Coronavirus is no reason to cut Social Security

A lunatic scheme to undermine your retirement has apparently infiltrated the White House

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

America has spent trillions so far on economic rescue packages to deal with the coronavirus pandemic, and the national debt is therefore soaring. As a result, The Washington Post reports, some of the president's economic advisers are increasingly keen on finding ways to cut spending, though the president himself is apparently not much interested.

One possibility being floated by conservatives is a particularly harebrained scheme to undermine Social Security, in the guise of helping people get through the crisis. The proposal might be sort of well-intentioned, but it's also pointlessly convoluted, harmful in the long term, ideologically blinkered, and politically toxic. It emerges from a cramped, false view of what Social Security is, and a desire to capitulate to the dangerous austerity mindset. Don't be fooled by these bad, bad ideas.

The suggestion originates with a couple different groups of conservative or neoliberal economists. One paper in question comes from Sylvain Catherine, Max Miller, and Natasha Sarin from the Wharton School at the University of Pennsylvania. It is similar to an idea from conservative scholars Andrew Biggs and Joshua Rauh, but bears closer examination because it is nominally framed in a progressive way. The proposal is to give current workers access to 1 percent of their future Social Security benefits in a lump sum payment. This would swiftly boost the economy "by providing more than $2,000 to the large majority of workers."

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The modeling of the paper is extremely complicated, but the idea is fairly simple. Basically we would hand out a cash payment calculated as 1 percent of the present value of whatever someone would be entitled to when they retire, according to the Social Security benefit formula and estimates for how wages would evolve over time. Then we would reduce their future retirement benefits by 1 percent when they do enroll in Social Security.

There are several huge problems here. First, while Catherine and company are correct that Social Security benefits are relatively equitably distributed throughout the population, many people would still be left out of this proposal, because benefits are calculated based on income history. Those who haven't earned much (that is, the poor) wouldn't get much. Second, this approach would make the program substantially more complicated, because differing benefit amounts would have to be calculated for each person. Third, the proposal would give less to younger workers simply because they don't have as long of an earning history — which would also be regressive on net, as older people tend to make more money than younger ones.

Fourth, and most significantly, people would needlessly suffer in the future. A 1 percent decrease in future benefits doesn't sound like much, but Social Security benefits are already meager — about $1,500 per month on average in 2019. That one percent would tip a lot of people into financial insolvency. Indeed, America is already in the early stages of a serious retirement crisis, because traditional pensions are vanishing and the 401(k) experiment was a disastrous failure. We should be increasing Social Security benefits, not reducing them.

There is no reason whatsoever to structure a coronavirus rescue package this way. Yes, people need money to weather the coronavirus crisis — but we can just give it to them on an equal basis without any of this pointless rigmarole. We can just borrow or print the money, and soak up payments to the rich through taxes on the back end. It's really that simple.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

It is clear why the authors have structured their proposal this way, however. On the one hand, their use of inappropriate business lingo is a big ideological tell. They describe households today as suffering from a "liquidity" problem, but this is highly misleading. Liquidity refers to how easily some asset can be sold. A business with a liquidity problem, for instance, has plenty of assets but can't easily convert them to cash (as opposed to a business that is simply bankrupt). Households suffering as a result of the pandemic have an income problem — they don't have enough money coming in to cover their obligations, or enough assets to sell (or they can't sell them, because they need their home or car).

The authors talk about "liquidity" because they treat future Social Security benefits like an asset, perhaps because it is functionally similar to retirement savings, and because the program has been sold as a savings program for its entire history. The only problem is that this is flagrantly false. Social Security is not a savings vehicle, it is a welfare program which takes from the currently-employed and gives to the retired. It is literally impossible to "tap" into future benefits as they describe it — you can't buy or sell your benefits on any kind of market, because they don't exist until you actually go to collect them. This policy would mean the government handing out a cash payment now and then cutting benefits in the future solely to maintain the savings facade, and so seniors can continue to pretend they aren't on welfare.

On the other hand, the authors also want to appease deficit scolds — their idea "does not increase the overall liabilities of the federal government," they boast. Remarkably, they say that even though they don't actually think the debt is an important problem: Policymakers "would do well to sustain stimulus measures to support household consumption by continued fiscal expenditure," they write. Describing the paper on Twitter, Sarin wrote: "In a world with low interest rates and no inflationary concerns, preoccupation w/ deficit misplaced. But for those keen to support households w/o increasing gov't debt, it merits consideration."

This is an odd pose indeed for scholars. One would think the job of academics is to figure out the best policies to achieve some objective, and leave it to the politicians to figure out what can be passed. Or they might deconstruct the ideological claptrap that misleads people about important national programs. Trying to play amateur political forecaster, by contrast, risks enabling advocates of inferior policy. Perpetuating obviously false pictures of Social Security confuses the public and enables harmful narratives that the budget deficit is a real problem.

In any case, this idea would barely do anything about the budget deficit. The immediate effect would be to cause a surge of borrowing, only compensated for by cutting future Social Security payments over decades — a policy that could be reversed at any time. If we're effectively going to rely on future workers and Congresses to sort things out anyway, we might as well just fix our current screaming emergency, and let succeeding generations sort out the problems that arise over time.

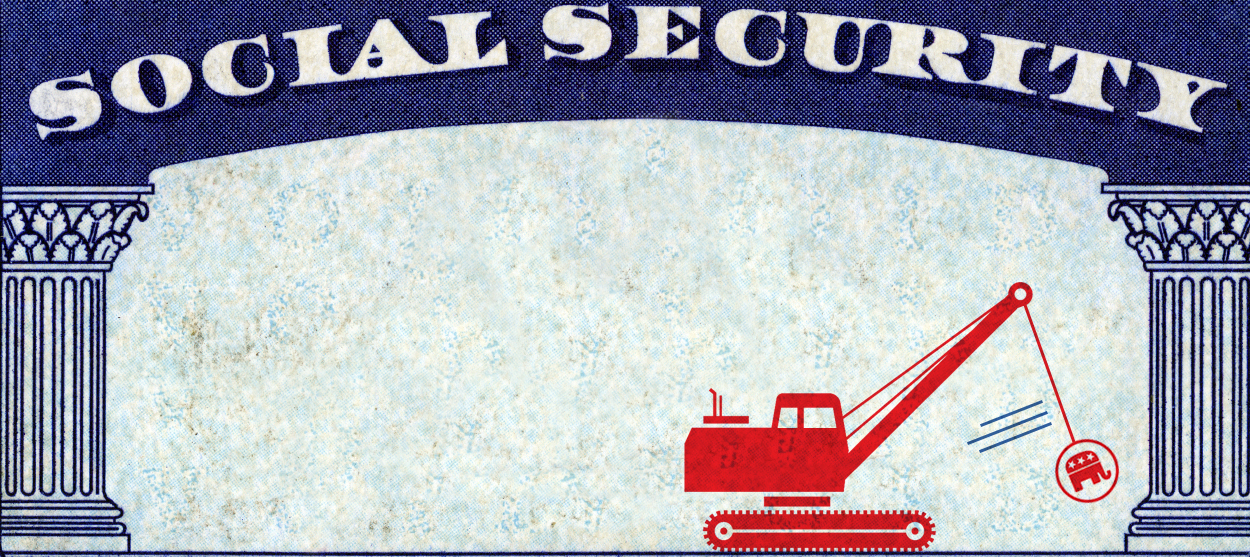

But this isn't the first time people have proposed raiding Social Security as part of some Rube Goldberg policy scheme. Several Republican senators and Ivanka Trump have proposed setting up a paid family leave program that would be paid for by cuts to future Social Security benefits. This was clearly inspired by a proposal from conservatives Kristen Shapiro and Andrew Biggs — the same Biggs who is now proposing cuts to deal with the coronavirus pandemic. The truth is that Republican ideologues have hated Social Security ever since it was introduced in the 1930s. Grandparents should be working to make profit for capitalists until they die, not enjoying their golden years or baking cookies for their grandkids (unless they have private wealth). Conservative fanatics want to chip away at the program until it can finally be destroyed, or better yet handed over to Wall Street as they tried to do under George W. Bush.

Liberals shouldn't even entertain these horrible proposals. If Social Security cannot be boosted, at least leave it alone.

Want more essential commentary and analysis like this delivered straight to your inbox? Sign up for The Week's "Today's best articles" newsletter here.

Ryan Cooper is a national correspondent at TheWeek.com. His work has appeared in the Washington Monthly, The New Republic, and the Washington Post.

-

Is Andrew’s arrest the end for the monarchy?

Is Andrew’s arrest the end for the monarchy?Today's Big Question The King has distanced the Royal Family from his disgraced brother but a ‘fit of revolutionary disgust’ could still wipe them out

-

Quiz of The Week: 14 – 20 February

Quiz of The Week: 14 – 20 FebruaryQuiz Have you been paying attention to The Week’s news?

-

The Week Unwrapped: Do the Freemasons have too much sway in the police force?

The Week Unwrapped: Do the Freemasons have too much sway in the police force?Podcast Plus, what does the growing popularity of prediction markets mean for the future? And why are UK film and TV workers struggling?

-

The billionaires’ wealth tax: a catastrophe for California?

The billionaires’ wealth tax: a catastrophe for California?Talking Point Peter Thiel and Larry Page preparing to change state residency

-

Bari Weiss’ ‘60 Minutes’ scandal is about more than one report

Bari Weiss’ ‘60 Minutes’ scandal is about more than one reportIN THE SPOTLIGHT By blocking an approved segment on a controversial prison holding US deportees in El Salvador, the editor-in-chief of CBS News has become the main story

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred