The daily business briefing: December 3, 2020

Congress approves law threatening to ban U.S. trading of Chinese companies' shares, the S&P 500 sets 2nd straight record, and more

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

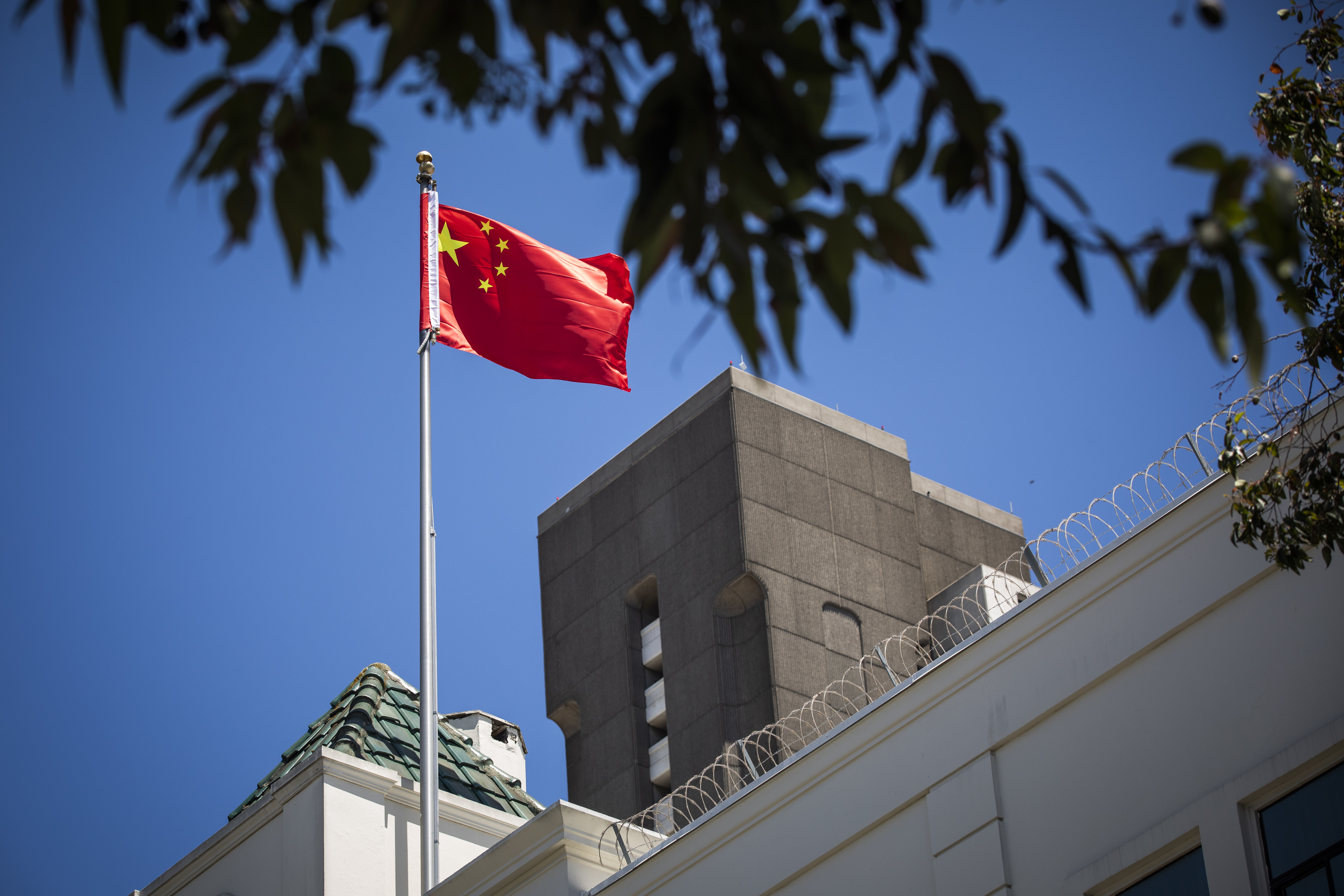

1. Congress approves bill threatening trading ban on Chinese shares

The House on Wednesday unanimously approved a bill threatening to ban U.S. trading of Chinese companies' stocks because of concerns their audits are inadequately regulated. The bipartisan measure passed the Senate in May, so all it needs to become law is President Trump's signature. Under the measure, Chinese companies such as Alibaba Group Holding and their auditors would have to comply with a requirement to let American regulators check their auditors' work or face the trading prohibition. To avoid the ban, the companies could go private or list their shares on an exchange outside the U.S. Chinese laws bar companies from sharing information, so U.S. regulators will have to come up with a plan that would let Chinese auditors legally comply with the inspection requirement.

2. S&P 500 sets 2nd straight record

The S&P 500 made modest gains on Wednesday, rising by 0.2 percent to its second straight record high. The Dow Jones Industrial Average also rose by about 0.2 percent. The tech-heavy Nasdaq edged down by less than 0.1 percent. The mood on Wall Street was buoyed by positive developments on coronavirus vaccines, including the emergency approval of the Pfizer-BioNTech vaccine in the United Kingdom, and by signs that lawmakers in Washington are eager to work out a deal on a new coronavirus relief package. Both rising coronavirus infections and weakening economic data underscored the need for a new stimulus spending bill. Stock index futures were mixed early Thursday as investors awaited news on how stimulus negotiations are going.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

3. Mnuchin: Trump will sign McConnell's limited coronavirus relief plan

President Trump will sign Senate Majority Leader Mitch McConnell's (R-Ky.) coronavirus stimulus proposal if Congress passes it, Treasury Secretary Steven Mnuchin told reporters Wednesday. McConnell hasn't revealed many details on his Tuesday proposal, but has insisted on a targeted $500 billion deal in the past. Mnuchin made no mention of the $908 billion proposal a group of bipartisan senators unveiled Tuesday. Leading Democrats said Wednesday that plan should serve as the starting point for negotiations, backing off demands for a larger package. The bipartisan bill had a price tag similar to the package McConnell shot down in July, but repurposed funds from the CARES Act, meaning only half the figure is new money. McConnell's package meanwhile included proposals from GOP senators, and came just hours after the bipartisan bill in what seemed like a blatant rejection of it.

4. Federal regulators accuse Google of spying on workers

The National Labor Relations Board on Wednesday issued a complaint against Google, accusing the tech giant of violating employees' rights by monitoring them, and firing workers for protesting company policies and trying to unionize. The labor regulator's complaint said that Alphabet-owned Google unlawfully put some employees on administrative leave and terminated them for accessing documents regarding how the company polices internal forums. Google said it did nothing illegal. "Google has always worked to support a culture of internal discussion, and we place immense trust in our employees," the company said. "Actions undertaken by the employees at issue were a serious violation of our policies and an unacceptable breach of a trusted responsibility."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

5. Report: UPS imposed shipping limits on big retailers

United Parcel Service this week imposed shipping restrictions on some large retailers in an early response to what is expected to be an overwhelming surge in online shopping this holiday shopping season, The Wall Street Journal reported Wednesday. UPS told drivers on Cyber Monday to stop collecting packages from six retailers — Gap, Nike, L.L. Bean, Hot Topic, Newegg, and Macy's. "No exceptions," the message said. The move came as overall sales fell over the long Thanksgiving weekend that includes Black Friday and Cyber Monday, but online sales boomed as Americans shopped from home to reduce the risk of coronavirus infection. The temporary limits could have helped UPS control the flow of packages into its network and avoid a drop in performance in one of the year's busiest shipping weeks.

Harold Maass is a contributing editor at The Week. He has been writing for The Week since the 2001 debut of the U.S. print edition and served as editor of TheWeek.com when it launched in 2008. Harold started his career as a newspaper reporter in South Florida and Haiti. He has previously worked for a variety of news outlets, including The Miami Herald, ABC News and Fox News, and for several years wrote a daily roundup of financial news for The Week and Yahoo Finance.