, they've downright soared since 2011. And while smaller credit unions and community banks really have declined, that trend started long before Dodd-Frank or the CFPB were created and can be chalked up to long-term weaknesses in the economy.

I would be remiss here if I didn't mention that Mulvaney is a die-hard opponent of government spending. When it comes to creating jobs and economic growth, Americans basically have two choices: public investment or private borrowing. Like a good Republican, Mulvaney has sought to cut off the first option as White House budget director. So banks, private lenders, and big financial firms become Americans' only remaining option. Now Mulvaney's been put in charge of policing them. And he seems to have convinced himself that preventing them from fleecing, exploiting, or defrauding customers will actually be bad for Americans.

Anyone want to take bets on how this will go?

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.

-

Book reviews: ‘Bonfire of the Murdochs’ and ‘The Typewriter and the Guillotine’

Book reviews: ‘Bonfire of the Murdochs’ and ‘The Typewriter and the Guillotine’Feature New insights into the Murdoch family’s turmoil and a renowned journalist’s time in pre-World War II Paris

-

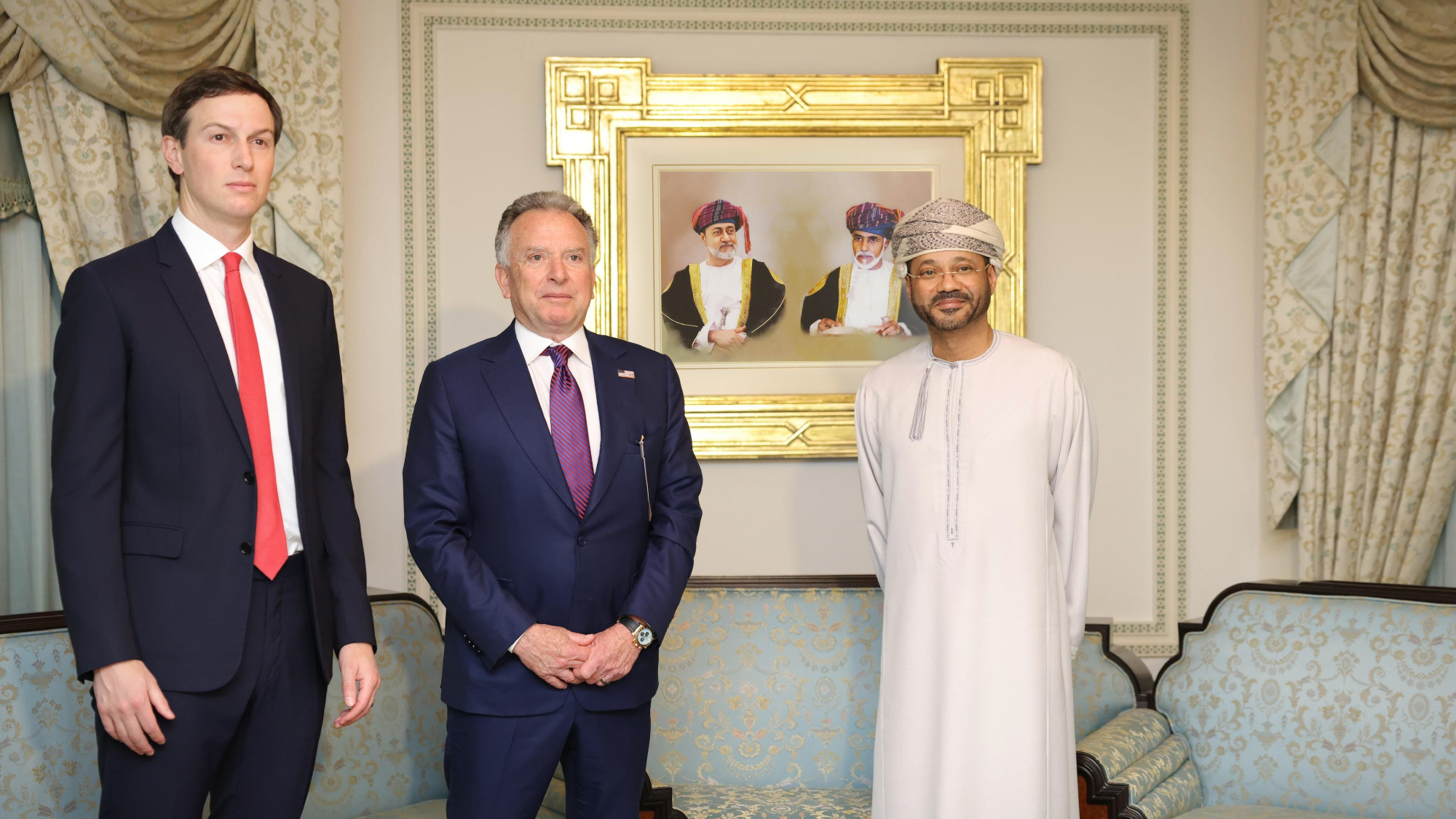

Witkoff and Kushner tackle Ukraine, Iran in Geneva

Witkoff and Kushner tackle Ukraine, Iran in GenevaSpeed Read Steve Witkoff and Jared Kushner held negotiations aimed at securing a nuclear deal with Iran and an end to Russia’s war in Ukraine

-

What to expect financially before getting a pet

What to expect financially before getting a petthe explainer Be responsible for both your furry friend and your wallet

-

The billionaires’ wealth tax: a catastrophe for California?

The billionaires’ wealth tax: a catastrophe for California?Talking Point Peter Thiel and Larry Page preparing to change state residency

-

Bari Weiss’ ‘60 Minutes’ scandal is about more than one report

Bari Weiss’ ‘60 Minutes’ scandal is about more than one reportIN THE SPOTLIGHT By blocking an approved segment on a controversial prison holding US deportees in El Salvador, the editor-in-chief of CBS News has become the main story

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred