1929: ‘work of true scholarship’ offers insight into devastating Wall Street crash

Full of ‘true-crime thrills’, Sorkin’s book is a ‘blow-by-blow’ account of the crisis

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

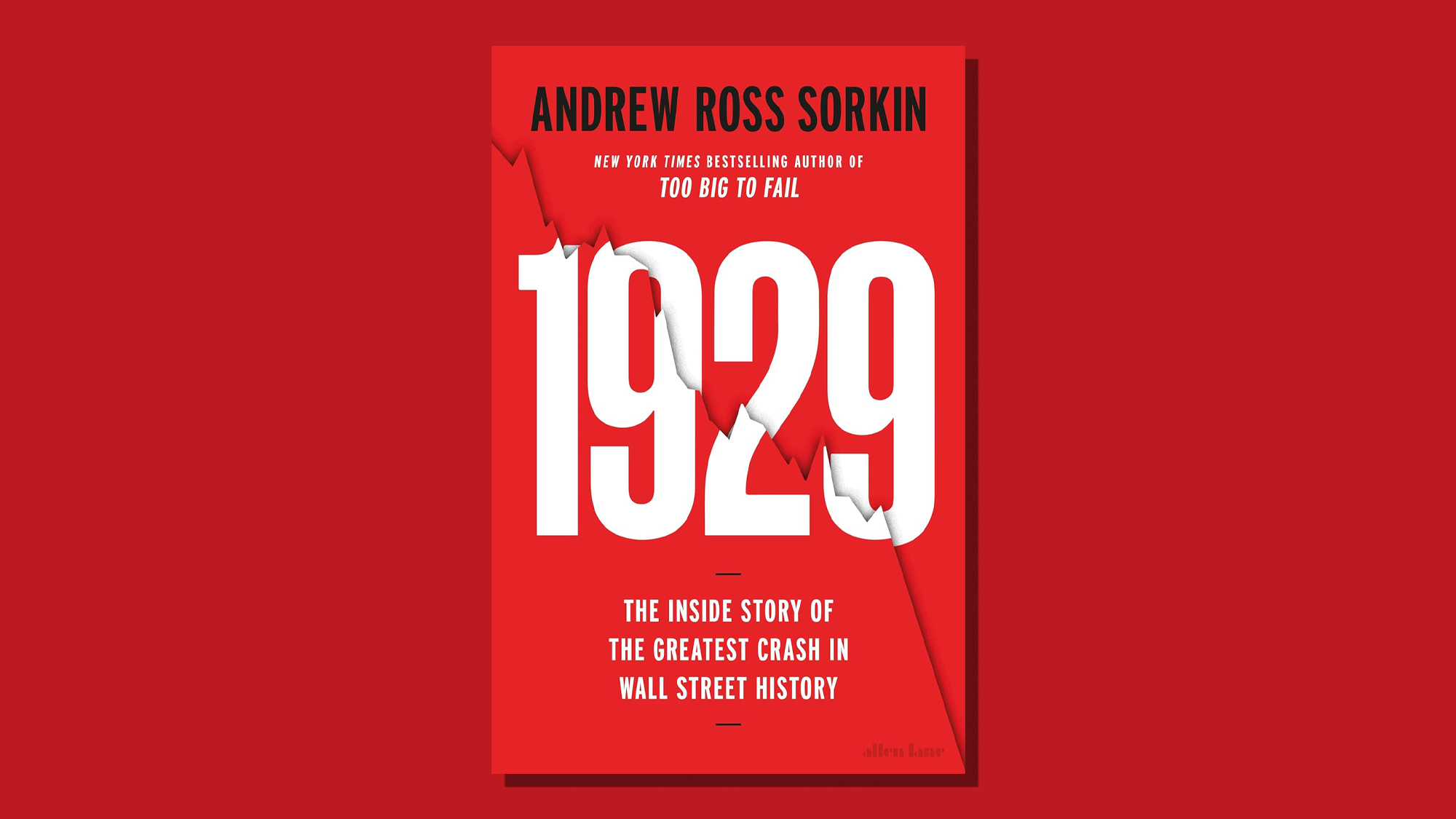

With “Too Big to Fail”, Andrew Ross Sorkin “defined the story of the 2008 financial crisis”, said Pratinav Anil in The Times. Now he has turned his gaze to an “earlier frenzy of leverage and illusion”: the Wall Street crash of 1929.

In the 1920s, with liquor outlawed, speculation became America’s “legal intoxication”. Financial regulation was lax – “insider trading was not a crime but a craft” – and debt was the “new gospel”. Key to Sorkin’s “blow-by-blow” account is a “gallery of finely drawn pen portraits”. We meet the “whip-smart” trader Jesse Livermore, who made “pots of money” shorting the market on 24 October – “Black Thursday” – only to “lose it all betting against the recovery”; the “folksy Southern Democrat” Carter Glass, the “presiding spirit behind” the 1933 Glass-Steagall Act; and even Winston Churchill, who was visiting New York in October 1929 and saw a man fling himself from his hotel window. If Sorkin’s concern for human drama makes his book seem superficial at times – he largely steers clear of “complicated explanations” – it is nonetheless “pacy” and enjoyable.

It certainly delivers plenty of “true-crime thrills”, said Zachary D. Carter in The New York Times. We learn all about the “outrageous pump-and-dump schemes”, in which bankers sold stocks to one another at inflated prices, encouraging speculators to “pile on”, before selling out and leaving the “suckers holding the bag”. There’s New York Stock Exchange president Richard Whitney, who extolled his employer as a “perfect institution”, while embezzling “more than $1m of securities to fund a life of country estate fox hunting”. Inevitably, Sorkin’s cast is “almost all-male”, said Piers Brendon in Literary Review, but there’s one entertaining exception. Evangeline Adam, an astrologer, “made a mint” advising Charlie Chaplin and others to buy shares based on their zodiac signs, but lost $100,000 on Black Thursday.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Sorkin doesn’t neglect the “ugly aftermath” of the crash, when “panic moved from Wall Street to Main Street”, said Andy Haldane in the Financial Times. He documents the slide into the Great Depression of the 1930s, when unemployment rose above eight million and shanty towns, nicknamed “Hoovervilles” (after President Herbert Hoover), sprang up across America. The product of eight years of meticulous research, this book is a “work of true scholarship”. “A people’s tragedy told through the lens of the leading players”, it is sure to be considered one of the best books in the “Great Crash/Depression genre”.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

Local elections 2026: where are they and who is expected to win?

Local elections 2026: where are they and who is expected to win?The Explainer Labour is braced for heavy losses and U-turn on postponing some council elections hasn’t helped the party’s prospects

-

6 of the world’s most accessible destinations

6 of the world’s most accessible destinationsThe Week Recommends Experience all of Berlin, Singapore and Sydney

-

How the FCC’s ‘equal time’ rule works

How the FCC’s ‘equal time’ rule worksIn the Spotlight The law is at the heart of the Colbert-CBS conflict

-

Travel for all: 6 of the world’s most accessible destinations

Travel for all: 6 of the world’s most accessible destinationsThe Week Recommends Experience all of Berlin, Singapore and Sydney

-

Bad Bunny’s Super Bowl: A win for unity

Bad Bunny’s Super Bowl: A win for unityFeature The global superstar's halftime show was a celebration for everyone to enjoy

-

Book reviews: ‘Bonfire of the Murdochs’ and ‘The Typewriter and the Guillotine’

Book reviews: ‘Bonfire of the Murdochs’ and ‘The Typewriter and the Guillotine’Feature New insights into the Murdoch family’s turmoil and a renowned journalist’s time in pre-World War II Paris

-

6 exquisite homes with vast acreage

6 exquisite homes with vast acreageFeature Featuring an off-the-grid contemporary home in New Mexico and lakefront farmhouse in Massachusetts

-

Film reviews: ‘Wuthering Heights,’ ‘Good Luck, Have Fun, Don’t Die,’ and ‘Sirat’

Film reviews: ‘Wuthering Heights,’ ‘Good Luck, Have Fun, Don’t Die,’ and ‘Sirat’Feature An inconvenient love torments a would-be couple, a gonzo time traveler seeks to save humanity from AI, and a father’s desperate search goes deeply sideways

-

A thrilling foodie city in northern Japan

A thrilling foodie city in northern JapanThe Week Recommends The food scene here is ‘unspoilt’ and ‘fun’

-

Tourangelle-style pork with prunes recipe

Tourangelle-style pork with prunes recipeThe Week Recommends This traditional, rustic dish is a French classic

-

Samurai: a ‘blockbuster’ display of Japan’s legendary warriors

Samurai: a ‘blockbuster’ display of Japan’s legendary warriorsThe Week Recommends British Museum show offers a ‘scintillating journey’ through ‘a world of gore, power and artistic beauty’