Interest rate rise predicted as CBI warns on house prices

Policymakers must be ready to act on 'unsustainable house prices', business leaders warn

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

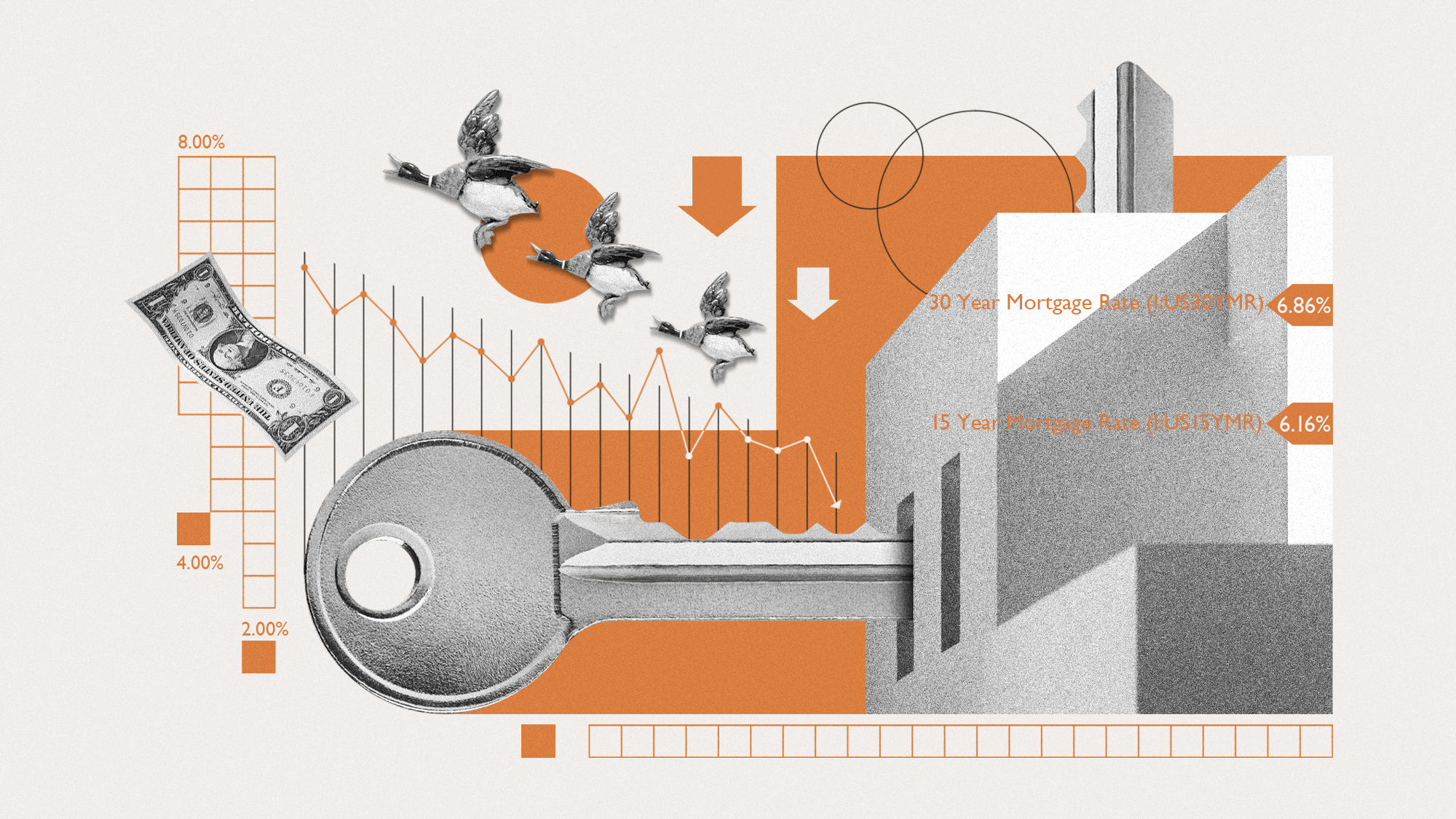

BUSINESS leaders have predicted an early rise in interest rates, amid warnings of "unsustainable" house prices in the UK.

The Confederation of British Industry (CBI), which represents tens of thousands of businesses across the country, anticipates a quarter-point rise in interest rates in the first three months of 2015, from 0.5 per cent to 0.75 per cent – six months earlier than it had previously predicted.

The CBI's director-general, John Cridland, said: "We have to remain alert to the risks posed by unsustainable house price inflation.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

"Housing has come back under the spotlight as annual house price inflation figures have reached double digits on some measures," Cridland said. "While housing transactions are still running almost 30 per cent below their last peak in 2006, they are picking up steadily".

Property prices are set to increase by 8.2 per cent this year and 5.1 per cent in 2015, which is "fuelling speculation of a bubble", the Daily Telegraph says.

The warning on house prices comes as the "economic backdrop brightens", The Times reports. The CBI has pushed its UK growth forecast for this year up to three per cent from 2.6 per cent, and for 2015 to 2.7 per cent – up from 2.5 per cent.

But the group also warned that in the lead up to next year's election in May, politicians must not jeopardise the rebound with "pre-election soundbite policies", The Independent reports.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Katja Hall, chief policy director at the CBI, said: "Political positioning must not be allowed to stifle investment, whether it's an unrealistic immigration target, unjustified interventions into specific markets, flirting with leaving the EU, delaying vital long-term infrastructure projects or restricting labour market flexibility.

"Pre-election pledges should not deter overseas and home-grown investors and entrepreneurs, nor limit a future government's ability to deliver prosperity in the UK," Hall said.

-

Political cartoons for February 22

Political cartoons for February 22Cartoons Sunday’s political cartoons include Black history month, bloodsuckers, and more

-

The mystery of flight MH370

The mystery of flight MH370The Explainer In 2014, the passenger plane vanished without trace. Twelve years on, a new operation is under way to find the wreckage of the doomed airliner

-

5 royally funny cartoons about the former prince Andrew’s arrest

5 royally funny cartoons about the former prince Andrew’s arrestCartoons Artists take on falling from grace, kingly manners, and more

-

The end for central bank independence?

The end for central bank independence?The Explainer Trump’s war on the US Federal Reserve comes at a moment of global weakening in central bank authority

-

Fed cuts interest rates a quarter point

Fed cuts interest rates a quarter pointSpeed Read ‘The cut suggests a broader shift toward concern about cracks forming in the job market’

-

How will Wall Street react to the Trump-Powell showdown?

How will Wall Street react to the Trump-Powell showdown?Today's Big Question 'Market turmoil' seems likely

-

Will Rachel Reeves have to raise taxes again?

Will Rachel Reeves have to raise taxes again?Today's Big Question Rising gilt yields and higher debt interest sound warning that Chancellor may miss her Budget borrowing targets

-

Fed cuts rates half a point, hinting victory on inflation

Fed cuts rates half a point, hinting victory on inflationSpeed Read This is the Fed's first cut in two years

-

US job growth revised downward

US job growth revised downwardSpeed Read The US economy added 818,000 fewer jobs than first reported

-

Is the Fed ready to start cutting interest rates?

Is the Fed ready to start cutting interest rates?Today's Big Question Recession fears and a presidential election affect the calculation

-

Will the housing slump ever end?

Will the housing slump ever end?Today's Big Question Probably not until mortgage rates come down