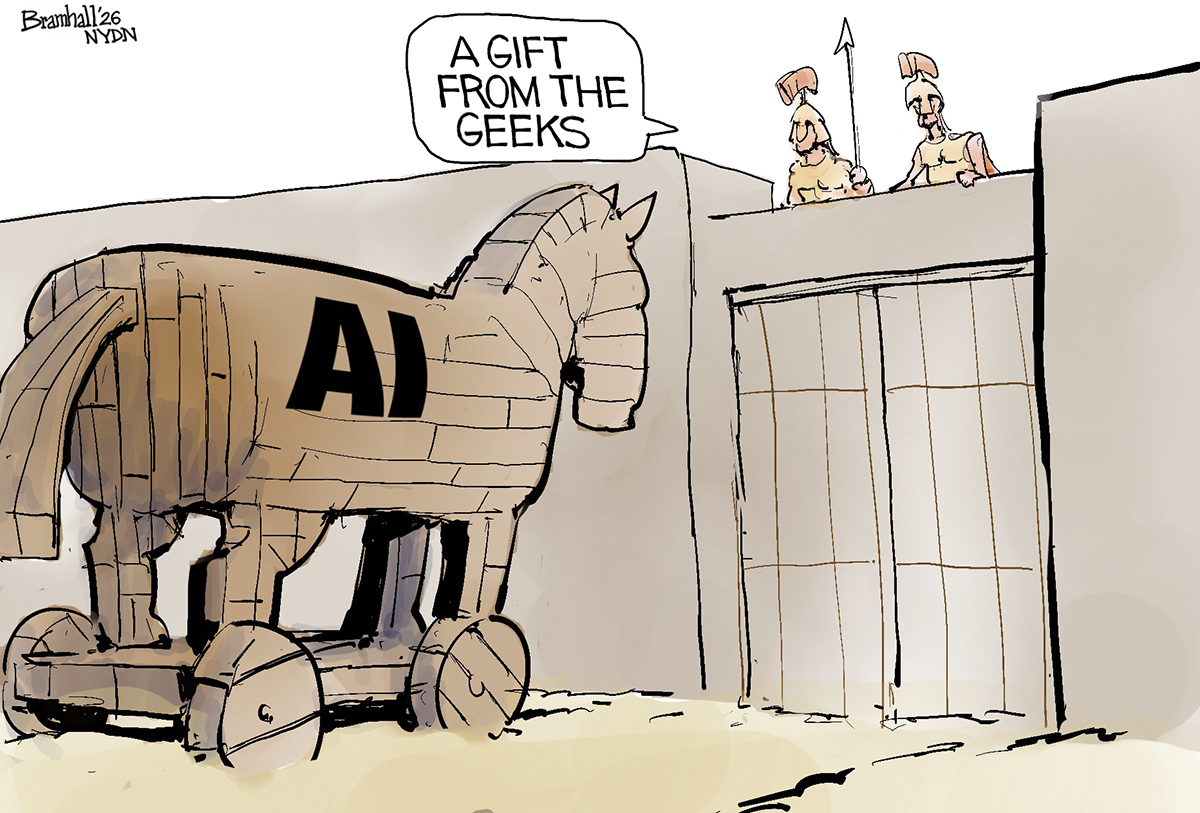

The AI stock market wave: chancing an Arm?

The SoftBank-owned British chip designer has started the countdown for a Nasdaq IPO in a snub to the London Stock Exchange

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

If ever a float could be said to test current market conditions, it may be that of Arm, the SoftBank-owned British chip designer that has “started the countdown” for a Nasdaq IPO in early September, said the FT.

It promises to be the biggest US listing in two years, valuing the Cambridge-based company at around $64bn. Chip stocks have rebounded sharply this year on the back of “the AI wave”, said Jacky Wong in The Wall Street Journal. And Arm can boast that its designs go into “almost every smartphone” on the planet. Even so, it is coming to market at a “lofty valuation”.

‘A useful stress test’

The bull case rests on the hope that it can extend its reach into the central server processors that power AI applications – and thus “experience the same sort of explosive growth as Nvidia”, whose valuation shot through $1trn in May. But the crucial question is whether investors will “pay up” for these prospects. “The Arm IPO is shaping up as a useful stress test for all the rosy assumptions” baked into the AI rally.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

There are other issues, said Katie Prescott in The Times. As Arm’s filing documents make clear, it is worryingly exposed to an “unpredictable China”, which accounted for a quarter of revenues in the year to March. The Biden administration’s crackdown on Chinese access to US tech and investment doesn’t help. But Arm’s problems extend far beyond the standard geopolitical headwinds facing strategic industries. It is also “at the mercy of a Chinese entity it does not own”.

‘Latest blow for London Stock Exchange’

The UK company’s single largest customer is “Arm China” – yet it has no control over its Chinese namesake. A “farcical episode” last year highlighted the potential for mischief when the latter’s CEO, Allen Wu, “was fired but refused to leave”. As the filing notes admit, even the name could prove an issue.“Although Arm China operates independently of us, [it] uses our trademarks in its marketing and branding” – meaning “our own brand and reputation may suffer significant damage” if “Arm China’s actions are imputed to us”.

For all these potential problems, there’s still “much lament” in the City that London has missed out on the world’s biggest listing this year, said Swetha Gopinath and Kit Rees on Bloomberg. “It’s the latest blow for the London Stock Exchange, which has seen more companies quit than join” this year, “and whose indexes lag behind European and US peers”. Indeed, 2023 could prove “the worst for UK listings since the global financial crisis”. We are seeing what one analyst calls a “worrying de-equitisation across the London market”. Whatever the fortunes of Arm next month, its loss to New York is symbolic.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

Political cartoons for February 19

Political cartoons for February 19Cartoons Thursday’s political cartoons include a suspicious package, a piece of the cake, and more

-

The Gallivant: style and charm steps from Camber Sands

The Gallivant: style and charm steps from Camber SandsThe Week Recommends Nestled behind the dunes, this luxury hotel is a great place to hunker down and get cosy

-

The President’s Cake: ‘sweet tragedy’ about a little girl on a baking mission in Iraq

The President’s Cake: ‘sweet tragedy’ about a little girl on a baking mission in IraqThe Week Recommends Charming debut from Hasan Hadi is filled with ‘vivid characters’

-

Currencies: Why Trump wants a weak dollar

Currencies: Why Trump wants a weak dollarFeature The dollar has fallen 12% since Trump took office

-

Elon Musk’s starry mega-merger

Elon Musk’s starry mega-mergerTalking Point SpaceX founder is promising investors a rocket trip to the future – and a sprawling conglomerate to boot

-

TikTok: New owners, same risks

TikTok: New owners, same risksFeature What are Larry Ellison’s plans for TikTok US?

-

Will SpaceX, OpenAI and Anthropic make 2026 the year of mega tech listings?

Will SpaceX, OpenAI and Anthropic make 2026 the year of mega tech listings?In Depth SpaceX float may come as soon as this year, and would be the largest IPO in history

-

Leadership: A conspicuous silence from CEOs

Leadership: A conspicuous silence from CEOsFeature CEOs were more vocal during Trump’s first term

-

Ryanair/SpaceX: could Musk really buy the airline?

Ryanair/SpaceX: could Musk really buy the airline?Talking Point Irish budget carrier has become embroiled in unlikely feud with the world’s wealthiest man

-

Powell: The Fed’s last hope?

Powell: The Fed’s last hope?Feature Federal Reserve Chairman Jerome Powell fights back against President Trump's claims

-

Did markets’ ‘Sell America’ trade force Trump to TACO on Greenland?

Did markets’ ‘Sell America’ trade force Trump to TACO on Greenland?Today’s Big Question Investors navigate a suddenly uncertain global economy