Republicans have just passed the worst tax bill in American history

Congrats?

Republicans pushed their big overhaul of the tax code through the House and the Senate on Tuesday. And once the bill gets one final House vote today, Republicans will have accomplished something extraordinary: They will have passed what may be the worst tax bill in history.

Clocking in at a svelte 560 pages, the bill will take months if not years to fully understand. But we can appreciate some of the key ways in which it is so spectacularly awful:

It's a huge break for the wealthy and a slap at most everyone else. That a Republican tax bill would help those who least need help was never in doubt, but now the final numbers are in. According to the Tax Policy Center's analysis of the final bill, in the first year, the top 1 percent of the wealthiest taxpayers get 20.5 percent of the benefits, but by 2027, they'll get an amazing 82.8 percent.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

And while regular folks will get a break of a few hundred dollars at first, not only do their breaks come with expiration dates, by 2027 every group earning less than $93,200 a year will on average see their taxes go up. More than half of American households will see a tax increase.

It's centerpiece — a corporate tax cut — was sold on a big lie. Republicans claimed that if we cut the taxes corporations have to pay, they'll take their windfall and use it to create jobs and raise wages. But corporations are already earning near-record profits and sitting on trillions of dollars in cash, so much they barely know what to do with it all. We're at almost full employment, and it's not like corporations have demand they could meet if only they had enough money to hire new workers. They've been candid that when they get their tax cut they'll use it for things like stock buybacks and dividends, sending the money back to wealthy shareholders and not to their employees.

It gives corporations something for nothing. The idea of cutting the corporate income tax rate has had bipartisan support in the past — back in 2012, President Obama proposed lowering it from 35 to 28 percent — but the point was supposed to be "lowering the rate and broadening the base." In other words, eliminate the baroque web of loopholes and deductions corporate lobbyists have inserted into the tax code over the years to benefit their particular industry or firm, but bring down the rate so all companies pay pretty much the same thing. That way you make things simpler and more fair, while still bringing in ample revenue.

But this bill brings down the rate without eliminating most of the loopholes that allow so many gigantic corporations to pay no taxes at all. Under the old system, a company like General Electric could make $40 billion in profit between 2008 and 2015 and not only pay no taxes but actually get a rebate of $1.4 billion, courtesy of taxpayers like you. Under the new system, a few corporate loopholes will be gone but other potentially even more lucrative ones will be created, leading to a whole new period of creative accounting and tax avoidance.

It will increase the deficit, which will then be used as a rationale for cutting government services. Republicans have barely bothered to hide their intentions on this score: As soon as this bill is done, they'll be attacking the safety net, which we supposedly have no choice but to do because of the deficit they just increased by $1.5 trillion.

It makes the tax code more complicated and increases the ability of rich people to game the system. Remember when Republicans said they wanted to simplify the tax code? Not anymore. The bill opens up gigantic loopholes that will enable the wealthy and those with creative accountants to reconfigure their taxes to slash what they have to pay the government. As a group of tax experts said in this report outlining the new opportunities for tax avoidance, the bill is "a substantial blow to the basic integrity of the income tax."

It increases inequality. While it gives some people of modest incomes a (usually temporary) tax break, the bill is chock-full of provisions that are embarrassingly generous to the wealthy. They can reclassify themselves as pass-through companies and get a big tax break. They'll be able to shield more of their inheritances from taxes. They'll be able to use tax-free investment accounts for private school tuition. At a time when people are increasingly aware that more and more of our national income is being grabbed by the wealthy, this bill will only make things worse.

There are a hundred other criticisms one could make of this bill — like how it will personally enrich President Trump and his family — but these are the broad strokes that make it so uniquely damaging to the country in both the short and long term. I suppose it might have been possible for Republicans to write an even worse tax bill, but it's almost hard to see how.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Paul Waldman is a senior writer with The American Prospect magazine and a blogger for The Washington Post. His writing has appeared in dozens of newspapers, magazines, and web sites, and he is the author or co-author of four books on media and politics.

-

Gavin Newsom mulls California redistricting to counter Texas gerrymandering

Gavin Newsom mulls California redistricting to counter Texas gerrymanderingTALKING POINTS A controversial plan has become a major flashpoint among Democrats struggling for traction in the Trump era

-

6 perfect gifts for travel lovers

6 perfect gifts for travel loversThe Week Recommends The best trip is the one that lives on and on

-

How can you get the maximum Social Security retirement benefit?

How can you get the maximum Social Security retirement benefit?the explainer These steps can help boost the Social Security amount you receive

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred

-

Will Trump's 'madman' strategy pay off?

Will Trump's 'madman' strategy pay off?Today's Big Question Incoming US president likes to seem unpredictable but, this time round, world leaders could be wise to his playbook

-

Democrats vs. Republicans: which party are the billionaires backing?

Democrats vs. Republicans: which party are the billionaires backing?The Explainer Younger tech titans join 'boys' club throwing money and support' behind President Trump, while older plutocrats quietly rebuke new administration

-

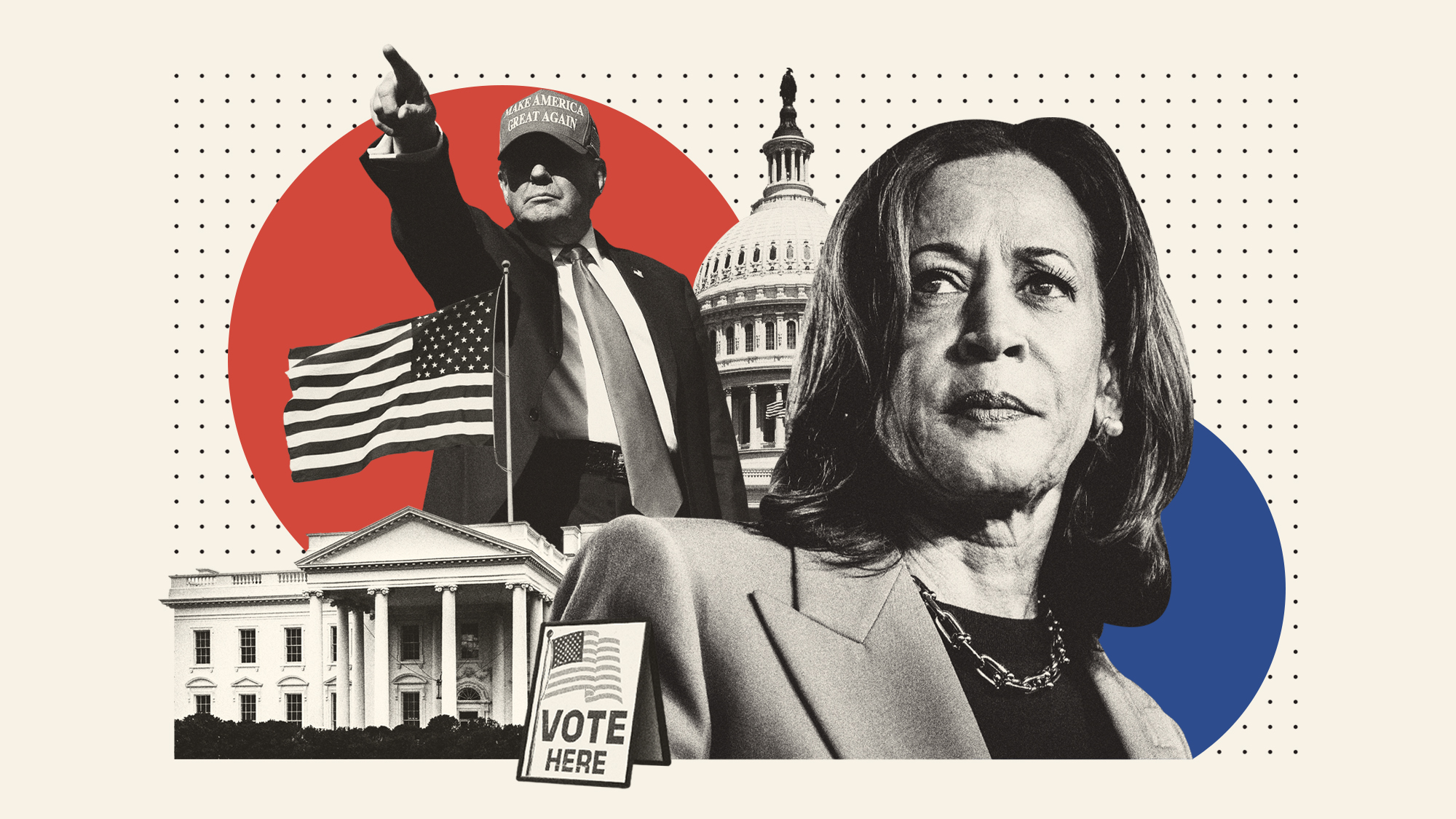

US election: where things stand with one week to go

US election: where things stand with one week to goThe Explainer Harris' lead in the polls has been narrowing in Trump's favour, but her campaign remains 'cautiously optimistic'

-

Is Trump okay?

Is Trump okay?Today's Big Question Former president's mental fitness and alleged cognitive decline firmly back in the spotlight after 'bizarre' town hall event

-

The life and times of Kamala Harris

The life and times of Kamala HarrisThe Explainer The vice-president is narrowly leading the race to become the next US president. How did she get to where she is now?