Tesla shares: what’s behind the ‘unexpected’ profits turnaround?

Company chief Elon Musk confirms Model Y production is ahead of schedule

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

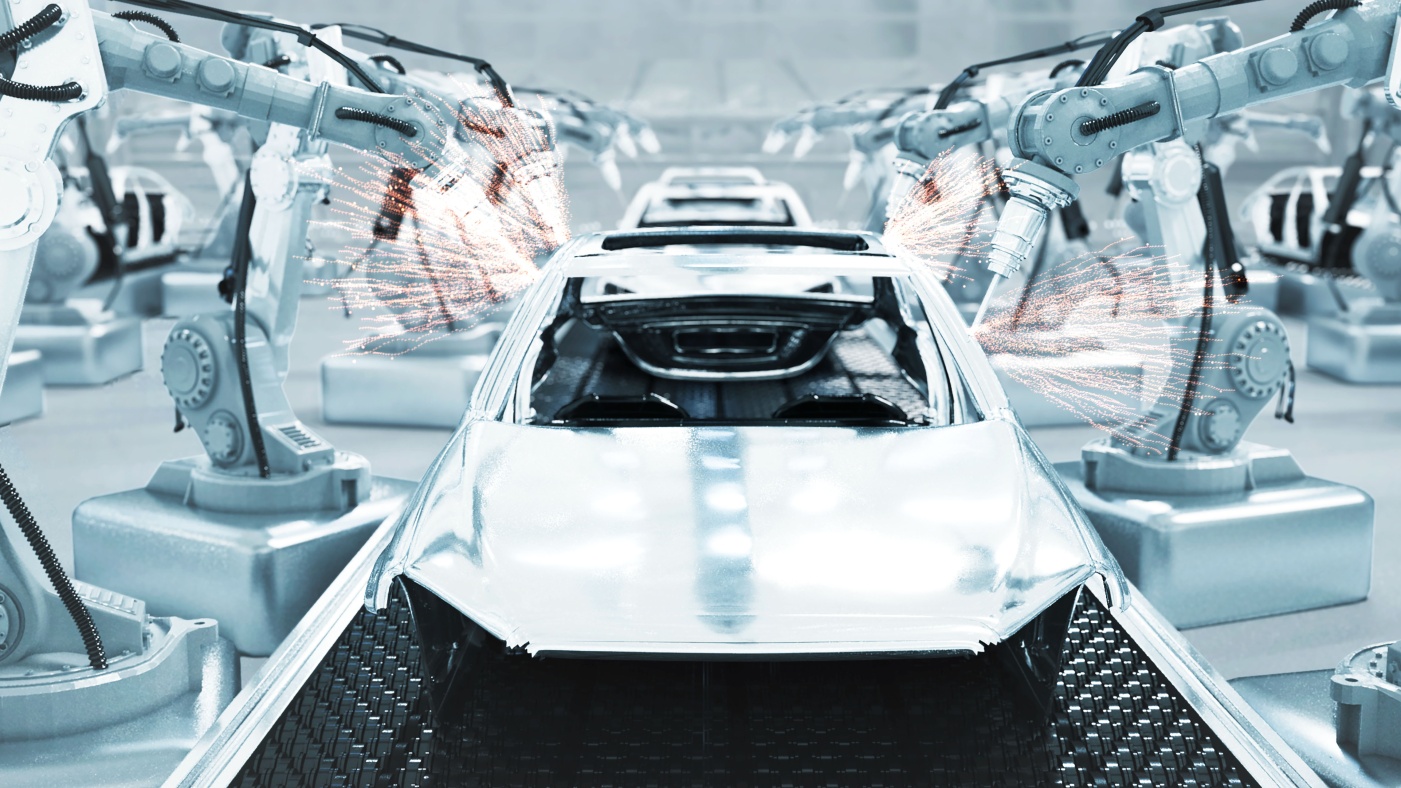

Tesla shares skyrocketed on Wednesday after the US electric carmaker posted profits for the first time since March.

Financial results for Tesla’s third quarter, ending on 30 September, revealed a cash balance increase to $5.3bn (£4.1bn) and profits of $1.86 (£1.44) per share, “shattering analyst expectations for a loss of 42 cents (33p) per share”, Reuters reports.

The “unexpected” turnaround in profits saw shares in the company rise by 21% to $307.12 (£238) in after-hours trading on Wednesday, crossing the $300 (£233) per share threshold for the first time since 1 March, the news site says.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The financial report marks a significant turnaround for the Elon Musk-backed electric carmaker.

Tesla has never posted an annual profit and has “struggled with years of losses”, according to the BBC. In recent years, the losses have had the effect of fuelling “investor doubts and casting a shadow over the shares”.

It will be hoping its positive third-quarter results are a sign that it may soon record a profitable year for the first time.

Why the sudden surge in profits?

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

As reported by The Guardian, Tesla attributed its positive quarterly result to “cost control efforts”, claiming that its operating costs were at their lowest point since production of its Model 3 budget saloon started some three years ago.

The company stated that “improved production schedules” also played a key role in streamlining its operating costs, The Sunday Times says.

But as noted by Business Insider, Tesla “laid off” 7% of its workforce in January and a further 8% in March, all of which were part of the company’s cost-saving efforts.

What about the share price?

Positive quarterly results typically serve as a catalyst for share prices, but comments made by company chief Elon Musk can often send values through the roof.

During yesterday’s investor call, which was shared publicly on YouTube, the South African-born billionaire revealed that the upcoming Model Y, a budget electric SUV, is ahead of schedule and is now expected to launch in the US next summer, Electrek reports.

Musk also claimed that the new production facility in Shanghai, China, will begin producing Model 3s imminently, which should greatly boost its presence in the region.

“Until now, all of the cars Tesla sold in China were made in the US and shipped to China, making them subject to tariffs and the shifting winds of the trade war,” The Verge says. “Producing cars locally means Tesla should be able to sell more in China, even with a sagging Chinese economy.”

-

Crisis in Cuba: a ‘golden opportunity’ for Washington?

Crisis in Cuba: a ‘golden opportunity’ for Washington?Talking Point The Trump administration is applying the pressure, and with Latin America swinging to the right, Havana is becoming more ‘politically isolated’

-

5 thoroughly redacted cartoons about Pam Bondi protecting predators

5 thoroughly redacted cartoons about Pam Bondi protecting predatorsCartoons Artists take on the real victim, types of protection, and more

-

Palestine Action and the trouble with defining terrorism

Palestine Action and the trouble with defining terrorismIn the Spotlight The issues with proscribing the group ‘became apparent as soon as the police began putting it into practice’

-

BMW iX3: a ‘revolution’ for the German car brand

BMW iX3: a ‘revolution’ for the German car brandThe Week Recommends The electric SUV promises a ‘great balance between ride comfort and driving fun’

-

The best new cars for 2026

The best new cars for 2026The Week Recommends From SUVs to swish electrics, see what this year has to offer on the roads

-

Are plug-in hybrids better for America's climate goals?

Are plug-in hybrids better for America's climate goals?Talking Points The car industry considers a 'slower, but more plausible path' to reducing emissions

-

EV market slowdown: a bump in the road for Tesla?

EV market slowdown: a bump in the road for Tesla?Talking Points The electric vehicle market has stalled – with worrying consequences for carmakers

-

The week's good news: Dec. 14, 2023

The week's good news: Dec. 14, 2023Feature It wasn't all bad!

-

MG4 EV XPower review: what the car critics say

MG4 EV XPower review: what the car critics sayFeature The XPower just 'isn't as much fun' as a regular MG4

-

Volkswagen ID.5 review: what the car critics say

Volkswagen ID.5 review: what the car critics sayFeature The ID.4's 'sportier, more stylish twin' – but 'don't believe the hype'

-

BMW iX1 review: what the car critics say

BMW iX1 review: what the car critics sayThe Week Recommends BMW’s smallest electric crossover has ‘precise’ steering and a ‘smart interior’