Moguls: Tesla's chief ratchets up the risks

Was Elon Musk serious about taking the company private?

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The smartest insight and analysis, from all perspectives, rounded up from around the web:

Tesla CEO Elon Musk testified this week in a shareholder lawsuit that he was serious when he tweeted in 2018 that he had "funding secured" to take the pioneering electric-car company private, said Patrick McGee and Hannah Murphy in the Financial Times. In response to the accusation he'd "artificially boosted Tesla's stock price" with that public statement, Musk told a federal jury that he had "what he considered a 'handshake' agreement" with Saudi Arabia's sovereign wealth fund to help finance a stock buyout. "Looking solemn in a dark suit with a dark tie," the billionaire denied the suggestion that the $420 stock price he floated was "a joke" based on "a commonly used term for cannabis." However, he added, there was "some karma around 420" — he just wasn't sure if it was "good or bad karma." Tesla's shares rose well above $420 but are now at only about a third of that level.

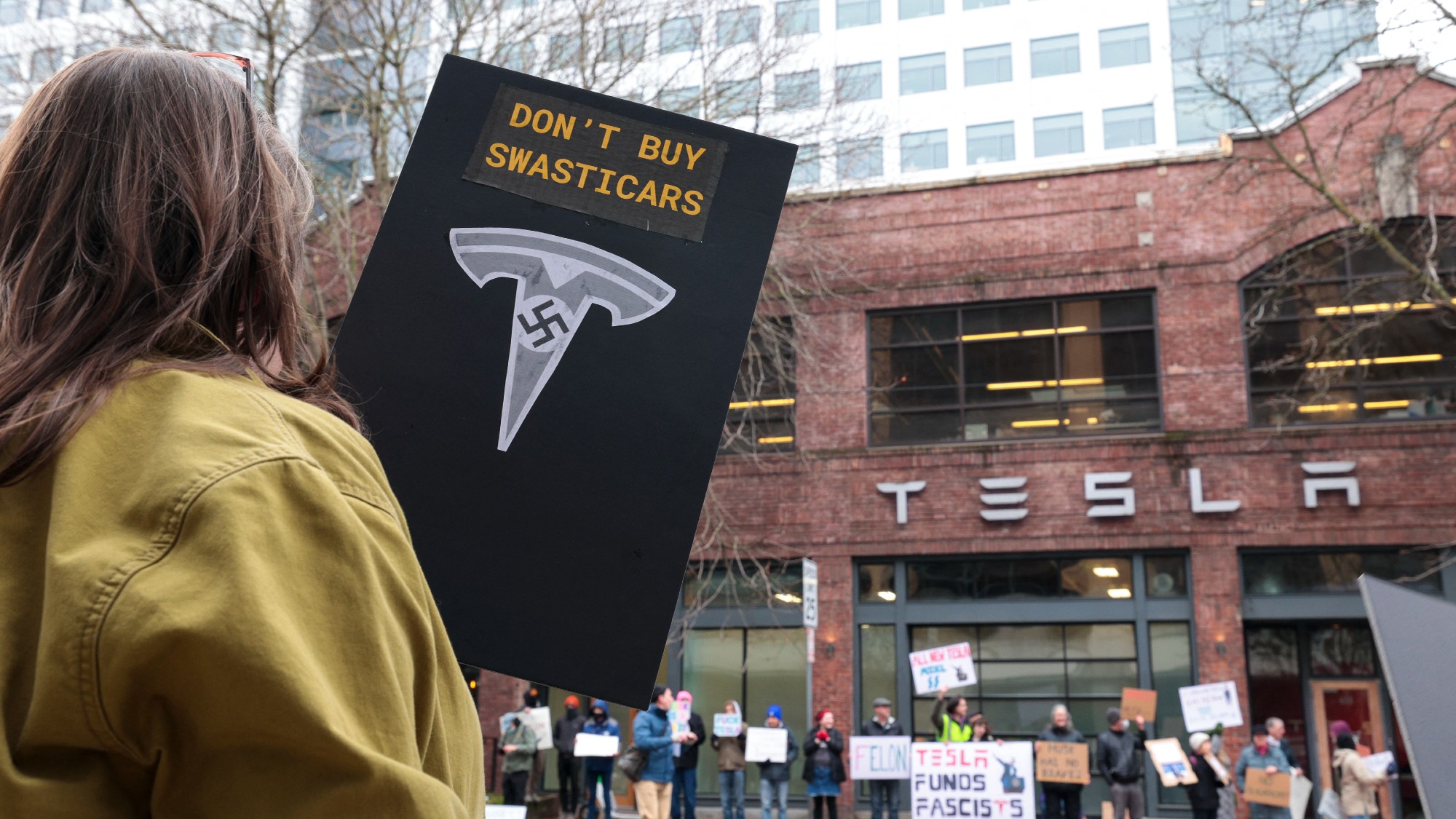

Even for Tesla, "the last three months have been a whirlwind," said Ian Sherr at CNET. With the resale value of its cars "dropping along with the company's stock," Musk has continued "to burn goodwill across the tech industry and the wider public" since his $44 billion acquisition of Twitter. Tesla's problems have raised "a crucial question" over the timing of his sale of nearly $3.6 billion of Tesla stock in December last year, said Jonathan Weil in The Wall Street Journal. A few weeks later, Tesla announced fourth-quarter vehicle deliveries "significantly below the company's most recent forecast." Did Musk "know that business had slowed when he sold his shares?" The question "should be of great interest to the SEC," said one expert on insider trading.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Meanwhile, Tesla's recent price cuts "are reverberating through the car business," said Nora Eckert and Mike Colias, also in the Journal. Tesla remains profitable, reporting a record $3.7 billion in earnings for the last quarter and shipments of 1.3 million vehicles in 2022. But some analysts see the 20-percent price cuts as a "response to waning demand" and potentially the start of a "price war" with competitors. After "a decade of being the only game in town," Tesla is entering a new era of competition with legacy automakers, said Jesus Diaz in Fast Company. That has exposed the failings in its design — ultimately a more central problem for Tesla than its "tanking stock price," slowing sales growth, or Musk's "Twitter train wreck." The "coup de grâce is Tesla's broken promise of full autonomous driving."

"Musk's embrace of risk has produced true breakthroughs," said Christopher Cox in The New York Times Magazine. Now, though, Musk may be forced to spend as much time in litigation as on the job, facing not just the securities lawsuits but a "wave of lawsuits" about the self-driving technology on which he's said he is staking the future of Tesla. After years of work, that technology has shown itself still "all too capable of catastrophic failure." Even if Tesla's problems with autopilot are fixable, its problems with the CEO may be less so. As the poet Robert Lowell once observed, "No rocket goes as far astray as man."

This article was first published in the latest issue of The Week magazine. If you want to read more like it, you can try six risk-free issues of the magazine here.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

Political cartoons for February 16

Political cartoons for February 16Cartoons Monday’s political cartoons include President's Day, a valentine from the Epstein files, and more

-

Regent Hong Kong: a tranquil haven with a prime waterfront spot

Regent Hong Kong: a tranquil haven with a prime waterfront spotThe Week Recommends The trendy hotel recently underwent an extensive two-year revamp

-

The problem with diagnosing profound autism

The problem with diagnosing profound autismThe Explainer Experts are reconsidering the idea of autism as a spectrum, which could impact diagnoses and policy making for the condition

-

Elon Musk’s starry mega-merger

Elon Musk’s starry mega-mergerTalking Point SpaceX founder is promising investors a rocket trip to the future – and a sprawling conglomerate to boot

-

Will SpaceX, OpenAI and Anthropic make 2026 the year of mega tech listings?

Will SpaceX, OpenAI and Anthropic make 2026 the year of mega tech listings?In Depth SpaceX float may come as soon as this year, and would be the largest IPO in history

-

Ryanair/SpaceX: could Musk really buy the airline?

Ryanair/SpaceX: could Musk really buy the airline?Talking Point Irish budget carrier has become embroiled in unlikely feud with the world’s wealthiest man

-

Musk wins $1 trillion Tesla pay package

Musk wins $1 trillion Tesla pay packageSpeed Read The package would expand his stake in the company to 25%

-

How Tesla can make Elon Musk the world’s first trillionaire

How Tesla can make Elon Musk the world’s first trillionaireIn The Spotlight The package agreed by the Tesla board outlines several key milestones over a 10-year period

-

Tesla reports plummeting profits

Tesla reports plummeting profitsSpeed Read The company may soon face more problems with the expiration of federal electric vehicle tax credits

-

How could Tesla replace Elon Musk?

How could Tesla replace Elon Musk?Today's Big Question The company's CEO is its 'greatest asset and gravest risk'

-

Elon Musk: has he made Tesla toxic?

Elon Musk: has he made Tesla toxic?Talking Point Musk's political antics have given him the 'reverse Midas touch' when it comes to his EV empire