Is China a currency manipulator or not?

How to understand their recent actions — and Trump's response

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Late on Monday, the Trump administration turned its trade war with China up to 11, by officially labeling the country a "currency manipulator."

It was an obvious reaction to a sudden fall in the value of China's currency, which will help keep Chinese exports cheaper and help neutralize the pain of President Trump's tariffs. But it also raises a tension: By all accounts, the renminbi dropped because China stopped intervening in the foreign exchange market. The whole idea of "currency manipulation" tends to shift depending on who's doing the accusing and what their frame of reference is.

All of which is to say: Whether or not China is a "currency manipulator" requires a lot of unpacking.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

When the debate over China's "currency manipulator" status first heated up after a series of campaign promises by Trump, Council on Foreign Relations senior fellow Brad Setser explained that there are at least two definitions of currency manipulation the new president could draw on.

The first comes from the 1988 Omnibus Trade and Competitiveness Act, and it's pretty broad: The Treasury Department can label another country a currency manipulator based on whether their currency policies are "preventing effective balance of payments adjustments or gaining unfair competitive advantage in international trade." The Act also doesn't name any precise remedies — it's essentially a symbolic provision, whereby slapping the label on a trading partner confers political legitimacy for further moves down the line. (In Trump's case, most likely even more tariffs.)

The second approach is more recent, via the 2015 Trade Facilitation and Trade Enforcement Act. To define currency manipulation, the 2015 act demands specific numerical criteria regarding a foreign government's policies towards its bilateral trade balance, its current account, and the foreign exchange markets. It also lists specific retaliations, such as trade penalties or an appeal to the International Monetary Fund (IMF) to arbitrate the dispute.

In this case, Trump's Treasury Department explicitly cited the 1988 Omnibus Trade and Competitiveness Act, likely because China's behavior doesn't meet the Trade Facilitation and Trade Enforcement Act's more specific definitions. Among experts and economists who keep an eye on foreign exchange markets, there's widespread agreement that China's actions haven't fit the more precise definition since roughly 2013. As Setser pointed out, China currently meets only one of the three 2015 criteria, and the IMF recently gave China its stamp of approval.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

To push up the value of the U.S. dollar relative to the renminbi, China buys financial assets denominated in U.S. dollars. Conversely, selling off its dollar-denominated assets lowers the value of U.S. currency relative to the renminbi. And while China's reserves of dollar assets remain enormous — a bit over $3 trillion as of June — they've actually been shrinking in recent years. On the face of it, that selloff has been pushing the renminbi up relative to the dollar; the downward pressure has come from other forces out in the foreign exchange markets. The value of the renminbi dropped this week because China, fed up with Trump's trade war, basically threw up its hands and stopped trying to resist the downward pressure.

In short, present circumstances rule out accusing China of currency manipulation in a precise technocratic sense. The most the Trump administration can justify is saying the broader results of Chinese currency policy and trade flows are damaging and unfair to U.S. interests.

This gets at a deeper problem, which is that to accuse a country of currency manipulation, you have to answer the question "Compared to what?" The going assumption in mainstream economics is that trade flows between countries should be free from government intervention, and governed by "natural" market forces. The trouble is that this whole distinction between the market and government policy breaks down on close inspection.

For instance, even if China isn't adding to its dollar reserves, their sheer scale is enough to put ongoing downward pressure on the renminbi relative to the U.S. dollar. But since holding dollar reserves is considered "normal" policy for national governments to engage in, no one thinks of it as currency manipulation.

For another example, Norway pumps the returns from its massive oil reserves into a sovereign wealth fund. But it does that because what international markets "naturally" want is just more and more oil, in which case Norway's expanding domestic oil industry would warp and overrun the rest of its national economy, by driving up the value of Norway's currency. The sovereign wealth fund is a government intervention in the foreign exchange markets — "currency manipulation," if you will — that protects the rest of Norway's economy.

Even more fundamentally, a big part of why the U.S. dollar is stronger than a lot of other national currencies is that the U.S. economy is stronger than a lot of other national economies. That makes America a much needed source of demand for the rest of the world's exports, and it makes U.S. financial assets unusually attractive to foreign investors. In that sense, domestic macroeconomic policy is also inevitably a form of currency and foreign exchange policy as well.

From a certain angle, everything is currency manipulation, and thus nothing is. Trump's objections to China are less that they are manipulating their currency, and more that they are manipulating it in a direction Trump does not approve of. At the same time, the mainstream effort to distinguish "market driven" currency movements from movements dictated by government policy is hopelessly subjective and artificial. There is no "natural" market baseline for foreign exchange rates against which Trump's accusation of manipulation could be judged inaccurate.

Perhaps a better question to ask then, rather than attempting to enforce some utopian market state, is how we can best pursue our interests as we understand them as a democratic society: What do we want to achieve with our currency policy, what should we be asking of other countries, and what deals and arrangements can we strike to facilitate that?

To that end, the strategy and tools Trump prefers may be a mess. But he has at least re-opened the argument that foreign exchange rates and balances of trade flows are perfectly legitimate objects of government concern.

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.

-

The 8 best TV shows of the 1960s

The 8 best TV shows of the 1960sThe standout shows of this decade take viewers from outer space to the Wild West

-

Microdramas are booming

Microdramas are boomingUnder the radar Scroll to watch a whole movie

-

The Olympic timekeepers keeping the Games on track

The Olympic timekeepers keeping the Games on trackUnder the Radar Swiss watchmaking giant Omega has been at the finish line of every Olympic Games for nearly 100 years

-

TikTok secures deal to remain in US

TikTok secures deal to remain in USSpeed Read ByteDance will form a US version of the popular video-sharing platform

-

How will China’s $1 trillion trade surplus change the world economy?

How will China’s $1 trillion trade surplus change the world economy?Today’s Big Question Europe may impose its own tariffs

-

Shein in Paris: has the fashion capital surrendered its soul?

Shein in Paris: has the fashion capital surrendered its soul?Talking Point Despite France’s ‘virtuous rhetoric’, the nation is ‘renting out its soul to Chinese algorithms’

-

Will latest Russian sanctions finally break Putin’s resolve?

Will latest Russian sanctions finally break Putin’s resolve?Today's Big Question New restrictions have been described as a ‘punch to the gut of Moscow’s war economy’

-

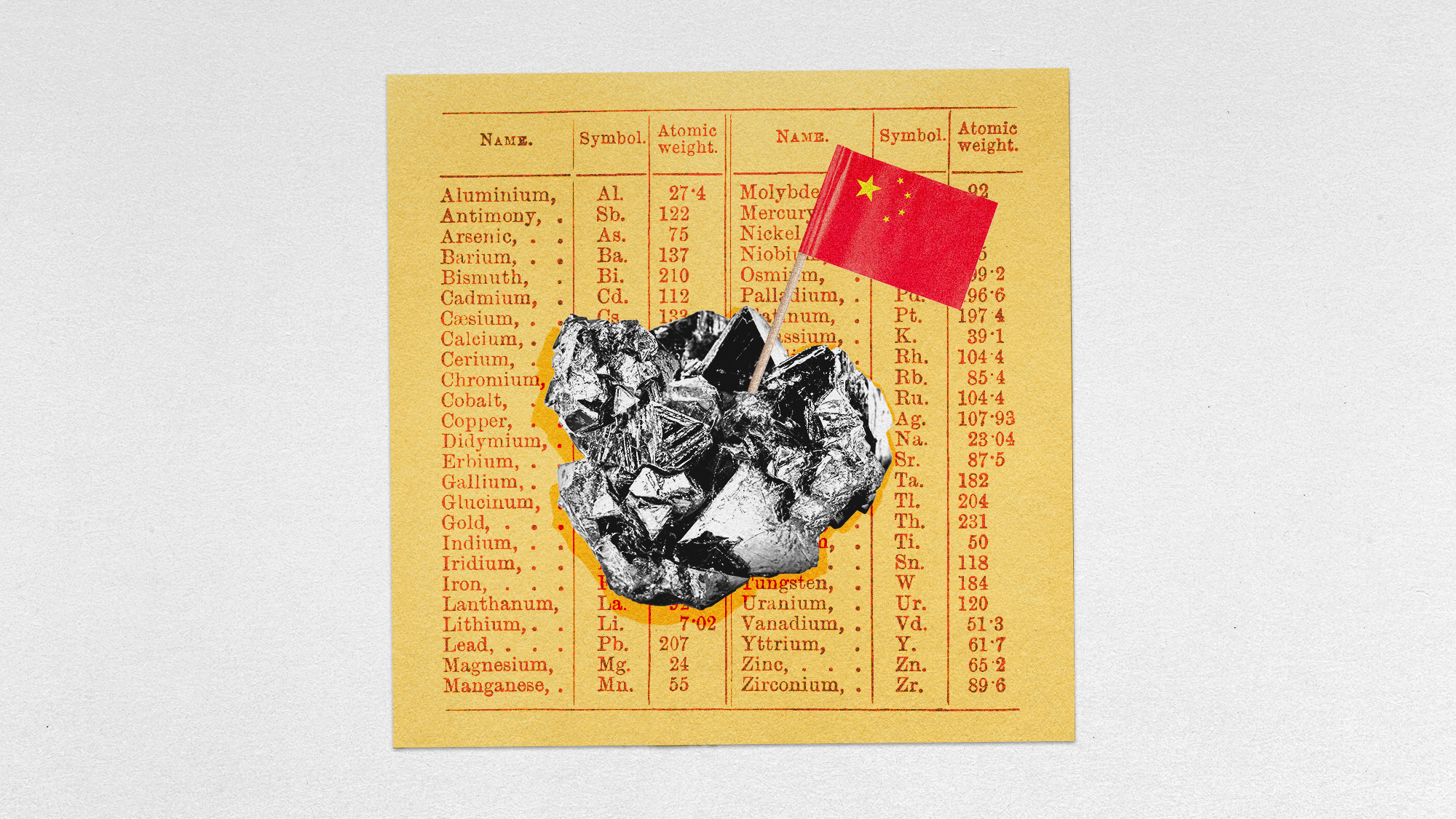

China’s rare earth controls

China’s rare earth controlsThe Explainer Beijing has shocked Washington with export restrictions on minerals used in most electronics

-

The struggles of Aston Martin: burning cash not rubber

The struggles of Aston Martin: burning cash not rubberIn the Spotlight The car manufacturer, famous for its association with the James Bond franchise, is ‘running out of road’

-

US to take 15% cut of AI chip sales to China

US to take 15% cut of AI chip sales to ChinaSpeed Read Nvidia and AMD will pay the Trump administration 15% of their revenue from selling artificial intelligence chips to China

-

Is Trump's tariffs plan working?

Is Trump's tariffs plan working?Today's Big Question Trump has touted 'victories', but inflation is the 'elephant in the room'