Janet Yellen's proposal to revolutionize corporate taxation

How to make big multinationals pay their fair share in every country

President Biden is proposing a substantial increase in the rate of corporate taxation as part of his infrastructure plan, bumping the headline rate up from 21 percent to 28 percent. This is actually below where it was before 2017, when the headline rate was 35 percent, but given the number of loopholes in the tax code, very few corporations actually paid full whack back then. If Biden's idea is passed, the effective rate of U.S. corporate tax will depend on what happens with those loopholes in Congress, which is not yet clear.

More importantly, Treasury Secretary Janet Yellen is leading an effort to implement a global minimum corporate tax. This would be one of the most revolutionary economic agreements in history — blowing up the model of tax havens around the world, and drastically shifting the balance of power between corporations and national governments (especially small ones).

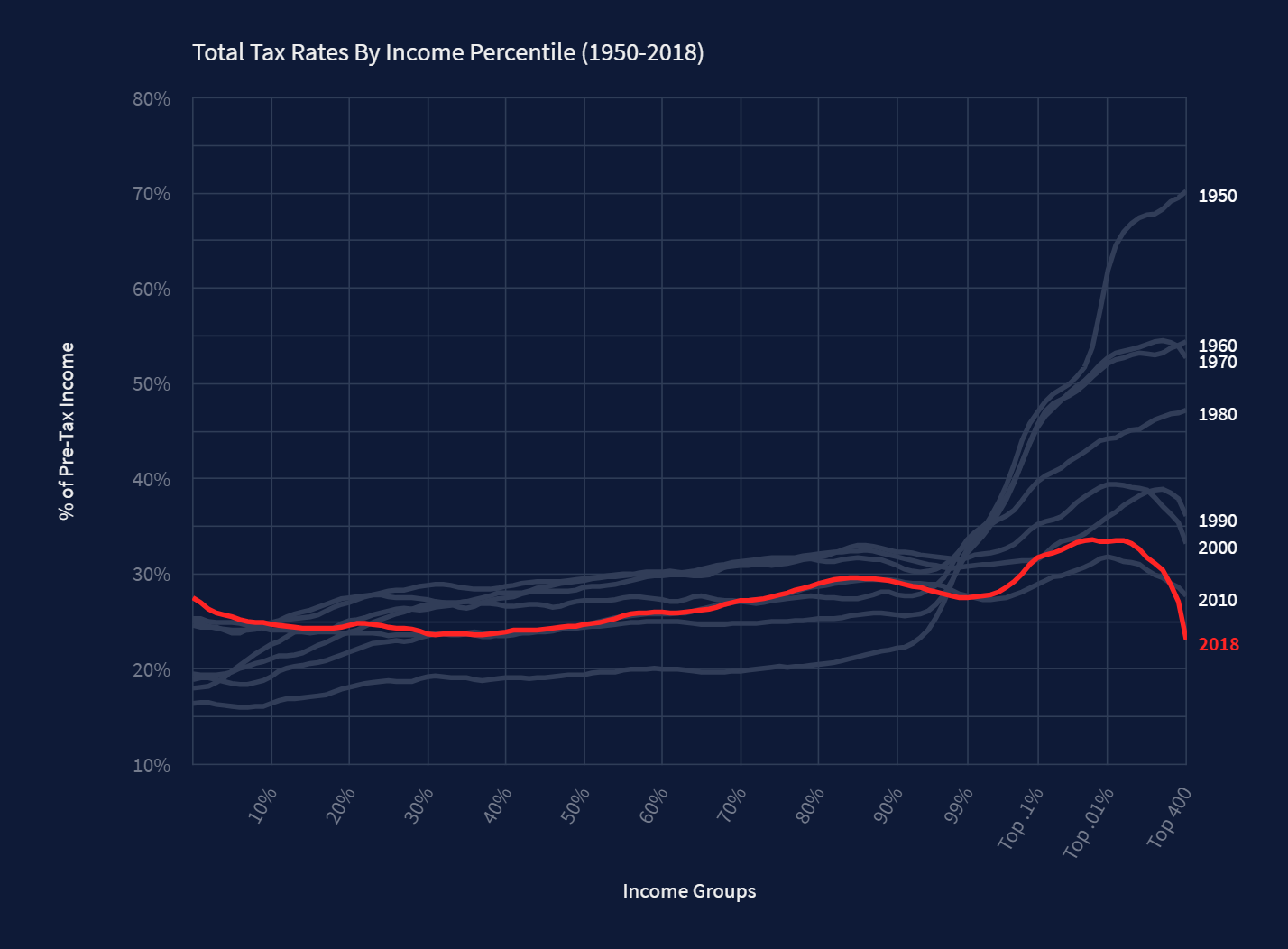

The last several decades have seen a race to the bottom in corporate tax rates around the world, as economists Emanuel Saez and Gabriel Zucman describe in their book Triumph of Injustice: How the Rich Dodge Taxes and How to Make Them Pay. America, for example, used to have very steep taxes on the rich — a 53 percent tax on corporate profits, a 75 percent tax on the biggest inherited estates, and a 94 percent top marginal income tax rate. Figures from economist Thomas Piketty show similar rates in France, Germany, and Britain in the period after the Second World War. But these have been gradually whittled away over the years through a combination of legal innovation from tax lawyers and accountants, and learned helplessness on the part of governments — especially after the neoliberal turn in the 1980s, when taxes came to be viewed an economic drag if not legalized theft. In 1980 the average corporate tax rate in Europe was about 45 percent; in 2020 it was about 20 percent. "Looking at most of the great retreats of progressive taxation, we find the same pattern: first, an outburst of tax dodging; then, governments lamenting that taxing the rich has become impossible and slashing their rates," they write.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Thanks to all the succeeding rounds of tax cuts, today ultra-billionaires pay less in tax than any other group in the U.S. According to data compiled by Saez and Zucman, people on the Forbes 400 list of the richest people in the country pay just 23 percent of their income in tax, as compared to about 40 percent for the upper-middle class or 28 percent for the very poorest:

It is of course wildly outrageous for the most well-off people to be contributing so little to support the country that makes their wealth possible, and the gigantic concentration of money in so few hands is manifestly corrupting politics around the world. Low corporate taxes are a big reason for this — as you can see with their handy tool, increasing the effective corporate rate to 40 percent would bump up the Forbes 400 tax rate by about 7 percentage points.

But perhaps more insidious still is the politics of tax havens created by all these cuts.

One of the key legal strategies that corporations use to avoid tax is by stashing their money overseas. Google, for instance, books much of its profit in Ireland, where the headline corporate tax rate is 12.5 percent (and in practice lower than that) and Bermuda, where the corporate tax is zero. As Saez and Zucman explain, companies do this basically through trickery. By selling assets that have no market price (above all intellectual property) to foreign subsidiaries for cheap, they can then book profits relating to those assets there and pay little in tax.

In an economic sense, this is tantamount to fraud. There is not anything like the level of business activity that would justify all those profits being "made" in Ireland or Bermuda. They are overwhelmingly profits made elsewhere that are sheltered from tax authorities through accounting gimmicks.

But the ability to book profits in tax havens provides corporations with a powerful weapon against national tax authorities. By moving profits overseas (or threatening to do so), they have induced nations to continually cut their domestic corporate tax rates, inaugurating a race to the bottom as countries struggle to undercut each other. In 1980, the average corporate rate was 40.11 percent, but today it is just 23.85 percent. There have always been countries that charged little in corporate tax, but as Saez and Zucman demonstrate, before the 1970s they were not used to book fake profits, for fear of a crackdown from the IRS or other tax authorities. But once authorities in rich countries gave up trying to rein in tax cheats, evasive behavior exploded: Between 1980 and today, the percentage of foreign profits booked by U.S.-based multinational corporations in tax havens has tripled, from less than 20 percent to almost 60 percent. There is no sign of the trend stopping, either — in 2020 alone, nine countries cut their corporate rate.

Now, America is so big and powerful that it could probably destroy tax havens by itself. Biden's tax plan would double the tax rate U.S. companies pay on their foreign profits, which would strike a substantial blow by itself. But America could also legally forbid the use of tax shelter accounting strategies for American companies, and require that any international company doing business here do the same — forcing them to book British profits in Britain, German profits in Germany, and so on. Any serious multinational must have access to the vast American domestic market, and they would basically have no choice but to comply. In the extreme, the U.S. could apply economic sanctions to tax havens or even threaten them with military force.

But Yellen is pushing a different argument. The corporate tax race to the bottom is a poisonous zero-sum game — the benefits to Ireland or Bermuda must come at the expense of other countries, and erode the global rate of corporate tax over the long term. It follows that it is in the interest of all nations to set up a universal minimum standard so that nobody is tempted to go for beggar-thy-neighbor development strategies. That holds even for Ireland, where the flood of corporate money has badly corrupted national politics, and the average Irish person barely sees any of those fake profits anyway.

"This is not sustainable, either politically or economically," Zucman told The Week. "A high global minimum tax would address the issue — and ultimately allow the world to reconcile globalization with tax justice." The rate of the minimum tax is still being discussed, but if set at a reasonable level, it would be a huge blow against corporate power. In effect, nations would regain a great deal of economic sovereignty — allowing them to choose corporate policies based on what they think is best, rather than being forced to follow the herd and prostrate themselves before the corporate elite.

It is an interesting question as to why Democratic establishment types like Biden and Yellen are pushing this kind of fairly aggressive policy. The complete failure of the Trump corporate tax cuts to perform as promised probably has something to do with it. According to neoliberal economic theory, such cuts should spark investment because companies will get to keep a greater share of the revenues resulting from that investment. That did not happen because of inequality — the mass of American consumers did not have the money to buy the products that new investment would have produced and corporations were already sitting on record hoards of cash. Corporate investment is only surging now thanks to all the money put into ordinary people's pockets through the various pandemic rescue packages, which has spiked demand for all sorts of things.

At any rate, it remains to be seen whether Biden's tax plan can get through Congress. But Yellen could still accomplish a great deal without that happening. If a critical mass of countries can agree to stand together against big corporations, politics around the world would take a sharp turn for the better. Ultimately, corporations depend utterly on state laws and structures to exist at all. It's only fair to make them pay their fair share.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Ryan Cooper is a national correspondent at TheWeek.com. His work has appeared in the Washington Monthly, The New Republic, and the Washington Post.

-

How will Trump's spending bill impact student loans?

How will Trump's spending bill impact student loans?the explainer Here's what the Republicans' domestic policy bill means for current and former students

-

Can the US economy survive Trump's copper tariffs?

Can the US economy survive Trump's copper tariffs?Today's Big Question Price hike 'could upend' costs of cars, houses, appliances

-

Film reviews: Superman and Sorry, Baby

Film reviews: Superman and Sorry, BabyFeature A hero returns, in surprising earnest, and a woman navigates life after a tragedy

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred

-

Will Trump's 'madman' strategy pay off?

Will Trump's 'madman' strategy pay off?Today's Big Question Incoming US president likes to seem unpredictable but, this time round, world leaders could be wise to his playbook

-

Democrats vs. Republicans: which party are the billionaires backing?

Democrats vs. Republicans: which party are the billionaires backing?The Explainer Younger tech titans join 'boys' club throwing money and support' behind President Trump, while older plutocrats quietly rebuke new administration

-

US election: where things stand with one week to go

US election: where things stand with one week to goThe Explainer Harris' lead in the polls has been narrowing in Trump's favour, but her campaign remains 'cautiously optimistic'

-

Is Trump okay?

Is Trump okay?Today's Big Question Former president's mental fitness and alleged cognitive decline firmly back in the spotlight after 'bizarre' town hall event

-

The life and times of Kamala Harris

The life and times of Kamala HarrisThe Explainer The vice-president is narrowly leading the race to become the next US president. How did she get to where she is now?