Does the Fed control Trump's 2020 destiny?

President Trump may have a problem. His name is Jerome Powell.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

President Trump has frequently pointed to the rising U.S. stock market as affirmation of his economic supergenius. But what the market giveth, it can also taketh away.

This week, stocks dropped sharply after the first congressional testimony of Trump's new Federal Reserve Chairman Jerome Powell. Why? Perhaps because investors interpreted his comments as raising the odds that the central bank will accelerate its pace of interest rate hikes. The result could be higher-than-expected borrowing costs and lower corporate profits.

As it happens, just as Powell was alerting markets to the Fed's possibly more hawkish turn, the Drudge Report was blaring a headline that Trump was ready to announce his plans to run for re-election in 2020 and appoint a digital guru to run the effort. But clever Facebook ads won't be enough to win the president a second term. Team Trump is surely counting on the economy to provide a powerful tailwind for the campaign. Indeed, new forecasts from the White House economic team anticipate 2018 will be the start of a long-term upturn in economic growth.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Wall Street economists aren't nearly as bullish. Yet they do acknowledge the economy's considerable near-term momentum, thanks in part to fiscal stimulus from the Trump tax cuts and higher Washington spending. Trump might well head into his re-election year with an unemployment rate sinking toward 3 percent. The lowest jobless numbers since Eisenhower was in the Oval Office could help persuade swing voters that Trump has indeed made America great again.

Unless the Fed mucks things up — as it has in the past.

Since the creation of the Fed, every single recession — with the exception of post-World War Two military demobilization — has been associated with monetary tightening. Either the Fed raised interest rates too far, too fast or it failed to offset tighter monetary conditions. For instance: Had Ben Bernanke's Fed acted more aggressively in 2008, the Great Recession might have been a more modest downturn at worst.

One Fed boss with a fantastic record of not screwing things up was Powell predecessor Janet Yellen, whom President Obama appointed in 2014 to succeed Bernanke. During her tenure, stocks soared, inflation stayed low, and the economy generated gobs of jobs. In a Wall Street Journal survey of economists, 60 percent gave her performance an A.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

That track record wasn't enough for Trump, who broke with recent precedent by declining to reappoint Yellen to a second term. What made that move especially odd was her reputation as a monetary dove, who had mused about the possible benefits of running a low-rate, "high-pressure economy" to heal the scars of the Great Recession. On paper, she seemed a comfy fit for Trump, who has in the past stated his love for easy money. And his advisers must have been aware that past presidents have worried that a tight Fed would hurt their re-election efforts (LBJ, Nixon) or even blamed the central bank for losing (Bush I).

Then again, candidate Trump disingenuously blamed the Yellen Fed for creating a "false economy" to help Barack Obama. Pretty tough to appoint a Fed chair whom you've basically accused of corruption.

It's a charge Trump may live to regret if the Powell Fed makes a monetary mistake. With a persistently low approval rating, Trump likely needs a booming economy to win re-election.

Remember, the slow recovery during the Obama years was a terrible headwind for Hillary Clinton in 2016. The well-regarded election forecasting model from Yale University economist Ray Fair predicted Clinton would lose badly because of weak growth and voter antsiness, getting just 44 percent of the two-party vote. Instead, she overperformed with 51 percent (but still lost). Fair's explanation for his model's big miss:

While this is not possible to test, most people would probably say that it is due to Trump's personality. Had the Republicans nominated a more mainstream candidate, they may have done much better — much closer to what the equation was predicting. ... The election was theirs to lose because of the economy and the duration effect, and they almost lost it! [Ray Fair]

Anything could still happen. The highly caffeinated U.S. economy may well power through future Fed rate hikes or higher rates due to higher budget deficits. (Fear of the latter or perhaps higher inflation from too much stimulus roiled markets earlier in February.) The Powell Fed might adeptly manage the transition to a higher rate environment. Trump had better hope so. More than almost any other potential GOP nominee in 2016, he needed a weak economy to be competitive. And he will almost certainly need a robust one to capture another four years.

James Pethokoukis is the DeWitt Wallace Fellow at the American Enterprise Institute where he runs the AEIdeas blog. He has also written for The New York Times, National Review, Commentary, The Weekly Standard, and other places.

-

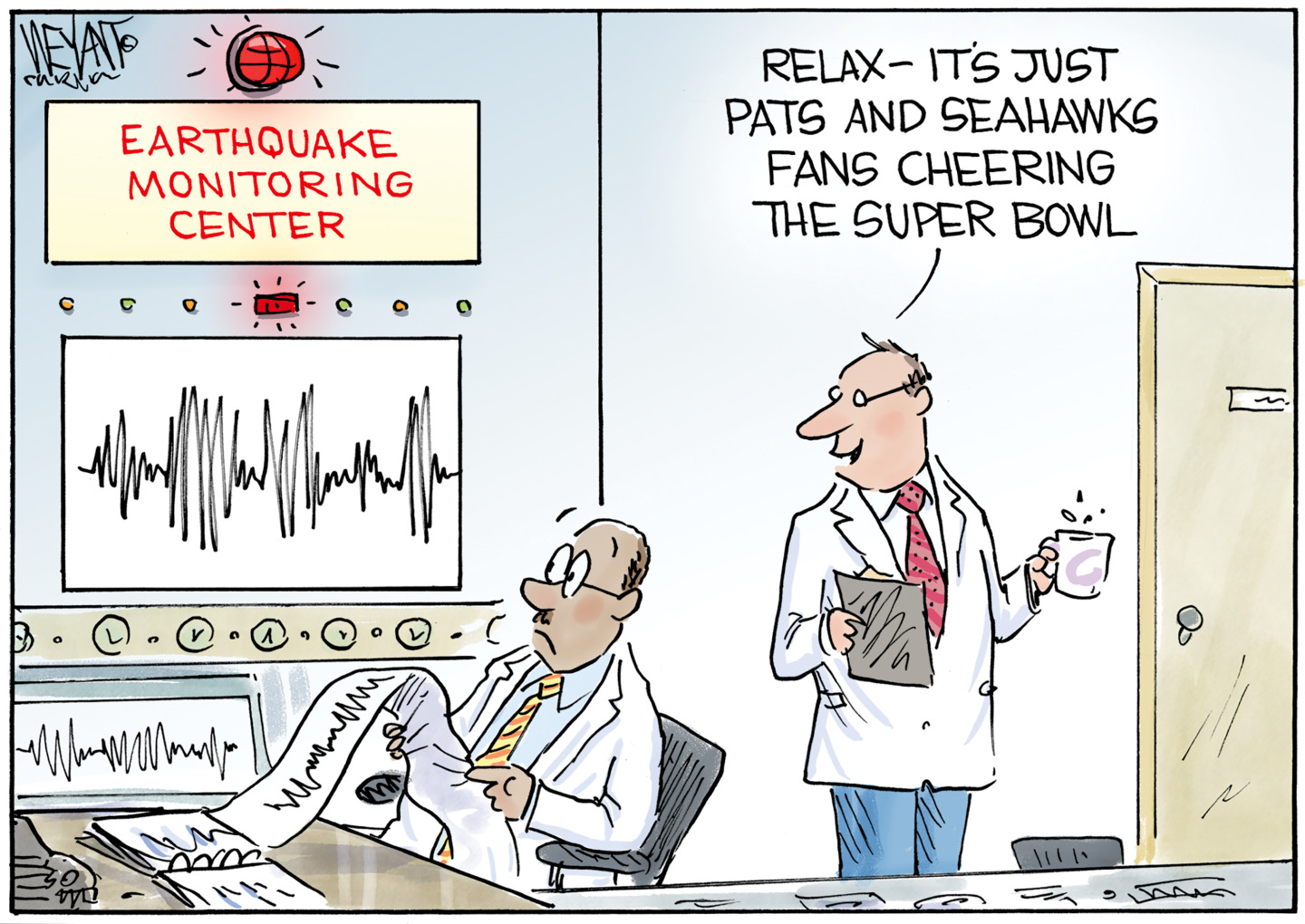

Political cartoons for February 7

Political cartoons for February 7Cartoons Saturday’s political cartoons include an earthquake warning, Washington Post Mortem, and more

-

5 cinematic cartoons about Bezos betting big on 'Melania'

5 cinematic cartoons about Bezos betting big on 'Melania'Cartoons Artists take on a girlboss, a fetching newspaper, and more

-

The fall of the generals: China’s military purge

The fall of the generals: China’s military purgeIn the Spotlight Xi Jinping’s extraordinary removal of senior general proves that no-one is safe from anti-corruption drive that has investigated millions

-

The billionaires’ wealth tax: a catastrophe for California?

The billionaires’ wealth tax: a catastrophe for California?Talking Point Peter Thiel and Larry Page preparing to change state residency

-

Bari Weiss’ ‘60 Minutes’ scandal is about more than one report

Bari Weiss’ ‘60 Minutes’ scandal is about more than one reportIN THE SPOTLIGHT By blocking an approved segment on a controversial prison holding US deportees in El Salvador, the editor-in-chief of CBS News has become the main story

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred