The class folly of canceling student loans

It would blow up in Biden's face

It's been just two weeks since Joe Biden won the presidential election, and the progressive feeding frenzy over policy priorities is already well underway.

Thanks to a widely reported tweet last week from Massachusetts Sen. Elizabeth Warren, calls for the Biden administration to come roaring out of the gate with a plan to cancel billions of dollars in student loan debt have been reverberating across the left. That it may be possible for the president to erase that debt through executive action (and without congressional involvement) only makes the plan more appealing to progressives.

But canceling student loan debt would be a massive unforced error for the newly minted Biden administration. It would show that one of the new Democratic president’s highest priorities during a pandemic and a destabilizing economic shock is to provide a bailout to people who are overwhelmingly likely to end up as members of the upper-middle class. It would amount to a transfer payment from contractors and service workers to high-earning knowledge workers and other white-collar employees. As such, it would also accelerate trends in the Democratic Party that would leave it vulnerable to a Republican Party increasingly trying to rebrand itself as a champion of the working class.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

As economist Thomas Piketty and others have pointed out in recent years, center-left political parties suffer at the ballot-box when they come to represent the interests of the upper-middle class at the expense of the working class, allowing the nationalist-populist right to make inroads with the latter. This has happened in a series of European countries in recent years, and it’s happening in the U.S. as well, with the Democrats enjoying surging support in inner-ring suburbs but losing ground in working-class, exurban, and rural areas. In the 2020 election, Democrats were able to defeat Donald Trump with this coalition, but they got tripped up down ballot, most likely falling short of a Senate majority, losing seats in the House, and failing to flip even a single state legislature.

Canceling billions of dollars in student loans would make this problem significantly worse.

Those who attend selective four-year colleges routinely overestimate the number of Americans who go to college and carry student debt. In reality, only 35 percent of Americans over the age of 25 hold a bachelor’s degree — and only 30 percent of adults under age 30 have debts from student loans. Their indebtedness is a burden, but their education is a ticket to earnings significantly higher than those without it. In 2017, median usual weekly earnings for someone with a Bachelor’s degree was $1,173. That's compared with $712 for someone with a high school diploma and no college coursework (and thus presumably no education-related debt). Added up over a lifetime, someone who graduated from a four-year college will earn significantly more than someone who didn’t and will come out far ahead, even after paying down a hefty pile of student loans.

Those who carry student debt are nowhere near the neediest people in the country. In a world of finite resources, where priorities need to be made, they should be nowhere near the top of the list of those receiving a multi-billion-dollar handout from the federal government.

Many on the left say that something as economically and intellectually beneficial as a college education shouldn’t require that the student go so deeply into debt. I agree. But canceling those debts won’t address this problem at all. In fact, it would likely exacerbate the problem.

The easy availability of federal grants and loans for college have allowed universities to increase prices far in excess of the inflation rate for decades — because the schools have known that money would be available to pay the bills. With that arrangement in place, the only thing putting downward pressure on those constantly rising prices has been hesitation on the part of young people to take on responsibility for the debts. But once the federal government starts canceling those debts, that concern will vanish, inflating prices further — especially since everyone will know perfectly well than it will be politically impossible for the act of debt forgiveness to be a one-time event. Once one generation of college graduates has been liberated from its debt burdens, every subsequent generation will appeal to the principle of fairness in demanding the same.

Before long, we will live in a country in which the federal government in effect provides free college for anyone who wants it — not just at community colleges and state schools, but at the most expensive private colleges as well. Some might think that sounds like a dream, but they should think again — because as soon as Washington is on the hook for the bill, constituents will demand cost-cutting. And that will almost certainly mean price controls — along with a much greater government involvement in what colleges teach and what professors are permitted to say in the classroom and in their writing and research.

Is that really the future progressives want — de facto federal control of universities in a country that regularly elects conservative Republicans to Congress and the presidency?

Of course this scenario presumes that a program of student-loan forgiveness will be politically popular enough not to blow up immediately in the faces of Democrats — and that is doubtful. Sixty-five percent of Americans haven’t graduated from a four-year college. Will that large majority really favor a multi-billion-dollar bailout for people who hold those degrees when their indebtedness was freely taken on and has granted them a credential that gives them a ticket to lifetime higher earnings? Or will it instead be seen by many as an unusually vivid example of how American elites (and those on a fast track to joining them) have captured the machinery of government to benefit themselves?

The country’s two major parties are locked in a multi-decade-long battle to determine which of them will come to be seen as the greater champion of the American worker. Spending tens of billions of dollars canceling college debts would be a major act of surrender in that fight. Which is why politically savvy Democrats should prefer that the new president pursue a broad-based stimulus package, infrastructure spending, expansion of the Affordable Care Act, or just about any other policy over the cancelation of college debt.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Damon Linker is a senior correspondent at TheWeek.com. He is also a former contributing editor at The New Republic and the author of The Theocons and The Religious Test.

-

Can Texas redistricting save the US House for the GOP?

Can Texas redistricting save the US House for the GOP?Today's Big Question Trump pushes a 'ruthless' new plan, but it could backfire

-

'No one should be surprised by this cynical strategy'

'No one should be surprised by this cynical strategy'Instant Opinion Opinion, comment and editorials of the day

-

Intellectual property: AI gains at creators' expense

Intellectual property: AI gains at creators' expenseFeature Two federal judges ruled that it is fair use for AI firms to use copyrighted media to train bots

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred

-

Will Trump's 'madman' strategy pay off?

Will Trump's 'madman' strategy pay off?Today's Big Question Incoming US president likes to seem unpredictable but, this time round, world leaders could be wise to his playbook

-

Democrats vs. Republicans: which party are the billionaires backing?

Democrats vs. Republicans: which party are the billionaires backing?The Explainer Younger tech titans join 'boys' club throwing money and support' behind President Trump, while older plutocrats quietly rebuke new administration

-

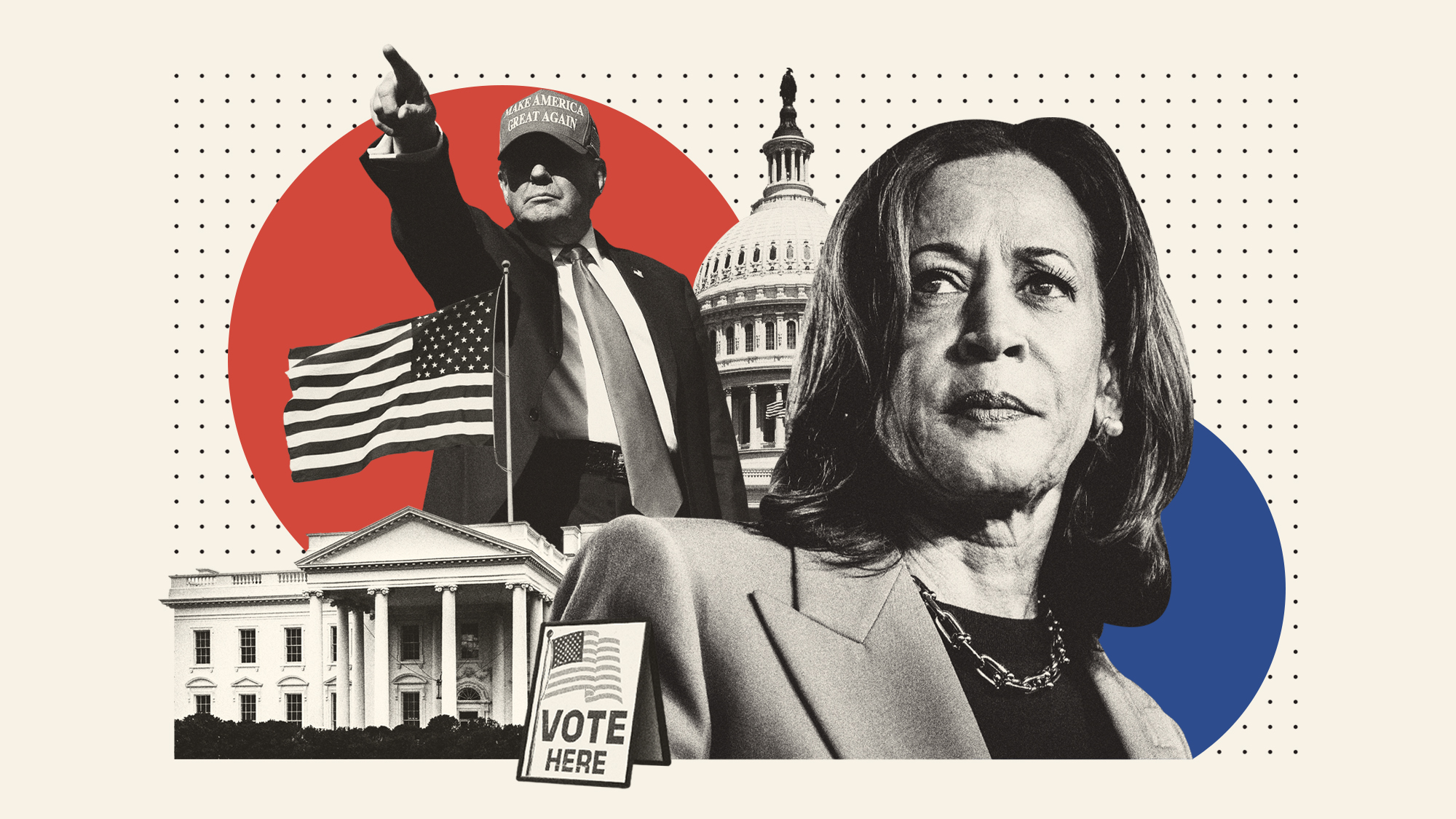

US election: where things stand with one week to go

US election: where things stand with one week to goThe Explainer Harris' lead in the polls has been narrowing in Trump's favour, but her campaign remains 'cautiously optimistic'

-

Is Trump okay?

Is Trump okay?Today's Big Question Former president's mental fitness and alleged cognitive decline firmly back in the spotlight after 'bizarre' town hall event

-

The life and times of Kamala Harris

The life and times of Kamala HarrisThe Explainer The vice-president is narrowly leading the race to become the next US president. How did she get to where she is now?