Cryptocurrencies in 2018: what can we expect from Bitcoin and Ethereum?

Everything you need to know about the most popular digital coins

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

One of the hottest topics last year was the rise of cryptocurrencies, a form of digital money that can be stored without using a bank.

The technology has gained popularity in recent years because in most cases cryptocurrencies are untraceable, The Daily Telegraph reports. This allows users to make purchases and investments anonymously.

There’s only a finite amount of digital coins available. This has driven the value of some cryptocurrencies to five-figure sums.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Here are some of the top virtual currencies of 2017 and how they might fare over the next 12 months:

Bitcoin (BTC)

Bitcoin is currently the most valuable cryptocurrency on the market. Current prices for a single coin are priced at around £11,000, according to Coinranking.

The cryptocurrency kicked off 2017 with a value of just £800 per coin before reaching its current highs. The coin’s substantial growth could continue this year, says Inverse, as some experts believe the digital coin could reach six-figure values.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

That’s because the digital currency is relatively scarce, with only 21 million coins available for people to purchase.

But investor Jeremy Grantham says Bitcoin is currently experiencing a financial bubble and could plummet in value “before the broad market peaks”, reports CNBC.

Ethereum (ETH)

As one of the standout cryptocurrencies of the year so far, according to The Daily Telegraph, Ethereum passed the $1,000 (£740) per coin mark in the first week of January.

What sets it apart from Bitcoin is that Ethereum’s value is driven by its fast transaction speeds and hi-tech architecture, says Digital Trends, while Bitcoin’s relative scarcity has led to its £11,000 per coin price tag.

There’s a chance Ethereum could continue to grow in the early stages of this year, says Fortune. Financial institutions such as Barclays and Credit Suisse have announced plans to “test” the technology to help transfer money between European countries.

Ripple (XRP)

While Bitcoin’s jump in value from around £800 to £11,000 over the past 12 months stole the headlines last year, Quartz says the coin XRP from Ripple was the “best performing” digital currency.

Unlike decentralised coins like Bitcoin or Ethereum, which are aimed at those looking to store money without going through a bank, Ripple is a company that helps banks transfer funds between different countries faster and more securely.

Quartz says the value of the company’s coin “rose an astonishing 36,000%” last year. Its most successful month was December when the cryptocurrency market experienced a significant boom in value.

Ripple’s XRP coin could make further strides this year, The Sun says, as the company plans to secure a new partnership with credit card firm American Express.

Litecoin (LTC)

It’s been a quiet start to the year for Litecoin, a virtual currency based on the Bitcoin network that offers no transactions fees and hasn’t seen the same meteoric rise as Ripple’s XRP.

According to The Independent, the cryptocurrency is “up more than 5,195%” compared to January of last year. But its value has “slipped slightly over the past two days”, with current prices in the region of £180 per coin.

“There are reasons to keep Litecoin on the radar going forward”, says Investopedia, as the technology can perform more efficiently than virtual currencies such as Bitcoin.

Experts believe this allows users of the digital coin to make high-volume transactions with limited security risks, the website says. This makes Litecoin an enticing option for cryptocurrency traders.

-

Quiz of The Week: 14 – 20 February

Quiz of The Week: 14 – 20 FebruaryQuiz Have you been paying attention to The Week’s news?

-

The Week Unwrapped: Do the Freemasons have too much sway in the police force?

The Week Unwrapped: Do the Freemasons have too much sway in the police force?Podcast Plus, what does the growing popularity of prediction markets mean for the future? And why are UK film and TV workers struggling?

-

Properties of the week: pretty thatched cottages

Properties of the week: pretty thatched cottagesThe Week Recommends Featuring homes in West Sussex, Dorset and Suffolk

-

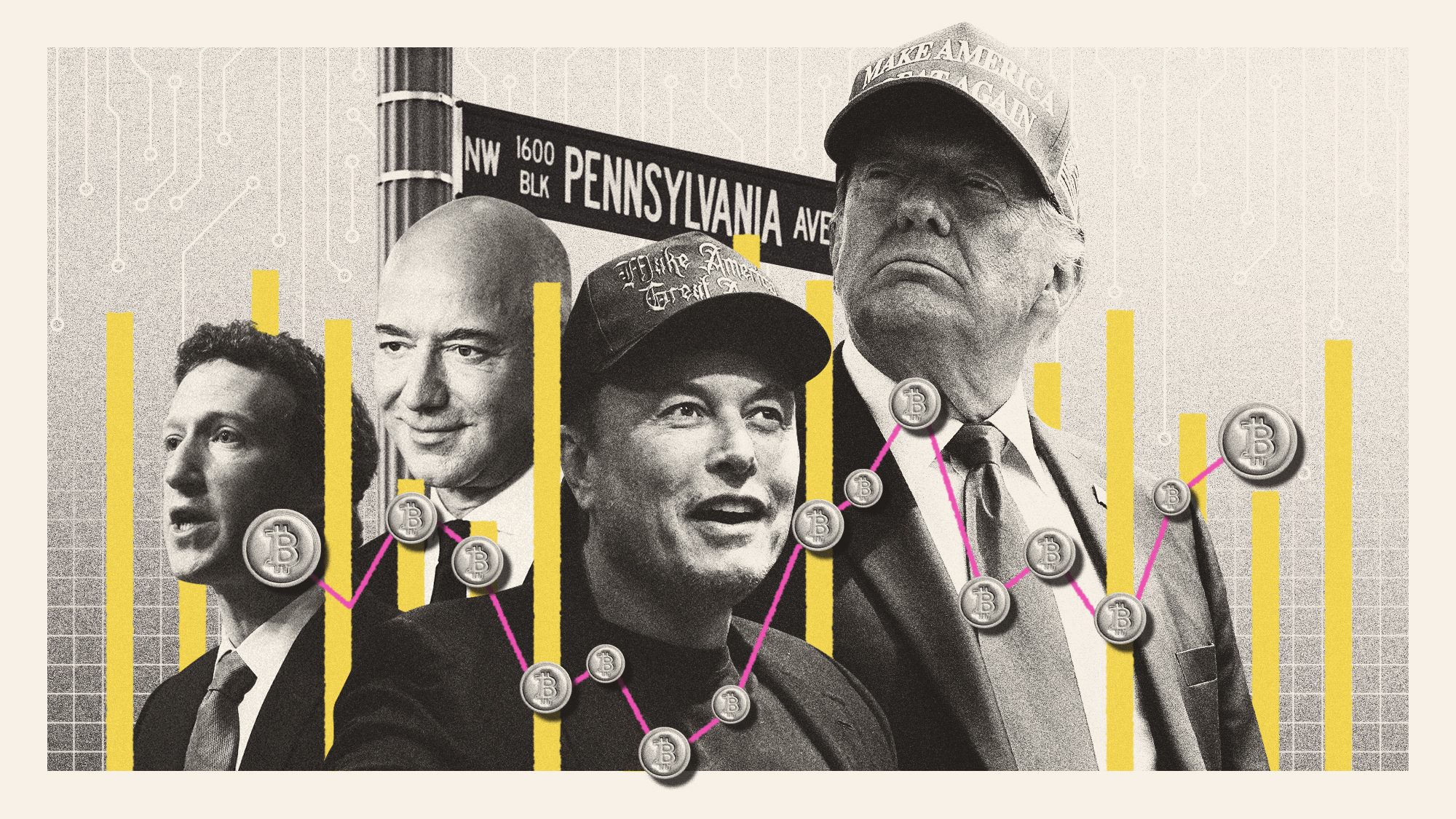

Why Trump pardoned crypto criminal Changpeng Zhao

Why Trump pardoned crypto criminal Changpeng ZhaoIn the Spotlight Binance founder’s tactical pardon shows recklessness is rewarded by the Trump White House

-

Bitcoin braces for a quantum computing onslaught

Bitcoin braces for a quantum computing onslaughtIN THE SPOTLIGHT The cryptocurrency community is starting to worry over a new generation of super-powered computers that could turn the digital monetary world on its head.

-

The noise of Bitcoin mining is driving Americans crazy

The noise of Bitcoin mining is driving Americans crazyUnder the Radar Constant hum of fans that cool data-centre computers is turning residents against Trump's pro-cryptocurrency agenda

-

What Trump's win could mean for Big Tech

What Trump's win could mean for Big TechTalking Points The tech industry is bracing itself for Trump's second administration

-

Network states: the tech broligarchy who want to create new countries

Network states: the tech broligarchy who want to create new countriesUnder The Radar Communities would form online around a shared set of 'values' and acquire physical territory, becoming nations with their own laws

-

Paraguay's dangerous dalliance with cryptocurrency

Paraguay's dangerous dalliance with cryptocurrencyUnder The Radar Overheating Paraguayans are pushing back over power outages caused by illegal miners

-

2023: the year of crypto instability

2023: the year of crypto instabilityThe Explainer Crypto reached peaks — and valleys — throughout 2023

-

Sam Bankman-Fried found guilty: where does crypto go from here?

Sam Bankman-Fried found guilty: where does crypto go from here?Today's Big Question Conviction of the 'tousle-haired mogul' confirms sector's 'Wild West' and 'rogue' image, say experts